Top 10 Optimism DEX & Optimism DEX Aggregators to Use (2025)

Now, in 2024 and probably beyond, with the rise of the Optimism network—a layer 2 scaling solution for Ethereum known for its low fees and high-speed transactions—many traders are shifting their focus to Optimism-based decentralized exchanges (DEXs) and DEX aggregators.

That’s why, in this article, we explore the top 10 Optimism DEXs and DEX aggregators to use in 2025.

Let’s dive in!

[nativeAds]

Table of contents

Top 5 Optimism Decentralized Exchanges to Use in 2025 and Beyond

Uniswap V3 (Optimism)

- 24h Trading Volume (as of March 27, 2025): $7,257,333

- Pairs Accepted: 158

- KYC/No-KYC: No-KYC

Uniswap is one of the first decentralized exchanges (DEX) in the DeFi space, launched in November 2018, and perhaps the most popular DEX.

As one of the earliest successful applications on Ethereum (and later available on the Optimism network), Uniswap introduced the Automated Market Maker (AMM) model. This model replaced traditional order books with liquidity pools and algorithms that set market prices based on supply and demand. This innovation has allowed anyone to participate by supplying tokens to liquidity pools, earning rewards, and facilitating peer-to-peer trading.

Moreover, with its continued success and commitment to decentralization, Uniswap launched the UNI token, granting the community voting rights on key protocol decisions.

Based on all of these and more, we consider Uniswap the best DEX for the Optimism network, making it a top choice for Ethereum layer 2 scaling solutions.

Pros of Uniswap

- Lower fees;

- Faster transactions;

- Increased scalability.

Cons of Uniswap

- Bridging asset costs;

- Potential liquidity fragmentation;

- Inherent security risks.

Velodrome Finance V2 (Optimism)

- 24h Trading Volume (as of March 27, 2025): $825,600

- Pairs Accepted: 183+

- KYC/No-KYC: No-KYC

Velodrome is a decentralized exchange (DEX) built on the Optimism network, designed to offer efficient and rewarding trading experiences. It’s known for its innovative vote-escrow mechanism, which allows users to lock their VELO tokens for varying periods to gain governance power and share in protocol rewards.

Velodrome operates on an automated market maker (AMM) model, providing liquidity pools for various cryptocurrencies. Users can swap tokens, provide liquidity to earn fees and governance rewards, or participate in governance by locking their VELO tokens.

Pros of Aerodrome V2

- Fast transactions;

- Low fees;

- Innovative features.

Cons of Aerodrome V2

- Lower liquidity;

- New to market.

Clipper (Optimism)

- 24h Trading Volume (as of March 27, 2025): $9,947

- Pairs Accepted: 11

- KYC/No-KYC: No-KYC

Clipper is a decentralized exchange (DEX) designed specifically for traders executing smaller transactions, typically under $50,000. Its unique selling point lies in its focus on optimizing fees and slippage for these smaller trades, a segment often overlooked by other DEXes.

Unlike traditional DEXes that often prioritize large-scale trading, Clipper prioritizes the needs of retail traders. It employs a proprietary Formula Market Maker (FMM) mechanism, which differs from the commonly used Constant Product Market Maker (CPMM) by offering more precise pricing for smaller trades.

Clipper’s liquidity pools are structured into Core Pools and Coves. Core Pools are multi-asset pools where liquidity providers earn a pro-rata share of the pool’s total yield. Coves are smaller, more specialized pools designed to optimize specific trading pairs.

Pros of Clipper (Optimism)

- Low fees for small trades;

- Optimized pricing for small trades.

Cons of Clipper (Optimism)

- Limited liquidity compared to larger DEXes;

- Primarily focused on small trades.

Kromatika Finance

- 24h Trading Volume (as of March 27, 2025): $0

- Pairs Available: 70+

- KYC/No-KYC: No-KYC

Kromatika may not be a well-known Optimism DEX, but many consider it a game-changing decentralized exchange that simplifies trading by automating complex processes and offering innovative features.

Built on Uniswap V3, Kromatika stands out with its automated limit orders, gasless swaps, and the ability to engage in perpetual trading with up to 100x leverage.

With automated limit orders, traders can set and manage their trades without manual intervention, streamlining the trading experience.

Gasless swaps, made possible through Biconomy, allow users to trade without paying gas fees, making transactions more cost-effective. Additionally, the platform supports perpetual trading with high leverage, enabling traders to maximize their potential returns.

Pros of Kromatika Finance

- Automated limit orders;

- Gasless swaps reduce transaction costs;

- Offers high leverage for advanced traders.

