Top Crypto Prediction for 2023 and Beyond

Any crypto investor knows the golden rule whereby you only invest what you are willing to lose, yet this is partly true. Due to crypto market volatility, prices could change instantly, and indeed, investing more could lead to financial ruin if the market capital takes a downturn.

As a result, researching the best cryptocurrency price prediction sites for the currency of your choosing and analyzing the evolution of the investors’ sentiment are just a few things that could be done to ensure a good investment and possible significant gains. Moreover, many industry experts are constantly releasing news, updates, and reports on the state of the crypto landscape, yet they can be somewhat challenging to interpret.

So, in today’s article, we are delving deeper into the crypto market cap by analyzing some of the most well-known cryptocurrencies, along with the minimum and maximum prices, trading volume, and other technical analysis factors influencing the entire crypto ecosystem.

Will crypto rise again in 2023? Which crypto will boom in 2023? These are just a couple of questions that many investors are waiting for crypto market analysts to answer, and hopefully, we’ll discuss them in detail. So, without further ado, let’s jump in!

Top 9 Crypto Predictions 2030 – Key Takeaways:

- BTC Price Prediction 2030: Yearly Low: $ 154,478 and Yearly High: $ 278,206;

- AMP Price Prediction 2030: Yearly Low: $ 0.0370 and Yearly High: $ 0.0460;

- XLM Price Prediction 2030: Yearly Low: $ 1.2 and Yearly High: $ 1.5;

- FILE Coin Price Prediction 2030: Yearly Low: $ 54.66 and Yearly High: $ 58.22;

- SFM Price Prediction 2030: Yearly Low: $ 0.0063 and Yearly High: $ 0.0082;

- ELON Price Prediction 2030: Yearly Low: $ 0.00000161 and Yearly High: $ 0.00000172;

- CRO Price Prediction 2030: Yearly Low: $ 1.52 and Yearly High: $ 1.69;

- GALA Price Prediction 2030: Yearly Low: $ 0.080036 and Yearly High: $ 0.101303;

- JASMY Price Prediction 2030: Yearly Low: $ 0.030627 and Yearly High: $ 0.032541.

What Influences the Crypto Predictions?

Many influential factors significantly contribute to either the success or disaster of cryptocurrency market capitalization, such as economic conditions and geo-political influences, government regulations, technological innovations, and crypto sentiment and demand.

Economic Conditions

At this stage, it discusses inflation concerning unemployment and interest rates that impact whether users need to invest further in cryptocurrency. For example, if there is a high inflation rate within the country of residence, the citizens are influenced to invest in crypto to shield themselves from inflation.

Government Regulations

These crypto regulations play a significant role in the greater adoption of the cryptocurrency market, as stricter regulations could discourage the potential crypto investor’s sentiment, leading to a power and price decline in the crypto market capitalization. Moreover, it’s impacting the future of institutional investors, as they tend to reduce their digital asset holdings.

Technological Innovations

This is another factor that could be a heaven or could be a curse. Indeed, technological advancement, in general, is considered a great thing, yet within the crypto market, the mainstream adoption of blockchain technology could lead to a burst in mediocre cryptocurrencies and other digital assets that, ultimately, impact other currencies and could be scams.

Security Concerns of the Crypto Market

The history of crypto taught us that further research upon investing in crypto is the way to go, as in the past years, we saw a rise in crypto hacks and scams that plunged the crypto market capital. Indeed, the revenue of these crypto hacks dropped by 46% in 2022, and we still experience the aftermath.

Crypto Sentiment

Another essential aspect that sometimes gets overlooked is market sentiment. Investor sentiment is the attitude towards a particular crypto, security, or cryptocurrency market. As a result, researching investors’ sentiments could lead to better crypto investment strategies and help newbies from losing their hard-earned gains in a matter of days.

