Table of contents

Crypto has come a long way since 2009, when Bitcoin was launched. So many things have changed, and thousands of new cryptocurrencies have been developed. Users now have endless options regarding crypto, blockchain, Web3, NFTs (Non-Fungible Tokens), mining, staking, yield farming, and many more. Even mentioning those crypto-related terms can show how much crypto has grown.

While so many crypto projects are on the market, some remain in the spotlight thanks to their features, the years they have been traded for, and the security and safety they provide. Among them is Ethereum, one of the cryptocurrencies that progressed the most and revolutionized many concepts in the crypto industry.

So, if you have been around for the littlest of time, you might have considered purchasing Ethereum. Are we right?

And you may have also asked yourself what it takes to earn more by staking those ETH coins. Well, you are in the right place. This article will discuss Ethereum staking, its main requirements, and the best ways to stake your ETH.

About Ethereum

Officially launched on July 30, 2015, by a team of 5 founders, Ethereum is the 2nd largest cryptocurrency by market cap after Bitcoin. Unlike some may think, Ethereum was not conceived with fast transactions in mind.

However, the network’s initial developers, Vitalik Buterin, Jeffrey Wilck, and Gavin Wood, aimed to develop an ecosystem that can store decentralized applications (dApps) and help the DeFi industry evolve as much as possible.

The whitepaper of Ethereum, published in 2013, explained what dApps are, how they work, and how they can rely on the Ethereum blockchain. Currently, Ethereum is home to numerous decentralized applications and many other types of crypto projects, being the most developed blockchain.

The Ethereum Merge Update

Over the years, Ethereum has passed through plenty of updates and new launches, but the most significant remains The Merge. While Ethereum first worked based on a PoW (Proof-of-Work) consensus mechanism, on September 15, 2022, the network switched to PoS (Proof-of-Stake), thus moving from mining to staking.

The Merge was a major change for Ethereum and came with various significant benefits, including reduced energy consumption. After switching from PoW to PoS, Ethereum’s energy consumption was reduced by approximately 99.95%, a tremendous decrease in carbon emissions.

The Ethereum Dencun Upgrade

The Dencun upgrade took place on March 13 and is the latest update that starts the surge, Ethereum’s phase, in which it addresses certain scalability limitations. As Vitalik Buterin said, they aim to hit 100,000 transactions per second and beyond.

As a result, the new update consists of nine Ethereum Improvement Proposals (EIPs), including EIP-4844 or proto-dank sharding, which aims to introduce temporary storage called data blobs for Eteherum L2 networks to use.

These blobs will increase the capacity of the availability of data, whereby L2 rollups can use the extra space to submit the data to the mainnet, thus reducing L2 gas fees.

I don’t think there will be an immediate reduction (on March 13), I don’t know how far along the L2s are with rolling out their blob support, but I would suspect that it takes them a few days/weeks to fully support EIP-4844 and not post their data as CALLDATA but switch to blobs – said Marius van der Wijden, software developer at Geth, and Ethereum.

But what does this update mean for Ethereum staking?

There isn’t a direct impact on the Ethereum staking core process; the locking up of 32 ETH remains unchanged. However, the effect is more on the broader picture: the more transactions the network supports per second, the busier the network will become. Thus, it could make Ethereum staking even more appealing, increasing activity on the network.

Ethereum Staking

Once The Merge was completed, the Ethereum network moved to Ethereum 2.0, or the 2nd version of the blockchain. This way, users can stake their ETH to earn staking rewards based on the amount of ETH they lock up and the lock-up period.

Staking ETH implies using your coins to verify, secure, and validate transactions on the Ethereum network. Once a transaction is verified, you can receive a reward. That reward is the network fee required by the blockchain to complete that transaction.

However, with the new Dencun upgrade, the network will cater to more secure interactions between various blockchains through EIP-4788, improving cross-chain bridges and stake pools.

Where and How to Stake Ethereum

Since Ethereum switched from Proof-of-Work to Proof-of-Stake, crypto enthusiasts can now stake their ETH coins. It is widely known that the staking process is a little less complex than mining. Furthermore, you need less powerful (and expensive) hardware for staking than mining.

So, many crypto investors were eager to start staking Ethereum once this was possible.

