What is The Crypto Paper Trading Market?

The crypto market is a vast domain with many financial opportunities for all investors and traders. Regardless of experience, crypto paper trading offers new ways to buy, sell, and exchange coins, practice trading, and adopt various strategies. One such method is crypto paper trading.

But what is crypto paper trading? This method seems to be one of the safest methods to practice trading within a simulated market environment.

As we know it, only the idea of losing funds and capital seems overwhelming. In today’s article, we discuss everything you must know about crypto paper trading, the best crypto paper trading apps, and how to get started and trade.

Adopting crypto paper trading methods allows you to experiment with different trading strategies in a safe and risk-free environment.

So, why don’t you read further, take notes, test trading strategies, and increase your trading skills?

[nativeAds]

What is Crypto Paper Trading?

Crypto paper trading is practicing crypto investing within a simulated trading environment. As we know, crypto investing involves risk, yet using crypto paper trading apps allows you to test different trading strategies without risking real money.

The name comes from an old stock market process in which investors used it to propose trades on paper, tracking their hypothetical investments. Yet, in the crypto market, paper trading works the same way but is done technologically, not on paper.

So, this new approach benefits crypto exchanges, traders, and investors. For investors, crypto paper trading lets them see how their trading strategy performs.

In contrast, crypto exchanges open new doors for a new segment of audiences, acquiring new users.

How Does Crypto Paper Trading Work?

Crypto paper trading uses software technologies and algorithms, so you don’t need paper trading experience. You can enroll in an app or on crypto exchanges that offer this service, create a crypto trading demo account, and start paper trading.

The trading service will deposit funds into your demo account to perform your trading simulation. Depending on the chosen service, they will ensure the buying and selling of securities, while other paper trading platforms offer options.

The crypto paper trading apps then track your trades and performance, offering real-time market data and insight into whether you are losing or earning. As such, you’ll know better when actual trading and become more familiar with the overall trading process.

For example, let’s say you buy $100,000 ETH through the free paper trading account, and the real price of ETH drops. Your demo account shows you how you would have lost real money.

Even though you’re not risking real money, the golden rule of paper trading is to set a limit to avoid financial risk. As such, you learn some basic skills before real trading.

Why Crypto Paper Trading is Important

Paper Trading Importance for Beginners

Crypto paper trading is essential to all investors and traders, especially beginners. It allows them to test their trading skills without losing real money. Thus creating a risk-free learning environment in which to practice crypto trading and investing in different financial markets.

A crypto paper trading platform helps build the required essentials, such as market analysis, reading crypto charts, and technical indicators while developing risk management skills.

Novice traders can access the crypto market under various market conditions, which is an essential skill to learn.

The Crypto Paper Trading Importance for Experienced Traders

More experienced traders use these platforms to test new strategies within the virtual trading environment.

Paper trading allows fine-tuning successful strategies to optimize performance while avoiding actual crypto market pitfalls.

Moreover, given the volatility of the crypto market, crypto paper trading offers a way to test out strategies based on real market data, such as sudden price movements.

It helps investors and traders reduce the likelihood of costly mistakes while assisting them in creating and refining a comprehensive trading strategy.

The Pros and Cons of Crypto Paper Trading

As with any trading activity, paper trading has pros and cons for novice and more experienced traders. So, let’s jump in and discover them!

The Pros of Crypto Paper Trading

1. Identify Crypto Trading Pitfalls

Practice makes perfect, but what about you practice trading with virtual money, trading bots, and automated trading features?

Since this practice involves simulated trading, traders and investors can learn to identify potential trading mistakes and avoid falling prey to FOMO.

2. Enjoy Actual Trading Hands-On Experience

The power of actual trading experience and skills cannot be overstated. Moreover, diversifying your portfolio with actual hands-on experience is valuable.

In contrast, you can better understand how markets work and perform.

3. Test Your Trading Strategies Against Each Other

Imagine testing different trading strategies against each other in a risk-free simulated trading virtual account, right? Well, with a paper trading account, you can do this.

For example, you can use one demo account for a high-risk strategy and another for a low-risk approach. By doing this simultaneously, you can compare both strategies and see which works best for you.

