What’s the State of Stablecoins in 2024? Insights from CoinGecko’s Report

The crypto industry has seen its fair share of upheavals in recent years, from market crashes to major updates like The Merge.

Amid these changes, stablecoins—tokens pegged to assets like fiat currencies or commodities—have served as a bridge between traditional finance and blockchain technology.

Since 2014, companies like Tether and Circle have provided stablecoins to help users enter the crypto market, while decentralized options like DAI use different methods to maintain their value.

So, where do stablecoins stand in 2024? Are they holding their value amidst ongoing market volatility? In this article, we’ll explore the latest insights from CoinGecko’s report on stablecoins, covering trends in market cap, transaction volumes, and the performance of various stablecoin models.

Disclaimer: The information presented is based on CoinGecko’s state of stablecoin report, which incorporates data from January 2020 to August 2024. Shout out to CoinGecko, and be sure to read their full report for more details beyond our summary.

Key Takeaways

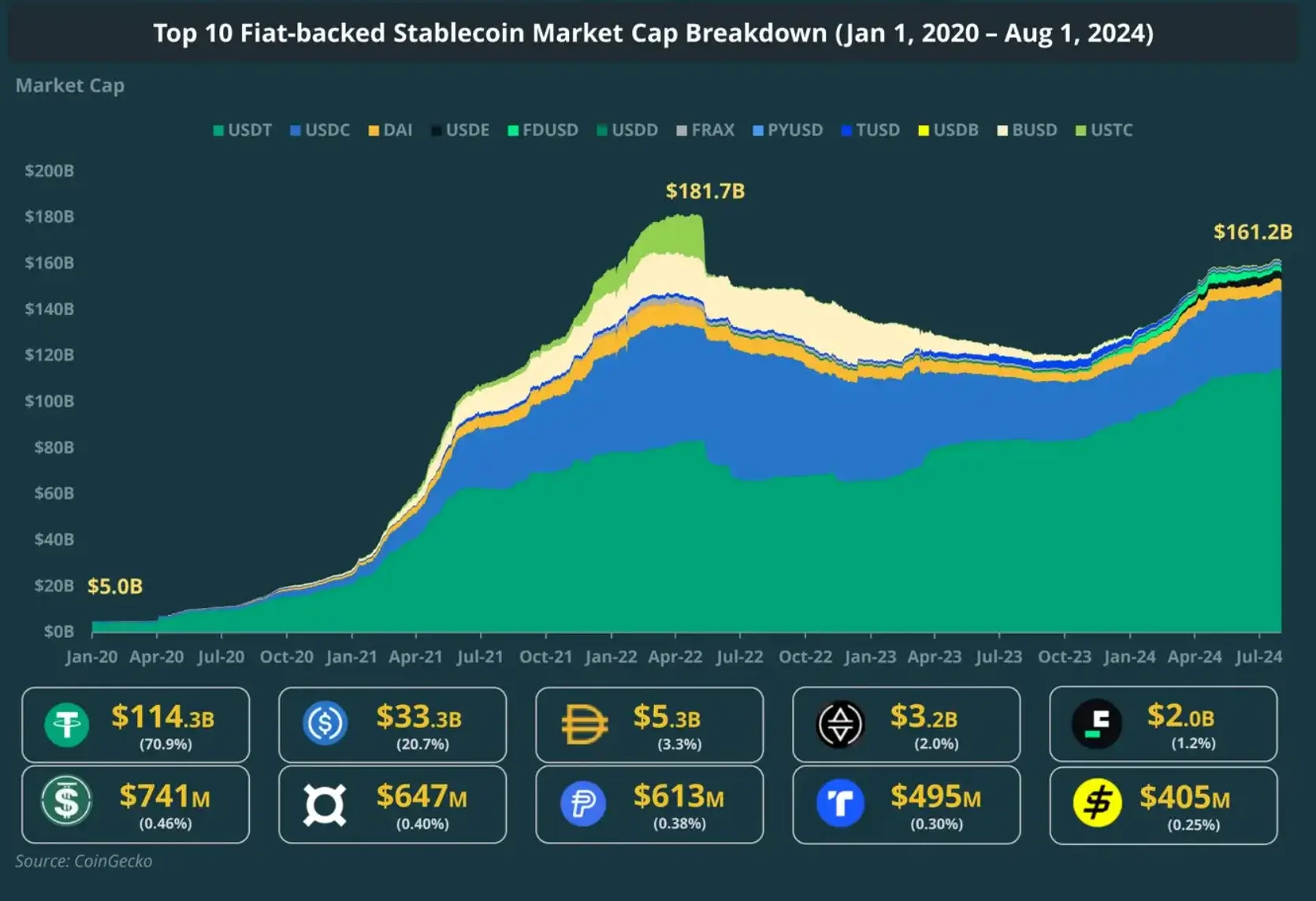

- Fiat-backed stablecoins reached a market cap of $161.2 billion in 2024 but remain below their 2021 peak of $181.7 billion.

