Table of contents

Investing involves an activity that can make or lose you money. We totally understand, especially when looking at the volatility of the crypto market.

However, even in the world of crypto assets, some variants are categorized as a little less volatile. So, remember that if this technology (blockchain and crypto) has caught your attention, you can be part of it by investing in a stablecoin.

But what is a stablecoin, and which is the safest? In this article, we’ll find out all this and more.

What is a Stablecoin?

A stablecoin is a type of cryptocurrency that aims to keep its value stable by linking it to something reliable, like regular money (fiat), commodities (like metals), or another cryptocurrency.

Stablecoins emerged in response to complaints about the unpredictable nature of cryptocurrencies in the market. People wanted a cryptocurrency that didn’t experience the same level of ups and downs as coins like Dogecoin, Shiba Inu, or Ripple.

So, the goal of stablecoins is to prevent significant fluctuations in value. They achieve this by tying the cryptocurrency’s value to something more stable, often a fiat currency like dollars or euros.

As of November 22, 2023, stablecoins comprise about 9.11% of the entire crypto market capitalization, summing around $127 billion within the $1.4 trillion asset class.

How Does a Stablecoin Work?

Simply put, in order to work a stablecoin, the people or organization managing the stablecoin need to keep a secure reserve of whatever is backing up the stablecoin. For example, they might save $10 million in a reserve to support 10 million units of their stablecoin.

This reserved money acts as a guarantee for the stablecoin. When someone wants to convert their stablecoin into fiat money, an equal amount of whatever is backing the stablecoin (like dollars from the reserve) is taken out and given to them.

Types of Stablecoins

As mentioned above, more directly or indirectly, there are several types of stablecoins. From these several stablecoins, there are three main stablecoins, each using different mechanisms to maintain their value:

Fiat-Collateralized Stablecoins

These stablecoins are backed by a reserve of fiat currency, often the US dollar, to ensure their value. Some may use other collateral like precious metals or commodities, but most are tied to US dollar reserves.

Popular examples include Tether (USDT) and TrueUSD (TUSD), both backed by US dollar reserves.

Crypto-Collateralized Stablecoins

These stablecoins are backed by other cryptocurrencies, making them overcollateralized to mitigate volatility risks. For instance, MakerDAO’s Dai (DAI) is pegged to the US dollar but backed by cryptocurrencies like Ethereum (ETH).

Algorithmic Stablecoins

Algorithmic stablecoins may or may not have reserve assets, unlike the other types. Their key feature is stabilizing value through algorithmic supply control. This means a computer program regulates the stablecoin’s supply based on a predefined formula. Unlike central banks with transparent policies, algorithmic stablecoin issuers lack similar advantages in times of crisis.

The Most Popular Stablecoins

As mentioned above, stablecoins comprise about 9.11% of the entire crypto market capitalization, summing around $127 billion within the $1.4 trillion asset class. However, it’s important to know that from this 9.11%, the most popular stablecoins with the highest dominance are the following:

- Tether (USDT);

- USD Coin (USDC);

- Dai (DAI);

- TrueUSD (TUSD);

- Binance USD (BUSD).

Among these five, the stablecoin with the highest dominance is USDT, accounting for more than 69.29% at the time of writing this article.

Stablecoins Trust Factors: What Makes a Stablecoin Safe?

As stablecoins become more widespread, investors have a range of choices, but this also raises the challenge of determining which stablecoin is a fully regulated stablecoin or secure and trustworthy. In this growing array of options, some factors are essential indicators of a stablecoin’s reliability, although the main purpose of a stablecoin is to keep a stable value.

So, here’s a breakdown of the essential elements to consider when investing in a stablecoin:

- Regulatory Oversight – Make sure the stablecoin issuer operates within a recognized regulatory framework, providing a level of trust and accountability.

- Asset Backing and Audits – Seek stablecoins backed 1:1 by reserve assets like US dollars stored in secure, audited vaults. Regular third-party audits and transparency reports should be easily accessible to verify these reserves.

- Network Security – Examine the security protocols of the underlying blockchain network. The stronger the network security, the less likely the stablecoin is to encounter vulnerabilities. For instance, a stablecoin issued on Ethereum ensures higher security than a network with fewer validators like EOS.