The Cons of Crypto Paper Trading

1. Not Presenting Real Fees

Trading with virtual money doesn’t accurately depict the commissions and other fees. For example, it is known that crypto purchasing costs $0.50 more on a real trading platform than it does in a crypto paper trade.

2. Lack of Real-World Emotion

Trading crypto can be nerve-wracking at times. Therefore, the lack of putting real money into paper trading doesn’t share the thrill or excitement of the real-world trading experience.

As in the crypto market, we analyze the market sentiment; paper trading lacks this and could greatly influence trades, even for more experienced traders.

Indeed, with a paper trading account, you can learn to make analytical decisions, yet emotions are part of the deal in the real world.

3. Potential Delayed Market Data

As with any digital product, it may have delayed responses, in this case, to real-world market data compared to live trading environments. Therefore, it can also impact your trading strategies.

So, as you can see, there couldn’t be any paper trades or simulated trading experiences without considering the pros and cons.

However, it is essential to be mindful of them, take everything with a grain of salt, and experiment while you can. But we will get to that in just a bit.

Crypto Paper Trading vs. Crypto Trading

Upon starting as a paper trader, you should consider the differences and similarities between crypto paper trading and crypto trading.

Paper Trading vs. Crypto Trading Similarities

The prominent resemblance is the crypto market movement, as paper trading platforms mimic real-time changes. Thus, paper trading can offer in-depth insights into a specific coin, besides seeing which ones are on the rise and which are dropping.

Furthermore, paper trading and real trading both help demonstrate the effectiveness of your trading skills and strategies. Successful trading strategies will display positive results in both instances, as each provides quick feedback.

Both use similar order types, including market orders, limit orders, and stop orders, and they imply the same psychological factors, emotional control, and discipline.

Paper Trading vs. Crypto Trading Differences

The first difference between paper trading and crypto trading is the zero risk, as opposed to the latter, where investing involves risk.

However, fake and virtual money doesn’t present earnings as well. In contrast, trading on a crypto exchange and making the right choices learned on paper trading could lead to potential gains.

Then, there’s the fact that paper trading is short-term, as paper traders open a demo account, test strategies, and implement them in the real world.

Indeed, you could long-term follow a particular coin or token to harness an in-depth view of it, yet in real trading is the live action.

The 7 Best Crypto Paper Trading Platforms

1. Binance

Binance is a renowned crypto exchange offering various digital assets, crypto services, and a crypto trading demo account.

This crypto paper trading app, Binance Testnet Futures, and Testnet Spot enable spot and futures paper trading.

With Binance Testnet, you can simulate trading and test your trading skills and strategies while using virtual funds, thus eliminating the risk of financial losses.

Binance Features:

- A renowned crypto exchange platform;

- Offers over 500 cryptos;

- Secure 2FA;

- Ensures P2P trading options;

- Robust, secure, and has implemented KYC policies;

- Supports fiat-crypto purchases;

2. Kraken

If you’re interested in free future demo trading, you should check out Kraken. It is an excellent tool for novice and experienced traders, and it offers virtual funds, so you can trade without risking real money.

Kraken offers one of those crypto paper trading apps that focuses on futures trading, meaning that you are buying or selling securities at a specific price and data in the future.

Therefore, Kraken’s trading simulation platform can help you increase and sharpen your trading skills by trading futures contracts on various cryptos before implementing them in the real world.

The platform is very realistic and enables you to access real-time market data. It will smoothly make your transition to the world of crypto trading.

