Table of contents

Over the years, the crypto arena has been growing extensively, and most people are gradually venturing deeper into the industry.

However, many crypto enthusiasts have no idea that major cryptocurrencies, such as Bitcoin and Monero, are mined through a Proof of Work algorithm or a variation of it.

As for the mining process, it is usually very extensive, requiring the use of a heavy CPU mining rig. And, of course, these mining rigs are usually designed for the sole purpose of mining data from the blockchain. Of course, there are other options, such as cloud mining. However, getting involved with a cloud mining contract can lead to lower crypto mining profits. Mining pools are another option, but some users decide to opt for solo mining, even if it may be a little harder in the beginning.

The cryptocurrency mining process is considered the backbone of the crypto industry; therefore, users will be required to know the best CPUs for mining to engage in it.

If you want to start mining, this article will help you choose from the best CPUs for great results.

What To Consider When Buying a CPU for Crypto Mining?

When looking to buy a CPU for crypto mining, there are several factors to consider:

Threads and cores

A CPU with more threads and cores can handle more calculations simultaneously, improving mining performance: the more cores, the better the CPU.

Clock speed

A CPU with a higher clock speed can perform calculations faster, which can also improve mining performance. Faster clock speeds mean faster hash rates, meaning more money will ade du mining process.

Power consumption

Mining can consume tremendous amounts of energy, and a CPU with low power consumption can help reduce electricity costs. If the cost of electricity is high within the area of the miner, it is advised that they mine less strenuous coins or move to an area where the pool covers electricity.

Compatibility

Compatibility with mining software is not just important; it’s vital! So, when purchasing a CPU, make sure that the mining software and CPU are compatible with the rest of your mining rig, including the motherboard and any other components.

Price

The cost of the CPU should be considered, as its performance and potential return on investment can either increase or decrease from one CPU to another. And such performance comes with a higher price, of course.

Overclocking

Some CPUs can be overclocked, increasing power consumption and the risk of hardware failure, so it should be considered carefully.

Cooling

A CPU with a good cooling system is crucial for crypto mining, as the process generates a lot of heat. It’s vital because it may save money, especially if miners live in an area with high electricity costs.

Warranty

It’s always good to have a warranty on your hardware, just in case something goes wrong. It will help you repair or replace the device.

However, you need to know that mining is mostly done on a Graphics Processing Unit (GPU), and most miners use dedicated GPUs for this GPU mining. Using a CPU for mining is less efficient and less profitable than using GPU miners.

How Much Energy Does the CPU Consume for Mining?

The amount of energy consumed by a CPU for mining cryptocurrency can vary depending on the specific model of the CPU and the efficiency of the mining algorithm being used.

However, mining with a CPU is generally considered less energy-efficient than mining with ASIC hardware (Application-Specific Integrated Circuit).

This is because CPUs are designed for general-purpose computing, whereas ASICs are designed specifically for the task of mining. And that comes with a significant increase in computing power capability to power consumption in the ASIC mining favor.