Currently, there are multiple ways to stake ETH, and you have to choose the most profitable and accessible to complete, depending on your needs, holdings, and knowledge.

The most popular Ethereum staking options include solo staking, staking pools, staking through a centralized crypto exchange, or even SaaS (Staking as a Service).

We will take them one by one and highlight their features and advantages.

1. Staking Ethereum on Crypto Exchanges

Hundreds of cryptocurrency exchanges are on the market, each with new or improved features and products. Most of them also support Ethereum, among other cryptocurrencies, and some also allow users to stake their ETH tokens to improve the Ethereum network and earn extra coins.

Staking on a crypto exchange is easier than you think. First, you must sign up on a platform if you still need an account. Then, you should purchase ETH or move it from another platform. Afterward, you must select the amount of ETH you want to lock up and start staking it.

Binance

Binance is the largest cryptocurrency exchange by trading volume, with over 168 million registered users. The platform is user-friendly but most suitable for crypto investors with at least a little trading knowledge.

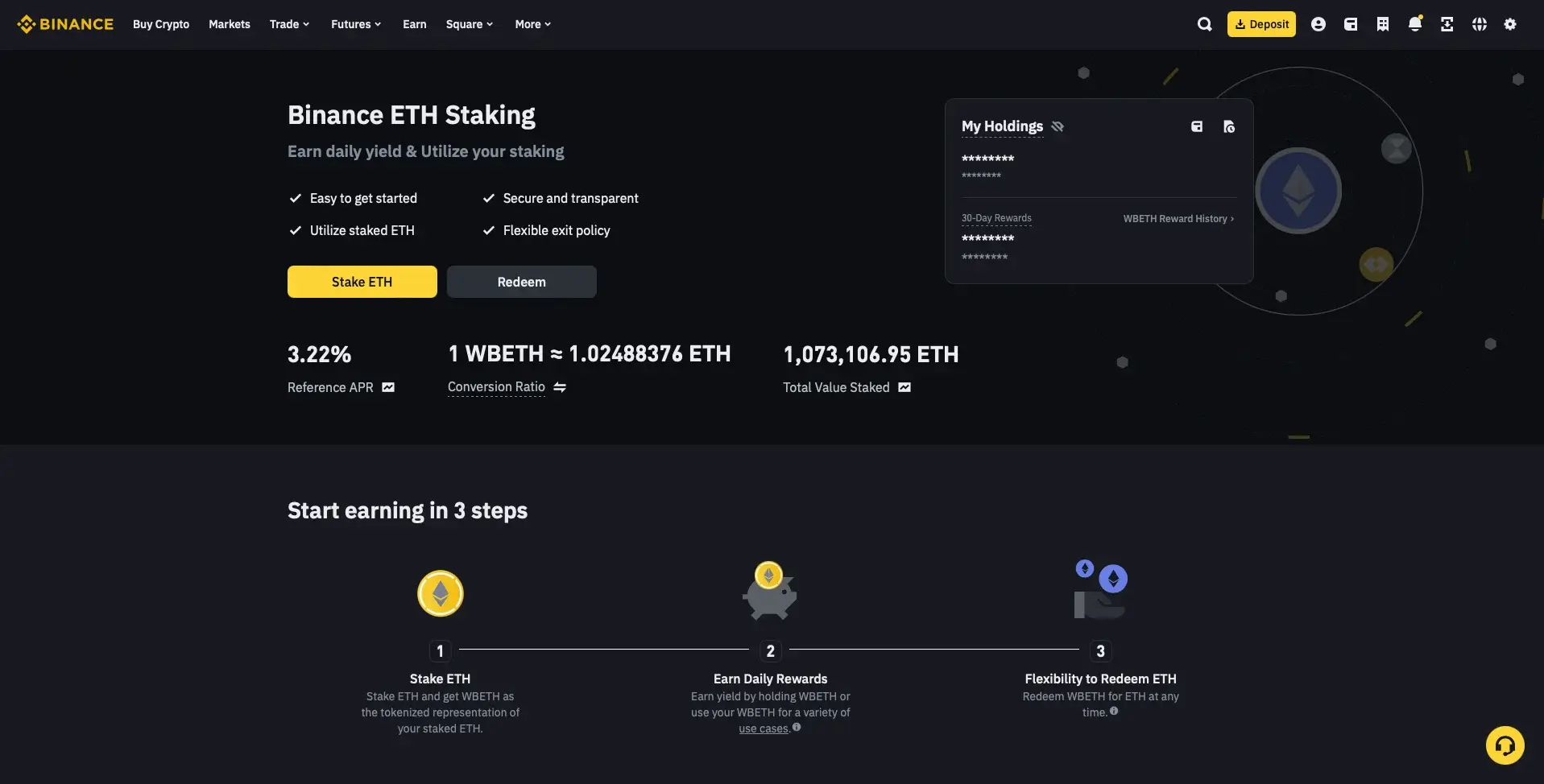

Binance supports over 350 cryptocurrencies, including Ethereum (ETH). Furthermore, the platform allows users to stake their ETH coins. The minimum required amount is 0.1 ETH, and the reference APR varies but is approximately 3.5%. At the moment of writing, the reference APR was 3.22%.

Staking ETH on Binance is as straightforward as possible. You do not need extensive crypto knowledge to do this, and Binance is here to help its users stake their Ethereum coins by explaining the process on its official website.

Step 1: Sign up on Binance

First, if you do not have a Binance account, you should sign up. To do this, you will have to provide an email address, your phone number, and other similar information. However, Binance will never ask you to provide too much information, as it only requires what it needs to create your account.

