Table of contents

Besides being an intriguing concept that revolutionizes many financial processes, trading crypto can indeed bring some profits, especially when done right and when you are not required to pay tremendous fees to a broker or a crypto exchange.

And in this article, we will talk about the fees Coinbase charges for various types of transactions and whether there are some ways in which you can avoid the fees or at least minimize them.

So, let’s dive in and see how to avoid Coinbase fees to keep as much of the profit as possible.

About Coinbase

Coinbase is one of the first digital currency exchanges ever launched. Currently the 2nd largest cryptocurrency exchange on the market, Coinbase gathers millions of new users on its platform, allowing them to buy, sell, and trade over 250 cryptocurrencies.

Coinbase was launched in 2012 by Brian Amstrong and Fred Ehrsam. Based in San Francisco, California, the crypto exchange offers over 350 trading pairs and is available in over 100 countries, including the US, Canada, the United Kingdom, and almost all countries from Europe.

Usually, crypto investors choose Coinbase thanks to its user-friendly and beginner-friendly interface. Furthermore, Coinbase has developed multiple security features; considering that security is one of the most important aspects crypto investors consider when choosing a crypto project or company, Coinbase is among the top options for every crypto enthusiast.

In May 2018, Coinbase launched Coinbase Pro, an advanced trading platform formerly known as GDAX. Coinbase Pro was designed for experienced crypto traders seeking a more complex platform to fulfill their crypto trading needs.

However, in June 2022, Coinbase announced that it would migrate the Coinbase Pro accounts to Coinbase Advanced Trade, a platform developed on the main Coinbase website. Coinbase Advanced Trade would be highly similar to Coinbase Pro, the main difference being that Coinbase Advanced Trade users would not be required to create a different account besides their regular Coinbase account. Instead, Coinbase users would use the same account for Coinbase Simple Trade and Coinbase Advanced Trade.

The Coinbase Fees

Another thing Coinbase is famous for is the fees it charges. However, instead of being popular for low fees, new investors believe that Coinbase fees are pretty high, and many look for the best ways to reduce these fees. But let’s see what fees the crypto exchange usually charges.

Transaction Fees

The fees charged by Coinbase follow a pretty complex fee structure. Thus, depending on the user’s region, the size of the order, the market conditions, the payment method used, and the crypto they buy or sell, they can pay a flat fee or a variable percentage of the crypto they trade.

Usually, the transaction fees are displayed in the last step of any transaction and are usually paid from the total you aim to buy or sell. Thus, if you want to buy $100 worth of BTC and the transaction fee is $2, you will receive $98 worth of BTC when the transaction is completed. On the other hand, if you want to sell $100 worth of BTC and the fee is $3, let’s say, the receiver will be transferred $97 worth of BTC to their account.

Staking Services Fees

It is widely known that Coinbase allows users to stake their digital assets on Coinbase Prime. Currently, crypto holders can use Coinbase to stake Ethereum (ETH), Avalanche (AVAX), Ethereum Liquid Staking (LsETH), Solana (SOL), Tezos (XTZ), Cardano (ADA), Polkadot (DOT), Polygon (MATIC), Near Protocol (NEAR), Cosmos (ATOM), Kusama (KSM), and Celo (CGLD).

And when it comes to staking fees, Coinbase has set different fees ranging from 15% to 35%, depending on the cryptocurrency and whether the user is a Coinbase One member or has a basic account.

Coinbase Fee for Credit Cards

Coinbase’s credit card also comes with its own conversion fees. If you hold a credit card, you may be charged a 2% flat fee for every transaction you complete with this card. Furthermore, there is a 2.49% conversion fee for Coinbase Wallet currency conversions.

Besides, you may want to check the withdrawal fees when you plan to use the Coinbase Card at an ATM, as some operational fees might be applied to your transactions. It is recommended to check these withdrawal fees before confirming the transactions.

Spread Fees

Coinbase charges a spread fee on crypto sales and purchases. Usually, the fee is calculated by considering the market fluctuations, but it is usually around 0.5%. However, just like transaction fees, users should be aware that the spread fee is calculated by considering the size of the order, the payment method, and the market conditions.

Thus, while the fee may be around 0.5% most of the time, it strongly depends on other factors Coinbase considers when calculating it.