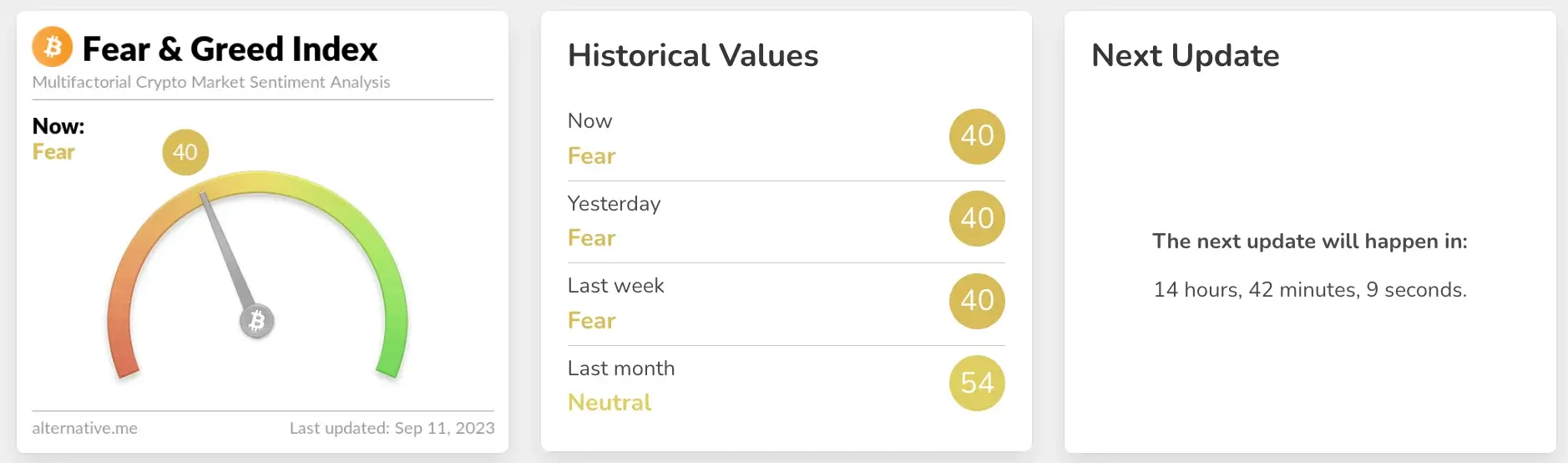

Here, the rule is simple: There is a fear-greed index that implies the optimism or pessimism of the market, whereby it can be the most evident in the overall price projection trends. Let’s take the above example in which the market is fearful. Extreme fear means a buying opportunity, instead of the excessive greed index where the market is due for correction.

Please note that these are just a few influential factors that actively contribute to the crypto price analysis, and they should not be taken as literal investment advice but rather as a paddle to reach your realistic goals.

How Does Crypto Prediction Work?

Three main ways to determine and further research the market are technical, fundamental, and sentiment analysis. As a result, many times, and if done correctly, the price projections are pretty accurate.

However, we should remember that it is an analysis based on the market’s past performance and the factors already discussed instead of a source of truth as often seen by the new starters.

Technical analysis is accountable for the value movement and trading activity that determines the crypto price prediction; the fundamental analysis determines the value by examining related economic and financial factors and, nonetheless, the sentiment to which any crypto investors contribute.

1. Bitcoin Price Prediction in 2023 and Beyond

We know that many questions are rumored about the evolution of Bitcoin, with its strengths and limitations. Yet, analysts predict the end of the crypto winter before the 2024 Bitcoin halving event. The next halving is expected to occur in April or May 2024, when the block reward will fall to 3.125 from a maximum supply of 21,000,000 BTC.

But let’s take things slowly and analyze how the market has performed up until now, starting with Bitcoin’s value, market data, and its yearly price prediction.

Bitcoin 2023 Overview:

