Table of contents

- Coinbase at a Glance

- What Is PayPal?

- How to Withdraw Funds from Coinbase to Paypal?

- Can I use PayPal as a Payment Method on Coinbase?

- How to Withdraw from Coinbase to PayPal | Step-by-Step

- Coinbase Withdraw to PayPal Fee

- How Long Does Coinbase Withdrawal Take?

- About Coinbase

- FAQ

- How to Withdraw from Coinbase to PayPal: Conclusion

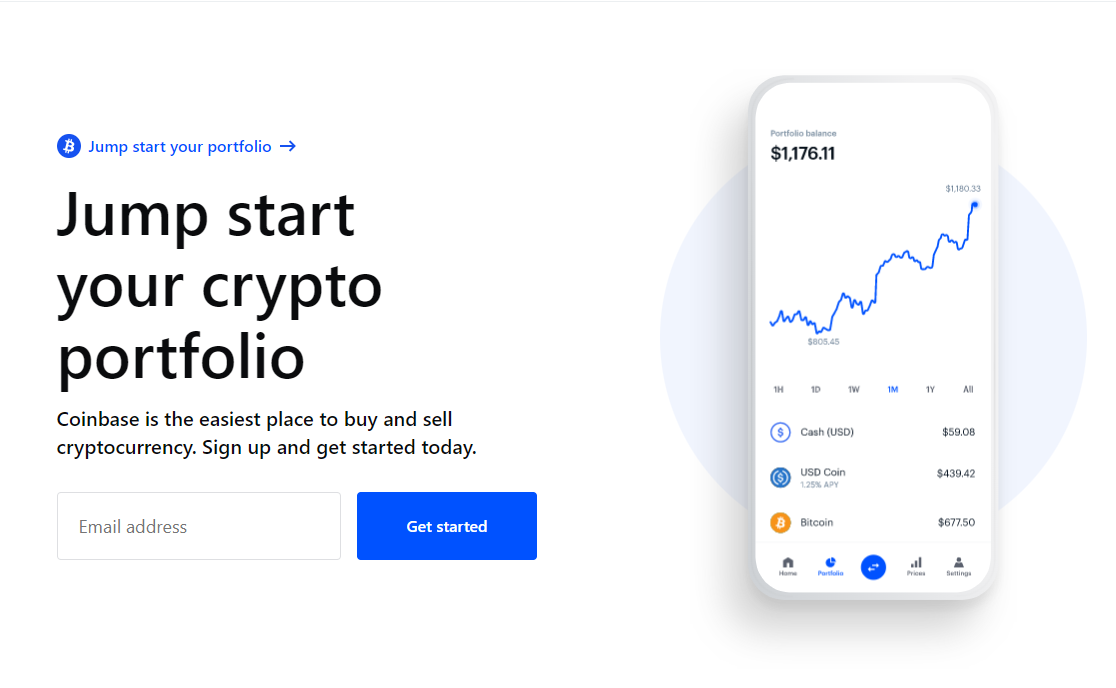

Coinbase is currently one of the most prominent platforms used across the world when it comes to crypto buying and selling. Over the last few years, millions of individuals across the United States and the world have been using Coinbase to conduct transactions, and this has made it grow as one of the biggest crypto exchange platforms.

With most crypto enthusiasts making use of the platform daily, Coinbase has allowed them to link their accounts with PayPal.

This article looks at how users can withdraw from Coinbase to PayPal. Crypto investors will also come to understand how long withdrawals from Coinbase can take and why Coinbase-PayPal withdrawal is so efficient.

Thus, if you too want to know how to withdraw money from Coinbase, stick with us.

Coinbase at a Glance

Fred Ehrsam, Ben Reeves, and Brian Armstrong established Coinbase in 2012. Though it was first developed to provide Bitcoin-only trading services, Coinbase has grown to be the most widely used crypto exchange. The platform that initially started as a simple interface was made easily accessible to traders, as it was easy to understand and trade digital assets.

These properties made Coinbase a popular cryptocurrency exchange platform and broker, adding points to its safety and reliability. Currently, the platform does not support depositing funds from PayPal but allows users to withdraw to it.