Trading Fees

Whether you’re looking to purchase cryptocurrency or sell cryptocurrency, and sell cryptocurrencies, keep in mind that Coinbase uses a maker-taker fee model for determining the trading fees, and the costs can be the following:

| Tier | Taker fee (bps) | Taker fee (%) | Maker fee (bps) | Maker fee (%) |

| $0 – $9,999 | 60bps | 0.6% | 40 bps | 0.4% |

| $10,000 – $49,999 | 40bps | 0.4% | 25 bps | 0.25% |

| $50,000 – $99,999 | 25bps | 0.25% | 15 bps | 0.15% |

| $100,000 – $999,999 | 20bps | 0.2% | 10 bps | 0.1% |

| $1,000,000 – $14,999,999 | 18bps | 0.18% | 8bps | 0.08% |

| $15,000,000 – $74,999,999 | 16bps | 0.16% | 6bps | 0.06% |

| $75,000,000 – $249,999,999 | 12bps | 0.12% | 3bps | 0.03% |

| $250,000,000 – $399,999,999 | 8bps | 0.08% | 0bps | 0% |

| $400,000,000+ | 5bps | 0.05% |

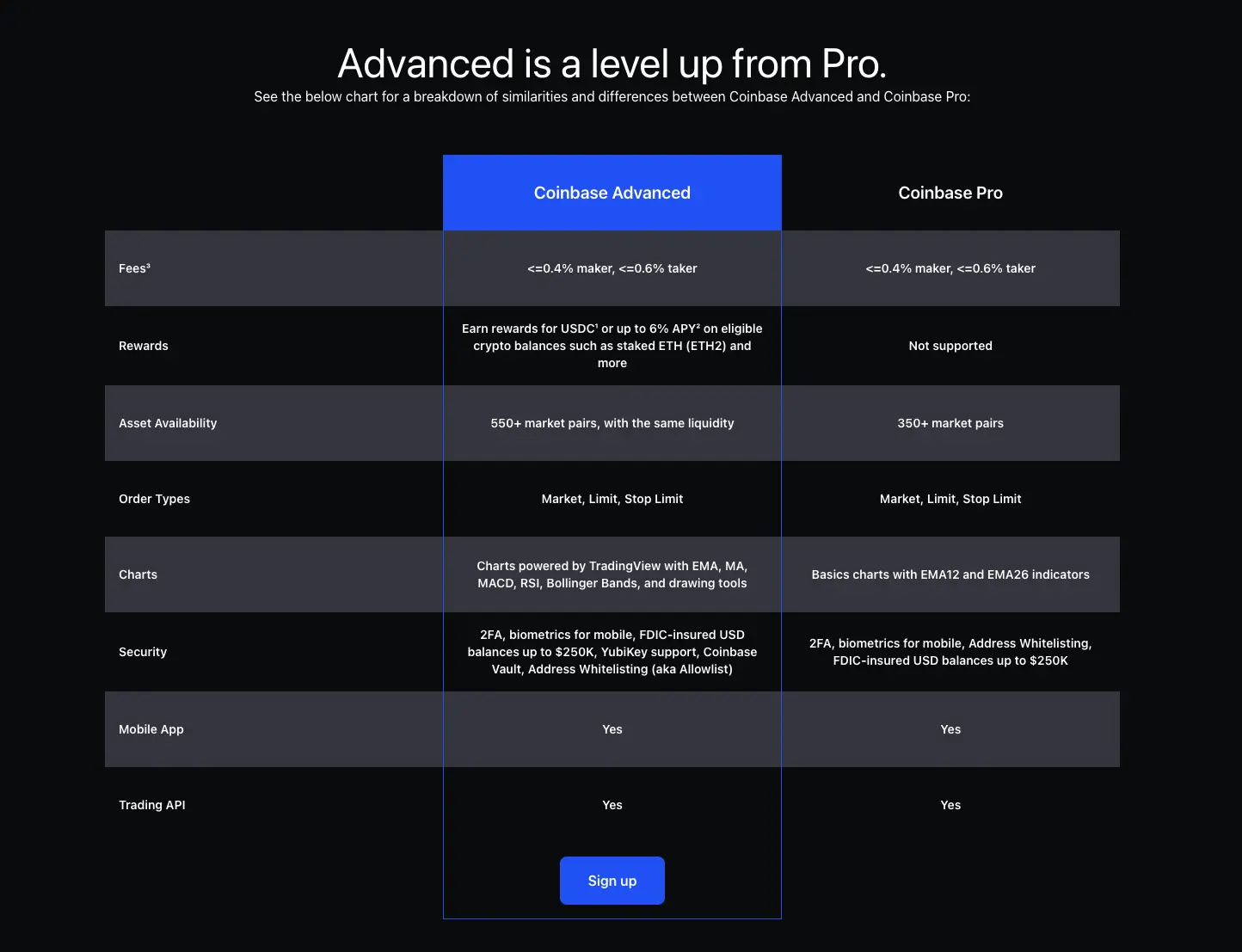

Coinbase Advanced Trade Fees

Just like Coinbase and Coinbase Pro fees used to differ, it is the same with Coinbase Simple Trade and Coinbase Advanced Trade. Thus, while Coinbase Simple Trade charges the fees mentioned earlier, Coinbase Advanced Trade has set other fees.

On the advanced trading platform provided by Coinbase, the taker fees are never higher than 0.60% and the maker fees are never higher than 0.40%.