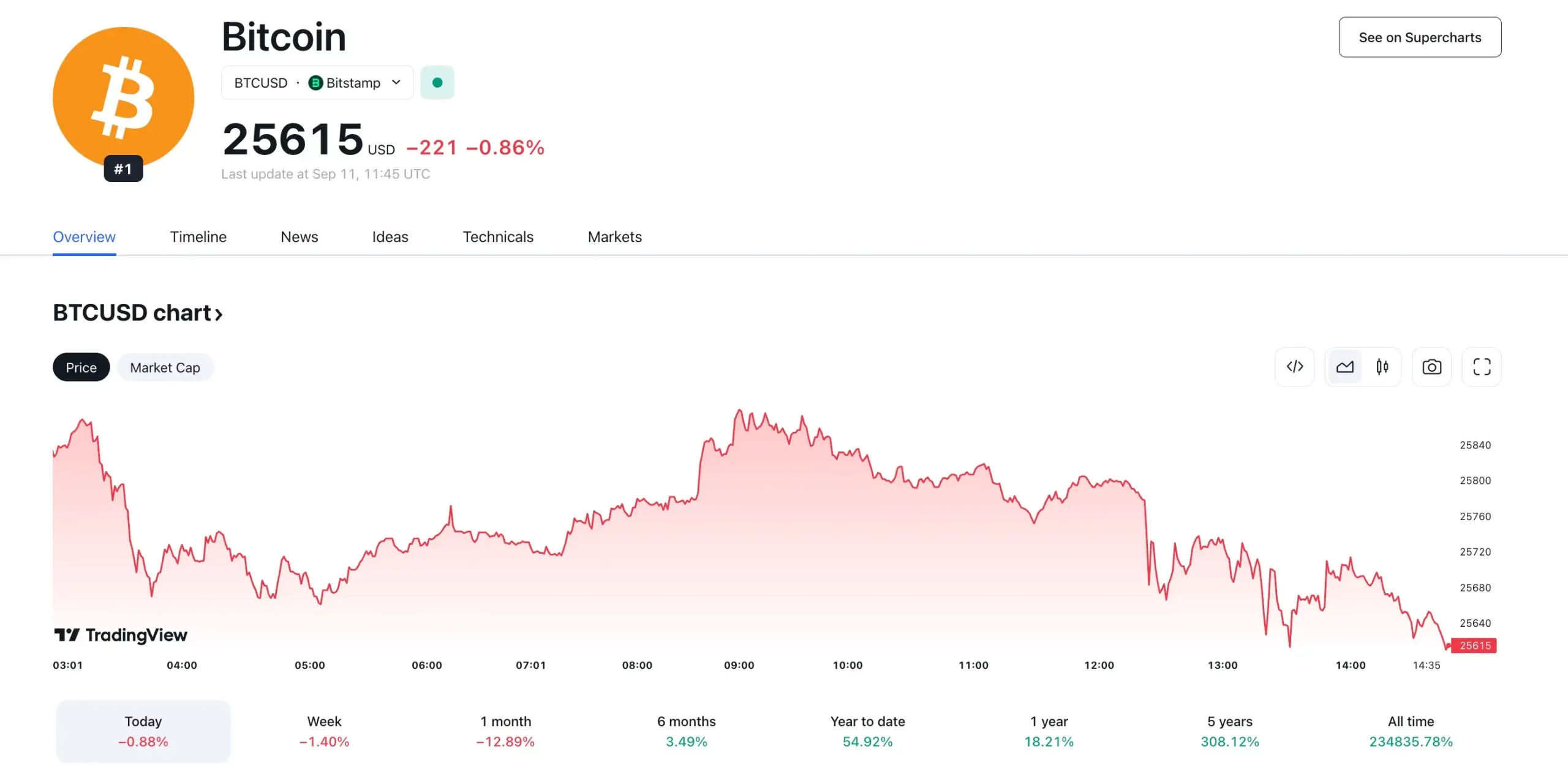

- Bitcoin Price: $25,608.00;

- 24h Low / 24h High: $25,663.69 / $25,918.58;

- 7d Low / 7d High: $25,576.56 / $26,387.75;

- Trading Activity: $8,514,729,215;

- Market Cap Rank: #1,

- Market Capital: $500,819,074,766;

- Market Capital Dominance: 47.059%;

- Volume / Market Capital: 0.0164;

- All-Time High: $69,044.77 on Nov 10, 2021;

- All-Time Low: $67.81 on Jul 06, 2021.

Will Bitcoin be Able to Recover?

There is no doubt Bitcoin suffered greatly in the past year, losing around 65% of its market value due to unpredictable events such as the FTX collapse, macroeconomics, and the appearance of other cryptos.

However, 2023 has been the year of a slow and steady recovery period, whereby Bitcoin ended August with $26,179, a market capital of $504 billion, and a market volume of $20 billion.

After July’s $31,000 billion mark, many analysts are signaling a 16% bearish market, and with a 40% fear investor sentiment – so, is there a chance for Bitcoin to recover?

As we are past the middle of 2023, on average, the trading price action of Bitcoin is $27,907.40, yet, until the near future, December this year it is estimated that the BTC value will reach $28,191.84, with a potential Return on Investment of 9,3%.

Bitcoin Price Forecast 2024

As mentioned already, many factors influenced the crypto values. It’s possible to see new U.S. regulations that will alleviate the market and push investors’ sentiment toward investment in the coming year.

Also, there is a chance for the U.S. Federal Reserve to cut interest rates, which will encourage investments in BTC. Yet, the industry leaders and crypto experts advise that the impact of such changes will be most experienced in the years to come.

Nevertheless, based on technical analysis, many experts believe that BTC will start 2024 with a minimum price of $25,352.70, leading to a medium price of $31,572.95 and a maximum value of $28,462.82.

In June, the mid of 2024 it is projected that the minimum price of $21,806.21, leading to an average value of $30,637.69 and a maximum price of $26,221.95, whereby in December 2024, will drop even further, with the maximum price action of $23,532.89.

Bitcoin Price Prediction for the Years to Come

Until 2030, it is speculated that BTC price prediction will reach at least $69,000, roughly the 2021 all-time high achieved only briefly. But as anything is tightly linked with macroeconomics, the greater use of Bitcoin and the introduction of Central Bank Digital Currencies (CBDCs) will be detrimental to future digital asset payments.