At the moment, Coinbase is the 2nd largest crypto exchange by market cap, with Binance being the 1st. Providing several safety and security features for worldwide crypto investors, Coinbase is indeed an option worth considering when looking for a cryptocurrency exchange.

With over 103 million verified users and approximately 9 million monthly active users, Coinbase is indeed a platform that aims to revolutionize the crypto industry.

One of the best things about Coinbase is the fact that it has a very accessible user interface, making it very good for those who have just started with crypto. Coinbase is usually compared with Binance, which is also a good exchange.

Coinbase allows its users to buy and sell cryptocurrencies and a deposit through a debit card or a bank transfer. Other advantages include the fact that it has pretty low fees and that it’s a fully regulated crypto exchange.

Another aspect that sets Coinbase apart is that it allows you to withdraw cash from your account and deposit it directly into your PayPal account. And, by taking advantage of PayPal’s Instant Transfer capability (available to US citizens), you can instantly receive cash for a fee of $0 directly to your linked debit card. If you want to find more, you can check our Coinbase review.

Main Features

Currently, Coinbase is available in over 100 countries and supports over 250 cryptocurrencies, a number pretty big when compared to other similar platforms. Besides, Coinbase also supports several fiat currencies, such as USD, GBP, and EUR.

Coinbase can be used on almost all web browsers. Furthermore, there is a Coinbase mobile app available on both iOS and Android. This makes the platform easily accessible from any device, thus offering crypto investors increasingly more reasons to choose Coinbase as their main crypto exchange.

The account setup on Coinbase can take just a few minutes and can be completed in just 6 easy steps. Moreover, the Coinbase official website offers a detailed guide for this, along with many other valuable guides.

Regarding network fees, Coinbase currently has fees ranging from 0% to 3.99%, depending on the type of transaction. Furthermore, the platform has an account minimum of $0.

What Is PayPal?

PayPal was first established in 1998 as Confinity. Then, the platform went public through an IPO (Initial Public Offering) held in 2002.

At the moment, PayPal is the leading online payment system available almost worldwide. And the platform gained so much popularity thanks to the safety and security features it provides.

PayPal ensures that users’ transactions are encrypted. Besides, the platform encrypts the data stored on its servers, as well as the information between users’ browsers and the servers. PayPal currently uses SSL encryption, a cryptographic security protocol that keeps the information across a computer network safe.

Basically, PayPal is a platform that can keep a user’s credit or debit card safe while they complete various transactions in the online space.

Main Advantages of PayPal

It is no surprise that PayPal is so popular all over the world. The platform focuses on keeping transfers as secure as possible, and digital security is among the most important things everyone is looking for these days.

Besides, PayPal offers users cashback deals and discounts from various merchants. This is an extremely effective way of incentivizing users, and it may be one of the reasons PayPal has become so popular.

Another remarkable advantage of PayPal is that the platform can be used for free. Users who aim to pay with PayPal for online shopping, donations, or domestic payments will have no transaction fee.

How to Withdraw Funds from Coinbase to Paypal?

To successfully withdraw funds from Coinbase to PayPal, you will need to ensure that you have both accounts linked. This step-by-step guide will show you how to withdraw funds from Coinbase to PayPal.

Knowing how to take money out of Coinbase to PayPal will ease your withdrawal process, making sure you get your funds as soon as possible.

Can I use PayPal as a Payment Method on Coinbase?

Basically, you can link your PayPal as a payment method on Coinbase. But there is a catch.

For now, only US customers can deposit dollars on Coinbase. As for everybody else, they can only withdraw fiat.

As described above, access your Coinbase account to PayPal, go to Settings, select Payment Methods, click on Add a new payment method, and select Paypal.

But remember, you may only buy and deposit to Coinbase from PayPal if you’re from the US. If not, you may only withdraw money into your PayPal account.

How to Withdraw from Coinbase to PayPal | Step-by-Step

Here are the steps you need to follow.

