Technical vs. Fundamental Analysis in Crypto: Definitions, Differences, and Which is Better

Table of contents

- What is Technical Analysis in Crypto?

- What is Fundamental Analysis in Crypto?

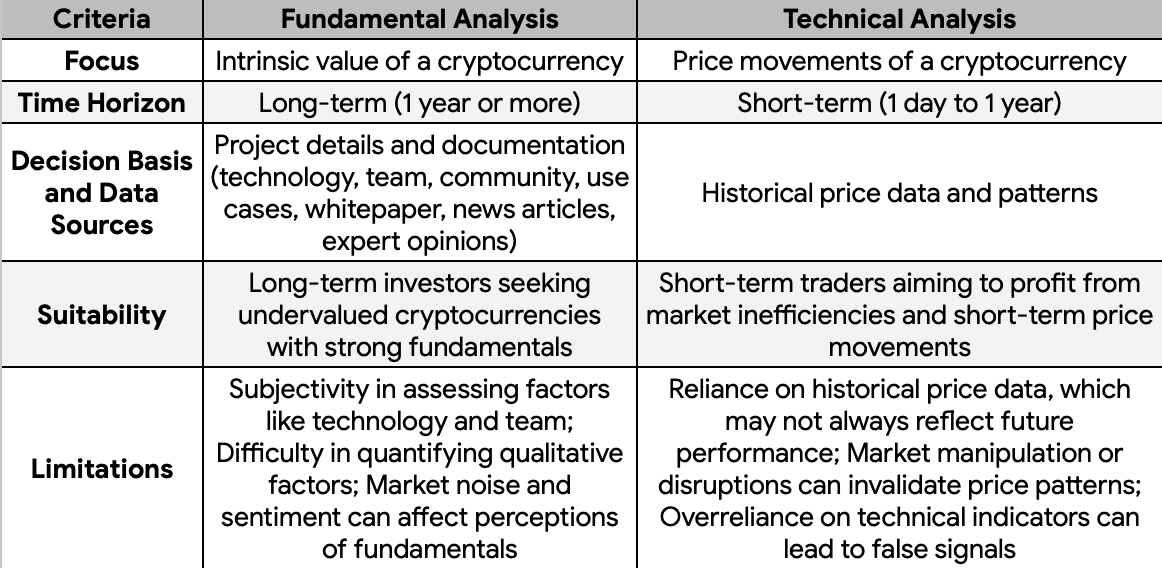

- Fundamental Analysis vs. Technical Analysis: Differences Between Fundamental and Technical Analysis in Crypto

- Fundamental Analysis vs. Technical Analysis: Their Focus

- Fundamental Analysis vs. Technical Analysis: Time Horizon

- Fundamental Analysis vs. Technical Analysis: Decision Basis and Data Sources

- Fundamental Analysis vs. Technical Analysis: Suitability

- Fundamental Analysis vs. Technical Analysis: Limitations

- Which is Better: Fundamental or Technical Analysis?

If you’re new to investing in stocks or cryptocurrencies, about stock prices or crypto prices, you’ve likely come across terms like technical analysis and fundamental analysis. And you may be curious about what these terms really mean, and that’s perfectly normal.

That’s why this article is here to guide your understanding of these types of analyses, highlighting their differences and helping you determine which one might be more suitable for you.

SIDENOTE. Even though this article focuses more on crypto, most of the information presented applies also to other financial markets, such as bonds and stocks.

What is Technical Analysis in Crypto?

Technical analysis (TA) in the cryptocurrency market studies historical price and trading volume data (price and volume data) to identify patterns (or price trends) and predict future price movements. It uses quantitative financial metrics, focusing more on price figures and charts than the reasons behind them.

Technical analysis is based on the assumption that market participants tend to repeat their actions and reactions, creating recognizable patterns in price charts. TA practitioners believe that these patterns can be used to identify trends, support and resistance levels, and potential entry and exit points for trades.

It is a widely used trading methodology even in traditional markets like stocks and commodities, and it has also gained popularity among cryptocurrency traders.

Technical analyses use a variety of tools to analyze price data, including:

- Candlestick patterns – Candlesticks are a type of price chart that displays a cryptocurrency’s open, high, low, and closing prices over a specific period. Analysts identify specific candlestick patterns, such as doji, head and shoulders, and double tops and bottoms, to assess market sentiment and potential price movements.

- Support and resistance levels – Support and resistance levels are price points at which an asset has historically had difficulty rising above or falling below. When a price approaches a support level, it is considered a sign of strength, while approaching a resistance level is viewed as a sign of weakness. Technical analysts use these levels to predict potential price reversals.

- Indicators – Technical indicators are mathematical tools that calculate various aspects of price data, such as momentum, volatility, and trend strength. Common indicators technical analysts use include moving averages, the relative strength index (RSI), the moving average convergence divergence (MACD), and Bollinger Bands.

- Volume analysis – Volume analysis refers to the study of trading activity in relation to price changes. By analyzing volume data, technical analysts can gauge the strength of market sentiment and identify potential buying and selling opportunities. Sudden price changes accompanied by high trading volume are often considered more significant than those with low volume.

- Trendlines – are lines connecting consecutive price points that move in the same direction. Trendlines are used to identify the direction of a trend and potential breakout or breakdown points. Breakouts above trendlines are often seen as buying opportunities, while breakdowns below trendlines are seen as selling opportunities.

- Elliott Wave Theory – Elliott Wave Theory is a theory that claims that market price movements follow recognizable wave patterns. Elliott Wave analysts use this theory to forecast future market changes based on previous wave patterns.

