Coinbase Simple Trade and Coinbase Advanced Trade are 2 popular trading interfaces available on Coinbase. And while the latter may be newer and is still not used by all Coinbase traders, it still is extremely important, especially for advanced users. In this Coinbase Simple Trade vs Coinbase Advanced Trade comparison, we will explore what fees and other distinguishable features these two crypto exchanges offer.

Even if Coinbase Simple Trade and Coinbase Advanced Trade are part of the same platform, they operate differently regarding cryptocurrency trading. For instance, Coinbase Simple Trade aims to help beginner investors to buy their first cryptocurrency, while Coinbase Advanced Trade is designed for experienced traders looking for professional-level trading.

Coinbase at a Glance

Coinbase was developed by Brian Armstrong and Fred Ehrsam. It is a San Francisco-based exchange that was launched in 2012, being one of the most reliable and secure platforms for cryptocurrency trading. The exchange holds a BitLicense, meaning it’s one of the few crypto exchanges allowed to operate legally in New York.

Coinbase works with top brands like Dell, Expedia, Time Inc., and others to process Bitcoin payments. The platform serves as a broker that allows users to buy and sell cryptocurrencies at specific prices based on prevailing market trends.

This means traders do not wait for orders to be matched because transactions are fast and simple.

About Coinbase Simple Trade

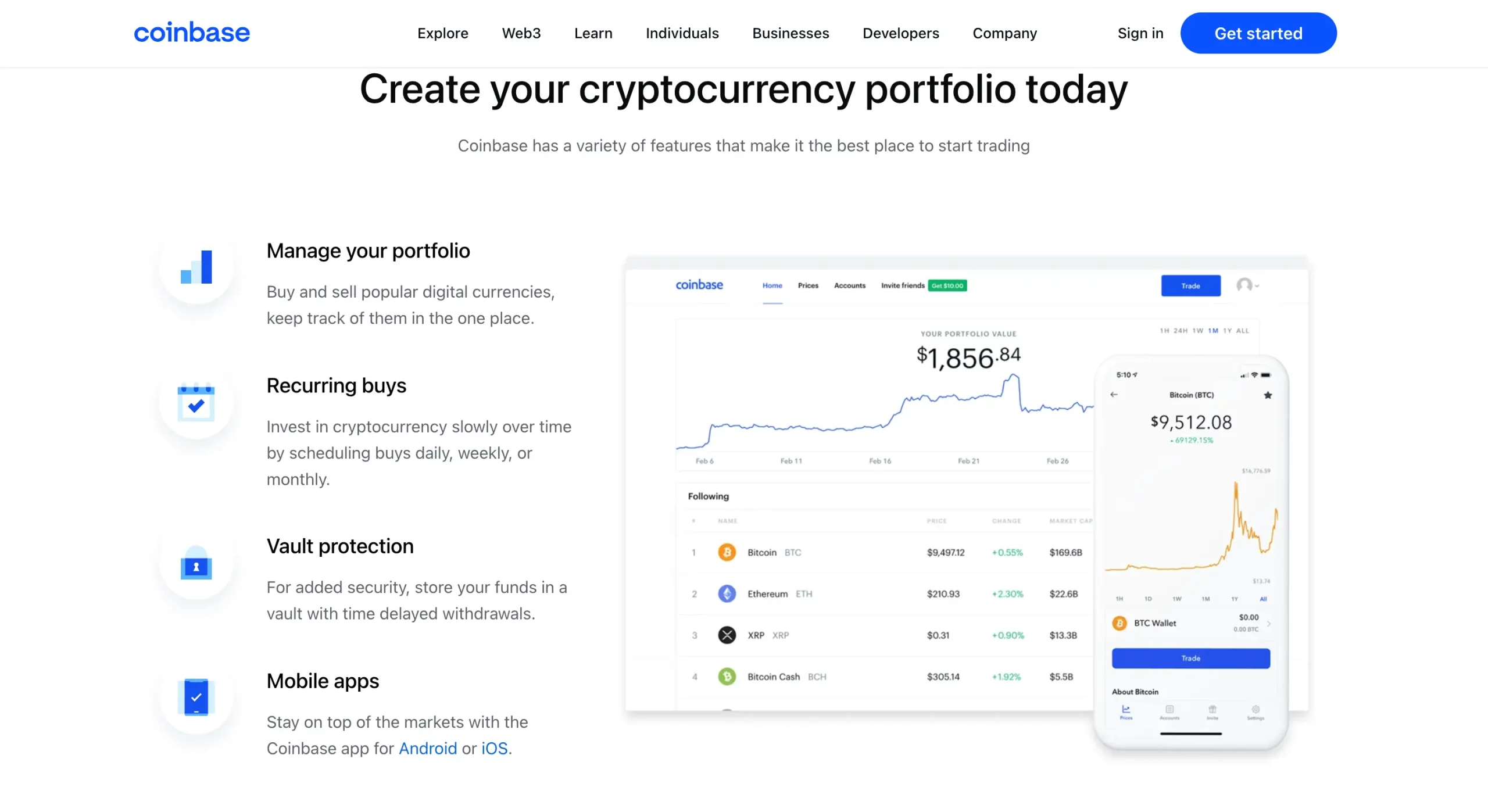

Coinbase Simple Trade is the main trading interface available on Coinbase. The simple trading interface is extremely beginner-friendly and is available on the web, Android, and iOS devices. With Coinbase Simple Trade, crypto investors can buy or sell crypto pretty quickly, considering that the platform is intuitive and the trading process is extremely straightforward. What users have to do in order to buy or sell crypto is to look for the “Buy & Sell” button.