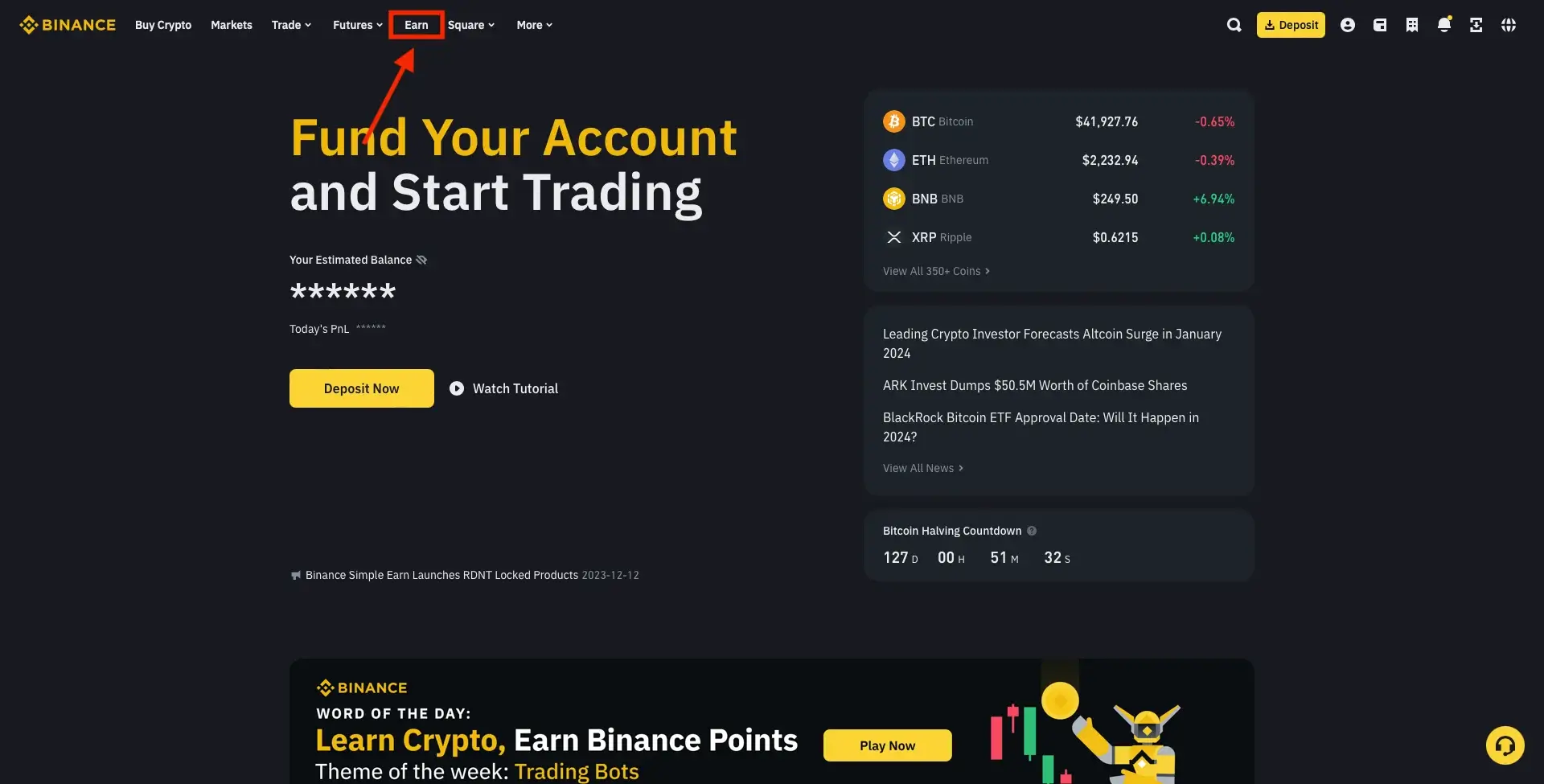

Step 2: Click on “Earn”

Once you are registered and signed in, you can go to the staking page. To do this, you will have to click on “Earn” from the top of the screen.