- Duration Risk of Reserves – Assess the types of reserve assets the stablecoin issuer holds. Short-term US Treasuries are generally preferable as they are less susceptible to interest rate fluctuations and offer better liquidity.

Safest Stablecoins: What is the Best Stablecoin to Invest in 2024?

After understanding the trust factors for stablecoins, you might be curious about the safest or best stablecoins in 2024. We’re here to help, presenting arguments for not just the top stablecoin but also the three best stablecoins currently available.

In assembling this list of the best and safest stablecoins, our team conducted a comprehensive multi-factor analysis considering various security and safety aspects, as outlined above. The following three stablecoins stood out as the best in terms of safety based on our analyses:

- USD Coin (USDC);

- Tether (USDT);

- Dai (DAI).

1. USD Coin (USDC) – Safest Stablecoin Overall

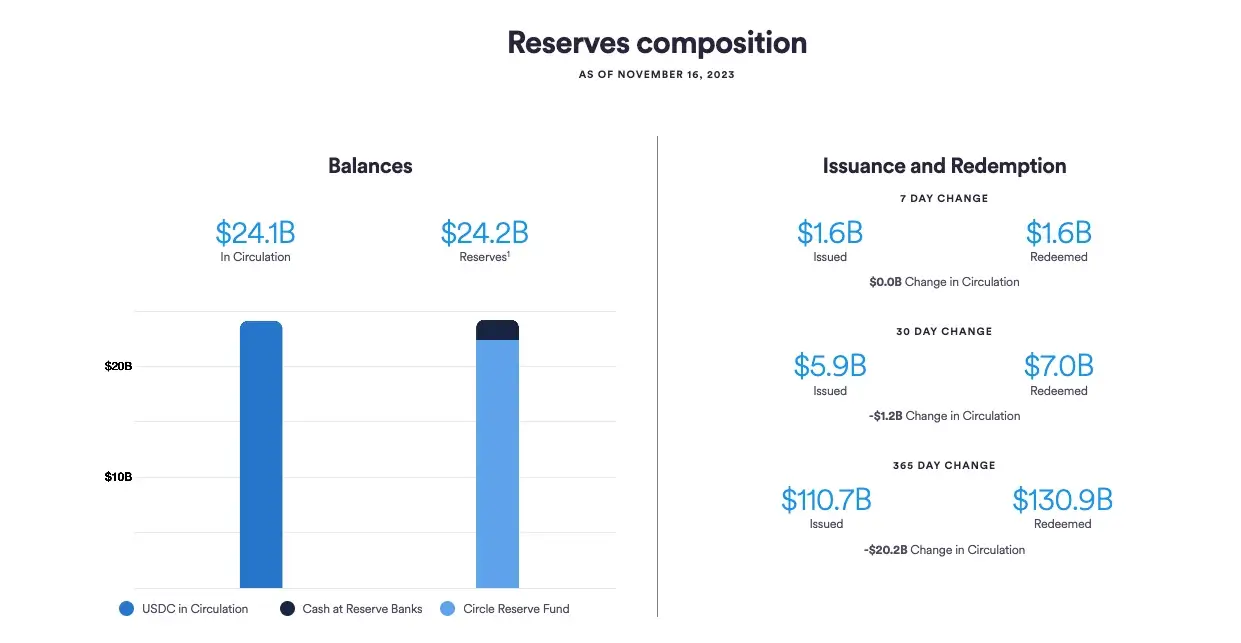

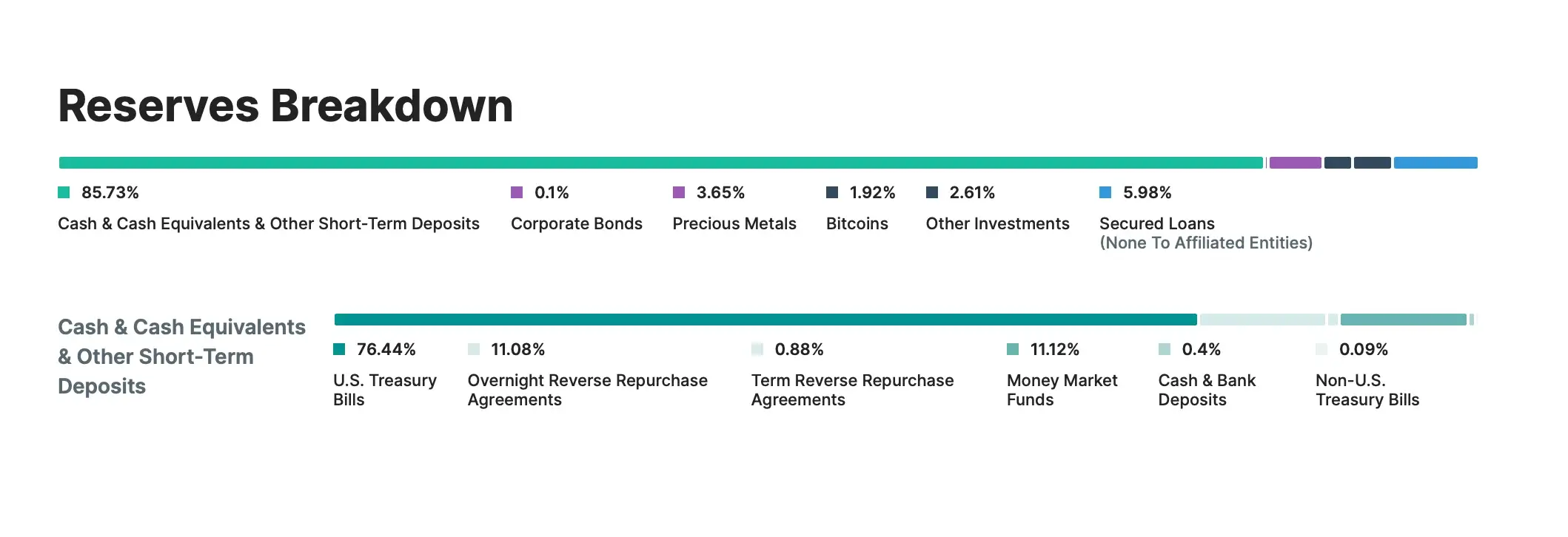

USDC is a top safe stablecoin, securely pegged to the US dollar at a 1:1 ratio. Each unit of this cryptocurrency in circulation is backed by a corresponding $1 held in reserve, a combination of cash and short-term US Treasury bonds.

Centre, a consortium founded by Circle (a regulated fintech company) and the Coinbase cryptocurrency exchange, developed USDC, which is subject to regulations in New York, a jurisdiction renowned for its rigorous auditing practices and strict licensing requirements. This makes it one of the most secure stablecoins, supported by a robust financial and regulatory framework.

Originally launched on a limited basis in September 2018, USDC embodies the mantra of “digital money for the digital age.” It is crafted for a world where cashless transactions are increasingly prevalent.

Why is USDC the Safest Stablecoin Overall?