Coinbase Advanced Trade

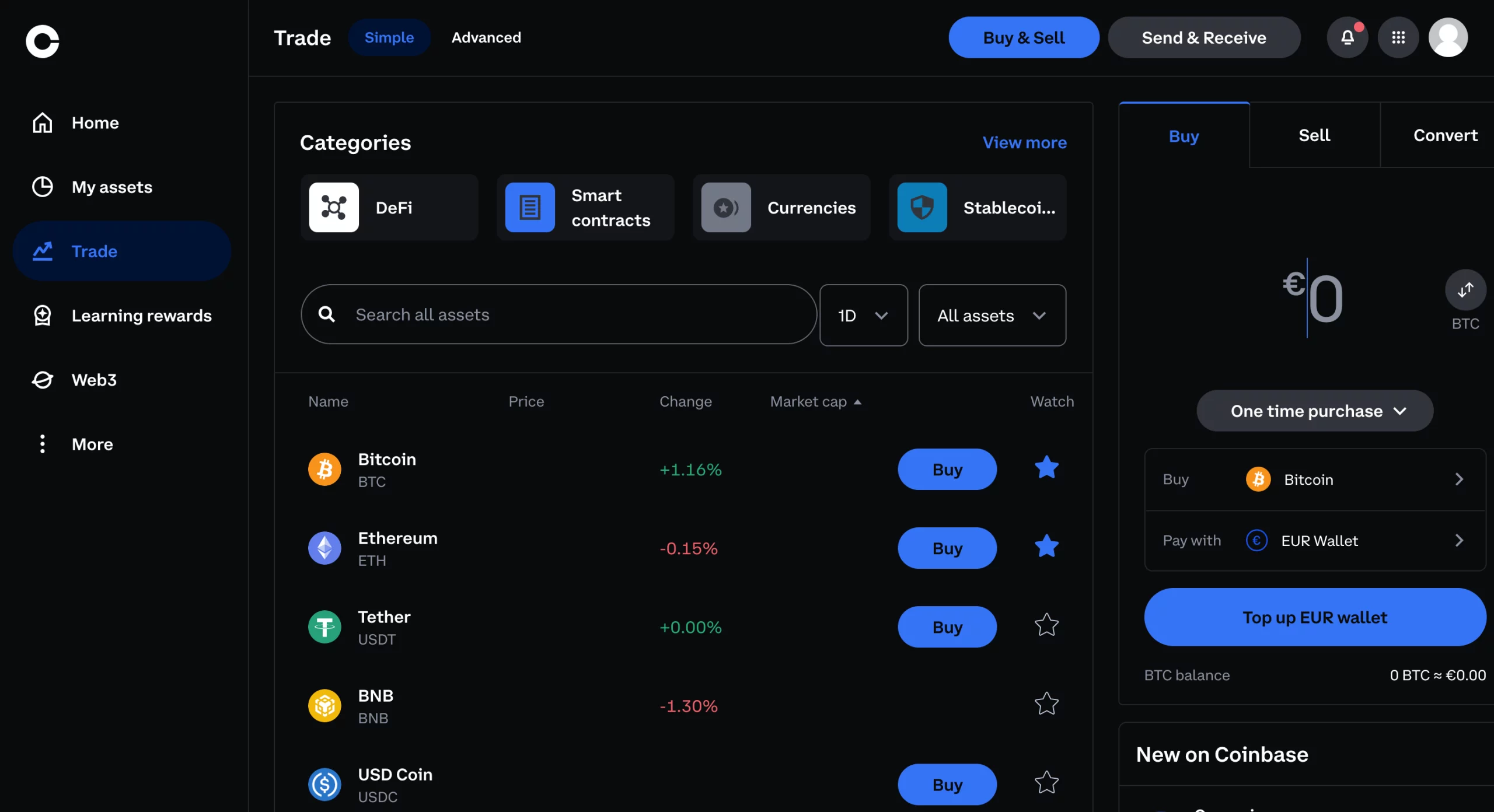

Coinbase Advanced Trade is the advanced trading interface Coinbase aims to use instead of Coinbase Pro. Coinbase’s main plan is to sunset Coinbase Pro and make Coinbase Advanced Trade popular in order to offer users more trading opportunities with only one account, on the same platform.

In Coinbase Pro’s case, users were required to register the same account but a different platform. Thus, if a user was trading on Coinbase and wanted to try Coinbase Pro out, they would have had to switch the website and send funds from the main platform to Pro.

However, with Coinbase Advanced Trade, crypto investors can access 2 different interfaces through a single platform, and all the information they need will be stored in a single place. Coinbase Advanced Trade maintains the features of Coinbase Pro, the main difference being that the former can be accessed from the main Coinbase website.

The Transition from Coinbase Pro to Coinbase Advanced Trade

In June 2022, Coinbase announced that Coinbase Pro would no longer be available and Coinbase Pro users’ funds should be transferred to the Coinbase Advanced Trade platform. However, 1 year has passed since the big announcement, and both Coinbase Pro and Coinbase Advanced Trade are available. And while they are similar, they still have many differences between one another.

Coinbase Simple Trade vs Coinbase Advanced Trade: Supported Countries