Kraken Features:

- Secure and reliable crypto paper app

- Low trading fees;

- There are many fiat currencies accepted;

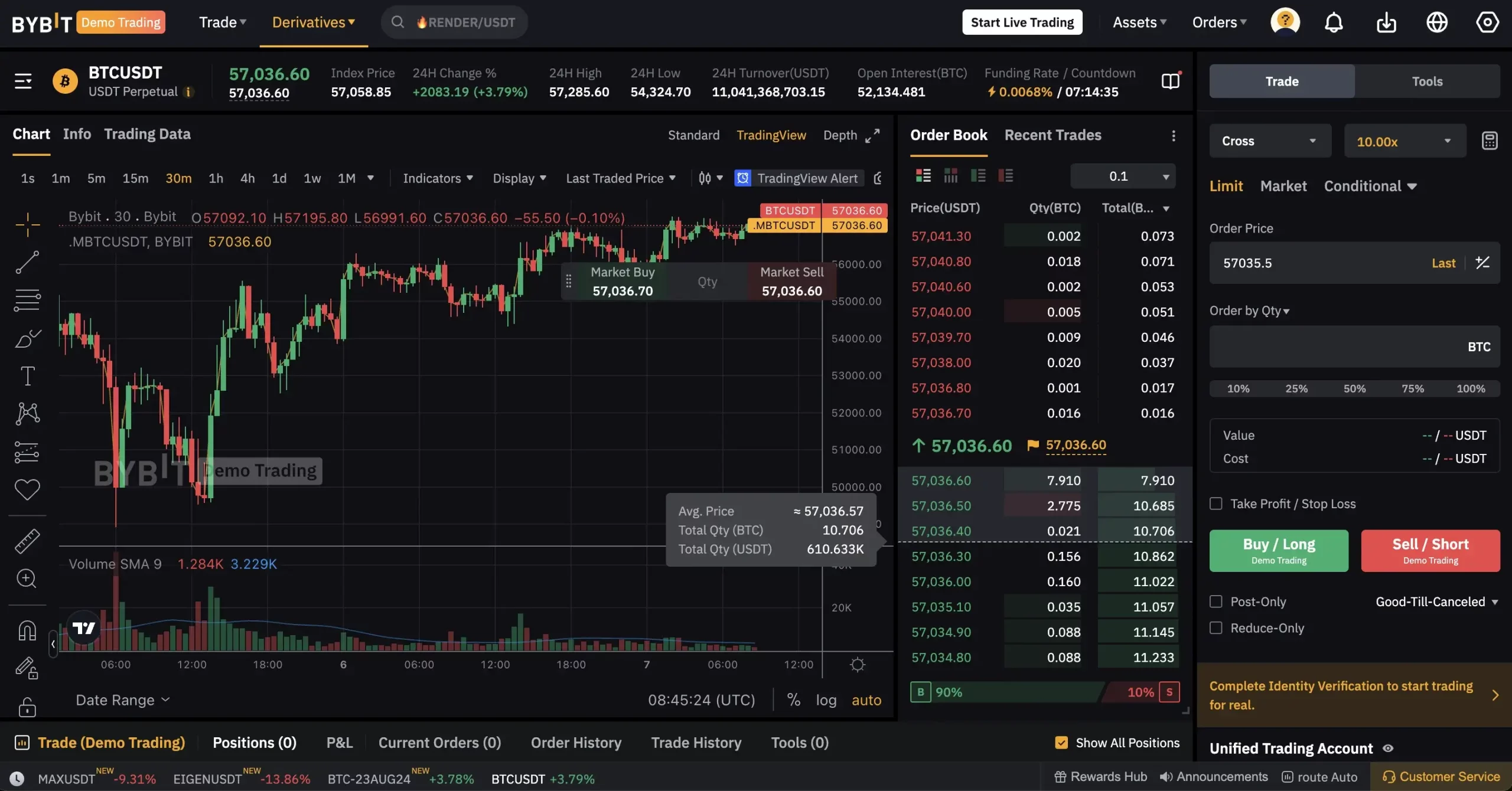

3. ByBit

By now, we all know that Bybit is one of the most popular crypto exchanges that offers a crypto paper trading app called the Bybit Testnet. As with any crypto paper trading app, it opens its doors to a simulated environment to practice trading with virtual money due to its various trading tools.

Moreover, Bybit Testnet is one of those advanced trading tools that mirrors its Bybit Mainnet to ensure familiarity and ease of use.

Also, it enables you to access trading features, multiple cryptos, and trading bots so that you can try new strategies, in addition to using limit orders, market orders, stop-loss orders, and others.