USDC stands out as the safest stablecoin due to its commitment to transparency and rigorous financial practices. As an idea, monthly attestation reports are openly published, offering a clear overview of the reserves that back USDC.

Currently, USDC is 100% demonstrably supported by US Dollar reserves and short-term US treasury securities with maturities of less than three months.

Adding to its credibility, USDC undergoes annual audits of its financial statements, sticking to the attestation standards outlined by the American Institute of Certified Public Accountants (AICPA).

The Circle Reserve Fund, an SEC-registered entity, further reinforces its security by maintaining a portfolio of short-term US Treasuries and overnight repurchase agreements.

Circle, the entity behind USDC, enjoys backing from major global investors, including BlackRock, JPMorgan, and Goldman Sachs, further solidifying its reputation for stability and reliability.

So, this multi-layered approach to safety and compliance positions USDC as a trusted option in both traditional and crypto financial landscapes.

2. Tether (USDT) – The Safest Alternative to USDC

USDT, or Tether, is a digital dollar (fiat-backed stablecoin) driven by blockchain technology. This stablecoin is pegged 1:1 to the USD, offering individuals and organizations a robust and decentralized means of exchanging value while using a familiar accounting unit.

Being among the pioneers, USDT was one of the earliest stablecoins to be introduced, and it has consistently held the position of the largest stablecoin by crypto market cap since its launch in 2014.

Originally known as Realcoin, it was developed by Brock Pierce, Reeve Collins, and Craig Sellars and is currently operational through Tether Limited Inc.

Tether aims to revolutionize the traditional financial system by adopting a more contemporary approach to money. Through its platform, Tether facilitates transactions with traditional currencies over the blockchain, mitigating the inherent volatility and complexity typically associated with digital currencies.