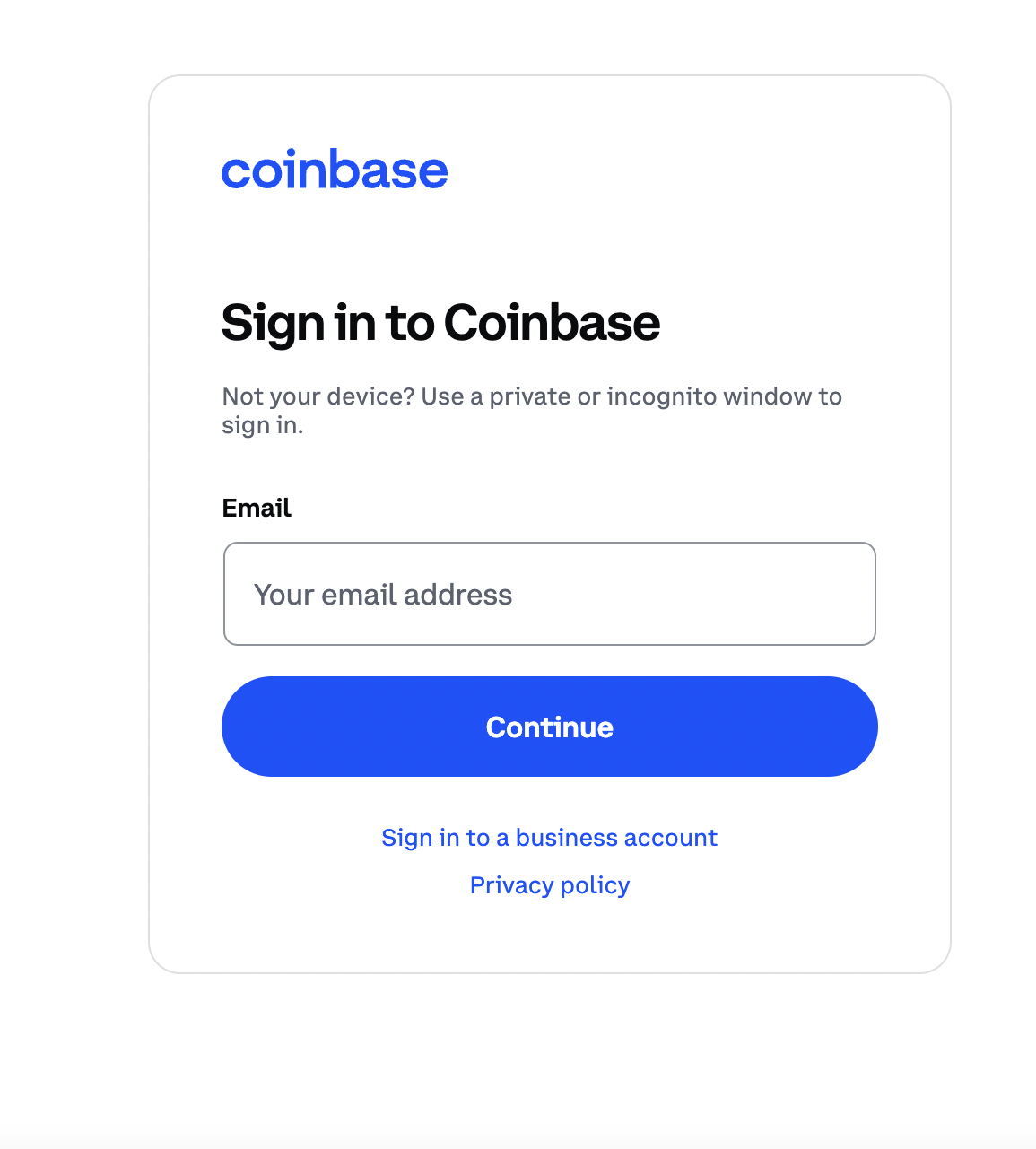

Step 1: Log in Coinbase Account

The first step to withdraw money from Coinbase to PayPal is to log in to your Coinbase account with your designated username and password.

Those lacking a Coinbase account will have to create one for themselves according to the company’s requirements. Make sure you’ve chosen the right location after completing the sign-up process. This data is used by the platform to guarantee the success of your transactions.

To create a Coinbase account, you will have to visit the Coinbase Website. Creating a Coinbase account will require you to complete the verification process depending on your selected country. Once a Coinbase account has been created and verified, you will be allowed access to the platform’s functionalities.