Maker Fees vs. Taker Fees

The main difference between makers and takers is related to how quickly an order gets a match. Thus, if you place an order and it is matched almost immediately, you are a taker and pay the fees accordingly.

However, if you place a trading order that an existing one does not immediately match, you are a maker, and your order is placed on the order book. Once the order has a match, you can complete the transaction and will be required to pay a maker fee.

How to Avoid Coinbase Fees?

Considering that crypto users see Coinbase fees as pretty high, many investors tried to find ways to avoid or at least minimize them. Thus, let’s see what Coinbase users can do to keep as much crypto as possible when trading on the crypto exchange.

Switch to Coinbase Advanced Trade

The most straightforward option to avoid (or reduce) Coinbase fees would imply switching to Coinbase Advanced Trade. If you’re trading regularly, this will help you save money and will be kinder to your bank account in the long term.

Just like Coinbase Pro, Coinbase Advanced Trade has different fees.

Coinbase Simple Trade vs Coinbase Advanced Trade Fees

As mentioned, Coinbase Advanced Trade has fees ranging from 0% to 0.6% for the taker and 0.4% for the maker.

Coinbase Simple Trade, on the other hand, can have various fees, and they usually vary based on factors such as the payment method, the user’s region, the size of the order, or the market conditions. Thus, if you place a bigger order and the market conditions do not benefit you, you may end up with surprising transaction fees.

Use Bank Transfers Instead of Credit/Debit Cards

As we previously mentioned, Coinbase fees depend on the payment method used. So it may be more profitable to use a bank transfer instead of a debit or credit card.

For instance, in the UK and Europe, the maximum fee for a bank transfer is €0.15, while in the US, the cost reaches 1.49%. On the other hand, if you use a debit or credit card to complete Coinbase transactions, you may have to pay fees of 3.99% of the order, regardless of your region.

Now, imagine that you want to purchase $10,000 worth of BTC. If you complete this transaction using a bank transfer, you will pay a €0.15 ($0.16) fee if you are based in the UK in Europe, and you will end up with $9,999.86 worth of BTC in your account. If you are a US citizen, you will be charged a $149 fee, thus keeping $9,851 worth of Bitcoin. However, if you want to buy Bitcoin with a credit or debit card, you will have to pay $399 worth of buying fees, leaving you with only $9,601 worth of BTC.

The difference between €0.15, 1.49%, and 3.99% may not seem that big when you are trading small amounts of crypto, but if you decide to purchase or sell larger amounts (like the example we have just discussed), you may want to complete the transactions through bank transfers.

And while a 3.99% fee may not seem that worrying, imagine that you purchase a digital currency that will surge shortly, increasing its price by x1,000. Would 3.99% seem much at that moment?

We Also Recommend: How Long Does Coinbase Verification Take?

FAQ

Why are Coinbase fees so high?

First, if we are talking about Coinbase’s fee structure, it is essential to note that in some cases, Coinbase calculates the fees by considering market conditions, a user’s region, payment methods, and the order size. Thus, if you are “in the wrong place, at the wrong time” and want to trade a considerable amount of crypto, you may incur tremendous fees.

Then, Coinbase is one of the most popular and widely used cryptocurrency exchanges in the world, implying that the platform has a surprising trading volume. This also brings higher costs, considering that Coinbase also looks at market conditions when setting the fees.

Furthermore, Coinbase’s popularity and the fact that the company is based in the US make the crypto exchange a point of interest for the SEC.

Thus, Coinbase is subject to various SEC regulations, and the financial institution is well-known for its stringent rules. This means that Coinbase sets higher fees to pay the compliance costs required by the SEC.

One more thing crypto investors should consider is that Coinbase is popular for its beginner-friendly interface. And a platform designed for beginners will allow users to buy, sell, and trade crypto through shorter trading processes and without requiring traders to have extensive crypto trading knowledge.

Of course, easier trading processes come at a price, and that price can be seen in higher transaction fees.

Can you deposit on Coinbase without fees?

Usually, Coinbase does not apply deposit fees for crypto. However, if you want to add money to your account using fiat currencies, you may be required to pay specific fees, depending on the currency.

In Conclusion

Coinbase is one of the first cryptocurrency exchanges launched. Currently, Coinbase is the 2nd largest crypto exchange on the market, supporting over 250 crypto assets and more than 350 trading pairs and being available in over 100 countries, including the US, the UK, Canada, and Europe.

While Coinbase is well-known for its security features and beginner-friendliness, the crypto exchange also surprises crypto traders with pretty high fees, so make sure you always keep an eye on the exchange rate. Coinbase uses various fee structures and models, which may confuse some crypto investors.

However, if you want to pay lower fees or avoid Coinbase fees altogether, you can switch to Coinbase Advance Trade, Coinbase’s cryptocurrency trading platform designed for advanced users. Furthermore, you can use bank transfers instead of credit or debit cards.