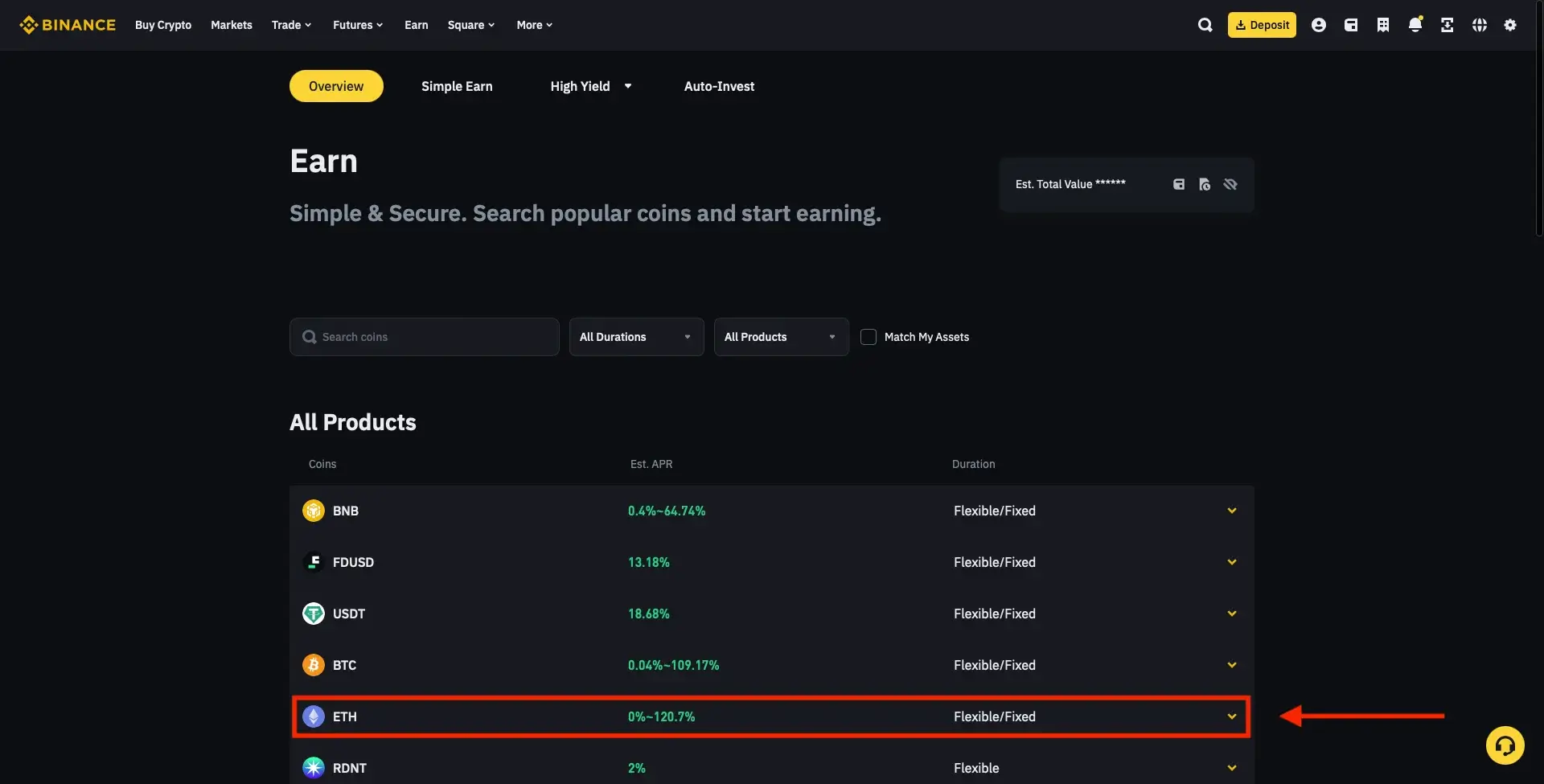

Step 3: Click on Ethereum

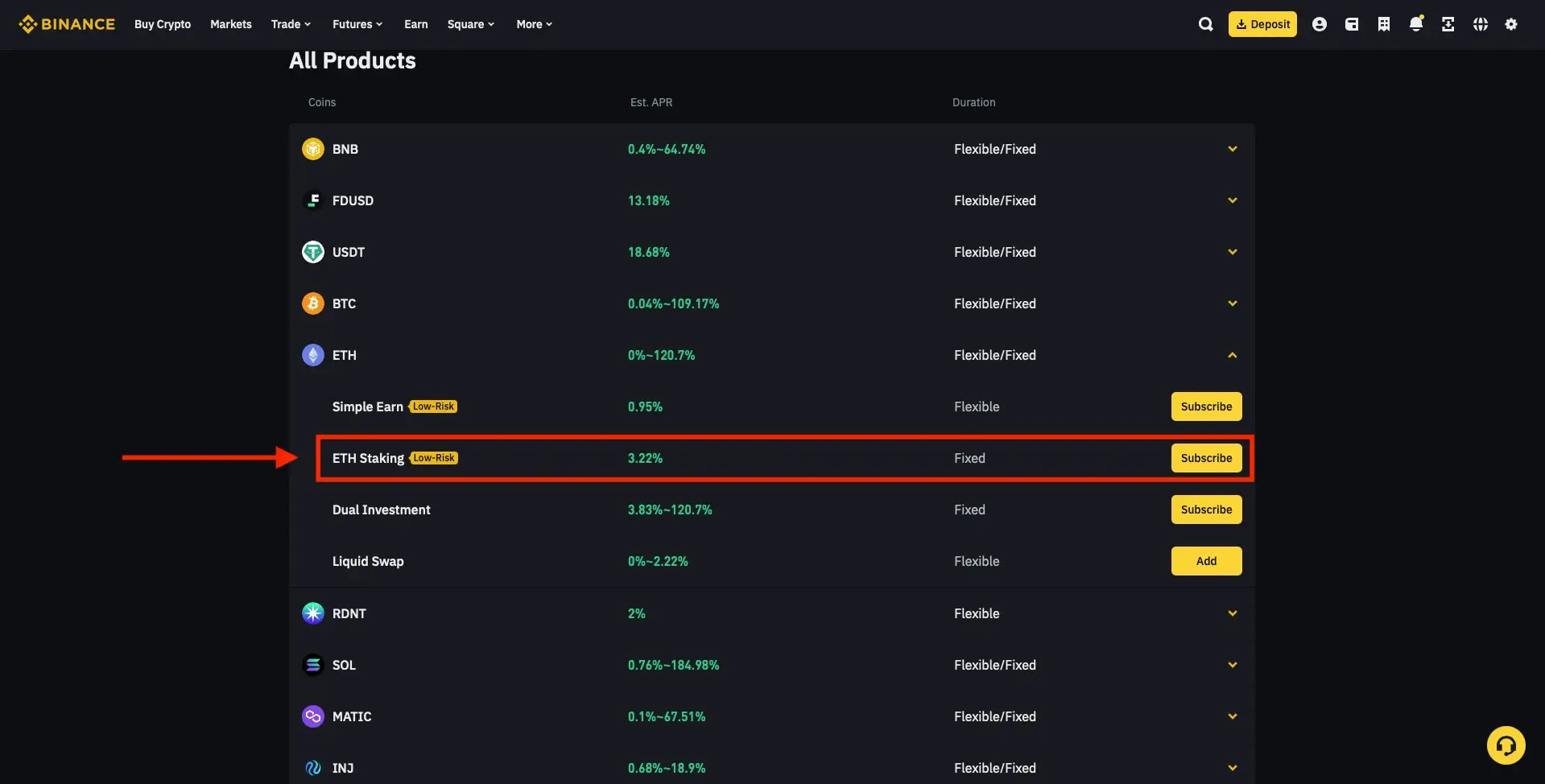

Then, you should see multiple cryptocurrencies available, each having a dropdown. Click on “Ethereum.”

Step 4: Click on “ETH Staking”

Then, you will see the staking option.

Step 5: Start Staking Ethereum

After you click on “ETH Staking,” you will be able to stake your Ethereum coins as desired. You will also notice the reference APR, the conversion ratio, and the total value staked on Binance.

Of course, it is essential to note that you must hold ETH to stake it on Binance or any other platform. So, if you do not hold it yet, you can purchase it directly on Binance.

Coinbase

Coinbase is the 2nd largest crypto exchange on the market, available almost worldwide and offering numerous trading services. Coinbase allows users to buy, sell, and trade over 250 cryptocurrencies through 2 leading platforms: Coinbase Simple Trade and Coinbase Advanced Trade.

Staking on Coinbase is pretty straightforward. The platform is user-friendly, and the staking feature is not significantly more complicated than other processes supported by the Coinbase exchange.

Once you have some ETH coins in your account, you can start staking it and earn ETH staking rewards. The estimated reward rate for Ethereum staking is 3.49%. Thus, depending on your holdings and the amount you lock up, you can earn approximately 3.49% of the amount of staked ETH.