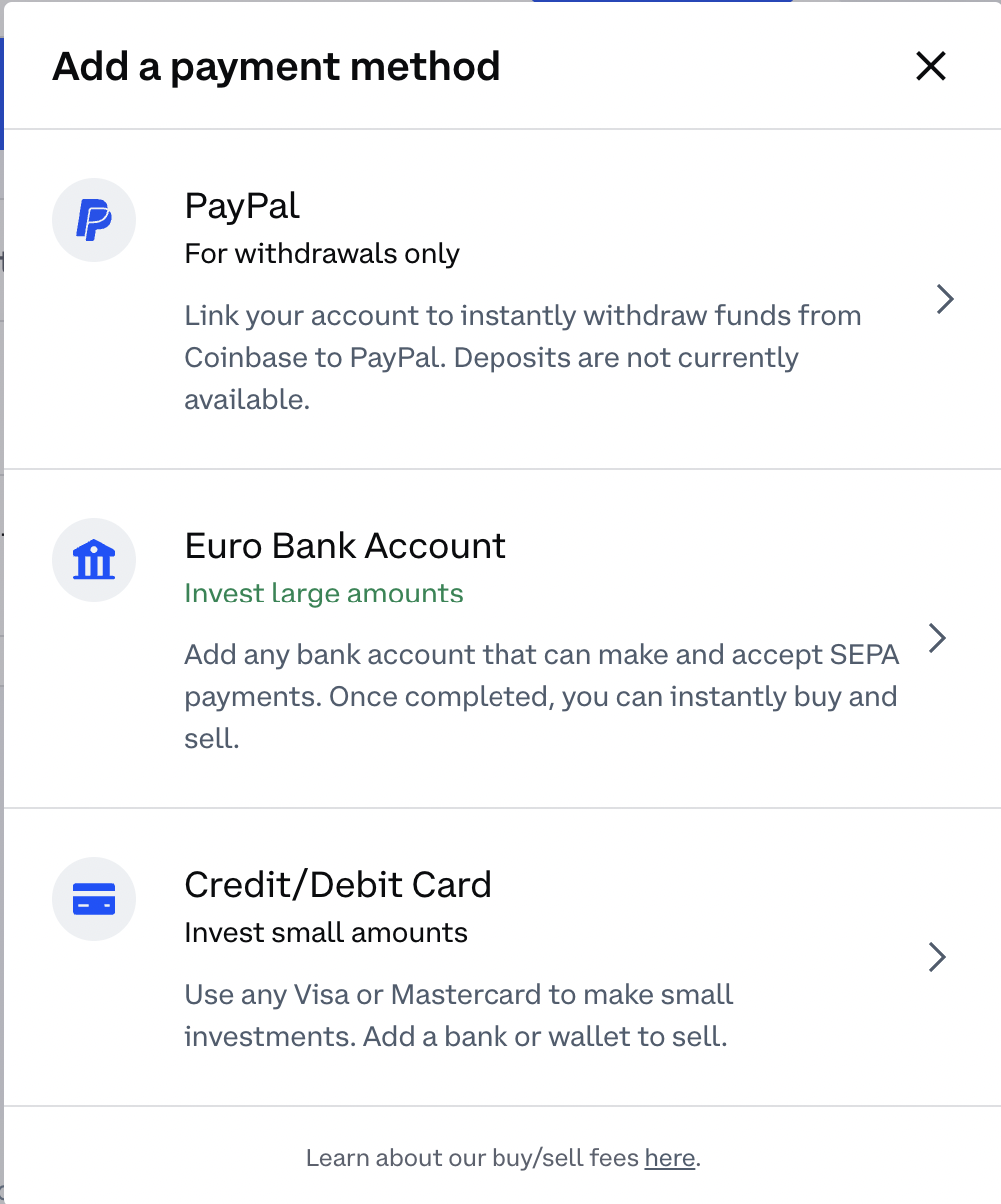

Step 2: Connect your PayPal Account to Coinbase

You may jump over this step if you have already connected your PayPal account to Coinbase. If not, here is what you need to do.

The simplest way to link your Coinbase account to PayPal is to go to Settings, select Payment Methods, and click on Add a new payment method. There, you will see the PayPal option on top. Click on it, and you will be redirected to their website, where you will have to log in.

The second way to link your Coinbase and PayPal is by going to your assets and selecting the fiat balance. You will be given the option to cash out your fiat, and there, you can link your PayPal in the same way as described above.