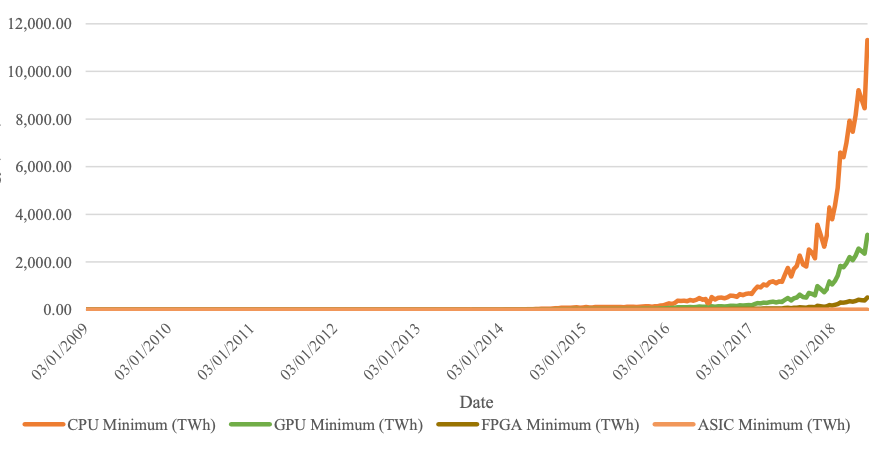

A 2019 study by researchers Sinan Küfeoğlu and Mahmut Özkuran of Cambridge University showed that the choice of mining hardware significantly impacts the energy consumption of mining operations.

And this can be noticed when talking about the Bitcoin network. The picture above illustrates the minimum energy consumption for Bitcoin mining for different types of hardware, such as CPU, GPU, FPGA, and ASIC.

If all crypto miners kept employing CPU hardware, Bitcoin mining would consume energy at around 11,000 TWh per year, so the energy consumption of Bitcoin mining would be equivalent to nearly half of the world’s annual electricity demand.

However, as more efficient mining devices become available, the energy consumption of Bitcoin mining is expected to decrease. And this will also happen for other cryptocurrencies, not only for mining Bitcoin.

Now, mining Bitcoin can be energy-consuming, but let’s see how we can reduce the energy used for Bitcoin mining in an effective way.

Best CPU for Mining – Introduction

Mining crypto with a CPU is a great way to earn passive income, as it is profitable to a reasonable extent.

However, all these methods depend on a single variable – the crypto mining equipment used.

The best CPU for mining cryptocurrencies has been designed specifically for this process and therefore comes with different yet specific accessories such as mining graphic cards and easily accessible ports.

In addition, some CPUs come with a cooling system, but they may be more expensive than ordinary CPUs. Below are some of the best CPUs that can be part of your mining equipment.

To cut a long story short, the best CPU for mining in 2024 identified by us are the following:

- AMD Ryzen 9 3900X;

- AMD Ryzen 9 3950X;

- AMD Ryzen Threadripper 3970X;

- Intel Core i9-10900X;

- AMD Ryzen 9 5950X;

- AMD Ryzen 9 7950X;

- Intel Pentium Gold G-6400.

For an in-depth understanding, we recommend you carefully read all these detailed steps below to avoid any problems.

Top of the Best CPU for Mining

AMD Ryzen 9 3900X

The AMD Ryzen 9 3900X CPU is a powerful and versatile processor that has been well-received by the PC-building community. However, when it comes to cryptocurrency mining, there are several factors to consider:

Threads and Cores

The Ryzen 9 3900X has 12 cores and 24 threads, which is a substantial amount of processing power. This makes it well-suited for mining algorithms that can take advantage of multiple cores and threads.

Clock Speed

The Ryzen 9 3900X has a base clock speed of 3.8 GHz, which is relatively high for a CPU of this caliber. This means that it can perform complex calculations quickly and efficiently.

Power Consumption

The Ryzen 9 3900X has a TDP (thermal design power) of only 65W, which is relatively low for a processor of this performance level. This means it won’t consume much energy and will save on electricity costs.

Compatibility

The Ryzen 9 3900X is compatible with most modern motherboards and with the most popular mining software.

Price

The Ryzen 9 3900X is relatively expensive and might not be suitable for those on a tight budget.

Overclocking

The Ryzen 9 3900X is suitable for overclocking, which can increase its performance, but it will also increase its power consumption, and it’s essential to make sure that your cooling system can handle the increased heat.

Cooling

The Ryzen 9 3900X does not come with a cooling system. It’s essential to have an excellent cooling solution in place to prevent overheating, especially when overclocking.

Warranty

The Ryzen 9 3900X comes with a 3-year warranty, which covers defects in materials or workmanship, giving you peace of mind if something goes wrong.

The AMD Ryzen 9 3900X is a powerful and efficient processor well-suited for cryptocurrency mining. Relative to the quality-price ratio, we believe that this CPU is the most suitable for any mining operation in 2024.

