How Does Revolut Staking Work?

In 2023, Revolut, one of the leading digital banks globally, launched staking on its platform.

In this article, we will explore how Revolut staking works, the benefits it offers, and the potential risks, conditions, requirements, and fees associated with it.

What is Revolut Staking?

Just like the original staking process, Revolut staking implies temporarily locking some funds to secure a cryptocurrency’s network and getting rewarded for it. And, of course, as this process is Revolut staking, the entire process takes place exclusively on the Revolut platform.

Staking is suitable for Proof of Stake blockchains and is extremely helpful in supporting the network’s security and contributing to the validating process. Even though it is somehow similar to mining, staking requires less hardware and energy, thus being more accessible and eco-friendlier.

Revolut launched its staking feature in 2023 as part of its plan to expand its crypto-related services, and according to its official website, the process helps investors “earn rewards effortlessly.”

How Does Revolut Staking Work?

In some cases, staking may be pretty complicated, especially for users who perform such activities only sometimes or are beginners in the industry.

However, Revolut staking is extremely straightforward. This is no surprise, as the whole Revolut app is intuitive and user-friendly.

Thus, when it comes to staking on Revolut, users just have to buy some crypto (if they do not hold crypto on Revolut already) and lock it for a set period of time to get rewards based on the amount of crypto staked.

What Cryptocurrencies Can You Stake on Revolut?

At the moment, Revolut supports 6 cryptocurrencies for staking: Ethereum (ETH), Solana (SOL), Polkadot (DOT), Cardano (ADA), Tezos (XTZ), and Polygon (POL, ex-MATIC).

Depending on the cryptocurrency you choose for staking, you can earn various rewards. The rewards strongly depend on the amount of crypto staked, too. For instance, if you stake 1 ETH, you will not be rewarded as much as you would be if you stake 1,000 ETH. However, those temporarily locking their funds will receive a staking reward after a set period.

Revolut Staking APY and Rewards

Revolut provides detailed information about the potential rewards users can earn through staking on the dedicated page for each specific cryptocurrency. The exact reward rate varies depending on the crypto you choose to stake, with some options offering competitive APYs (Annual Percentage Yields).

SIDENOTE. In staking, the APY (Annual Percentage Yield) tells you about your compounded return per year as a percentage figure. For instance, if you stake 1 DOT and the APY is 12,30%, you will get an annual reward of 0.123 DOT for the amount staked. At the current DOT price of $5.93, this would be worth around $0.73.

Polkadot (DOT)

Currently, if you want to stake DOT on Revolut, you will work with an APY of up to 12.30%. Rewards for staking Polkadot are paid weekly, after a waiting period of around 2 days.

It is important to note that the DOT staked on Revolut has a lock-up period of 30 days. Thus, once you unstake DOT, you will have to wait 30 days before accessing the balance. Meanwhile, you will not be able to sell the locked balance of DOT coins.

Tezos (XTZ)

On Revolut, staking Tezos comes with an Annual Percentage Yield of 5.76%. Keep in mind that the reward varies based on network conditions, and even if you get an estimated reward when confirming the staking process, you may receive more or less, depending on how the market fluctuates.

Those staking Tezos will be rewarded after a waiting period of approximately 24 days. The reward timing varies based on network conditions.

Cardano (ADA)

If you decide to stake Cardano on Revolut, remember that the APY stands at 2.09%, and the rewards vary based on network conditions.

Just as in Tezos’ case, the waiting period can fluctuate based on network conditions. The rewards will be automatically restaked to increase your earnings.

Ethereum (ETH)

The APY for staking Ethereum stands at 2.95%, and those aiming to stake ETH on Revolut will receive their rewards daily after a waiting period of approximately 2 days.

In Ethereum’s case, once unstaked, you must wait 10 days before accessing the balance.

Solana (SOL)

Staking Solana on Revolut offers an APY of 5.25%, with rewards paid every 3 days after an initial waiting period of 3 days to start earning. Once unstaked, you’ll need to wait 3 days before accessing your balance.

Polygon (POL, ex-MATIC)

At this time, staking Polygon (POL) on Revolut offers an APY of up to 3.74%, with rewards paid daily after a 1-day warm-up period. Once unstaked, you’ll need to wait 4 days before accessing your balance.

