Best Crypto Credit and Debit Cards in 2024

In an era where digital assets have become a focal point of discussion, it’s hard to ignore the buzz it has created. Notably, credit cards have caught on to this trend by introducing rewards in the form of cryptocurrency.

If you’re navigating the landscape of crypto cards, let’s explore the best options available in 2024 to help you make an informed choice. So, below, you’ll find the best crypto credit cards in 2024 to redeem rewards. Let’s dive in!

What Do You Need to Know and Understand Related to Crypto Credit Cards?

When it comes to cards, and here we are not just talking about crypto cards, the general population tends to lump them all together, categorizing them broadly as credit cards.

However, this is not necessarily correct because there are several types of bank cards, among which the most popular and widely used are credit and debit cards.

That’s why, in this article, our selection of the best crypto credit cards will encompass debit cards as well, acknowledging the common tendency to group both types of cards under the same category.

However, before delving into their features, we’ll first clarify what crypto credit cards and crypto debit cards entail, aiming to differentiate between them and highlight the importance of understanding their distinctions before making a choice.

What is a Crypto Credit Card?

A crypto credit card operates similarly to a traditional credit card, but besides being linked to a banking account, it is connected to a cryptocurrency wallet.

It works just like a traditional credit card. You receive a line of credit from the bank, enabling you to make purchases you repay at the end of the billing cycle. It’s essentially a borrowing mechanism, as with any standard credit card.

Typically, crypto credit cards are co-branded, meaning they are issued by a bank but promoted by a specific brand, like an investment company or a crypto exchange.

The key distinction lies in the rewards they offer. While traditional credit cards often provide travel points or cashback rewards, crypto credit cards reward you in cryptocurrency. These rewards are deposited into the wallet linked to the card.

While there may be additional details to consider, this outlines the basic functioning of crypto credit cards.

What is a Crypto Debit Card?

This category includes most of the crypto cards you encounter in everyday life.

A crypto debit card offers a convenient way to use cryptocurrency for purchasing goods and services. Unlike other payment methods that involve a time-consuming conversion into fiat currency, crypto debit cards facilitate instant transactions globally.

While crypto credit cards focus on accumulating passive crypto rewards, crypto debit cards are designed to assist you in spending the crypto you already possess (even though many crypto debit cards also offer the possibility to earn crypto rewards and cashback).

The unique feature of a cryptocurrency debit card lies in its ability to instantly convert your cryptocurrency into fiat at the point of sale. This innovative mechanism allows you to spend the value stored in your coins and tokens even at retailers that do not directly accept crypto payments.