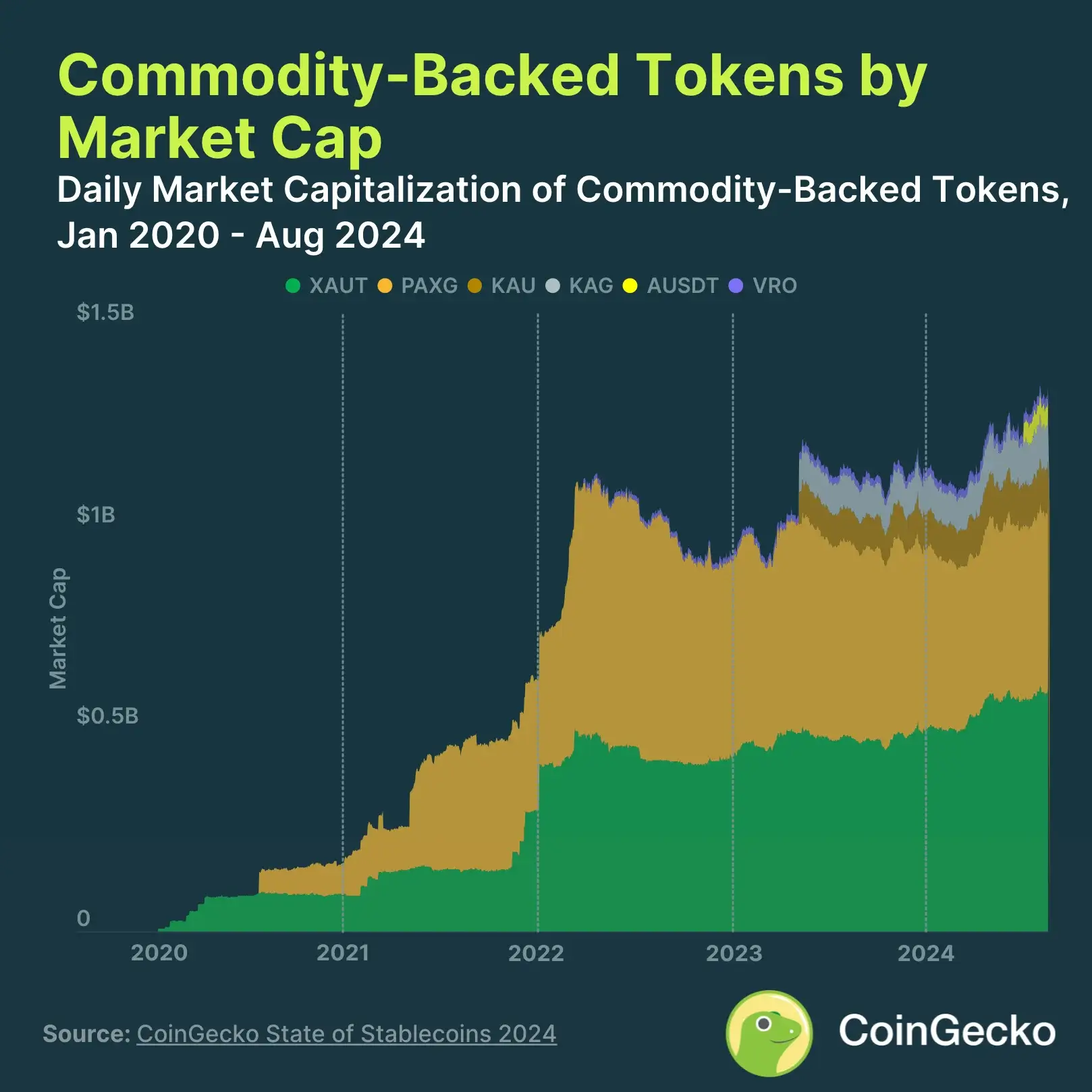

- Commodity-backed stablecoins grew by 18.1% in 2024, reaching $1.3 billion, but only up 0.8% of fiat-backed stablecoins.