AMD Ryzen 9 3950X

The AMD Ryzen 9 3950X is a slightly improved version of the AMD Ryzen 9 3900X, which also brings high performance in cryptocurrency mining. Consider that:

Threads and Cores

The Ryzen 9 3950X has 16 cores and 32 threads.

Clock Speed

The Ryzen 9 3950X has a base clock speed of 3.5 GHz, which is relatively high for a CPU of this caliber.

Power Consumption

The Ryzen 9 3950X has a TDP of only 72W, which is relatively low for a processor of this performance level. This means it won’t consume much energy and will save on electricity costs.

Compatibility

The Ryzen 9 3950X is compatible with most modern motherboards and is compatible with the most popular mining software.

Price

The Ryzen 9 3950X is relatively expensive.

Overclocking

The Ryzen 9 3950X is suitable for overclocking.

Cooling

The Ryzen 9 3950X does not come with a cooling system.

Warranty

The Ryzen 9 3950X comes with a 3-year warranty.

This CPU is in second place because AMD Ryzen 9 3900X brings better efficiency if it is to refer also to the price it has, compared to AMD Ryzen 9 3950x, which has a slightly higher price.

AMD Ryzen Threadripper 3970X

The AMD Ryzen Threadripper 3970X is a high-end processor that is well-suited for a wide range of demanding applications, including cryptocurrency mining. Here are several factors to consider:

Threads and Cores

The Ryzen Threadripper 3970X has 32 cores and 64 threads, which is a substantial amount of processing power. This makes it well-suited for mining algorithms that can take advantage of multiple cores and threads.

Clock Speed

The Ryzen Threadripper 3970X has a base clock speed of 3.7 GHz, which is relatively high for a CPU of this caliber.

Power Consumption

The Ryzen Threadripper 3970X has a TDP of 280W, which is relatively high for a processor of this performance level. This means it will consume a lot of energy and increase electricity costs.

Compatibility

The Ryzen Threadripper 3970X is compatible with most modern motherboards and is compatible with the most popular mining software.

Price

The Ryzen Threadripper 3970X is relatively expensive. It’s not suitable for those on a tight budget.

Overclocking

The Ryzen Threadripper 3970X is suitable for overclocking, which can increase its performance, but it will also increase its power consumption.

Cooling

The Ryzen Threadripper 3970X does not come with a cooling system.

Warranty

The Ryzen Threadripper 3970X comes with a 3-year warranty.

The AMD Ryzen Threadripper 3970X is undoubtedly a powerful mining hardware, and it can work wonders with the right mining software, but it is also very expensive. From our perspective, the value for money is not as justified, which is why, although it is perhaps a better CPU overall than AMD Ryzen 9 3900X or others, it barely occupies the third position at our top.

Intel Core i9-10900X

Even if it’s not the best CPU in the market for crypto mining, the 10th generation Intel Core i9-10900X remains one of the most powerful CPUs in the crypto mining industry.

Threads and Cores

The Intel Core i9-10900X CPU has a high number of cores and threads (10 cores and 20 threads), which is beneficial for cryptocurrency mining as it allows for more parallel processing and better performance. The Intel Core i9-10900X delivers a performance of 5.71% higher than most CPUs and performs up to 10.34% faster than its predecessors.

Clock Speed

Although there are a lot of threads and cores, its clock speed is relatively low at 3.5 GHz, which may not be optimal for mining specific cryptocurrencies. Also, the i9-10900X has a turbo speed of 4.7GHz, making it very effective in multitasking and handling heavy tasks.

Power Consumption

In terms of power consumption, the i9-10900X has a TDP of 165W, which is on the higher end for CPUs. This could lead to higher electricity costs for mining.

Compatibility

The i9-10900X is compatible with most modern motherboards, so compatibility even with a mining software is not an issue.