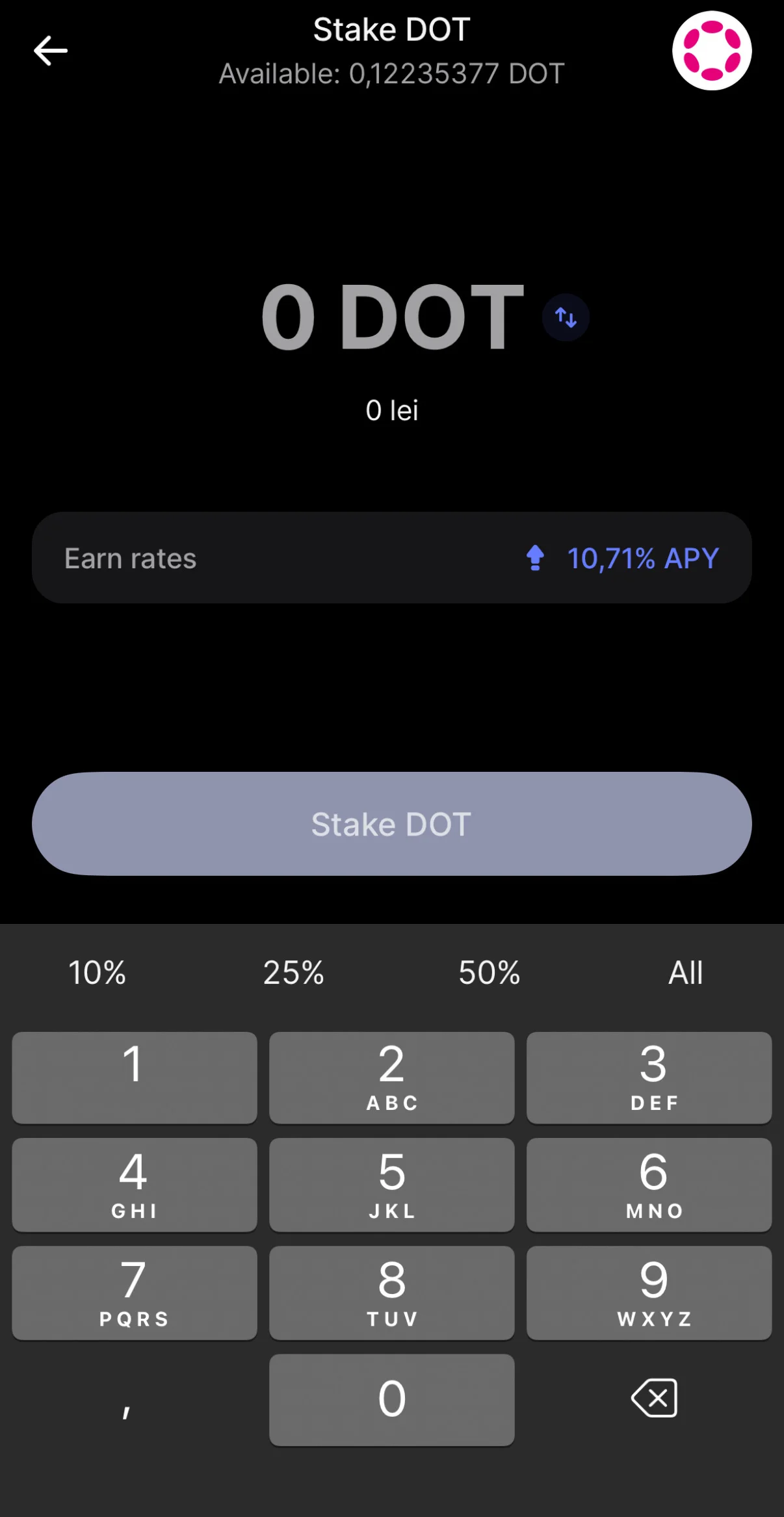

Revolut Staking Step-by-Step

- Open the Revolut app and make sure it’s up to date.

