Silver’s Historic Rally Sparks Aggressive Short Positioning

Silver’s explosive rally is now being met with an equally aggressive counter-trade, as investors pile into leveraged products betting on a pullback.

Fresh fund flow data and technical signals suggest the metal may be entering a far more unstable phase after one of its strongest runs in decades.

- Record inflows into leveraged short silver products show heavy conviction against the rally.

- Silver’s 2025 surge ranks among the strongest annual gains in modern history.

- Technical indicators suggest slowing momentum, not a confirmed trend reversal.

- Crowded positioning increases the risk of sharp, volatile price swings.

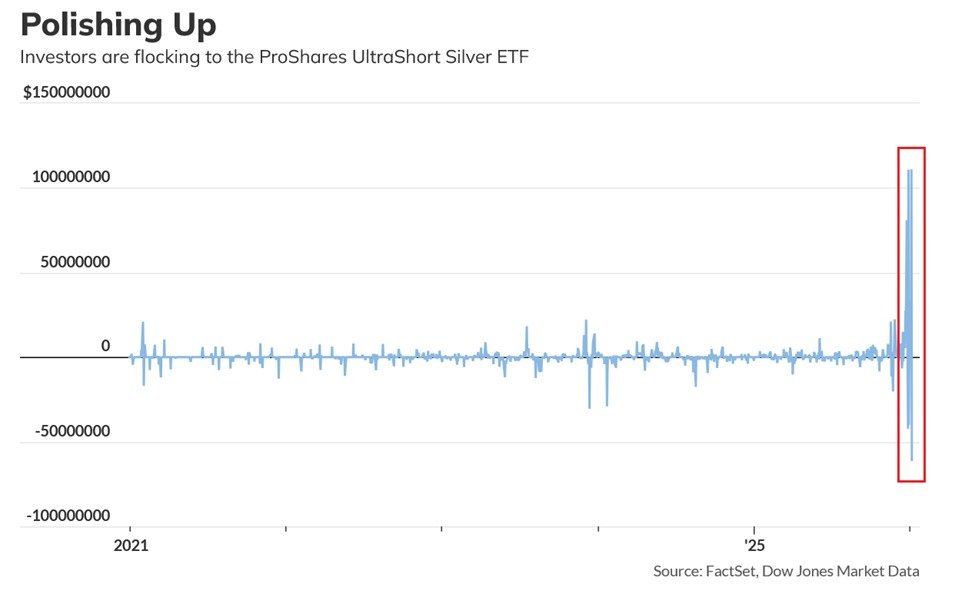

The 2x leveraged short silver ETF ProShares UltraShort Silver ETF recorded a $111 million inflow on Tuesday, the largest single-day addition in its history. A day later, the fund saw a $60 million outflow, also a record, highlighting extreme positioning swings in a very short period.

Despite the volatility, cumulative flows tell the bigger story. Over the past two weeks, investors have added a record $327 million to the fund, a clear signal that a growing share of the market is positioning for silver to cool off after its sharp advance.

A historic rally meets rising skepticism

Silver surged roughly 145% in 2025, marking its best annual performance since 1979. The move has only accelerated in recent months, with prices jumping more than 58% over the last three months alone. That rally has crushed inverse products, pushing the 2x short silver ETF down nearly 69% over the same period.

The scale of short positioning suggests many traders believe the rally has gone too far, too fast. However, the use of leveraged products also means even modest price swings can trigger outsized flows, reinforcing volatility rather than damping it.

Technical signals point to turbulence, not calm

On the price chart, silver remains in a strong broader uptrend, but momentum indicators are starting to look less one-sided. The MACD on the 4-hour timeframe is flattening after a recent peak, hinting at slowing upside momentum rather than a clean reversal. Meanwhile, RSI has pulled back from overbought territory toward the mid-50s to low-60s range, suggesting consolidation pressure rather than outright weakness.

This combination often precedes sharp, two-way moves, especially when positioning becomes crowded on either side of the trade.

What this means for silver markets

The surge in leveraged short bets does not automatically imply an imminent drop in prices. Instead, it raises the odds of sharper intraday swings, whipsaws, and sudden liquidations in both directions. If silver pushes higher again, short covering could amplify the move. If momentum fades, leveraged downside exposure could accelerate declines.

Either way, the data points to one conclusion: the calm phase of silver’s rally is likely over.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.