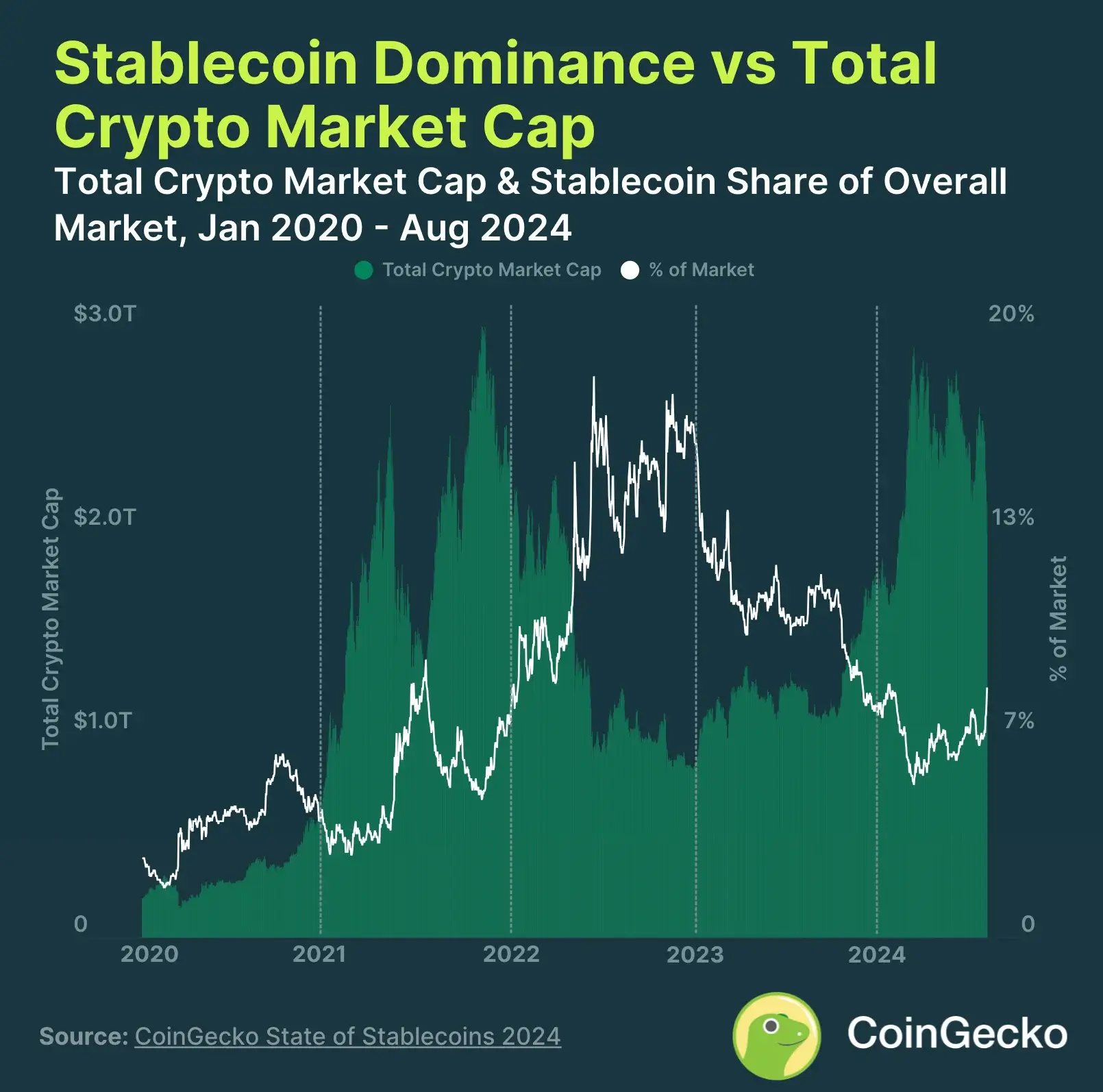

- Stablecoins represent 8.2% of the global crypto market cap and tend to gain more dominance during market downturns.

