What is Slippage in Crypto?

The crypto market is fast and risky, where big profits and losses can happen quickly. One hidden challenge that can reduce profits is slippage, which many new traders overlook.

Slippage it’s like trying to enter a closing elevator. Even a tiny delay can turn a winning trade into a loss in crypto trading.

This article will explain what slippage is and how it affects traders and offer practical tips to reduce its impact. By understanding slippage, crypto traders can improve their chances of success in the cryptocurrency market.

[nativeAds]

Table of contents

What is Slippage in Crypto?

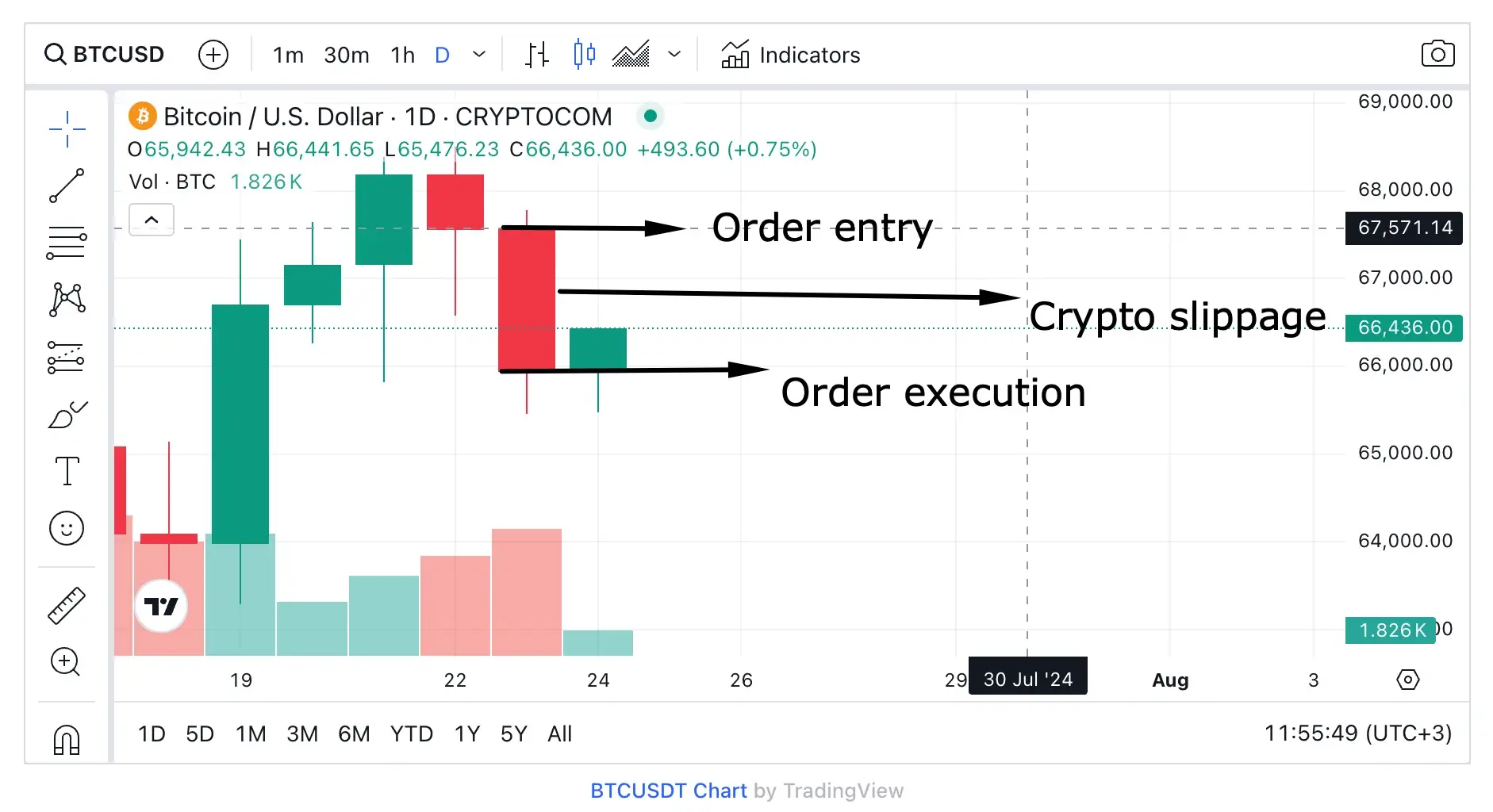

Crypto slippage refers to the difference between the expected price of a crypto buy or sell order and the final price of the order when it is executed.

Better said, the slippage percentage represents the lost or gained investment due to cryptocurrency market volatility, market fluctuations, and other market conditions. The situation is most often met on decentralized exchanges due to high price volatility.

How Does Crypto Slippage Work?

Slippage in crypto trading is caused by the liquidity levels of the crypto markets, which means how quickly an asset is bought or sold without affecting the current market price. If there’s low liquidity or low trading within the crypto market, then the slippage percentage will be higher.

However, allow us to give you a practical example to better understand the concept of slippage in crypto trading performance. Let’s say you buy or sell a crypto asset for $200, but in the end, the executed price is $205, and then a crypto slippage occurs.

The catch is this: crypto slippage is not a sign of fraud, scams, or poor quality; it’s simply a reflection of the crypto market volatility.

With the help of slippage percentage, traders and investors can assess the price movement, the trading strategy, and the volume. Therefore, it is mandatory to consider slippage when placing crypto market orders, as it can open new doors to risk management strategies.

Types of Slippage in The Crypto Market

As we understand by now, slippage in crypto trading can go both ways, up or down. As a result, the price movement marks two types of crypto slippages: positive slippage and negative slippage.

Indeed, no trader or investor would want a negative slippage, and the most desired one is a positive slippage due to the opportunity to buy and sell at a favorable price than anticipated.

The Positive Slippage

