Coinbase CEO Brian Armstrong said the company is actively working toward a regulatory “win-win” that advances the President’s crypto agenda while addressing longstanding concerns from the traditional banking sector.

A senior commodities analyst at Goldman Sachs says the gold market has entered a new phase, where private investors are now competing directly with central banks for limited bullion supply.

The cryptocurrency market staged a broad recovery on Friday, lifting total market capitalization to approximately $2.36 trillion, up more than 2% over the past 24 hours.

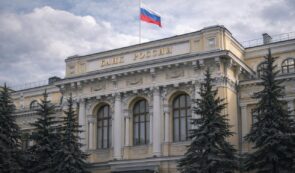

The Bank of Russia lowered its benchmark key interest rate by 50 basis points to 15.5% on February 13, 2026, extending its easing cycle with a sixth consecutive cut. The decision came as a surprise to most economists, who had expected policymakers to hold rates steady at 16% amid a recent inflation uptick.

Bitcoin’s latest drawdown is being framed by several market analysts as a controlled reset rather than the start of a prolonged collapse, with historical data suggesting the current cycle remains structurally stronger than previous downturns.

Brazil has revived legislation aimed at establishing a national Strategic Bitcoin Reserve, reopening debate over whether the country should begin accumulating Bitcoin at a sovereign level.

US inflation eased in January, reflecting a sharp decline in energy costs even as underlying price pressures showed signs of firmness.

The European Central Bank has entered what officials describe as a “monitoring phase” after the euro climbed roughly 14% in the first half of 2025.

Speaking on CNBC’s Squawk Box, Kevin Hassett argued that Bitcoin’s volatility should not surprise investors, noting that the asset has historically experienced average drawdowns of around 58% during major corrections.

Binance has launched its prepaid Mastercard crypto card across several countries in the Commonwealth of Independent States, marking a renewed push into everyday digital asset spending.

Dubai, United Arab Emirates, 13th February 2026, Chainwire

Indiana lawmakers are pushing forward a revised cryptocurrency bill that could open the door for digital assets inside public retirement accounts - but without placing state-managed pension funds directly into the market.