However, if your balance is 0, you won’t be able to proceed further on the desktop interface, only in the mobile app.

Regardless, keep In mind that it is essential to check if you have a linked bank account.

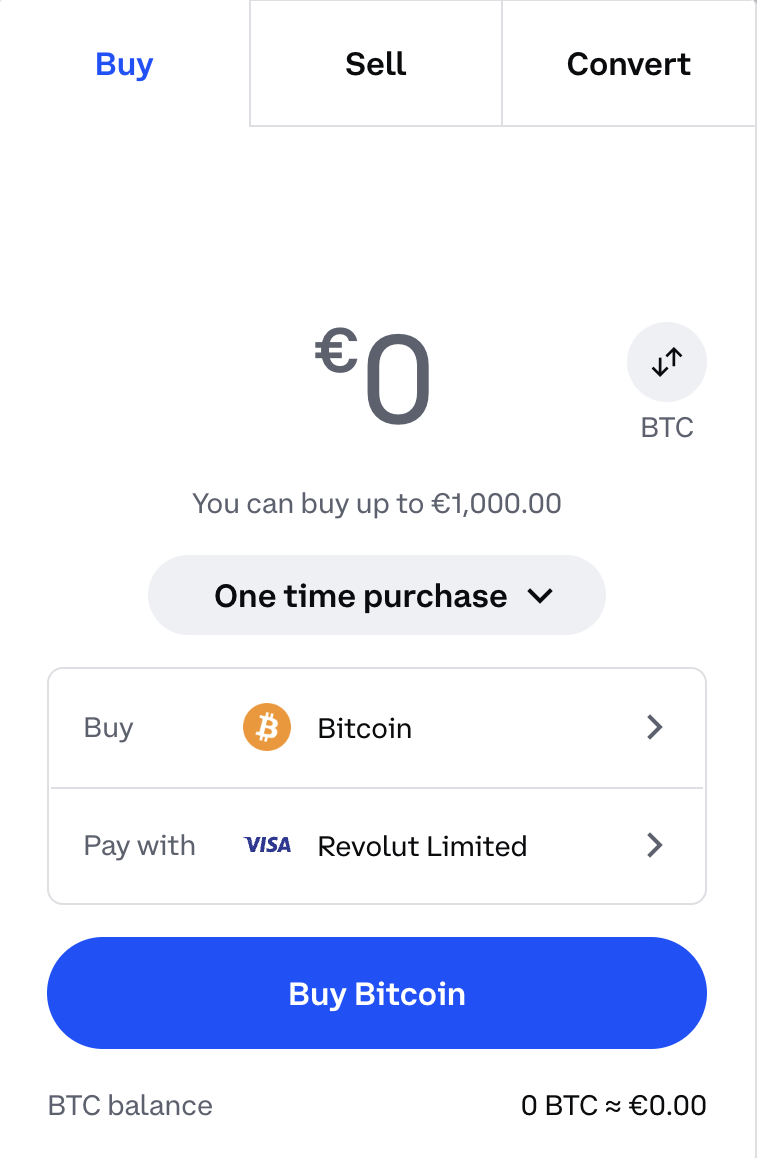

Step 3: Withdrawing Funds

To withdraw crypto from Coinbase to PayPal, you will first need to change your crypto assets to fiat (USD and EUR are 2 such examples). To do this, you will click on the Buy/Sell button displayed on your Coinbase account desktop dashboard or select the asset and click on Trade on the mobile app.

After you’ve sold your asset for cash, go to your assets list, select the fiat balance, and click on the cash out button.

The withdrawal process will begin immediately, and you will receive a message from Coinbase once the process is complete, after which you can confirm the account.

Step 4: De-Link PayPal Account (Optional)

Maybe you want to cash out and leave Coinbase for good or just don’t like leaving payment information in crypto exchanges.

So, those who wish to de-link their PayPal accounts from Coinbase have an easy way to do this.

- Log into your Coinbase account;

- Head to “Settings”;

- Select “Payment Methods”;

- Go to the Paypal payment method;

- Click on the “Remove” button.

Also, from that panel, you can remove any other payment method you’ve previously used.