A positive slippage occurs when the market order is filled at a lower-than-expected price, thus being the most advantageous type. This slippage occurs when high demand increases the prices and market orders are finalized faster than expected.

For example, a positive slippage occurs when you buy an asset for the actual price of $100, but the executed trade price is $95. The price difference marks a positive slippage, meaning that you got a better price than expected.

The Negative Slippage

A negative slippage means the market order is filled at a higher price than the expected price, thus leading to losses.

Also, a negative slippage is an unwanted slippage that occurs due to market conditions, such as low liquidity and fast market movements, causing market orders to be executed at an unexpected rate.

To avoid negative slippage, traders can limit orders, look up an algorithmic trading platform, and ensure risk management practices are in place, but we will get to that in a bit.

If the current market price on a crypto trading platform is $100, you place the order, and the actual execution price is $105, then the difference is marked by a negative slippage.

Therefore, it is essential for traders to minimize or eliminate slippage. Please read further as in the next chapters, we discuss some of the most essential strategies for reducing slippage and navigating volatile markets.

Crypto Slippages’ Impact Within the Market

The truth is this: slippage in crypto can make or break crypto traders’ success since trading fees can vary significantly, causing more substantial slippage. Additionally, orders may be executed at a worse price due to volatile markets, causing potential delays and even missing the order altogether.

Another key aspect is slippage risk management, especially for institutional investors, who often carry large orders. Thus, a good rule of thumb is to break down orders into more manageable ones and use advanced algorithms to minimize potential slippage or avoid slippage entirely.

Another key takeaway could be the slippage tolerance, which is set to mark crypto traders’ willingness to accept a certain slippage percentage. The higher the slippage tolerance, the more slippage.

The Slippage Tolerance

As said, slippage tolerance should be a must-have in any trading and investment strategy, as it allows crypto traders and investors to set their maximum slippage threshold. Moreover, by using different ways to limit orders, especially when there is a high volatility within the crypto market, traders experience less slippage.