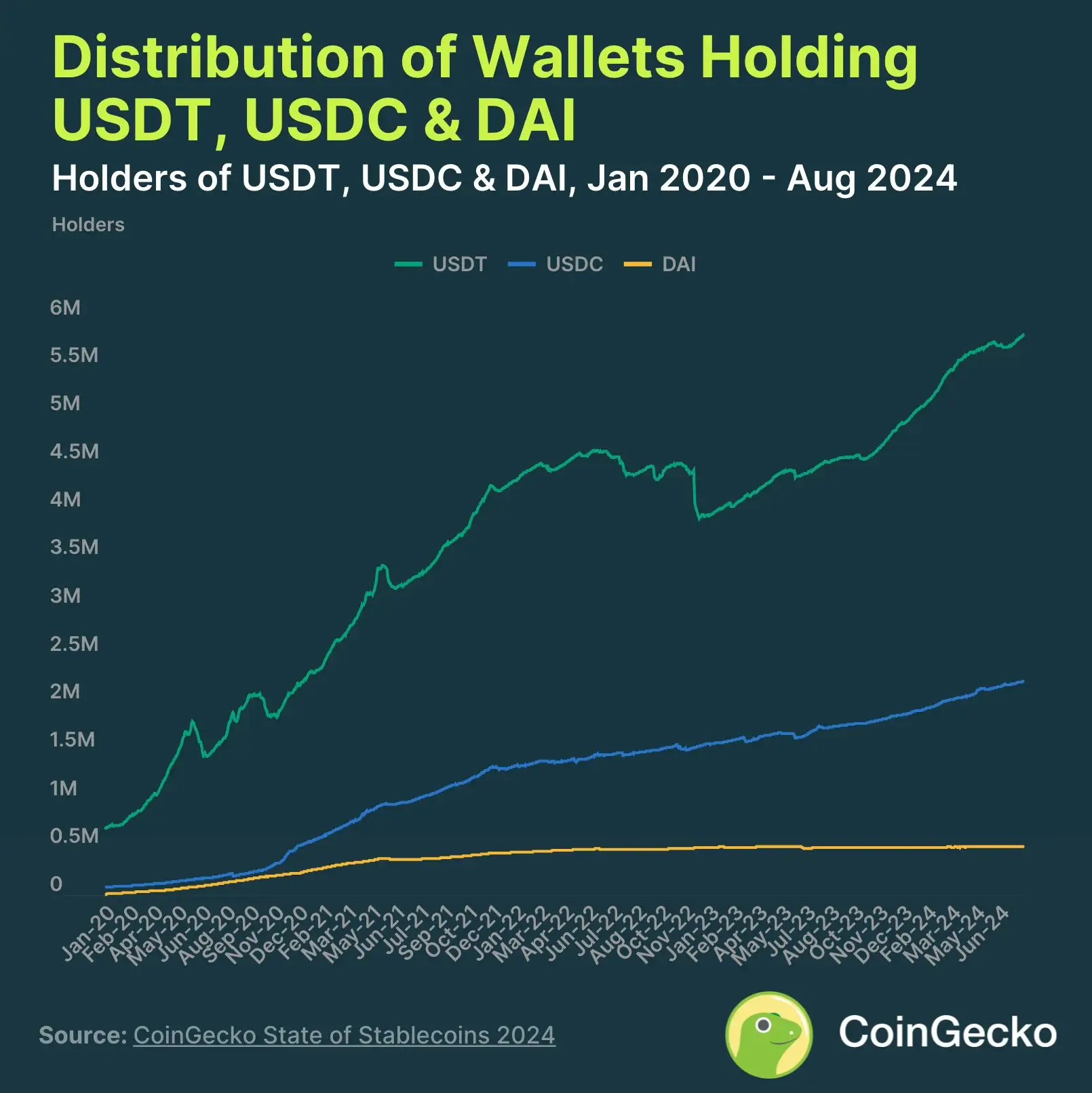

- There are 8.7 million addresses holding stablecoins, with 97.1% holding USDT, USDC, or DAI.