Coinbase Withdraw to PayPal Fee

Before using this withdrawal method, it’s important to understand the Coinbase withdrawal fees involved. Just like any other crypto project that has a specific network fee, Coinbase has some withdrawal fees.

Coinbase charges a flat 1% transaction fee on all cryptocurrency transactions. However, Coinbase offers quick withdrawals, and for withdrawals using PayPal, you can use the Instant Transfer feature (available to US citizens) and receive instant cash for a $0 fee.

It’s important to note that the 0% Coinbase fees are for withdrawals from fiat currency to fiat currency. If you did not convert crypto to fiat before withdrawal, PayPal also charges a fee for converting cryptocurrency to fiat currency, which can vary based on the exchange rate at the time of the transaction.

Also note that you can cash out up to $25,000 daily, with a maximum of $10,000 per transaction for US residents, or the equivalent of $20,000 per day, or $7,500 per transaction for non-US residents.

How Long Does Coinbase Withdrawal Take?

Most Coinbase users based in the United States prefer the option of using PayPal’s instant transfer. The reason for this is that withdrawal from Coinbase takes place almost instantly. Perhaps you’ve been wondering how long the Coinbase withdrawal takes. It works quite fast, almost instantly.

Once the digital currency has been sold using a PayPal account as a payment method, the funds are processed and credited immediately to the client’s account. The money hits the account in seconds as opposed to the procedural days.

About Coinbase

Coinbase has a rich history behind it, as it is one of the first crypto exchanges to become really big. It was founded in June 2012 by Brian Armstrong and Fred Ehrsam and has since been at the top of the charts in terms of daily trading volumes.

One of the best things about Coinbase is the fact that it has a very accessible user interface, making it very good for those who have just started with crypto. Coinbase is usually compared with Binance, which is also a good exchange. Coinbase allows its users to buy and sell cryptocurrencies and a deposit using debit cards and bank transfers. Other advantages include the fact that it has very low fees and that it’s a fully regulated crypto exchange.

Another aspect that sets Coinbase apart is that it allows you to withdraw cash from your account and deposit it directly into your PayPal account. And, by taking advantage of PayPal’s Instant Transfer capability (available to US citizens), you can instantly receive cash for a fee of $0 directly to your linked debit card. If you want to find more, you can check our Coinbase review.

We also recommend: How to Close a Coinbase Account | How to Avoid Coinbase Fees

FAQ

Why can’t I link my PayPal Account to Coinbase?

There could be 3 main reasons why you are unable to link your PayPal account to Coinbase:

Country Restrictions

PayPal and Coinbase are not available in all countries and regions, and the ability to link a PayPal account to Coinbase may depend on your location.

Verification issues

To link a PayPal account to Coinbase as a payment method, you may need to verify your identity and your PayPal account. If there is an issue with the verification process, it could prevent you from linking the accounts.

PayPal account restrictions

PayPal may have certain restrictions that prevent certain types of transactions, such as those involving cryptocurrency. If your PayPal account is restricted, you may not be able to link it to Coinbase.

Why has PayPal declined my Coinbase transaction?

PayPal may decline a transaction for various reasons, such as lacking funds in the account, banking errors, or suspicion of fraud. If your payment fails, you have the option of trying again with a different funding source connected to your PayPal account or selecting another payment method. To better understand the situation, you can also contact PayPal support for assistance.

How to Withdraw from Coinbase to PayPal: Conclusion

The money withdrawal process from Coinbase to PayPal is a simple and effective process that every Coinbase user should embrace. Even though the account linking process may seem a little complicated, the rewards of instant withdrawal are an advantage to users. This might discourage some people from using the method.

However, users should note that there are some downsides to the withdrawal process, with the most significant disadvantage being the foreign exchange fees that Coinbase charges. Coinbase applies a conversion fee of 5% for the total amount of funds withdrawn, which is very steep.

It is also important to note that even though withdrawals are instant, there have been several complaints lodged against PayPal when it comes to freezing user accounts with no particular explanation and failing to adhere to banking regulations. However, the general conclusion is that Coinbase-PayPal withdrawal is as effective as it could be.

We hope that our guide on How to Withdraw from Coinbase to PayPal was helpful. If you have Bitcoin on Cash App and want to withdraw it, you might be interested in our Cash app bitcoin withdraw guide.