Let’s say you buy or sell orders for $100, with a slippage tolerance of 5%; your order is complete only when you buy the shares for no more than $105, as this will be the minimum price.

As such, slippage tolerance is often expressed in percentage, but it can also be a certain number of pips or ticks.

How to deal with slippage tolerance?

Well, it depends on your slippage tolerance and acceptance. You can accept cost trading and integrate it within your overall strategy or avoid slippage by using limit orders in exchange or market orders. Thus, you could ensure your purchasing price is the exact desired price level.

How to Calculate Crypto Slippage

As with almost all crypto notions, you can calculate slippage by subtracting the execution price from the actual price, but you can use the following formula:

Slippage = Current Market Price – Executed Trade Price.

For example, if you place an order to buy one Bitcoin for $10,000, and the executed price is $9,900, then your slippage would be $100.

When discussing the slippage percentage, you can subtract the executed price from the current market price and divide it by the current market price. This is the formula for slippage percentage:

Slippage Percentage = (Current Market Price – Executed Trade Price) / Current Market Price * 100

So, we are going to take the same example: If you buy one Bitcoin for $10,000 and the executed price is $9,900, your slippage percentage would be 1%. Thus, you receive a lower price than expected due to the 1% slippage.

However, if you want to automate the calculations, luckily, the crypto market offers several slippage calculation tools. You just input your parameters, and the slippage calculator takes care of the rest.

Top Crypto Slippage Calculators

Even if calculating slippage in crypto trades is a straightforward process, you can always use a crypto slippage calculator if you don’t want to do it on your own. Here are some options you have:

1. Calculate Slippage with TradingView

This Slippage Calculator is a TradingView script specifically designed for the volatile cryptocurrency market but can also be adapted for forex trading.

2. Calculate Slippage with ForexBee

Another option for a crypto slippage calculator is the one developed by ForexBee. It provides basically the same features as the TradingView’s calculator.

Top Strategies to Avoid Slippage in Crypto

Reducing slippage is key to improving trading performance and navigating the cryptocurrency market effectively. By understanding the factors contributing to slippage and implementing strategic approaches, traders can significantly enhance their trading outcomes.

So, let’s present to you some top strategies to avoid crypto slippage:

Prioritize Limit Orders

Limit orders allow traders to set a specific price at which they want to buy or sell an asset, as opposed to market orders, which execute immediately at the current market price. Using limit orders helps avoid paying more than intended, especially during volatile periods when prices can change rapidly.

Focus on Liquid Trading Pairs

Liquidity refers to how easily an asset can be bought or sold. Trading pairs with high liquidity—where there are plenty of buyers and sellers—generally have lower slippage. Trading less liquid pairs can lead to greater market impact and higher slippage, meaning the price you get could be less favorable.

Time Your Trades Strategically

Market conditions affect slippage, especially during periods of high volatility, such as major news events or economic reports. To reduce slippage, try to trade during quieter periods when price changes are less extreme.

Set a Slippage Tolerance

Many cryptocurrency exchanges allow traders to set a maximum slippage percentage. This feature helps prevent trades from executing at undesirable prices by setting a limit on the amount of slippage tolerated.

Consider Off-Peak Trading

Trading during off-peak hours, when trading volumes are lower, can lead to less market impact and reduced slippage. Avoiding peak trading times can help achieve prices closer to your intended levels.

Conclusion

Slippage is an unavoidable part of cryptocurrency trading, but it doesn’t have to ruin profits.

By understanding what causes slippage and how it works, traders can reduce its impact and trade more effectively. Choosing exchanges with high liquidity, using limit orders, and being mindful of trade sizes can help reduce slippage.

While it can’t be completely avoided, knowledge and careful planning can help traders handle the volatile crypto market more confidently.

Every trade matters in the competitive crypto world. Reducing slippage is not just about saving profits; it’s about refining your trading strategy for long-term success.