And if you’re interested in derivatives trading, then Bybit is the one for you!

Bybit Features:

- Low crypto trading fees;

- Ease of use and great user experience;

- Mobile trading app available;

- Great customer support;

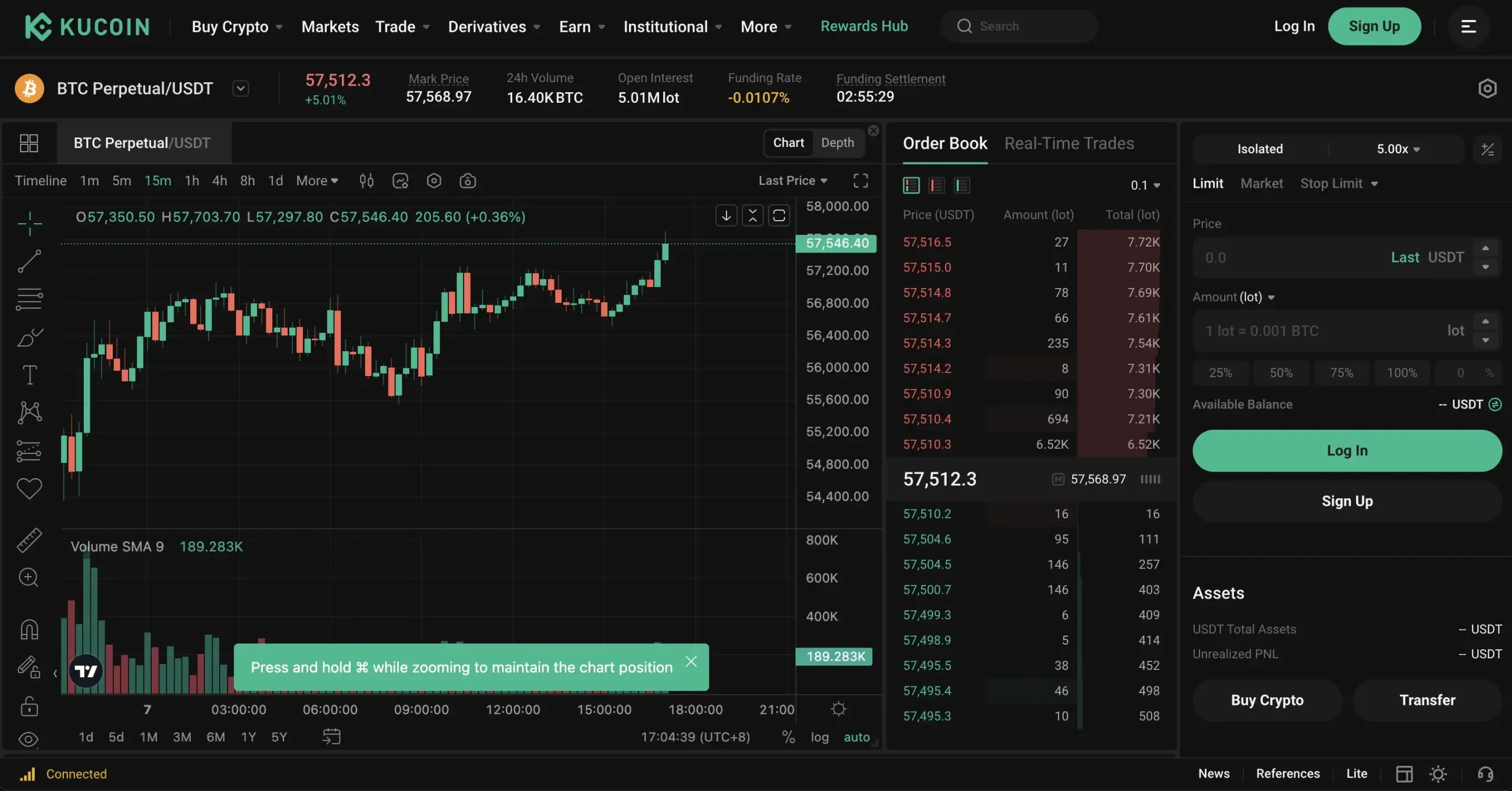

4. KuCoin

As we know it, KuCoin is an altcoin exchange founded in 2017 that launched its paper trading platform to support the community further.