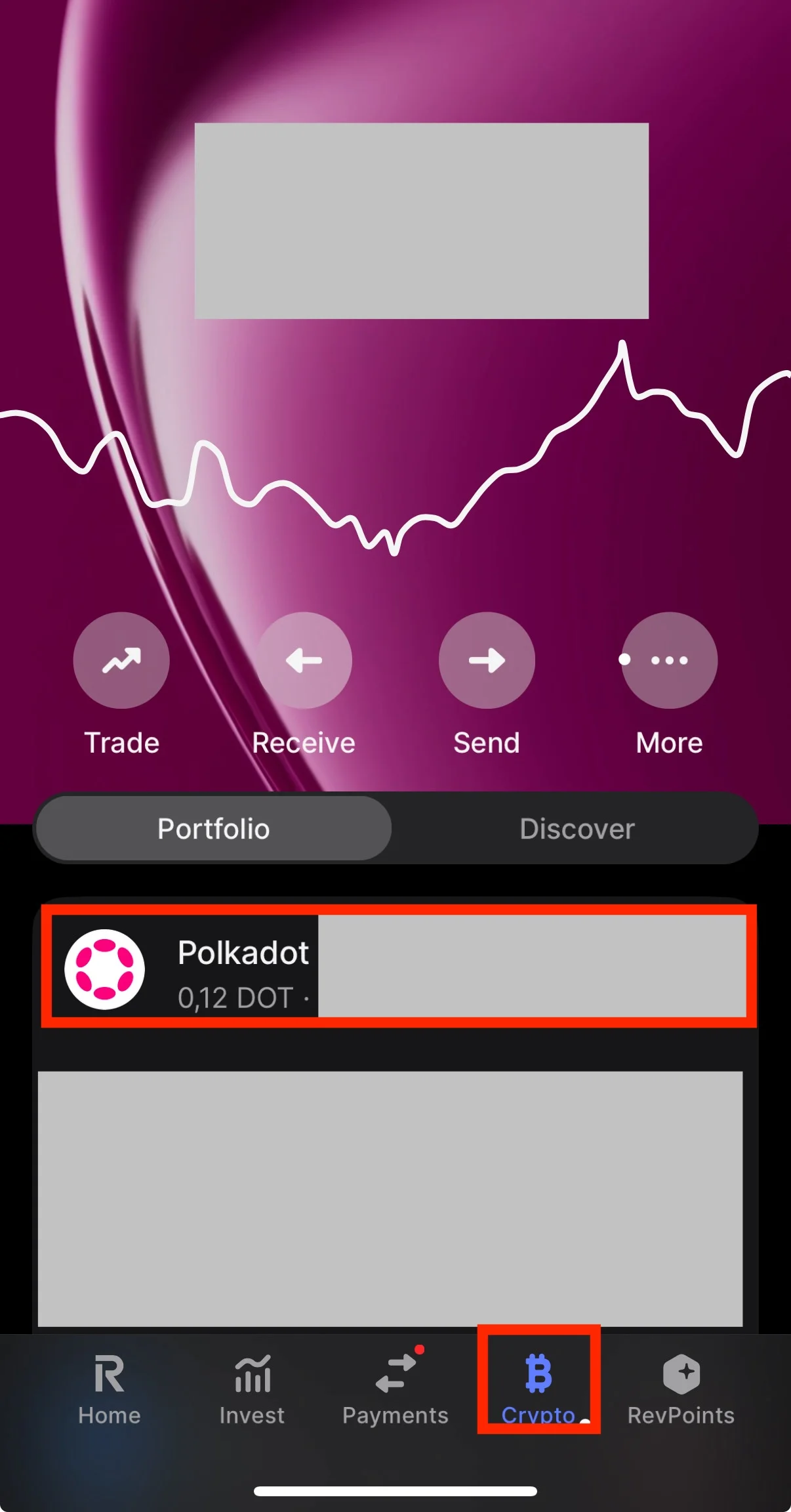

- Go to the “Crypto” section and choose the cryptocurrency you want to stake (e.g., Polkadot).

- If you haven’t purchased that crypto you want to stake yet, you’ll need to buy some first. Remember that you’ll pay a transaction fee when purchasing it.