Kraken

Kraken is one of the most trusted cryptocurrency exchanges, allowing users to buy, sell, and exchange over 220 cryptocurrencies, including the most popular, Bitcoin and Ethereum.

Although the staking feature is a little affected at the moment by a lawsuit filed by the SEC against Kraken at the beginning of the year, the crypto exchange still offers staking for various cryptocurrencies, such as Ethereum (ETH), Cardano (ADA), Cosmos (ATOM), Polkadot (DOT), Polygon (MATIC), Solana (SOL), Tezos (XTZ), or Tron (TRX). However, it is essential to note that the feature is still not available for US citizens.

Still, if you want to earn rewards by staking ETH, you can use Kraken, as the platform is extremely intuitive, so the process should not take too much. The yearly rewards for Ethereum staking range between 3% and 6%, depending on the amount of staked ETH and the period you decide to lock up your coins.

2. Stake Ethereum on Crypto Wallets

Staking Ethereum through crypto wallets is as easy as with crypto exchanges. Things are similar, and the main requirement is to hold some ETH coins in your account. Numerous wallets allow users to stake ETH, some of the most popular being MetaMask and MyEtherWallet.

MetaMask

MetaMask may be one of the most popular cryptocurrency wallets on the market. It is available as a web browser extension (available on Chrome, Firefox, Brave, Edge, and Opera) and a mobile app (available on Android and iOS devices), and users usually praise the wallet for its user-friendliness. MetaMask allows you to stake crypto on both its extension and app.

In the app, for instance, you have to go to the “Explore” section and search for “MetaMask Portfolio.” Afterward, all you have to do is access the MetaMask dashboard and tap on “Stake.” Then, you can select Ethereum and choose a platform.

You can choose from Lido and Rocket Pool. The rewards differ, too. Lido offers rewards of up to 3.83%, while Rocket Pool has a reward rate of approximately 3.65%.

MyEtherWallet

MyEtherWallet is one of the best Ethereum wallets on the market, supporting all ERC-20 and ERC-271 tokens. On MyEtherWallet, users can buy, sell, swap, and exchange crypto seamlessly, thanks to the company’s user-friendly platform. The wallet is free to use, and investors must support network fees.

MyEtherWallet also allows users to stake ETH on the platform, offering 2 types of staking. Users can run a validator node or stake smaller amounts of ETH through pooled or liquid staking.

Users can check their rewards on the MyEtherWallet platform, available on web and mobile devices. The rewards vary depending on the amount of staked ETH and the lock-up period.