KuCoin Futures offers many advanced trading tools, tech indicators, and crypto charts to simulate the real crypto trading experience. These tools allow you to adjust leverage, manage risk positions, and more.

Furthermore, a KuCoin crypto paper trading account ensures a 20x performance boost and 90% reduced latency, which is handy when transitioning to real crypto trading.

Also, KuCoin has its crypto paper trading app that you can use if you create an account. What’s even cooler is that you only need one account for both crypto paper trading and crypto trading.

KuCoin Features:

- Increased security features;

- +700 available cryptocurrencies;

- Many trading and earning features;

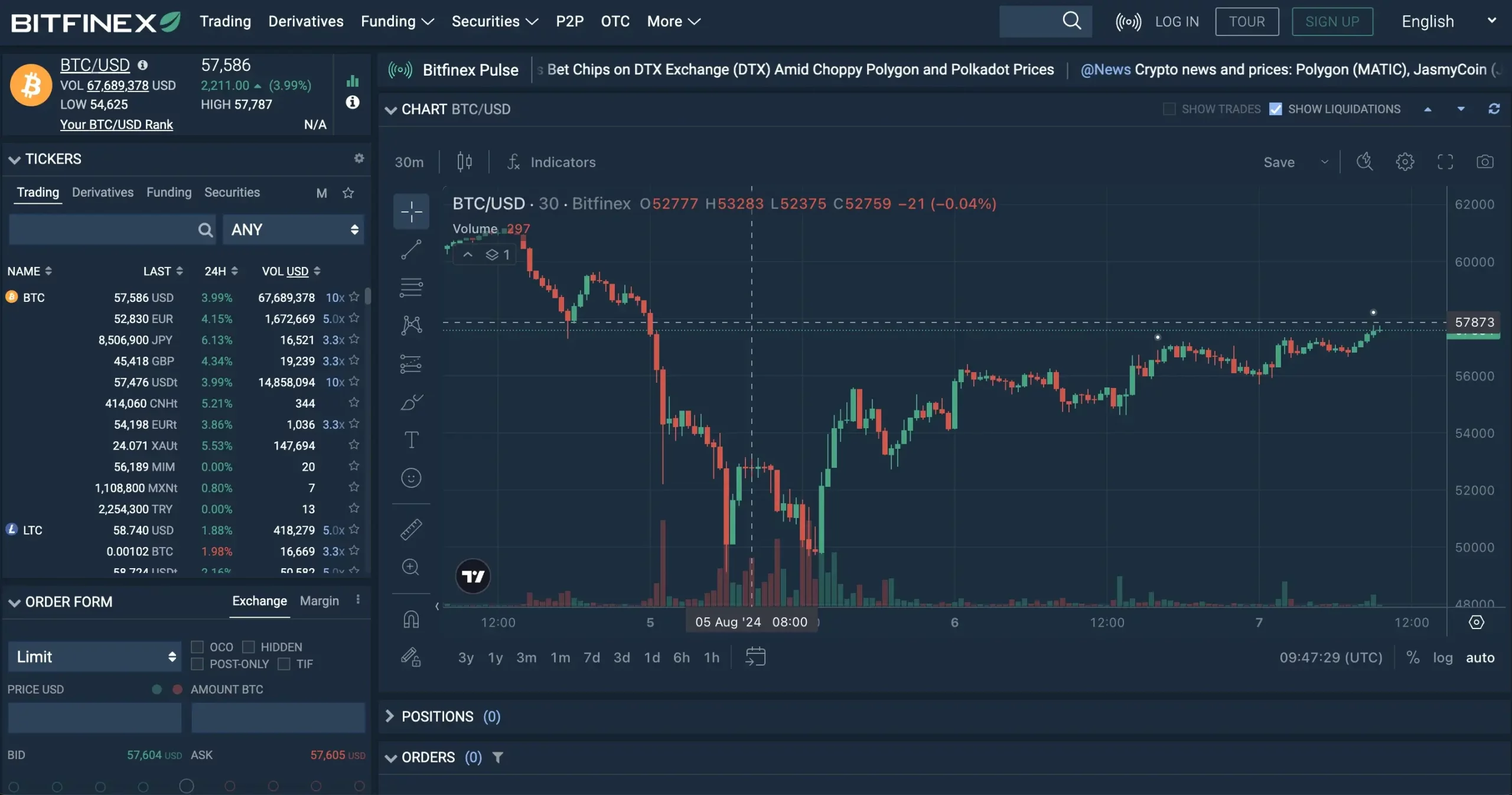

5. Bitfinex

Bitfinex is one of those crypto exchanges offering a crypto paper trading app that allows you to test your trading strategies in a safe and simulated environment.

Thus, Bitfinex offers spot, margin, and derivatives crypto trading with a demo account and margin funding, Bitfinex Borrow, and OTC.

So, to get started with Bitfinex, you must create or log into your account and then create a sub-account with which you can perform paper trades. Then, provide an email address and choose a username and password, and you’re done.

You can always use Bitfinex Honey, an open-source and customizable toolkit for paper trading. This toolkit enhances the functionalities of the Bitfinex platform and allows traders to run multiple trading strategies, create custom orders, and more.

Bitfinex Features:

- Over 170 available cryptos;

- Fiat deposits;

- Advanced trading tools;

- Lower fees;

- Increased security features;