BTC Price Prediction 2025:

- Yearly Low: $ 39,546;

- Yearly High: $ 177,384;

BTC Price Prediction 2026:

- Yearly Low: $ 79,164;

- Yearly High: $ 132,066;

BTC Price Prediction 2027:

- Yearly Low: $ 77,087;

- Yearly High: $ 80,981;

BTC Price Prediction 2030:

- Yearly Low: $ 154,478;

- Yearly High: $ 278,206. Source: Coin Desk

2. AMP Price Prediction in 2023 and Further

Built on the Ethereum blockchain, AMP allows most crypto enthusiasts to buy and sell in fiat or any other currency, thus cutting short the payment transaction process. Yet, as popular as AMP got, it is essential to look further and see how it’s performing, learning more about what analysts are predicting to strategize your investment better.

However, some technical indicators marked the fluctuant price over the last years, whereby the current price action is $0.00168526, with a total market value of $94,832,941 and a circulating supply of 56,127,938,240 AMP.

The constant decline started in June 2021, when it reached a time of $0,09484, and since then, AMP has traded moderately for a brief time, yet it was not enough, and as a result, the coin dropped considerably.

Nevertheless, in 2022, the price action of AMP was set on a downward trend, and now, in 2023, we are left to wonder if AMP will recover and what are the price predictions for the years to come since the trading volume has also drastically fallen by 41.86%.

AMP 2023 Overview:

- Amp Price: $0.00168845;

- 24h Low / 24h High: $0.00168340 / $0.00179094;

- 7d Low / 7d High: $0.00168962 / $0.00187388;

- Trade Volume: $3,032,416;

- Market Cap Rank: #231;

- Market Capital: $94,832,941;

- Market Capital Dominance: 0.009%;

- Volume / Market Capital: 0.032;

- All-Time High: $0.120813 on Jun 16, 2021;

- All-Time Low: $0.00168526 on Sep 11, 2023.

Will AMP be Able to Recover?

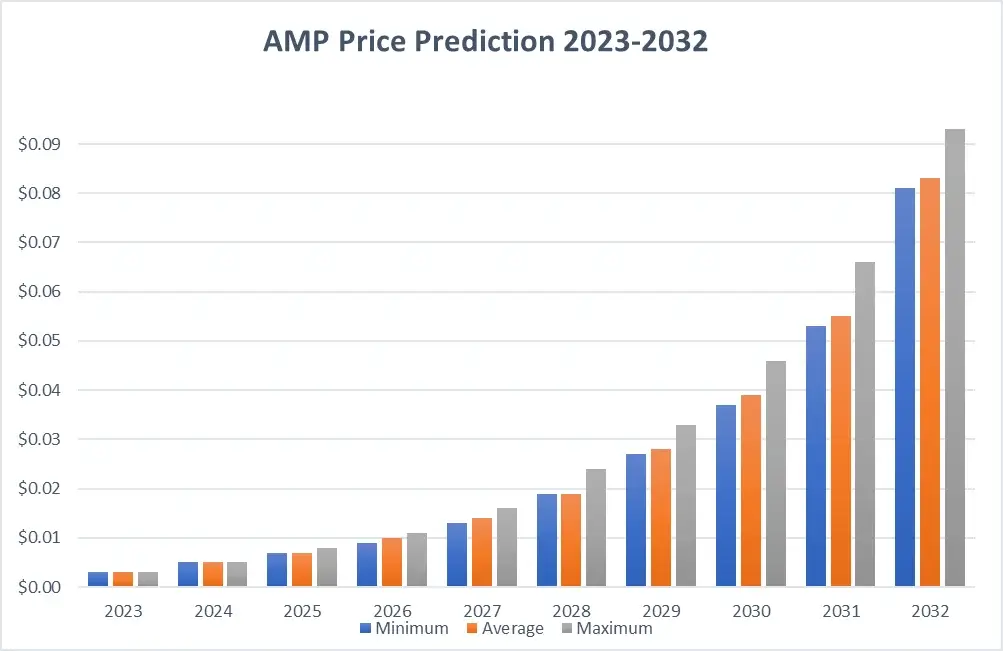

This is a tricky question given the current price and the steady decline that lasted since 2022 and today. Moreover, many industry experts speculate that there will be a pivotal moment for AMP, reaching a maximum price of $0.093 by 2032, with an average of 0.083 and a minimum price of 0.081.

But just as discussed on Bitcoin, the price prediction of AMP is linked to external contributing factors. As for September 2023, technical analysis suggests bearish signals, with a 40 Fear & Greed Index score, making AMP part of the risky assets category.

AMP Price Predictions 2024

Based on the historical values up until now, crypto analysts advise that in January 2024, AMP can reach a trading average of $0.00230, with a minimum value of $0.00192 and a maximum price of $0.00267. Crossing the line, this could mean a Return on Investment of 33.5%.