Both services can be accessed by users from multiple areas, including:

- The US;

- The UK;

- Canada;

- Europe – Andorra, Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Gibraltar, Greece, Guernsey, Hungary, Iceland, Ireland, Isle of Man, Italy, Jersey, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Monaco, Netherlands, Norway, Poland, Portugal, Romania, San Marino, Serbia, Slovakia, Slovenia, Spain, Sweden, Switzerland, Mexico and more.

Coinbase Simple Trade vs Coinbase Advanced Trade: Supported Cryptocurrencies

Coinbase Simple Trade currently lists over 240 cryptocurrencies and more than 530 trading pairs, including popular coins and tokens, such as Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), USD Coin (USDC), Polkadot (DOT), Solana (SOL), Cardano (ADA), Dogecoin (DOGE), Polygon (MATIC), Shiba Inu (SHIB), and many more.

Coinbase Advanced Trade is not in to disappoint. There are over 350 popular cryptocurrencies and trading pairs available, some of them being Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Litecoin (LTC), Bitcoin Cash (BCH), EOS, Cosmos (ATOM), Basic Attention Token (BAT), Bitcoin SV (BSV), Civic (CVC), DAI, DASH, District0x (DNT), Ethereum Classic (ETC), Golem (GNT), Kyber Network (KNC), Chainlink (LINK), Loom Network (LOOM), Decentraland (MANA), Maker (MKR), Orchid (OXT), Augur (REP), USD Coin (USDC), Stellar (XLM), Tezos (XTZ), Zcash (ZEC), and 0x (ZRX).