3. Solo Staking

Also called “native staking,” solo staking brings you the most significant rewards, but there is a catch: to be a solo staker, you have to get your own validator node, and this requires 32 ETH. Such crypto may be too much for some users, considering that ETH exceeded $2,000.

However, solo staking is quite profitable, and the hardware required for this type of staking is not that expensive, especially compared to the hardware you need to mine crypto.

If you decide to stake ETH alone, you must do all the work. Solo Ethereum validators will have to wait a bit more to earn rewards, as they also have to go through an activation process enforced by the protocol. The process might take a few days, but in some cases, it can also take a couple of weeks.

Overall, solo staking is considered the least risky option, assuming you have complete control over your staked ETH and validator rewards.

Staking as a Service (SaaS)

If you hold at least 32 ETH and want to earn native block rewards but do not want to get directly involved with the staking process, you can choose SaaS (Staking as a Service). Specific staking platforms can manage the validator on your behalf.

Of course, if you choose to do this through such staking services, you must pay a little commission to the company managing your validator. All in all, staking-as-a-service is an excellent option for those who aim to earn crypto through staking but need more time or the proper hardware to do it themselves.

Of course, once you give your ETH to a SaaS platform, the entire staking process becomes a little less safe. However, just like with any other crypto-related process, we strongly advise you to research the platforms available and choose the safest option.

With so many crypto platforms, you will find a trustworthy platform to manage the staking process.

4. Pooled Staking

If you do not have 32 ETH, you can join a staking pool, where users’ ETH coins are combined to get the total required for running a staking node. Pooled staking platforms offer many users the opportunity to join the Ethereum ecosystem without the burden of having to purchase 32 ETH (approximately $70,630).

While the Ethereum network does not directly support pooled staking, various platforms allow you to join staking pools in no time. That platform will activate and deactivate validators according to deposits and withdrawals. Furthermore, they must manage and ensure that it supports the pool.

5. Liquid Staking

Liquid staking is similar to pooled staking, but some differences are worth considering. This staking method implies staking your coins into a pool, but the reward part is entirely different.

In liquid staking, users receive rewards based on their percentage ownership. However, you will not receive tokens; you will receive transferable receipt tokens (also called liquid staking tokens). These tokens will prove ownership and allow you to withdraw your funds.

Remember that many consider liquid staking one of the riskiest methods, as it implies counterparty risks with the transferable receipt. However, once you get the ETH staked to a safe place, everything should be under control.

Pros and Cons of Ethereum Staking

Ethereum staking brings pros and cons to the table, so in the following chapters, we’ll find out which are which and how to harness this process in your favor.

ETH Staking Pros

1. Staking Rewards

By now, it’s clear that when you stake Ethereum, you are rewarded with the ETH for your contribution and securing the network. The amount depends on how much you staked and for how long.

2. Assist the Network

The staking process heavily contributes to the Ethereum network security and decentralized principles, as all stakes, with no exception, are responsible for validating the transactions.

3. Maintaining the ETH Ecosystem

As we’ve seen in the Ethereum update for PoS, staking is more eco-friendly as it doesn’t require high computational power, as seen in PoW or mining Bitcoin.

4. Being Part of The ETH Governance

All validators have an essential role within the governance network, and since they are doing the hard work to keep the network secure, they have the power of the decision-making process.

ETH Staking Cons

Regarding the downsides of staking Ethereum, the first and foremost is the technical risk, which means a network attack and losing your ETH.

Overall, ETH staking is an excellent way of getting rewarded, yet it is essential to take into consideration all factors, good and bad.

Final Thoughts

Staking Ethereum is a great opportunity to earn passive income by locking up the coins you hold for as long as you want. With so many staking options, it may seem hard to choose the best option for your funds.

Solo staking requires more advanced hardware and a minimum of 32 ETH to become a validator. However, with pooled or liquid staking, things get a whole lot easier.

Furthermore, if you hold 32 ETH, you can choose staking-as-a-service, and a staking provider will manage your funds and complete the staking process.

Besides, you can always consider staking through a crypto exchange or wallet, as many such platforms also provide staking services. On exchanges and wallets, things get a lot easier, but there is a possibility that the rewards will decrease once you choose such a staking method.