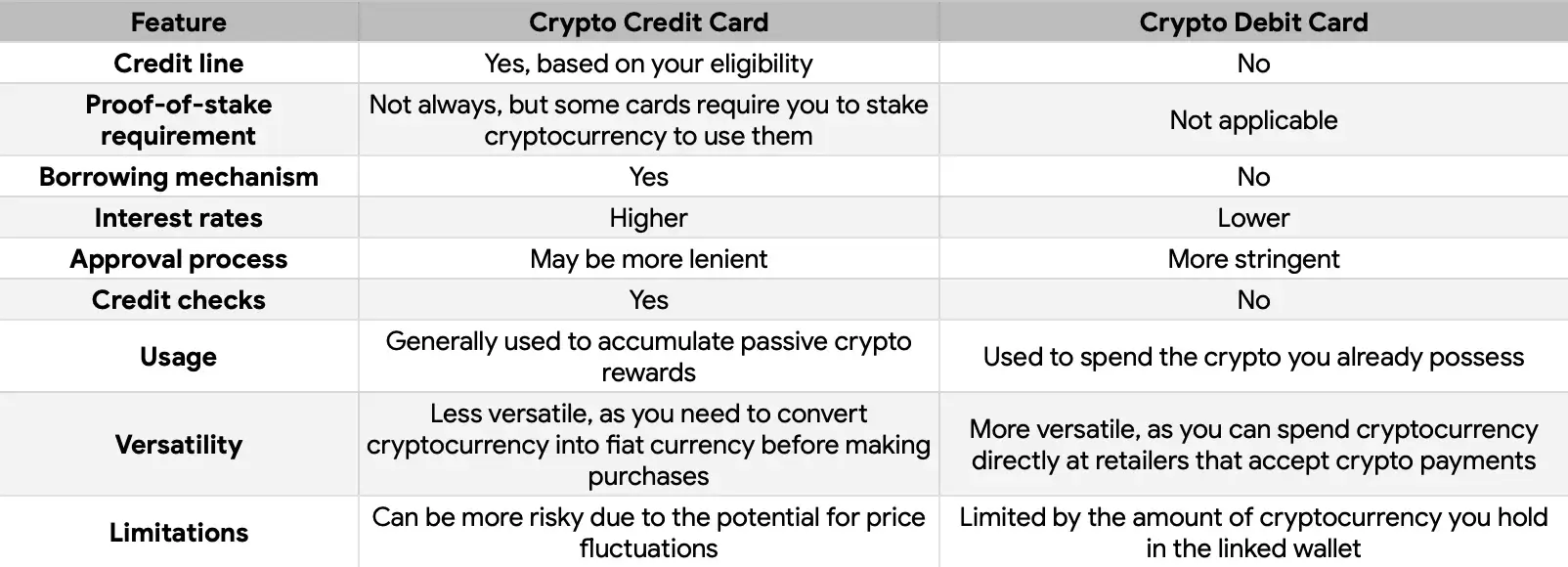

The Main Differences Between Crypto Credit Cards vs. Crypto Debit Cards

Best Crypto Credit Cards and Debit Cards in 2024

Now that you understand the fundamentals better, let’s explore the 7 best crypto credit or debit cards to consider in 2024.

In the quest to find the best crypto credit cards and debit cards for any user’s needs, we carefully created a methodology considering top priorities related to a crypto card, such as meticulously researching available options and thoroughly evaluating each card’s features, fees, rewards, and overall value proposition.

We also chose a medium risk tolerance, scrutinized the fine print, and selected cards harmonized with a broad user’s general financial goals and risk appetite.

In a nutshell, the best crypto credit and debit cards in 2024 are:

- Brex Card;

- Gemini Card;

- Venmo Card;

- WhiteBIT Nova Card

- Binance Card;

- Coinbase Card;

- Bybit Card.

Now, for a review of each cryptocurrency card mentioned above, read below our extended explanation to understand why we chose those cards in that order.

1. Brex Credit Card

If you want to look for other articles in your search for more opinions, you’ll see that Brex is often praised as one of the top choices in lists of “best crypto credit cards,” and that’s for good reasons. We also consider this crypto card the best, even if it’s not a cryptocurrency card per se and (in some aspects) is too restrictive.

Designed specifically for businesses, the Brex card is an attractive option with a unique rewards system that lets users receive points for various benefits, including cryptocurrency. That’s why it is often praised as one of the top choices, based on its generous rewards for users compared to competitors, making it a well-deserved first place.

Brex Card General Details

- Card Type – Business Credit Card.

- Acceptance – Issued on the Mastercard network for global usability.

- Variants – Virtual and Physical Cards available.

- Focus – Tailored exclusively for businesses.

- Fees – No annual fees, no personal guarantee required.

- Crypto Rewards – Offer exclusive program rates: 7 points per dollar spent on rideshares and taxis, 4 points per dollar on travel booked through the Brex portal, 3 points per dollar on restaurant purchases, 3 points per dollar on Apple products via the Brex dashboard, 2 points per dollar on recurring software expenses, 1 point per dollar on all other eligible purchases.

Brex Pros

- Tailored for businesses, emphasizing rewards and financial flexibility.

- Global acceptance.

- Adjusts based on the business’s financial health.

- Users enjoy the benefits without incurring annual charges.

