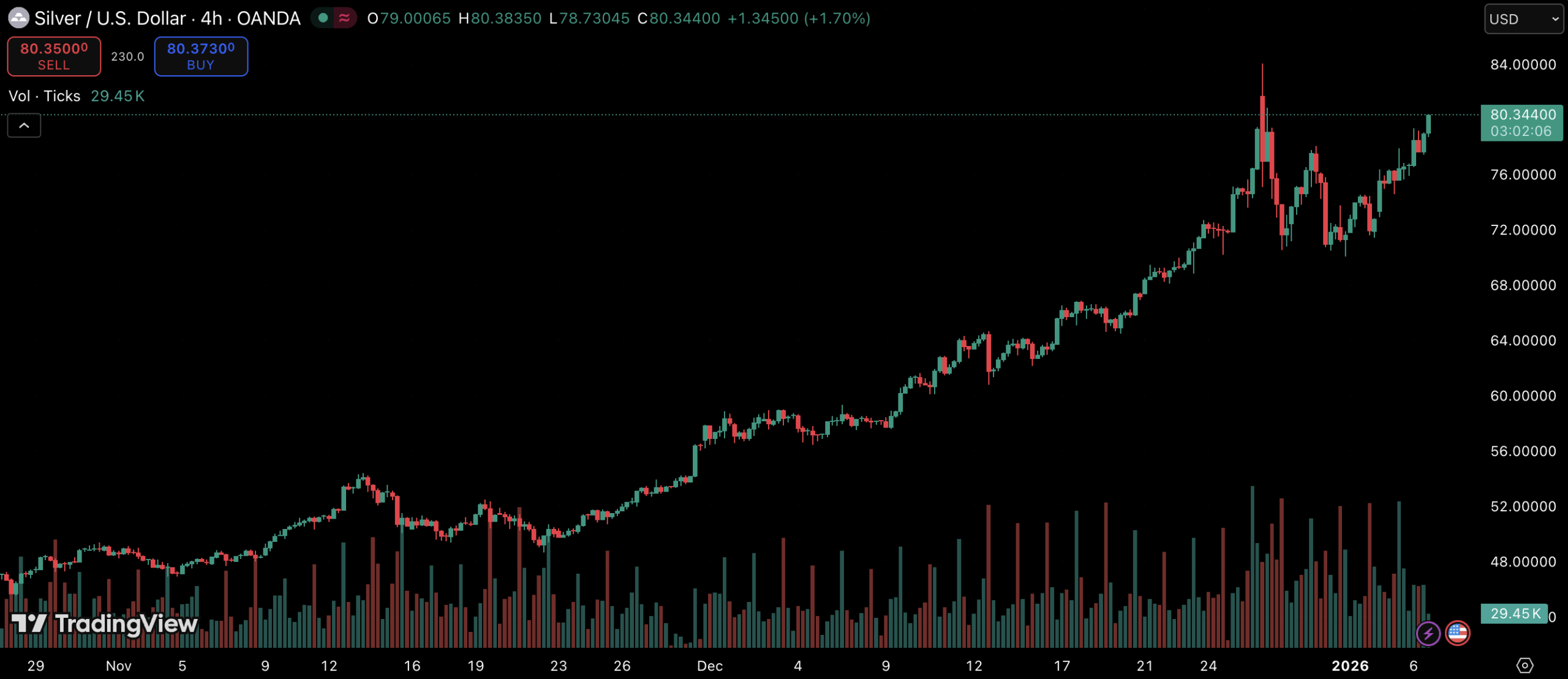

Silver Jumps Back to $80 After Correction, Extends Winning Streak

Silver surged back to the $80 level, marking a decisive return of bullish momentum after a brief correction earlier this month.

The move extends a four-day winning streak and reinforces the metal’s strong trend as investors rotate back into safe-haven assets amid rising geopolitical uncertainty.

Silver Regains Momentum After Pullback

After pulling back from recent highs, silver quickly found support and resumed its upward trajectory. Buyers stepped in aggressively, pushing prices back above the psychologically important $80 mark.

The recovery highlights resilient demand, with market participants viewing the recent dip as a temporary pause rather than a trend reversal. The current rally now marks four consecutive sessions of gains, underscoring strong short-term momentum.

Geopolitical Tensions Fuel Safe-Haven Demand

Renewed geopolitical stress has played a key role in silver’s advance. Market uncertainty intensified following reports surrounding Nicolás Maduro, adding to broader concerns around political stability in Venezuela.

These developments have unsettled global markets and boosted demand for precious metals as investors seek protection from rising risks.

Further amplifying the cautious mood were comments from Donald Trump, who warned of potential additional measures if Washington’s demands toward Venezuela are not met. Such rhetoric has reinforced risk-off positioning, benefiting assets traditionally seen as stores of value.

Silver’s Rally Builds on Strong Momentum

With silver now firmly back above $80, traders are watching whether the metal can maintain its upside pace after the recent correction. The combination of technical recovery, consecutive daily gains, and heightened geopolitical tension continues to support the bullish narrative, keeping silver in focus as one of the standout performers in the commodities market.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.