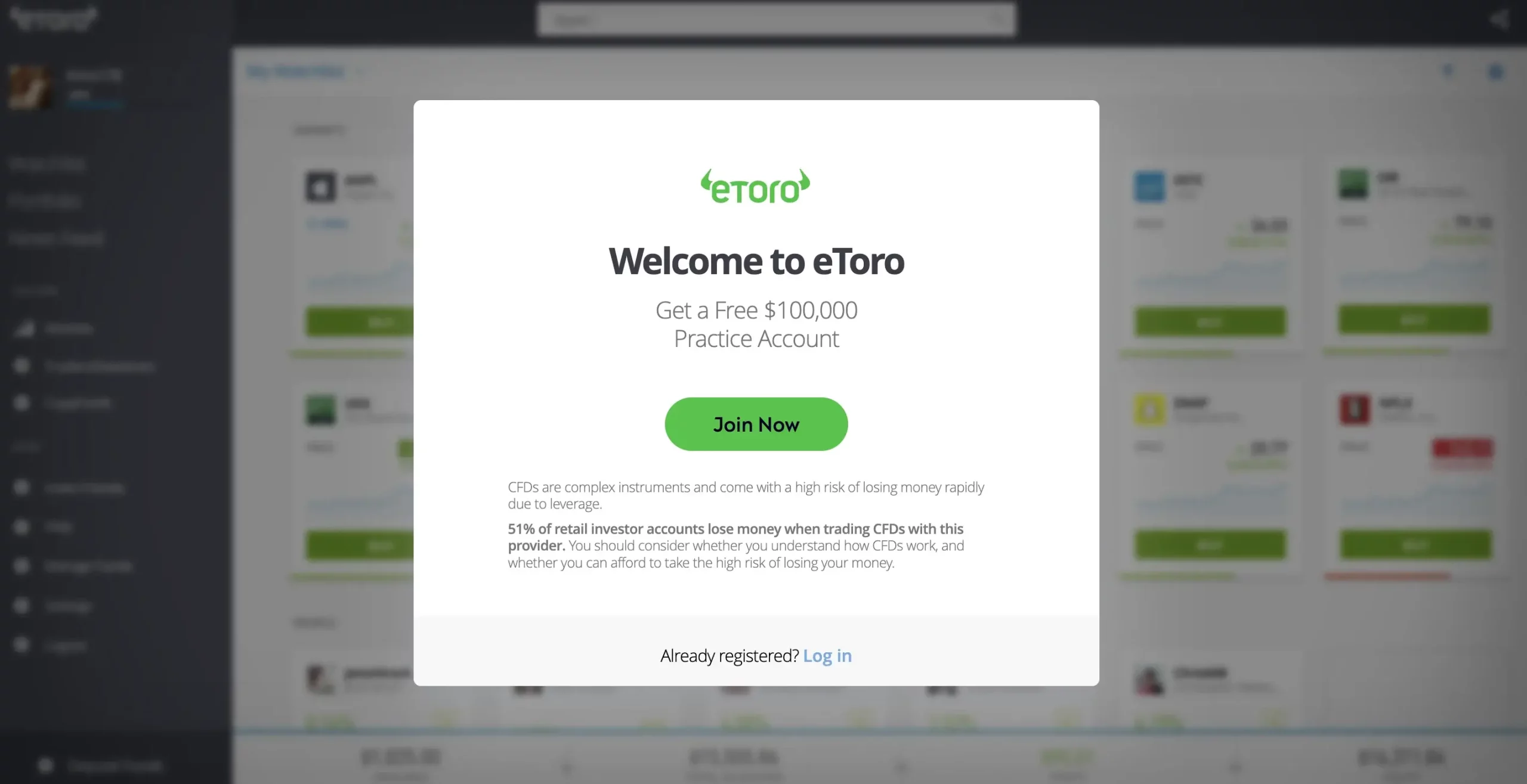

6. eToro

The eToro paper trading platform lets you easily create demo accounts to practice trading and benefit from multiple eToro features, such as the metric installment, create buy/ sell orders, and others.

Also, you benefit from advanced trading tools, such as stop-loss, take-profit, leverage, and others, to experiment with different risk levels.

But if we look at usability, eToro doesn’t fall short. Its clean and straightforward interface makes paper trading even more accessible than ever. Thus, eToro paper trading is considered one of the best crypto paper trading apps for beginners.

eToro Features:

- Copy trading services;

- A broad range of available crypto;

- Beginner-friendly;