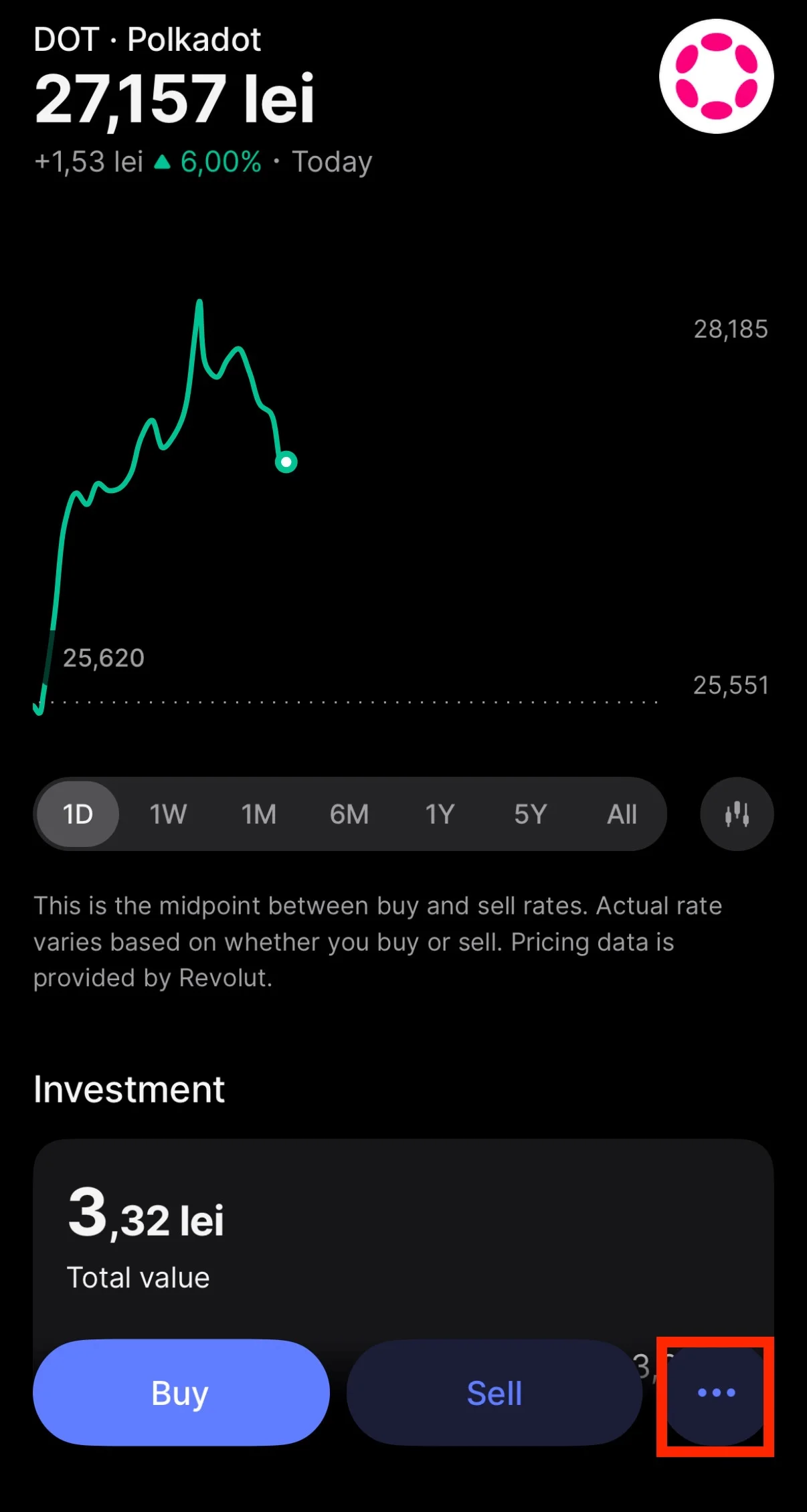

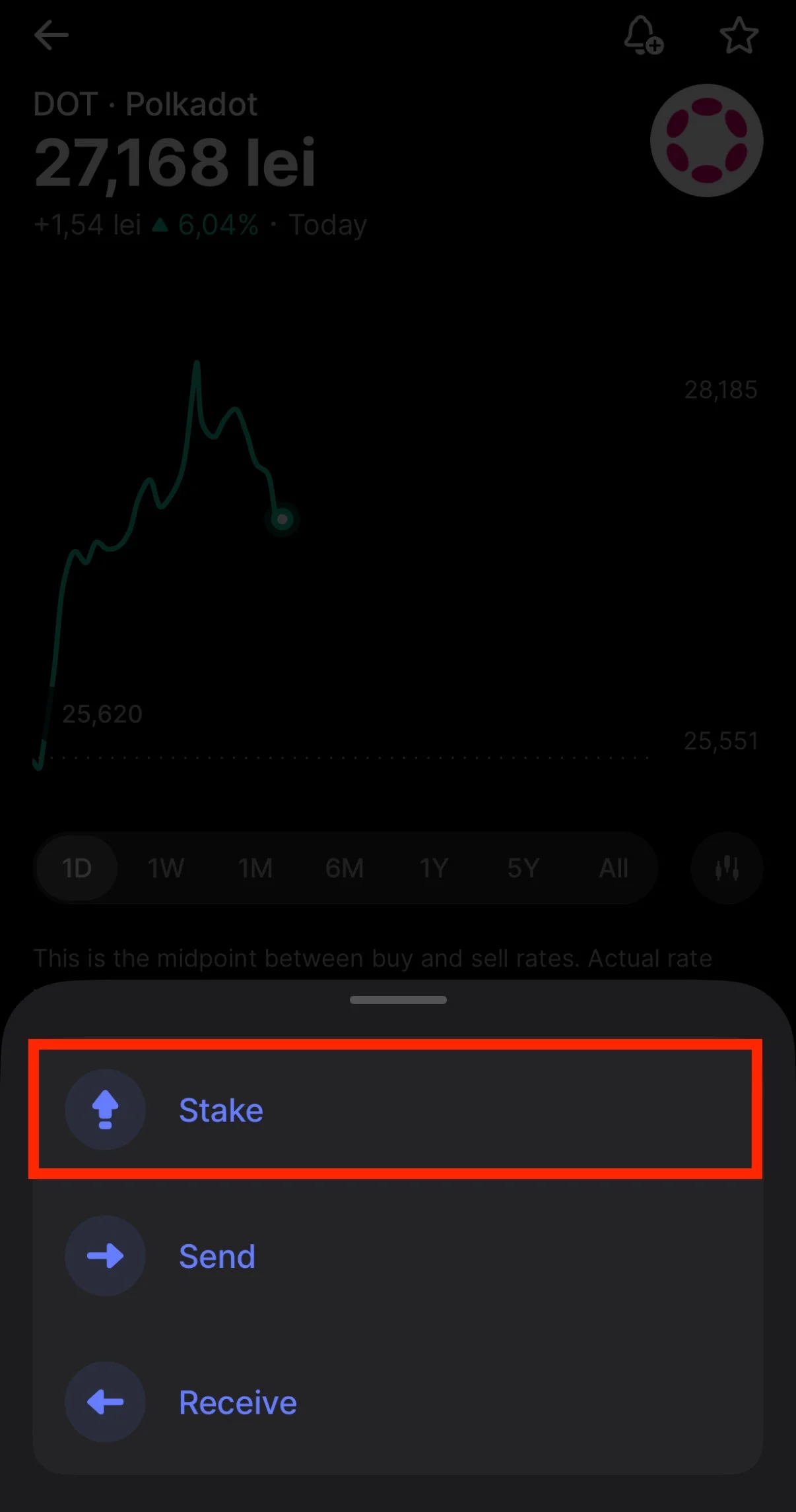

- After purchasing it, go to your portfolio and tap on it. Then, tap the 3-dot menu and select “Stake.” Make sure to read the details carefully before proceeding.

- Tap “Continue” to move forward.