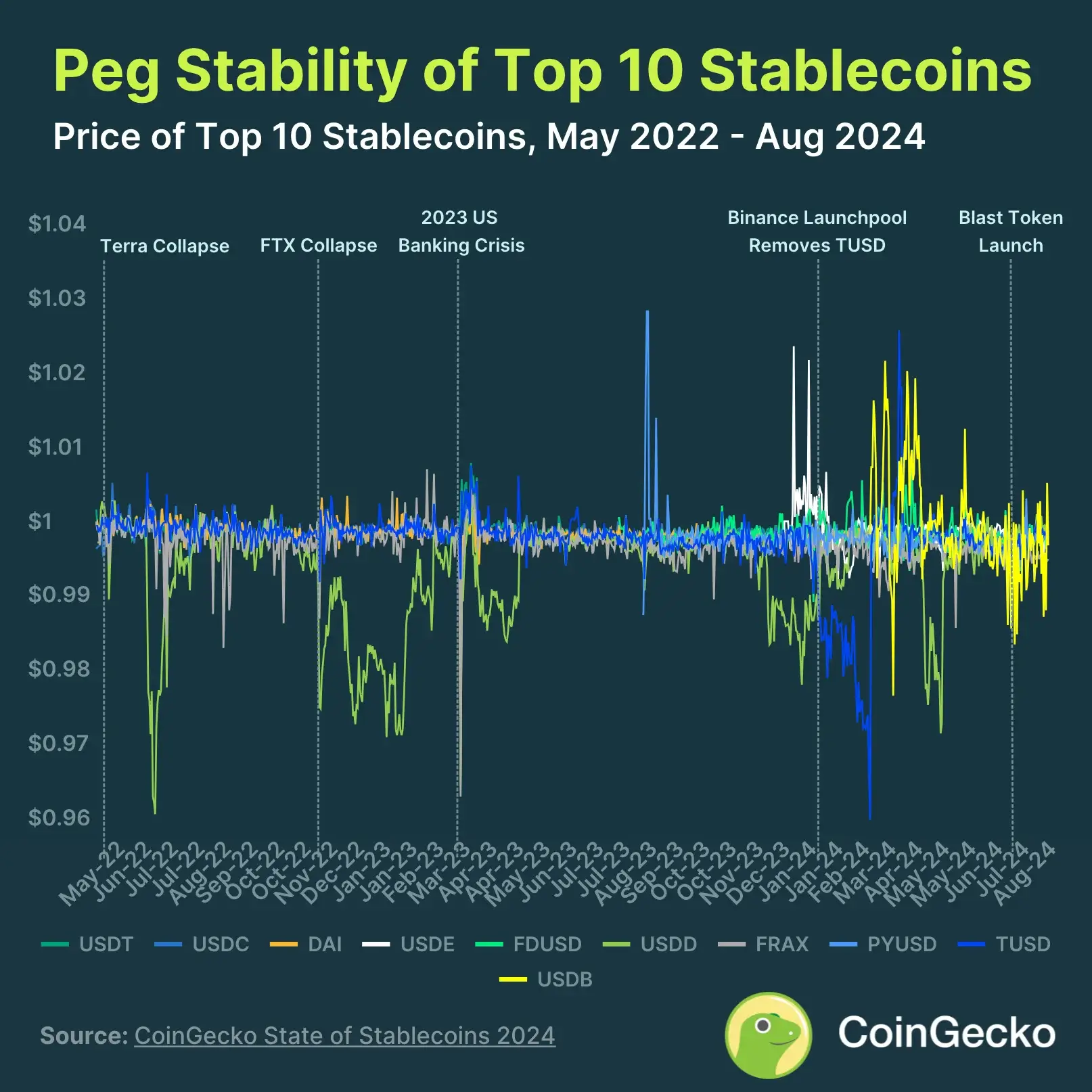

- Stablecoins still struggle to maintain their $1 peg, especially during uncertain or volatile periods.