It is estimated that mid-2024 will be marked by a minimum value of $0.00173, a medium price of $0.00374, and a maximum price of $0.00273. The end of 2024 will mean a maximum price of $0.00343.

AMP Price Prediction for the Years to Come

As mentioned, the researchers from Cryptopolitan advised that by 2032, AMP will reach a maximum price of $0.093, but we’ll have to wait and see how the future unfolds.

3. XLM Price Prediction in 2023 and Beyond

Stellar, often called XMP, is a decentralized open-source blockchain network for virtual currency payments and trading. And just like with any other digital currencies, the Stellar network also has its native currency, called Lumen.

As Stellar grew in popularity, more than network growth was needed to sustain such a crypto ecosystem further, thus making many crypto investors wonder if XLM is a good investment. Regardless, we advise you to do your own research before investing and check the price actions, as crypto analysts predicted that XLM will reach $1.508 over the next five years.

XLM 2023 Overview:

- Stellar Price: $0.126633;

- 24h Low / 24h High: $0.124637 / $0.134194;

- 7d Low / 7d High: $0.118571 / $0.134081;

- Trade Volume: $124,904,945;

- Market Cap Rank: #20;

- Market Capital: $3,485,867,390;

- Market Capital Dominance: 0.328%;

- Volume / Market Capital: 0.0361;

- All-Time High: $0.875563 in Jan 03, 2018;

- All-Time Low: $0.00047612 on Mar 05, 2015.

In 2023, XLM has been in an upward trend, reaching a growth of 180% between April 2022 and July 13, 2023, and as a result, crypto industry experts believe the digital currency could breach the $0.24 mark by the end of this year.

XLM Price Prediction from 2024 until 2030

The price prediction on XLM for the years to come is promising and seems like a good investment, and the future price is expected to reach over $0.3 in 2024. Again, it all depends on multiple factors.

Additionally, if Stellar continues to develop and simplify its network, the price is expected to reach $0.45 at highs, having its low around $0.31. Given this steady upward trend until 2030, blockchain growth will be achieved, and XLM is estimated to reach $1.5, with a minimum price of $1.2.

XLM Price Prediction 2023:

- Potential Low: $0.11;

- Medium Price: $0.15;

- Potential High: $0.24;

XLM Price Prognosis 2024:

- Potential Low: $0.25;

- Medium Price: $0.27;

- Potential High: $0.3;

XLM Price Prediction 2025:

- Potential Low: $0.31;

- Medium Price: $0.4;

- Potential High: $0.45;

XLM Price Prediction 2030:

- Potential Low: $1.2;

- Medium Price: $1.4;