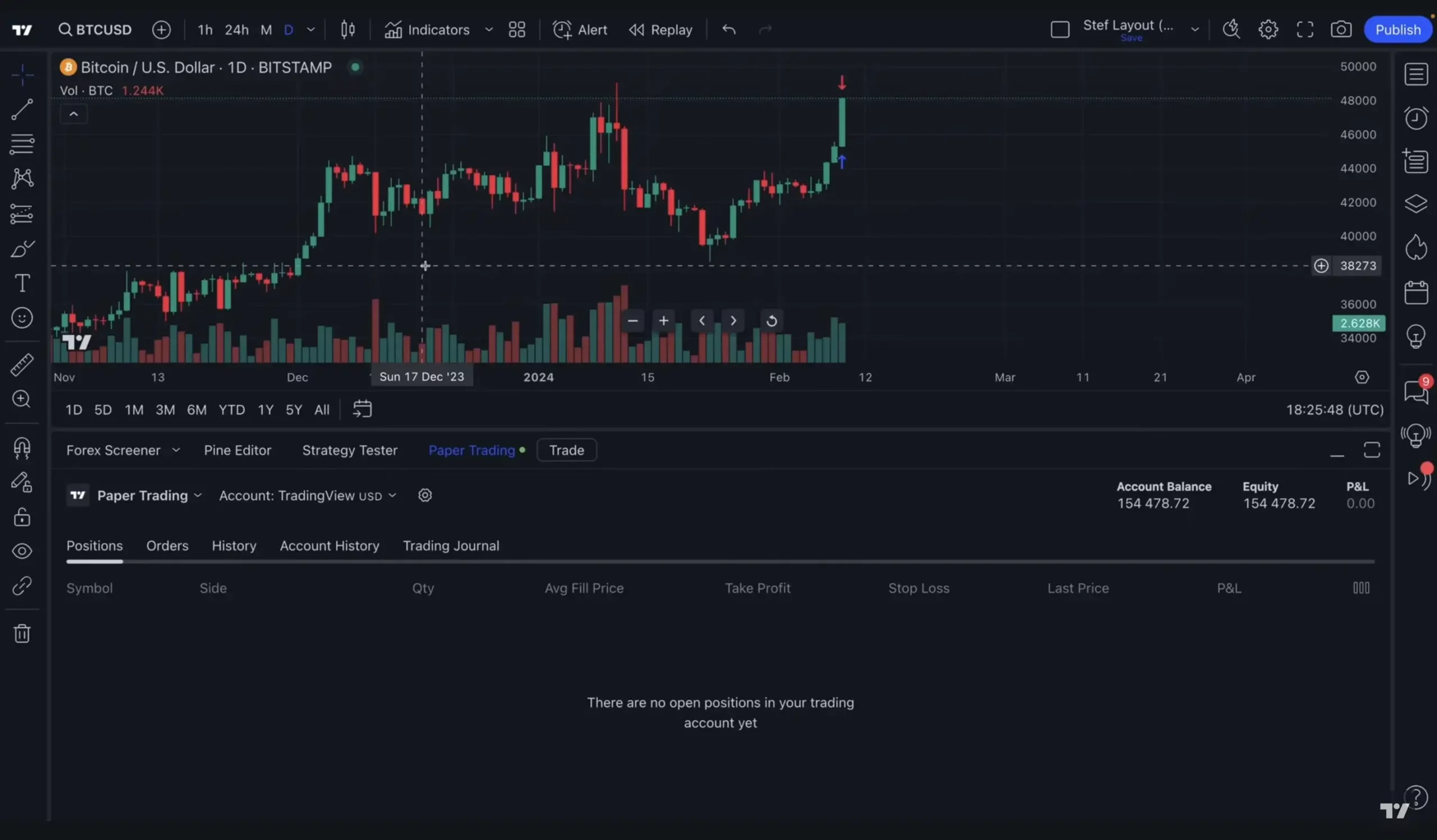

7. TradingView

TradingView’s paper trading platform has multiple use cases, such as offering live access to information, crypto charts, technical analysis tools, a social trading network, and others.

What is remarkable about this paper trading platform is its ability to track multiple trading strategies at once. This becomes effective for those who wish to compare different trading approaches and choose the best fit for their needs.

Furthermore, it allows snapshots of paper trades with setup details and virtual purchases, effectively tracking performance and progress.

Trading View Features:

- Crypto-fiat pairing;

- Crypto-crypto pairs available;

- Free and paid accounts;

- Chart analysis tools;

How to Get Started with Paper Trading

As we’ve learned more about paper trading, its importance, and the best 7 paper trading apps, it is time to move further and find out how to get started.

1. Choose Your Paper Trading Platform

Binance, Kraken or KuCoin? Whatever you choose, be sure to do your research before opening a paper trading account.

Look into fees and advanced tools. Does it have a trading bot, derivatives trading options, or a paper trading sub-account?

What are users saying about their paper trading service? One platform can be the best crypto exchange, yet it may lack the quality of the paper trading system.

2. Create Your Paper Trading Account

Now that you’ve selected your paper trading platform, you need to create your account, select your paper trading option, and enjoy the virtual money allocated to it.

3. Get to Know the Platform

As you play a new video game and learn its mechanics, the same applies to the paper trading platform. You need to know it in depth to understand its capabilities, learn how to place trades, and then start placing paper trades.

4. Develop a Paper Trading Strategy

Your paper trading strategy is mandatory to reap great results. Thus, you could start by lining out the following:

- Trading simulation goals: do you aim to gain experience or test strategies?

- Risk tolerance: how much risk are you willing to accept?

- Trading strategy: what are your approaches for buying and selling cryptos?

- Entries and existing: what are your criteria for entering and exiting the markets?

5. Start Trading

Monitor your trades, analyze performance, and refine your strategy.

Conclusion

Crypto paper trading could be your virtual playground to master the cryptocurrency trading market. Simulating real-market conditions empowers both novices and seasoned traders to experiment, learn, and refine their strategies without risking real capital.

Remember, while paper trading offers invaluable experience, it’s essential to transition to live trading with caution and a well-defined plan.

Ready to take the plunge? Choose your preferred paper trading platform, create your demo account, and embark on your crypto trading journey!