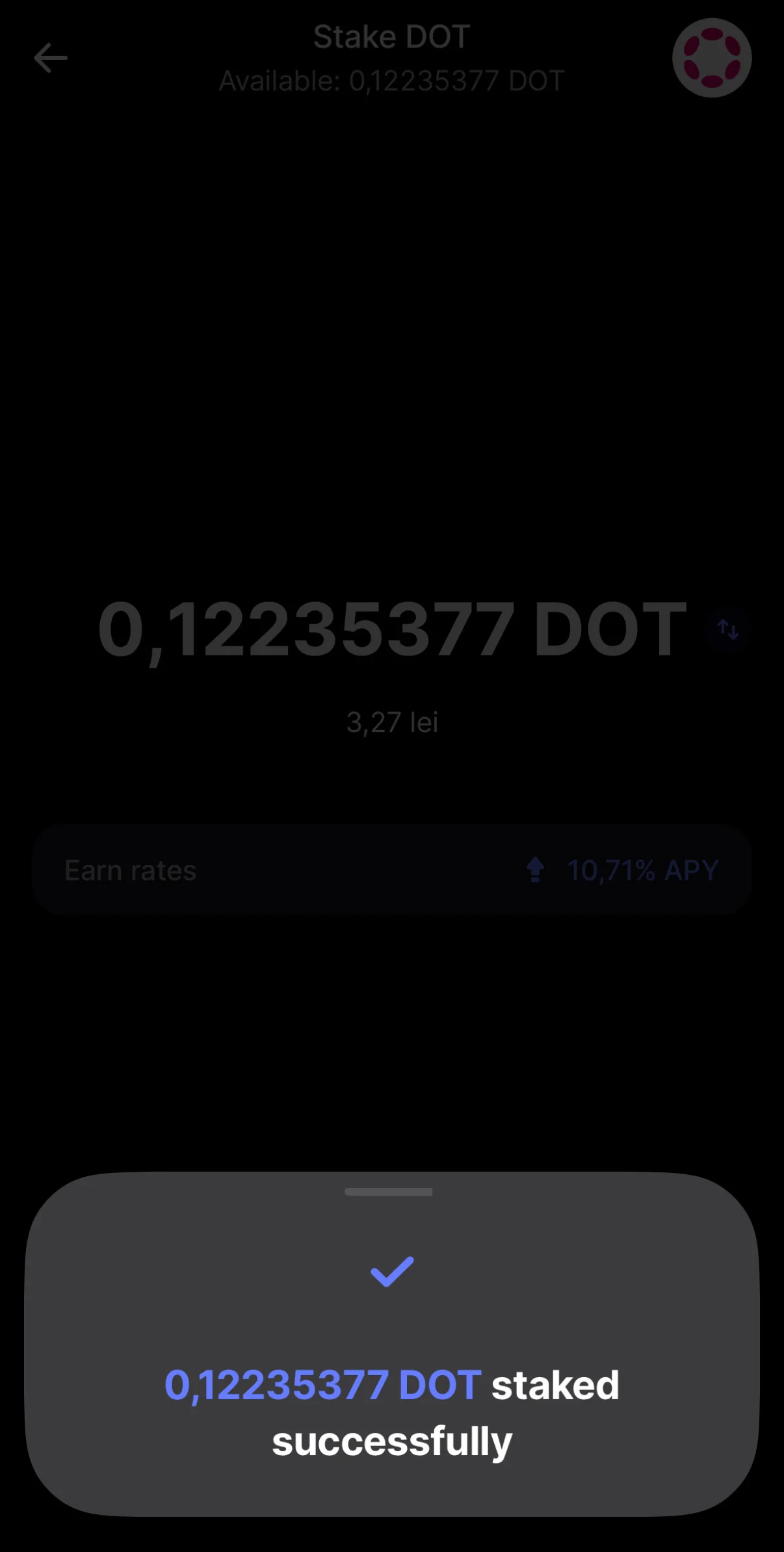

- Choose the amount of crypto you want to stake. You’ll see details about your estimated annual rewards. Once you’ve decided, click “Confirm”.

- You can view more information about your staked coins in your portfolio, such as when you’ll receive your first reward, the staked value in fiat, and the estimated rewards rate.

Risks, Conditions, Requirements, and Fees

Staking on Revolut is a simple and accessible way to earn rewards by locking cryptocurrency on the platform. It allows users to benefit from their crypto holdings through staking.

However, staking still involves certain risks. One of the primary risks is market volatility. Even though you are provided with an estimated annual reward when you stake your crypto, the actual reward may be smaller due to market fluctuations. In the worst case, you may end up with no reward at all.

Additionally, staking crypto comes with potential risks, such as slashing and downtime penalties, which could result in the loss of your staked assets.

Despite these risks, Revolut staking remains a great option for those who want to engage with crypto quickly and easily without needing advanced technical knowledge.

Revolut’s staking service is available in select countries within the EEA. In the UK, the staking product is being phased out, and new stakes are no longer allowed; users can only un-stake their tokens.

Fees for staking vary by region and token. In the EEA, fees range from 15% to 35%, depending on the token and the amount staked. In the UK, the fees are flat and range from 15% to 30%. It’s important to check the specific fees before staking, as they can significantly affect your rewards.

In Conclusion

Revolut staking offers an easy and accessible way to earn rewards by locking cryptocurrencies, making it a great option for both beginners and those looking to engage with crypto in a simple manner.

With support for popular cryptocurrencies like Ethereum, Solana, and Polkadot, users can stake their tokens and earn rewards, though the amount varies depending on the token and the amount staked.

While the process is straightforward, users should be aware of the risks, including market volatility and potential penalties.

Additionally, fees vary depending on the region and cryptocurrency, so it’s important to consider these costs before staking.

Despite these factors, Revolut staking remains a valuable tool for those seeking to earn passive rewards through crypto.