Payment Options

Both trading platforms have the same payment options:

- Bank transfer (as well as ACH in the US and SEPA in the EU);

- Credit cards;

- Debit cards;

- Coinbase to PayPal withdrawal and PayPal to Coinbase deposit;

- Listed cryptos;

- CAD, EUR, GBP, SGD, & USD;

- Apple Pay;

- Google Pay;

- Sofort;

- 3D Secure Card.

Coinbase Simple Trade vs Coinbase Advanced Trade: Fees

Coinbase Simple Trade has the following fee structure:

- $10 and below $0.99 fee;

- $10 to $25: $1.49 fee;

- $25 to $50: $1.99 fee;

- $50 to $200: $2.99 fee.

Coinbase Advanced Trade, on the other hand, has a fee of a maximum of 0.4% for the maker and a maximum of 0.6% for the taker. Based on the 30-day trailing volume, the platform calculates the trading fee each player has to pay.

However, it is essential to note that, unlike Coinbase Pro, Coinbase Advanced Trade allows users to earn up to 7% APY on various cryptocurrencies such as USDC and ETH. This is truly valuable, considering that Coinbase Pro did not have any rewards.

Coinbase Simple Trade vs Coinbase Advanced Trade: Interface and Features

At first look, Coinbase Simple Trade and Coinbase Advanced Trade look pretty similar. However, the 2 platforms are slightly different, especially in what concerns the categories they offer. For instance, while on Coinbase Simple Trade, you may see categories such as DeFi, Smart Contracts, Currencies, or Stablecoins, Coinbase Advanced Trade may provide categories such as Spot or Futures.

Overall, the interface of Coinbase Advanced Trade is more complex than in Coinbase Simple Trade’s case. And this is why the latter is recommended for experienced traders. The platform allows users to look at various trading pairs, sort the pairs available based on the currency, create a watchlist, and explore new markets.