- Potential High: $1.5. Source: Technopiedia

4. Filecoin Price Prediction 2023 and for Future Years

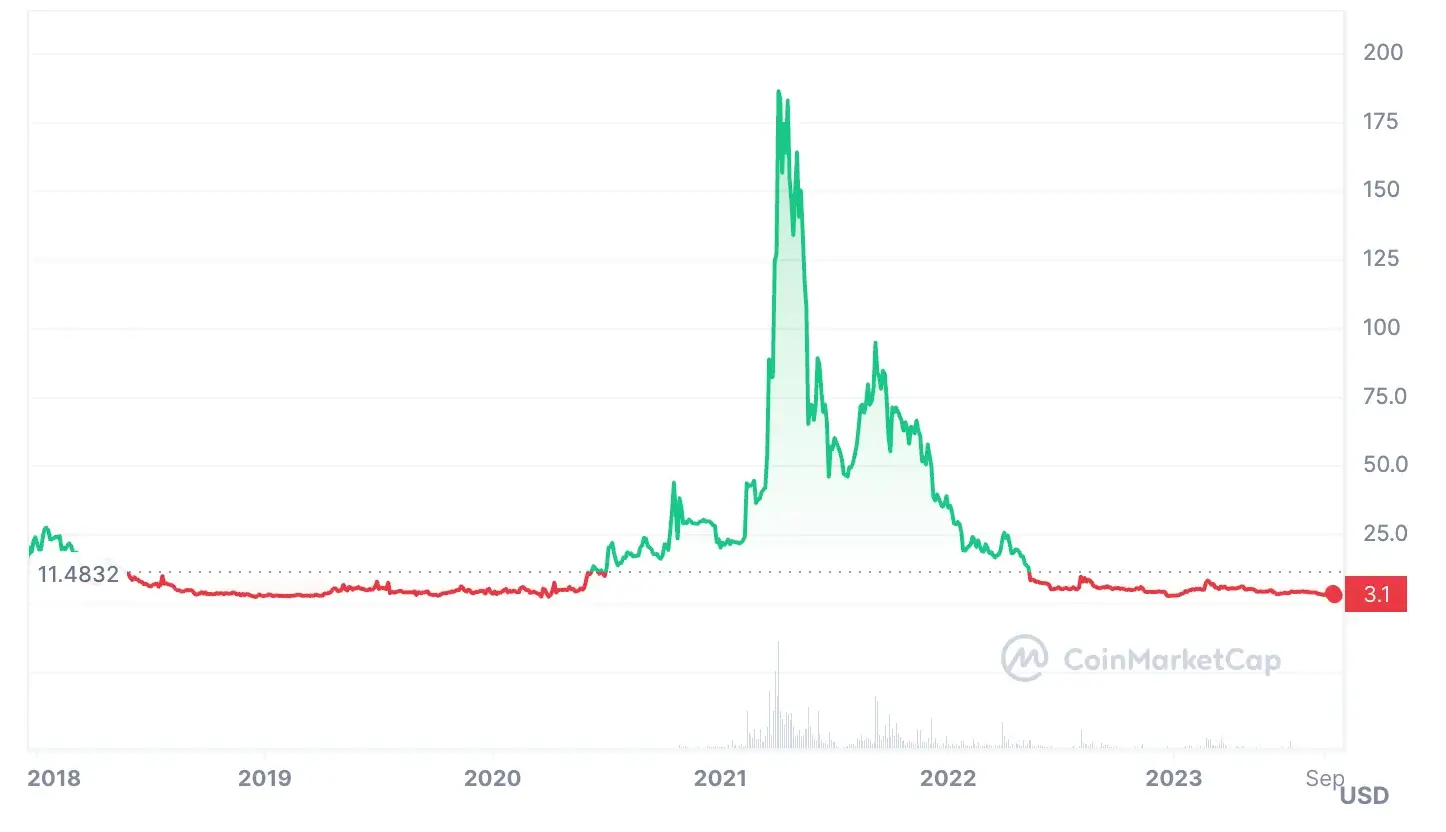

Launched in 2017, Filecoin raised over $200 million within 30 minutes of launching its initial coin offering. Since its inception, the FIL price movements reached $10.30 in January 2018 and $2 in 2019, with a recovery of $12.10 in June 2020.

Moreover, in 2021, FIL reached the maximum value of $237.24, marking an all-time high, but things lasted only a short time and dropped considerably by the end of the year, reaching a trading price of $35. Once again, Filecoin regained its power, reaching $95, but as history repeats itself, FIL was due for a correction.

Today’s price is $3.10 with a market capital of $1,383,284,188, and by the end of 2023, crypto analysts predict a maximum price of $11.98, with an average trading price of $8.

Filecoin 2023 Overview:

- Filecoin Today’s Price: $3.10;

- 24h Low / 24h High: $2.96 / $3.12;

- 7d Low / 7d High: $2.98 / $3.27;

- Trade Volume: $103,822,265;

- Market Cap Rank: #32;

- Market Capital: $1,383,952,861;

- Market Capital Dominance: 0.13%;

- Volume / Market Capital: 0.075;

- All-Time High: $236.84 on Apr 01, 2021;

- All-Time Low: $2.64 on Dec 16, 2022.

Filecoin Price Prediction from 2024 until 2030

Starting in 2024 and until 2030, FIL is estimated to reach new grounds, even though it will be a bumpy ride. Moreover, the price forecast for 2030 will mark new achievements, with an average price of $49.33 and $58.22 at its highest. But let’s see the yearly price movements:

FIL Price Prognosis 2023:

- Minimum Price: $8.41;

- Maximum Price: $11.98;

FIL Price Prognosis 2024:

- Minimum Price: $12.62;

- Maximum Price: $13.44;

FIL Price Prognosis 2025:

- Minimum Price: $15.87;

- Maximum Price: $16.90;

FIL Price Prediction 2030:

- Minimum Price: $54.66;

- Maximum Price: $58.22.Source: CryptoNewsz

5. SafeMoon Price Prediction from 2023 until 2030

The meme coin enjoyed an explosive launch in 2021, but the price declined constantly afterward. What is striking is the fact that in December 2021, SafeMoon launched SFM V2, a new token that wished to reinforce the smart contract security, having a holder ratio of 1000:1. On January 2022, SafeMoon reached an all-time high of $0.007232, yet the coin price kept on going lower.

SafeMoon 2023 Overview:

- SafeMoon Today’s Price: $0.00011560;

- 24h Low / 24h High: $0.00011488 / $0.00012811;

- 7d Low / 7d High: $0.00011208 / $0.00014132;

- Trade Volume: $879,593;

- Market Cap Rank: #304;

- Market Capital: $65,080,859;

- Market Capital Dominance: 0.006%;

- Volume / Market Capital: 0.0135;

- All-Time High: $0.00338272 on Jan 05, 2022;

- All-Time Low: $0.00010560 on Sep 07, 2023.