Brex Cons

- Geared towards businesses; not suitable for personal use.

- Supports only Bitcoin and Ethereum for crypto rewards.

- Minimum of 1,000 points ($7 worth of crypto) per transaction.

- Incurs fees for crypto rewards based on the chosen asset.

- Businesses must meet specific criteria, including US incorporation.

2. Gemini Credit Card

Our second choice will be the Gemini Credit Card, which was introduced in 2021 and made some noise at that time.

The Gemini Credit Card, like Brex, is not per se a crypto credit card. It offers a hybrid approach, combining traditional credit card perks with cryptocurrency rewards.

Unlike typical credit cards, it allows users to earn rewards in Bitcoin, Ethereum, or other over 40 cryptocurrencies available on the Gemini platform.

Crypto rewards are automatically and instantly deposited into your Gemini account. With those rewards, you can trade or HODL with complete control.

The diverse range of cryptocurrencies and the associated advantages in terms of crypto rewards and cashback are the key factors that secured the second position for this card and edge out slightly ahead of Venmo, positioned in third place.

Gemini Credit Card General Details

- Card Type – Traditional Credit Card

- Acceptance – Issued on the Mastercard network for global usability.

- Variants – Virtual and Physical Cards available.

- Focus – Tailored for individuals.

- Fees – No annual fees, no foreign transaction fees.

- Rewards – 3% back on dining, 2% back on groceries, and 1% back on all other purchases.

Gemini Card Pros

- Offers rewards in Bitcoin, Ethereum, and 40+ other digital currencies available on Gemini.

- Crypto rewards are deposited immediately into your Gemini account upon each transaction, allowing for real-time benefit from any crypto price appreciation.

- The card comes with no annual fees, making it a cost-effective option.

- Protected by Gemini’s world-class security features, ensuring the safety of crypto rewards.

- Enjoys Mastercard Zero Liability Protection on Unauthorized Transactions and Mastercard ID Theft Protection for enhanced security.

- Cardholders can choose from black, silver, or rose gold metal cards designed with a security-first approach.

Gemini Card Cons

- Incurs fees for selling or converting crypto rewards, impacting the overall value.

- Limited to residents of the United States, restricting access for international users.

- Rewards are based on specific spending categories, and users might not receive the maximum benefits for all purchases.

3. Venmo Credit Card

Our third selection is the Venmo Credit Card, another crypto card that is often featured on “best crypto credit card” lists, but, in the same manner as Gemini, it is a traditional credit card that adds a unique twist – the “Cash Back to Crypto” feature.

While not a fully dedicated crypto credit card, Venmo allows users to convert their rewards into popular cryptocurrencies, creating an enticing proposition for those interested in both traditional and digital financial realms.

Venmo Credit Card General Details

- Card Type – Traditional Card

- Acceptance – Issued on the Visa network for global usability.

- Variants – Virtual and Physical Cards available.

- Focus – Tailored for both individuals and businesses.

- Fees – No annual fees, 3% for purchases; no fees for sending money to others.

- Rewards – 3% on the highest spending category, 2% on the subsequent category, 1% on all others.

Venmo Pros

- Offers up to 3% cash back rewards on purchases.

- Users enjoy the benefits without incurring annual charges.

- Cashback is tailored to spending categories based on user preferences.

- Allows users to buy, hold, and sell crypto within the app.

- Utilize the “Cash Back to Crypto” feature for automated crypto purchases.

Venmo Cons

- Limited to residents of the United States.

- Supports only Bitcoin, Ethereum, Bitcoin Cash, and Litecoin.

- Charges a 3% fee for goods and services.

- Requires a good to excellent credit score (690 and above).

- A spread for crypto conversions is invoked each month.

4. WhiteBIT Nova Card

The WhiteBIT Nova Card is a cutting-edge Visa debit card introduced by WhiteBIT, the largest European cryptocurrency exchange by traffic, in collaboration with Visa. Launched as a seamless bridge between digital assets and real-world spending, the crypto card WhiteBIT Nova Card enables users to utilize their crypto holdings for everyday purchases with ease.