- Fibonacci retracement – Fibonacci retracement levels are horizontal lines that represent possible support and resistance levels based on the Fibonacci sequence. Traders use Fibonacci retracement to identify potential price reversal points following a large market movement.

Main Benefits of Technical Analysis

Technical analysis is a valuable tool for traders who want to make informed decisions in the dynamic cryptocurrency market. It helps them identify patterns and support and resistance levels in historical price data, giving them valuable insights into potential future price movements. This information can then be used to make informed trading decisions about when to buy and sell cryptocurrencies.

Technical analysis also helps traders implement risk management strategies. By identifying potential support and resistance levels, traders can set stop-loss orders, which can help them limit their losses if the market moves against them.

What is Fundamental Analysis in Crypto?

Fundamental analysis (FA) in the cryptocurrency market is a method used to estimate the asset’s intrinsic value. It takes into consideration that fundamental analysis relies on a mix of both quantitative and qualitative financial metrics.

- In this context, when discussing quantitative analysis, we refer to aspects such as cryptocurrency’s market cap, trading volume, network activity, developer activity, or (when it comes to the stock market, for example) the company’s financial statements, cash flow statement, income statement, balance sheet, etc.

- In this context, when we talk about qualitative financial factors in crypto, we refer to aspects such as technology and innovation, community and ecosystem, whitepaper, team members, roadmap, regulatory landscape, adoption and use cases, etc.

The purpose is to determine if the asset is overpriced, underpriced, or priced right in the market by examining the asset’s underlying health and performance (considering particular economic factors or economic data) to make long-term investments.

Main Benefits of Fundamental Analysis

Understanding the basics of the crypto market is crucial for making smart investment choices. Fundamental analysis digs deep into a project’s potential, sustainability, and factors affecting a cryptocurrency’s value. So, is it worth it? Absolutely.

This method assesses a project’s technology, scalability, and real-world applications. It gives investors confidence when they know the team’s background, vision, and execution ability.

Fundamental analysis also looks at tokenomics—supply, demand, and utility, providing vital information on a cryptocurrency’s viability. It evaluates partnerships, market demand, and legal compliance, giving a complete picture of the project.

Using these insights, investors can spot cryptocurrencies with strong fundamentals, ready to handle market ups and downs.

Fundamental Analysis vs. Technical Analysis: Differences Between Fundamental and Technical Analysis in Crypto

Fundamental Analysis vs. Technical Analysis: Their Focus

First of all, technical analysis and fundamental analysis differ in their primary focus. Technical analysis focuses on analyzing historical price data and patterns to identify potential trading opportunities in the short term (1 day to 1 year). Fundamental analysis, on the other hand, focuses on assessing the long-term intrinsic value of a cryptocurrency by evaluating factors such as its technology, team, community, and use cases.

Fundamental Analysis vs. Technical Analysis: Time Horizon

This difference in focus directly impacts the time horizon of each analysis method. Technical analysis is primarily used for short-term trading strategies to capitalize on short-term price fluctuations. On the other hand, fundamental analysis is better suited for long-term investment strategies, where investors hold their positions for an extended period (1 year or more) to benefit from the cryptocurrency’s long-term growth potential.

Fundamental Analysis vs. Technical Analysis: Decision Basis and Data Sources

The decision-making process and data sources also differ between technical and fundamental analysis. Technical analysts rely on historical price charts and patterns to identify trends, support, and resistance levels, momentum indicators, and volume patterns. They then use these indicators to predict future price movements and make trading decisions.

On the other hand, fundamental analysts assess a cryptocurrency’s underlying fundamentals, such as its technology, team, community, and use cases. They gather information from project documentation, white papers, news articles, and expert opinions to determine the cryptocurrency’s long-term potential and intrinsic value.

Fundamental Analysis vs. Technical Analysis: Suitability

Technical analysis is generally more suitable for short-term traders who seek to profit from market inefficiencies and short-term price movements. These traders can capitalize on technical patterns and anomalies to enter and exit trades quickly, aiming to generate profits from small price fluctuations. Fundamental analysis, however, is better suited for long-term investors who prioritize identifying undervalued cryptocurrencies with strong fundamentals and long-term growth potential. These investors are willing to hold their positions for an extended period to reap the long-term rewards of investing in promising cryptocurrencies.

Fundamental Analysis vs. Technical Analysis: Limitations

Despite their strengths, both technical and fundamental analysis have inherent limitations. Technical analysis relies on historical price data, which may not accurately predict future performance, especially in the volatile cryptocurrency market. Moreover, market events or investor sentiment can manipulate or disrupt price patterns.

On the other hand, fundamental analysis faces challenges in assessing subjective factors such as technology, team, community, and use cases. These factors can be difficult to quantify and may not always reflect actual performance.

Which is Better: Fundamental or Technical Analysis?

The choice between fundamental analysis and technical analysis depends on any investor’s risk tolerance and trading style.

Fundamental analysis is better suited for long-term investors who prioritize identifying undervalued cryptocurrencies with strong fundamentals and long-term potential. This approach requires a higher risk tolerance due to the subjectivity and market noise associated with fundamental analysis.

Technical analysis, on the other hand, is better suited for short-term traders who seek to profit from short-term price movements and capitalize on technical patterns and anomalies. This approach suits investors with a lower risk tolerance who prefer a more structured and data-driven approach to trading.

However, combining both fundamental and technical analysis is most effective in gaining a more comprehensive understanding of the cryptocurrency market and making informed investment decisions.

Also, before venturing into their use, remember that investing involves risk, and do not invest more money than you are willing to lose.