SafeMoon Price Prediction 2023 and Beyond

Remember what we’ve told you about the investors’ sentiment and how it plays a vital role in developing and growing crypto assets? Well, upon looking at the history of SFM, we could pinpoint some contributing factors, such as the community losing interest and trust in the SafeMoon ecosystem, followed by a lawsuit filed by many SFM investors. As a result, SafeMoon is likely to continue heading downward.

SFM Price Prediction from 2024 until 2030

In the near future, things don’t look so promising for SafeMoon, and as 2024 will be a year impacted by the Bitcoin halving event, many crypto enthusiasts and specialists know that their favorite altcoins can grow considerably.

Moreover, given the lawsuits and the project’s liquidity pool being hacked, meaning a loss of $8.9 million, it will be complicated for SafeMoon to reach new investors and attract new buyers. However, by the end of 2024, SFM’s average value will be $0.000255.

SFM Price Prognosis 2024:

- Minimum Price: $0.000512;

- Maximum Price: $0.000741;

SFM Price Prognosis 2025:

- Minimum Price: $0.000733;

- Maximum Price: $0.00099;

SFM Price Prognosis 2030:

- Minimum Price: $0.0063;

- Maximum Price: $0.0082.Source: Crypto Newsz

6. Dogelon Mars Price Prediction 2023 and for the Years to Come

We continue the price forecast with another highly discussed coin, Dogelon Mars. Since its launch, ELON has shown potential, whereby its launch price has been $0.0000000078, and within a week, it managed to pump up to $0.00000041. Additionally, in just one week of September – October 2021, ELON reached six times higher than it started at the beginning of the month, thus having momentum.

ELON 2023 Overview:

- ELON Price: $0.000000130105;

- 24h Low / 24h High: $0.000000127713 / $0.000000132472;

- 7d Low / 7d High: $0.000000127921 / $0.000000142049;

- Trade Volume: $4,389,831;

- Market Cap Rank: #284;

- Market Capital: $71,565,072;

- Market Capital Dominance: 0.007%;

- Volume / Market Capital: 0.0613;

- All-Time High: $0.00000259 on Oct 30, 2021;

- All-Time Low: $0.000000017563 on Apr 23, 2021.

ELON Price Prediction from 2023 until 2030

Whether ELON is a good investment or not, crypto experts could not say, yet it is essential to do your own research, make an investment plan, and invest what you’re okay with losing. However, analysts advise that ELON has a bright future, where the meme coin could reach a maximum price of $0.000000333 and a minimum price of $0.000000137 while growing exponentially until 2030.

ELON Price Prognosis 2024:

- Lowest Price: $0.000000399;

- Highest Price: $0.000000424;

ELON Price Prognosis 2025:

- Lowest Price: $0.000000514;

- Highest Price: $0.000000548;

ELON Price Prognosis 2024:

- Lowest Price: $0.00000161;

- Highest Price: $0.00000172.Source: Crypto Newsz

7. CRO Price Prediction 2023 and Beyond

Despite making an effort, another token that showed resilience is Crypto.com‘s blockchain project, called CRO. From the beginning, CRO remained stagnant until February 2021, when its price rose to $0.22, and in November of the same year reached an all-time high of $0.9698. Subsequently, CRO experienced sharp falls in December and April 2022, with the price in a bearish trend.

CRO 2023 Overview:

- Cronos Price: $0.050533;

- 24h Low / 24h High: $0.04961279 / $0.051135;

- 7d Low / 7d High: $0.04971659 / $0.053037;

- Trade Volume: $7,087,999;

- Market Cap Rank: #35;

- Market Capital: $1,328,730,971;

- Market Capital Dominance: 0.125%,

- Volume / Market Capital: 0.0052;

- All-Time High: $0.965407 on Nov 24, 2021;

- All-Time Low: $0.01211960 on Feb 08, 2019.

CRO Price Prediction from 2023 until 2030

Wallet Investor advises that CRO price is expected to reach $3.331 by 2027, and given a 5-year investment plan, the ROI could be +706.54%. But let’s see what analysts advise us about the price forecast for each year.

CRO Price Projection 2024:

- Lowest Price: $0.32;

- Highest Price: $0.49;

CRO Price Projection 2025:

- Lowest Price: $0.52;

- Highest Price: $0.69;

CRO Price Projection 2026:

- Lowest Price: $0.72;

- Highest Price: $0.89;

CRO Price Projection 2027:

- Lowest Price: $0.92;

- Highest Price: $1.09;

CRO Price Projection 2028:

- Lowest Price: $1.12;

- Highest Price: $1.29;

CRO Price Projection 2029:

- Lowest Price: $1.32;

- Highest Price: $1.49;

CRO Price Projection 2030:

- Lowest Price: $1.52;

- Highest Price: $1.69. Source: Crypto Newsz

8. GALA Price Prediction for 2023 until 2030

Launched in 2020, GALA is the native token of Gala Games, a gaming platform where users can purchase in-app game items and participate in other activities.