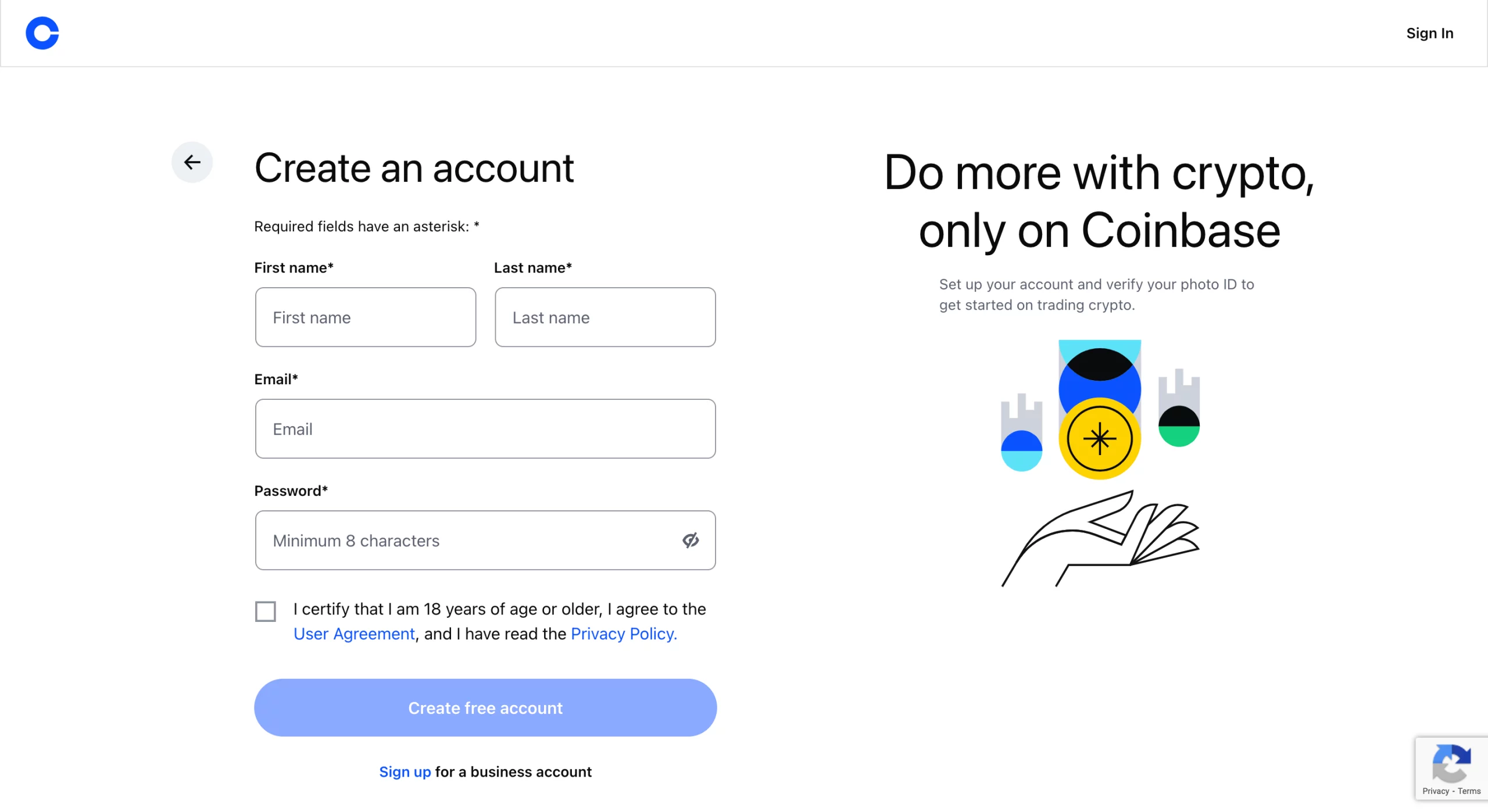

Creating an Account

Considering that both Coinbase Simple Trade and Coinbase Advanced Trade are part of the main Coinbase exchange, creating an account on Coinbase will give users access to both platforms. Thus, all you have to do is register on Coinbase and then select the trading option you want to use.

How to Create a Coinbase Account?

To sign up on Coinbase, all you have to do is:

1. Access the official Coinbase website;

2. Click on “Get Started” and fill in your details;

3. After you confirm your account, you will have to add some details about you, and your account will be ready.

Customer Support

Coinbase’s customer support is available via email and phone. Users have reported the support team to have decent response times, usually replying within 24-48 hours for support tickets.

Customer support is available for both Coinbase Simple Trade and Coinbase Advanced Trade, meaning that regardless of the issue you have, the team behind Coinbase will be ready to help you.