WhiteBIT Nova Card General Details

- Card Type: Visa Debit Card

- Issued by: WhiteBIT in partnership with Visa

- Usability: Global acceptance wherever Visa is supported

- Variants: Available in both digital and physical formats

- Supported Cryptocurrencies: 10

- Payment Methods: Integrated with Apple Pay and Google Pay for seamless transactions

Pros

- Support of 10 cryptocurrencies: USDC, BTC, ETH, XRP, SOL, NEAR, ADA, AVAX, WBT, and DOGE

- 0% card service: Opening or closing the card is free.

- Up to 10% Cashback: The card allows earning cashback in BTC or WBT on purchases.

- Mobile Wallet Compatibility: The cryptocurrency debit card WhiteBIT Nova can be integrated into Apple Pay or Google Pay.

- Invite Program: Active card users can earn up to 50 USDC for inviting new users to order a card. 1 USDC for 1 new user.

- ATM withdrawals: Users with a physical Nova card can withdraw cash at ATMs.

Cons

- KYC Verification Required – Users must complete identity verification before obtaining the card.

- Not available in some countries — KYC verification requires the proof of address

5. Binance Debit Card

Focusing on crypto debit cards alone, the Binance Card would undoubtedly claim the top spot. However, given the broader scope of this article covering crypto credit cards with priority, the Binance Card is our fourth choice.

Its affiliation with Binance, a prominent crypto exchange offering diverse services, supporting numerous popular crypto assets, and prioritizing robust security measures, is noteworthy.

The Binance card, available in virtual and physical forms, facilitates the purchase of goods and services using fiat or crypto at most locations accepting Visa while working like crypto reward cards. Additionally, users can easily link it to Google Pay and similar services.

The Binance Card is a contender for the “best crypto card” and a superior option. It not only rewards users with crypto for their expenditures but also seamlessly integrates the use of crypto, rivaling the ease of fiat transactions.

Binance Card General Details

- Card Type – Traditional Credit Card.

- Acceptance – Issued on the Visa network for global usability.

- Variants – Virtual and Physical Cards available.

- Focus – Tailored for individuals.

- Fees – No fees for ATM withdrawals, foreign transaction fees, or annual fees.

- Rewards – up to 8% BNB cash back rewards on eligible purchases made with both crypto and fiat.

Binance Card Pros

- No need to pre-convert crypto.

- Offers both virtual and physical cards for convenient use in various situations.

- Available in multiple regions, including Argentina, Bahrain, Brazil, Colombia, GCC, Peru, and Mexico, with potential expansion to more countries.

- Supports various fiat currencies and the most popular cryptocurrencies.

- Earns up to 8% BNB cashback on purchases made with both crypto and fiat, providing an additional incentive.

- BNB, the native token, offers various use cases, including discounts on trading fees, enhancing the overall value.

- There are no fees for ATM withdrawals, foreign exchange fees, or annual fees, ensuring affordability.

Binance Card Cons

- While available in multiple regions, it may not be accessible globally, restricting access for users in certain countries. For example, since December 20, 2023, Binance Card services in EEA have been closed.

- The utility of BNB is primarily limited to Binance, and its benefits might not extend beyond the Binance ecosystem.

- Usability is contingent on merchant acceptance of a Visa card, potentially limiting acceptance in some locations.

6. Coinbase Debit Card

Coinbase Card was introduced in 2020 by Coinbase crypto exchange, and what this card does is presented even from their unique proposition, as highlighted on their website: it’s a Visa debit card that transforms your everyday purchases into a method of earning crypto rewards.

Operating much like other crypto debit cards, the Coinbase card enables users to spend their cryptocurrency on daily essentials like clothing, food, and bills. Widely accepted wherever Visa is recognized, the card converts crypto to fiat during transactions. Moreover, it seamlessly integrates with Apple Pay, Google Pay, and similar services for added convenience.