Additionally, based on the price movement history, GALA is estimated to reach $0.021783 by the end of 2023, with the lowest value of $0.017426.

GALA 2023 Overview:

- GALA Price: $0.01450940;

- 24h Low / 24h High: $0.01373107 / $0.01446217;

- 7d Low / 7d High: $0.01383982 / $0.01644173;

- Trading Volume: $583,837,010;

- Market Capital Rank: #92;

- Market Capital: $371,906,489;

- Market Capital Dominance: 0.035%;

- Volume / Market Capital: 1.5698;

- All-Time High: $0.824837 in Nov 26, 2021;

- All-Time Low: $0.00013475 on Dec 28, 2020.

GALA Price Prediction

We must acknowledge that GALA has grown considerably in the last month, increasing by 38.6%, with only 13.23% in the past seven days, making GALA a good investment opportunity.

Moreover, technical indicators estimate that the minimum and maximum prices will be $0.0129 and $0.0192, with an average of $0.0255. As such, the ROI for GALA in 2023 is around 37.1%.

In this instance, it is essential to remember that crypto prognoses are speculative and should be taken cautiously.

GALA Price Prognosis 2024:

- Lowest Price: $ 0.012321;

- Highest Price: $ 0.032609;

GALA Price Prognosis 2025:

- Lowest Price: $ 0.027596;

- Highest Price: $ 0.111280;

GALA Price Prognosis 2026:

- Lowest Price: $ 0.030701;

- Highest Price: $ 0.050896;

GALA Price Prediction 2027:

- Lowest Price: $ 0.032221;

- Highest Price: $ 0.079935;

GALA Price Prediction 2028:

- Lowest Price: $ 0.069643;

- Highest Price: $ 0.078674;

GALA Price Prediction 2029:

- Lowest Price: $ 0.075149;

- Highest Price: $ 0.141640;

GALA Price Projection 2030:

- Lowest Price: $ 0.080036;

- Highest Price: $ 0.101303;

Source: Coin Desk

9. Jasmy Price Prediction for the Years to Come

Since its launch, Jasmy has managed to develop and sustain different partnerships with some of the industry leaders, initiating projects such as Proof of Concept in 2019, getting listed on the Bittrex crypto exchange, Coinbase and Coinbase Pro, and other influential events that set JASMY Coin on an ascending trend.

JASMY Coin 2023 Overview:

- JasmyCoin Price: $0.00356233;

- 24h Low / 24h High: $0.00343384 / $0.00357713;

- 7d Low / 7d High: $0.00344236 / $0.00390529;

- Trading Volume: $20,417,829;

- Market Capital Rank: #167;

- Market Capital: $172,257,819;

- Market Capital Dominance: 0.016%;

- Volume / Market Capital: 0.1187;

- All-Time High: $4.79 or Feb 16, 2021;

- All-Time Low: $0.00275026 on Dec 29, 2022.

Jasmy Price Forecast in 2023 and Beyond

Crypto analysts advise that JASMY is amongst the most promising cryptos that grew this year, forecasting the highest price close to $0.005147, an average price of $0.004804, and the lowest value of $0.004117.

JASMY Price Prediction 2023:

- Potential Low: $0.004117;

- Average Price: $0.004804;

- Potential High: $0.005147;

JASMY Price Projection 2024:

- Potential Low: $0.006862;

- Average Price: $0.007549;

- Potential High: $0.008578;

JASMY Price Projection 2025:

- Potential Low: $0.010294;

- Average Price: $0.01098;

- Potential High: $0.012009;

JASMY Price Prediction 2026:

- Potential Low: $0.013725;

- Average Price: $0.014411;

- Potential High: $0.01544;

JASMY Price Projection 2030:

- Potential Low: $0.027449;

- Average Price: $0.028136;

- Potential High: $0.029165.Source: Bitcoin Wisdom

Final Thoughts

Now that we’ve reached the end of this comprehensive crypto prediction report, we can conclude that the cryptocurrency industry is a dynamic and ever-changing landscape that offers both opportunities and risks for investors.

As we look ahead to 2024 and beyond, it’s vital to approach cryptocurrency acquisitions with caution and a clear insight into the market’s unique traits. Digital assets diversification could be a good strategy to spread risk, and investors should consider a mix of well-established cryptocurrencies and promising newcomers in their portfolios.

Above all, remember that cryptocurrency investments come with intrinsic risks, and individual risk tolerance and investment goals should guide decision-making. Moreover, staying informed about the latest developments in the crypto space is essential for making sound investment choices.