Price

The price of the i9-10900X is relatively high.

Overclocking

The i9-10900X is eligible for overclocking, which may improve performance, but this also increases power consumption and can void the warranty.

Cooling

The i9-10900X does not come with a cooling system, and you need to take into consideration buying a cooling solution because it requires a cooling solution that can effectively dissipate that heat to keep the CPU within safe temperature limits.

Warranty

Intel offers a 3-year limited warranty for the i9-10900X.

The i9-10900X may not deliver spectacular hash rates as some on this list, but this CPU is a potent processor for powering mining rigs.

AMD Ryzen 9 5950X

For cryptocurrency mining, the AMD Ryzen 9 5950X CPU can be another high-end processor that can produce a substantial amount of processing power. However, when it comes to cryptocurrency mining, consider the following characteristics:

Threads and Cores

The Ryzen 9 5950X has 16 cores and 32 threads.

Clock Speed

The Ryzen 9 5950X has a base clock speed of 3.4 GHz, which is relatively high for a CPU of this caliber.

Power Consumption

The Ryzen 9 5950X has a TDP (thermal design power) of 105W.

Compatibility

The Ryzen 9 5950X is compatible with modern motherboards and the most popular mining software.

Price

The Ryzen 9 5950X is relatively expensive.

Overclocking

The Ryzen 9 5950X is suitable for overclocking.

Cooling

The Ryzen 9 5950X does not come with a cooling system.

Warranty

The Ryzen 9 5950X has a 3-year warranty.

Compared to many similar CPUs, the AMD Ryzen 9 5950X looks very good, and in the benchmarks, you can easily see this.

AMD Ryzen 9 7950X

The AMD Ryzen 9 7950X was launched on September 27, 2022, and since then, it has already managed to surprise a few bitcoin miners thanks to the high hash rate it can produce. Some technical features of this processor are:

Threads and Core

The Ryzen 9 7950X has 16 cores and 32 threads.

Clock Speed

The Ryzen 9 7950X has a base clock speed of 4.5 GHz, which is high for a CPU of this caliber.

Power Consumption

The Ryzen 9 7950X has a TDP of only 170W, which is enormous for a processor of this performance level.

Compatibility

The Ryzen 9 7950X is compatible with most modern motherboards and is compatible with the most popular mining software.

Price

The Ryzen 9 7950X is relatively expensive.

Overclocking

The Ryzen 9 7950X is eligible for overclocking.

Cooling

The Ryzen 9 7950X does not come with a cooling system.

Warranty

The Ryzen 9 7950X comes with a 3-year warranty.

Even if this CPU is excellent in terms of hash rate, in our top list, it can only be at the bottom because of characteristics like power consumption and price. This variant may be suitable for some miners, but miners at the beginning will find it hard to amortize their investment.

Intel Pentium Gold G-6400

Intel Pentium Gold G-6400’s place in this top is not because it’s the most powerful processor but because it’s a budget-friendly one that, used properly, can maximize mining profit. Regarding Intel Pentium Gold G-6400, you can consider:

Threads and Cores

The Pentium Gold G-6400 has 2 cores and 4 threads.

Clock Speed

The Pentium Gold G-6400 has a base clock speed of 4.0 GHz, which is relatively moderate for a CPU of this caliber.

Power Consumption

The Pentium Gold G-6400 has a TDP of only 58W, which is relatively low and makes it an excellent option to save on electricity costs.

Compatibility

The Pentium Gold G-6400 is compatible with most modern motherboards and the most popular mining software.

Price

Compared to all presented so far in this chapter, the Intel Pentium Gold G-6400 is the best. The Pentium Gold G-6400 is relatively affordable and could be a good option for those on a tight budget.

Overclocking

The Pentium Gold G-6400 is not suitable for overclocking.

Cooling

The Pentium Gold G-6400 does not come with a cooling system.

Warranty

The Pentium Gold G-6400 comes with a 3-year warranty.