What sets the Coinbase card apart is its robust support for currencies. While it exclusively handles USD in fiat, it provides backing for all crypto assets available on the Coinbase exchange, numbering over several hundred. The card’s seamless integration with your Coinbase account makes this comprehensive coverage possible.

Coinbase Card General Details

- Card Type – Traditional Credit Card.

- Acceptance – Issued on the Visa network for global usability.

- Variants – Virtual and Physical Cards available.

- Focus – Tailored for individuals.

- Fees – No spending fees, and you don’t have to pay an annual fee.

- Rewards – 1% to 4%.

Coinbase Card Pros

- Linked to Coinbase, a highly secure cryptocurrency exchange.

- Enjoys Visa card benefits and other benefits.

- Wide range of supported crypto assets.

- Available in the US and various European countries.

Coinbase Card Cons

- Limited support for fiat currencies (only USD).

- Cashback rewards are comparatively smaller than those of some competitors.

7. Bybit Debit Card

Last but not least, the Bybit card launched in Q1 of 2023 also deserves our attention. While it may not hold the title of the best crypto credit card (as it isn’t a credit card), it certainly stands out as one of the top crypto debit cards.

To elaborate, the Bybit card is a Mastercard debit card widely accepted by millions of merchants. It acts like a crypto rewards card directly linked to your Bybit account; it allows seamless use of funds without additional wallet or account connections.

Highlighting the benefits of the Bybit card, it boasts zero staking requirements, multiple card tiers, participation in the Bybit VIP Card program, and exclusive loyalty rewards on purchases.

Bybit Card General Details

- Card Type – Traditional Credit Card.

- Acceptance – Issued on the Mastercard network for global usability.

- Variants – Virtual and Physical Cards available.

- Focus – Tailored for individuals.

- Fees – Don’t have to pay an annual fee.

- Rewards – Earn 1 point for every 1 EUR/GBP spent, with a monthly cap of 12,500 points and no expiration date. VIP users enjoy double reward points with no limits or expiration dates.

Bybit Card Pros

- Accepted by millions of merchants worldwide.

- Directly connected to Bybit account.

- Users can enjoy the benefits without any staking obligations.

- Offers different card tiers to suit user preferences and needs.

- The exclusive program provides additional perks for VIP users.

- Supports fiat currencies such as EUR and GBP and cryptocurrencies like XRP, USDT, BTC, ETH, and USDC.

Bybit Card Cons

- Available only to users in the UK and EEA countries (except for Romania, Ireland, Liechtenstein, Iceland, and Croatia).

- Imposes a foreign exchange fee for transactions in different currencies.

- Charges a fee for converting cryptocurrencies during transactions.

BONUS. KuCoin Debit Card

KuCoin, a significant player in the crypto exchange scene, intends to launch a crypto rewards card to provide users with a smooth and rewarding spending experience. While it’s not yet available for ordering, it’s expected to launch soon.

The KuCard card will be available in both physical and virtual forms and is accepted globally wherever Visa card transactions are supported. Users can enjoy convenient payment methods with the option to link it to Google or Apple Pay. Managing finances and tracking expenses is simplified through the user-friendly KuCoin app.

The KuCard offers exclusive rewards, including up to 10% cashback and various discounts. It also will enable real-time crypto-to-fiat conversion for instant transactions when using crypto to make purchases.

Even if it hasn’t been launched yet, its benefits to earn rewards made us include this crypto rewards card as a bonus in this article. It has the potential to become the best crypto credit card out there.

Conclusion

The evolving landscape of the crypto market has given rise to a range of crypto rewards cards, with both credit and debit options making their mark.

As we’ve delved into the best crypto credit cards available, it’s crucial to recognize that the perfect card for you depends on your individual preferences and requirements.

By carefully considering the features and benefits of each card, you can make an informed decision and optimize your crypto-spending experience while redeeming truly amazing rewards that will go directly into your crypto wallet from your everyday purchases.