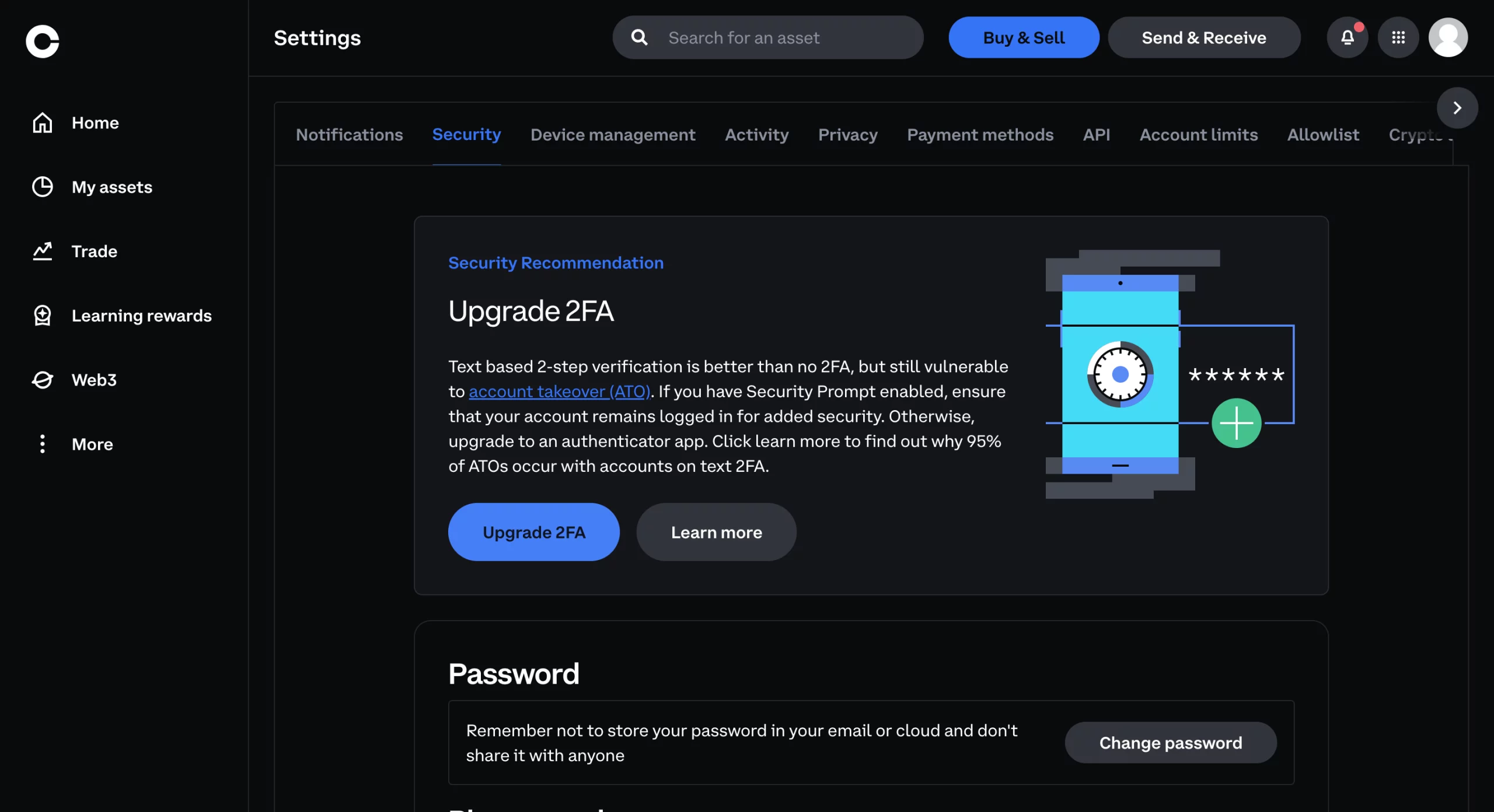

Security

The company and its platforms are fully compliant with all US laws and regulations. The exchange keeps its user funds segregated, with 98% kept in cold storage.

Other protection measurements that are included by both platforms are 2FA (2-Factor Authentication, address whitelisting (Allowlist), FDIC-insured USD balances, YubiKey for mobile devices, Coinbase Vault, and an intricate identity verification process.

Coinbase Simple Trade vs Coinbase Advanced Trade: Verdict

Looking at our Coinbase Simple Trade vs Coinbase Advanced Trade comparison, it is obvious that both services of the company are regarded as good platforms on which you can trade cryptos. It really depends on what type of trader you are and what your specific needs are.

If you are a day trader that performs multiple trades during the course of the month and has high volumes, then Coinbase Advanced Trade helps you the most, considering its interface and trading options.

However, if you are a novice and are not that good at placing trade orders, then Coinbase Simple Trade may be the best cryptocurrency exchange for you. Otherwise, you can check out some Coinbase alternatives that might suit your needs better.

We hope this Coinbase Simple Trade vs Coinbase Advanced Trade comparison can help you make an informed decision.