If you’re budget constrained and want to maximize as much profit as possible, Intel Pentium Gold G-6400 is apt to be the last CPU model we recommend for cryptocurrency mining at this top. If budget is a concern, it could be a good option, but better options are available if performance is a priority.

Best Strategies for Mining Rigs with CPUs

In the mining rigs process, it’s possible to meet some troubles regarding the CPU temperature. So, for secure CPU mining, you can opt for the following:

- Monitoring CPU Temperature – To ensure the safe mining of cryptocurrency with your CPU, it’s crucial to keep an eye on the temperature and ensure it stays below the benchmark of 80°C (176°F). One way to do this is through the basic input/output system (BIOS) or through specialized software.

- Limiting Processes – A CPU can handle multiple processes simultaneously, but this can lead to increased heat and potential damage. To prevent this, minimizing background processes while mining on the CPU is essential, including non-essential tasks such as gaming or browsing the internet.

- Cleaning Fans and Boards -To prevent clogging and overheating, keeping fans and boards clean and dust-free is essential. Use compressed air to blow off and clear dust regularly.

- Cooling Equipment – Invest in cooling equipment such as PC case fans, dust filters, and CPU coolers to maintain safe temperature ranges and prevent damage.

- Beware of Scams – Be aware of crypto mining scams that can use your processor to mine digital currencies without your knowledge, causing harm to your computer.

FAQ

Does CPU Matter for Crypto Mining?

Yes, CPU does matter for crypto mining, but its relevance depends on the cryptocurrency and mining algorithm. In some cases, CPU mining is efficient, while specialized hardware like ASICs tends to be more suitable for major cryptocurrencies like Bitcoin, particularly in advanced mining scenarios (like mining rigs).

What to Mine with CPU?

Currently, some of the more approachable CPU mining cryptos are Monero (XMR) or Ravencoin (RVN). For other prominent cryptocurrencies, we suggest utilizing ASICs, even though they demand a more significant initial investment.

What is CPU Mining?

CPU mining involves using a computer’s main processor to participate in cryptocurrency mining activities by solving complex mathematical problems.

While it was once common, CPU mining has become less profitable for major cryptocurrencies due to increased difficulty and the emergence of more specialized hardware like GPUs and ASICs.

However, it can still be viable for certain cryptocurrencies that use CPU-friendly algorithms.

Is It Worth Mining with CPU?

CPU mining is a feasible option when selecting cryptocurrencies with CPU-friendly algorithms; however, our general recommendation leans towards utilizing ASICs for improved efficiency and outcomes.

What is the Most Efficient CPU for a Mining Rig?

At the time of writing, we find the AMD Ryzen 9 3900X or AMD Ryzen 9 3950X to be among the most efficient CPUs for mining rigs. Nevertheless, for optimal outcomes, we advise opting for ASICs.

Is CPU Mining Faster Than GPU?

No, CPU mining is generally slower than GPU mining. While CPUs are versatile and can handle various tasks, GPUs (Graphics Processing Units) are specifically designed for parallel processing and perform better in complex calculations required for cryptocurrency mining.

Top Best CPU for Mining – Conclusion

This article has outlined the best CPUs for mining, and it is now upon the user to choose which will work the best depending on the mined coin. We have also outlined some of the things that should be considered in the mining process to get the most profits out of it. Keep in mind that there are other options for cryptocurrency mining, such as GPU (Graphics Processing Unit), FPGA (Field Programmable Gate Arrays), or ASICs (Application-Specific Integrated Circuits).

This list, however, has not covered all the CPUs, and there are still many other CPUs for mining by different companies, which users can explore.

If you don’t want to earn crypto through solo mining, you can get involved in mining pools. What is a mining pool? Well, a mining pool is a collaborative group of multiple miners who connect their computational resources over a network to boost the chance of finding a block. Basically, that group is called mining pool.

We hope that you choose the best CPU for mining. Now take the next step and start the mining process!