Why is Tether on #2 and Why is the Safest Alternative to USD Coin?

Tether (USDT), despite holding the position of the largest stablecoin by market cap, is not considered the safest option due to a range of concerns.

One prominent issue revolves around transparency, where Tether Limited, the company behind USDT, has faced criticism for its lack of openness regarding the reserves backing the stablecoin. Previous revelations indicated that only a small percentage was backed by actual USD, with a significant portion relying on commercial paper — a form of short-term corporate debt. This lack of clarity has contributed to doubts about whether USDT is fully backed by fiat currencies like USD.

Legal challenges, including allegations of fraud from the Justice Department (having lawsuits with the New York State Department), further contribute to major concerns surrounding the stability of USDT.

Moreover, in 2017, Tether was hacked, where 31 million USDT was stolen. Rather than demonstrating accountability, the company initiated an “emergency hard fork” to mitigate the issue, which later raised concerns about their commitment to transparency and responsibility.

Yet, to resolve some doubts related to Tether’s reserve, they started releasing comprehensive reserve reports conducted by BDO Italia every quarter.

However, even in this case, in contrast to Tether, USDC prioritizes transparency and publishes audits more often of their reserves. This commitment to openness and accountability makes USDC a preferred choice over USDT when considering which stablecoin is the safest.

3. Dai (DAI) – Safest Decentralized Stablecoin

DAI is a stablecoin launched in 2017, built on the Ethereum platform, managed by the Maker Protocol and the decentralized autonomous organization MakerDAO. MakerDAO operates as a decentralized autonomous organization, functioning autonomously through smart contracts on the Ethereum blockchain.

The value of DAI is designed to maintain a soft peg to the US dollar and is backed by a combination of various cryptocurrencies held in smart contract vaults each time new DAI tokens are created. It’s essential to distinguish between Multi-Collateral DAI and Single-Collateral DAI (SAI), an earlier version that only accepted a single cryptocurrency as collateral and lacked support for the DAI Savings Rate.

Multi-Collateral DAI, introduced in November 2019, expanded the collateral options and included features like the DAI Savings Rate, allowing users to earn savings by holding DAI tokens.

Why is DAI the Safest Decentralized Stablecoin?

DAI has made significant changes to enhance its safety. As an idea, only 6.3% of its collateral reserves come from centralized sources. Rather, it has shifted its reliance towards Ethereum derivatives like Wrapped Ether (WETH) and Wrapped Staked Ether (wstETH). This diverse backing improves DAI’s stability, making it one of the safest decentralized stablecoins.

To add to its strength, DAI has an over-collateralization ratio of 236%, making it more resilient as a stable asset.

FAQ

Which is the Major Stablecoin?

In terms of market cap, the major stablecoin in the crypto ecosystem is USDT. However, there are other major stablecoins that should be considered, with attributes that may be even better than USDT. Among these other (more secure) alternatives are USDC and DAI.

Which Stablecoin is the Safest in 2024?

Based on our multi-factor analyses, the safest stablecoin in 2024 is USD Coin (USDC), followed by Tether (USDT) and Dai (DAI).

Is USDC Safe?

Yes, USDC is considered one of the safest stablecoins. Pegged securely to the US dollar at a 1:1 ratio, every USDC in circulation is backed by an equivalent $1 held in reserve, a mix of cash and short-term US Treasury bonds. It is subject to New York regulations and is known for stringent auditing practices. Monthly attestation reports and annual audits ensure transparency, with 100% provable backing by US Dollar reserves. Supported by a robust financial and regulatory framework, USDC is recognized for its safety and reliability.

Is USDT Safe?

Yes, at the time of writing, USDT is a safe stablecoin, but we do not consider it the safest. While Tether is the largest stablecoin by market cap and has introduced measures to enhance transparency, concerns persist regarding its reserves and past legal issues. USDC is often considered a safer alternative due to its stronger commitment to transparency and more frequent reserve audits.

Conclusion

Now, after you have gained all this knowledge about what a stablecoin determines and which are the safest, you can start your journey in crypto, making your path a little bit safer.

However, remember that all investments represent a risk, and don’t invest more than you can afford to lose.

We hope our article helped you and wish you the best of luck!