1. Stablecoins Hit $161.2B in 2024, Still Below 2021 Peak

Since the 2020-2021 bull run, fiat-pegged stablecoins have seen massive growth, with their total market cap of $181.7 billion surging by over 3,100%.

However, after the collapse of Terra’s UST, the growth came to a complete halt, with the stablecoin market losing much of its value until November 2023.

According to CoinGecko, there has been some recovery since November 2023, as the stablecoin market recovered by 35.4% from late 2023 to August 2024, hitting a value of $161.2 billion. Even so, it hasn’t matched a new all-time high (as, for example, Bitcoin did).

Related to the dominance in the stablecoin sector, it remains heavily skewed. Tether (USDT), USD Coin (USDC), and Dai (DAI) control 94% of the market, with USDT alone taking 70.9%.

2. Commodity-Backed Stablecoins Market Grows with 18.1%, But It’s Still a Small Part of the Market (0.8%)

While the market for commodity-backed stablecoins has expanded, it remains a relatively small segment compared to the larger fiat-backed stablecoin market.

Based on CoinGecko’s report, commodity-backed stablecoins have seen notable growth since 2020, with their market cap reaching $1.3 billion as of August 1, 2024. Tether Gold and PAX Gold dominate the market, accounting for 78% of the total market cap.

However, despite this growth, commodity-backed stablecoins still represent only 0.8% of the overall fiat-backed stablecoin market. Precious metals remain the primary commodity backing these stablecoins, although other commodities like uranium have been explored.

3. Stablecoins at 8.2% of Market Share, Rising in Market Downturns

Stablecoins have become a significant part of the crypto market, accounting for 8.2% of its total value. According to the report, this growth is primarily due to the rise and fall of Terra’s UST stablecoin.

In early 2020, they represented just around 2%, growing to 6% during the rise of DeFi. Moreover, their dominance increased between November 2021 and May 2022, driven by the rapid growth of Terra’s UST, climbing from 4.8% to 15.6%.

After UST’s collapse, stablecoins saw a sharp decline in their market share. However, in the bear market that followed, their market share surged to 18.4% as investors sought safer, more stable assets.

4. 8.7M Stablecoin Holders, USDT, USDC, and DAI Dominate

As of now, there are 8.7 million addresses holding stablecoins. Among them, USDT, USDC, and DAI dominate, accounting for 97.1% of the total.

USDT leads with over 5.8 million holders, significantly outpacing USDC, which has about 2.2 million. The remaining eight stablecoins each have fewer than a million holders, with DAI held by just over 505,000 addresses.

Growth of these stablecoins was rapid in 2020 but slowed significantly in 2022 due to concerns about insolvency following the collapse of Terra.

5. Stablecoins Struggle to Stay Pegged During Uncertain Times

Stablecoins have often struggled to maintain their value, especially during uncertain times. While established stablecoins like USDT, USDC, and DAI are now better at staying close to $1, they still face challenges during market turbulence, such as the March 2023 banking crisis.

Newer, partially algorithmic stablecoins like USDD, DAI, and FRAX can be more unstable and rely on market trading to stay pegged. Some, like Iron Finance and Basis Cash, have even failed to maintain their peg.

Conclusion

So, it’s clear that stablecoins have become a key part of the crypto industry, acting as a link between traditional finance and the digital space.

Even though they’ve faced problems like market ups and downs and issues with maintaining their value, major stablecoins like USDT, USDC, and DAI have managed to stay strong.

Still, the fact that just a few big players dominate and the ongoing challenges with keeping stable pegs show there’s room for improvement.

As the crypto industry keeps evolving, it’ll be interesting to see if new stablecoin models can tackle these issues and offer more reliable options for users beyond 2024.