Cons of Kromatika Finance

- May have limited liquidity for certain pairs as this DEX is relatively new;

- Some features might be challenging for beginners.

- Very low activity

Rubicon (Optimism)

- 24h Trading Volume (as of August 20, 2024): $0

- Pairs Available: 1

- KYC/No-KYC: No-KYC

Rubicon is a decentralized exchange (DEX) built on top of the Ethereum network but also works with the Optimism network.

It focuses on offering deep liquidity for traders and aims to make trading easy and efficient by providing access to a wide selection of trading pairs with strong liquidity.

Rubicon’s main goal is to reduce slippage, ensuring that trades happen smoothly at good prices. The platform pulls in liquidity from multiple sources, working to create a reliable and stable trading experience for users.

Although it seems to currently have low activity, after analyzing and comparing Rubicon with other DEXs built on the Optimism network, Rubicon may be worth looking into further.

Pros of Rubicon (Optimism)

- Deep liquidity pools;

- Efficient trading experience.

Cons of Rubicon (Optimism)

- Might have higher fees compared to some other DEXes;

- Not considered popular in the industry.

Top 5 Optimism DEX Aggregators to Use in 2025 and Beyond

1inch Network

1inch Network is the leading decentralized exchange (DEX) aggregator, also available on the Optimism network, known for providing an advanced trading platform that ensures users get the best possible prices across multiple DEXes.

By integrating liquidity from various sources, 1inch minimizes price slippage and ensures efficient trade execution, making it a go-to option for traders looking to optimize their trades.

Beyond basic swaps, 1inch offers a range of advanced trading features like limit orders, stop-loss orders, and complex multi-hop token swaps, making it suitable for both beginners and experienced traders.

Additionally, 1inch has its own governance token, 1INCH, which allows holders to participate in important protocol decisions, fostering community engagement and decentralized governance.

Pros of 1inch

- Strong community focus;

- Yield farming opportunities;

- Wide range of trading pairs.

Cons of 1inch

- Governance complexity can be overwhelming for some users;

- Yield farming incentives can fluctuate.

Paraswap.io

ParaSwap is another leading DeFi aggregator that works very well on the Optimism network, designed to provide users with an efficient, cost-effective, and secure trading experience.

Acting as a personal trading concierge, ParaSwap enables users to get the best possible prices by pulling liquidity from a broad range of decentralized exchanges (DEXes) on Optimism and not only.

ParaSwap’s advanced routing algorithm evaluates millions of potential trade routes, taking into account factors like price, transaction speed, and gas fees, to ensure users get the most optimal outcome for their swaps.

Pros of ParaSwap

- Aggregates liquidity from multiple DEXes;

- Offers potentially better rates compared to single Optimism DEXs;

- User-friendly interface.

Cons of ParaSwap

- Might have higher gas fees due to complex routing;

- Reliance on underlying DEXs for liquidity.

OpenOcean

OpenOcean is a comprehensive gateway to the decentralized finance (DeFi) ecosystem. As a top Web3 middleware provider, OpenOcean offers a full suite of tools for traders and developers, making DeFi accessible and efficient for all levels of experience.

At the core of OpenOcean is its innovative Best Rate Swap function, which aggregates liquidity from over 1,000 sources across 30 networks, ensuring users consistently secure the best possible prices for their token swaps.

In addition to serving traders, OpenOcean provides developers with a powerful toolkit. The platform offers APIs and SDKs, allowing developers to integrate OpenOcean’s advanced features into their projects and enhance their DeFi solutions with the best-in-class trading infrastructure.

Pros of OpenOcean

- Aggregates liquidity from over 1,000 sources across 30 networks;

- Offers a seamless trading experience with the Best Rate Swap function;

- Provides a wide array of developer tools, including APIs and SDKs.

Cons of OpenOcean

- Can be overwhelming for new users due to its advanced features;

- Relies on underlying DEXes for liquidity, which may affect performance.

Rubic

Rubic is another interesting decentralized exchange aggregator that connects users to the best prices across multiple crypto networks (as they brag).

By aggregating liquidity from over 360 DEXs and bridges, Rubic ensures you get the most favorable rates for your token swaps.

With access to over 15,500 tokens, Rubic offers unparalleled flexibility and choice.

Rubic’s user-friendly interface makes it easy to navigate and execute trades. Simply enter the tokens you want to swap, and Rubic will instantly provide the best available price and execute the transaction.

Pros of Rubic

- Aggregates liquidity from multiple DEXs;

- Offers a wide range of trading pairs;

- Prioritizes security.

Cons of Rubic

- Might have higher gas fees due to complex routing;

- Reliance on underlying DEXes for liquidity.

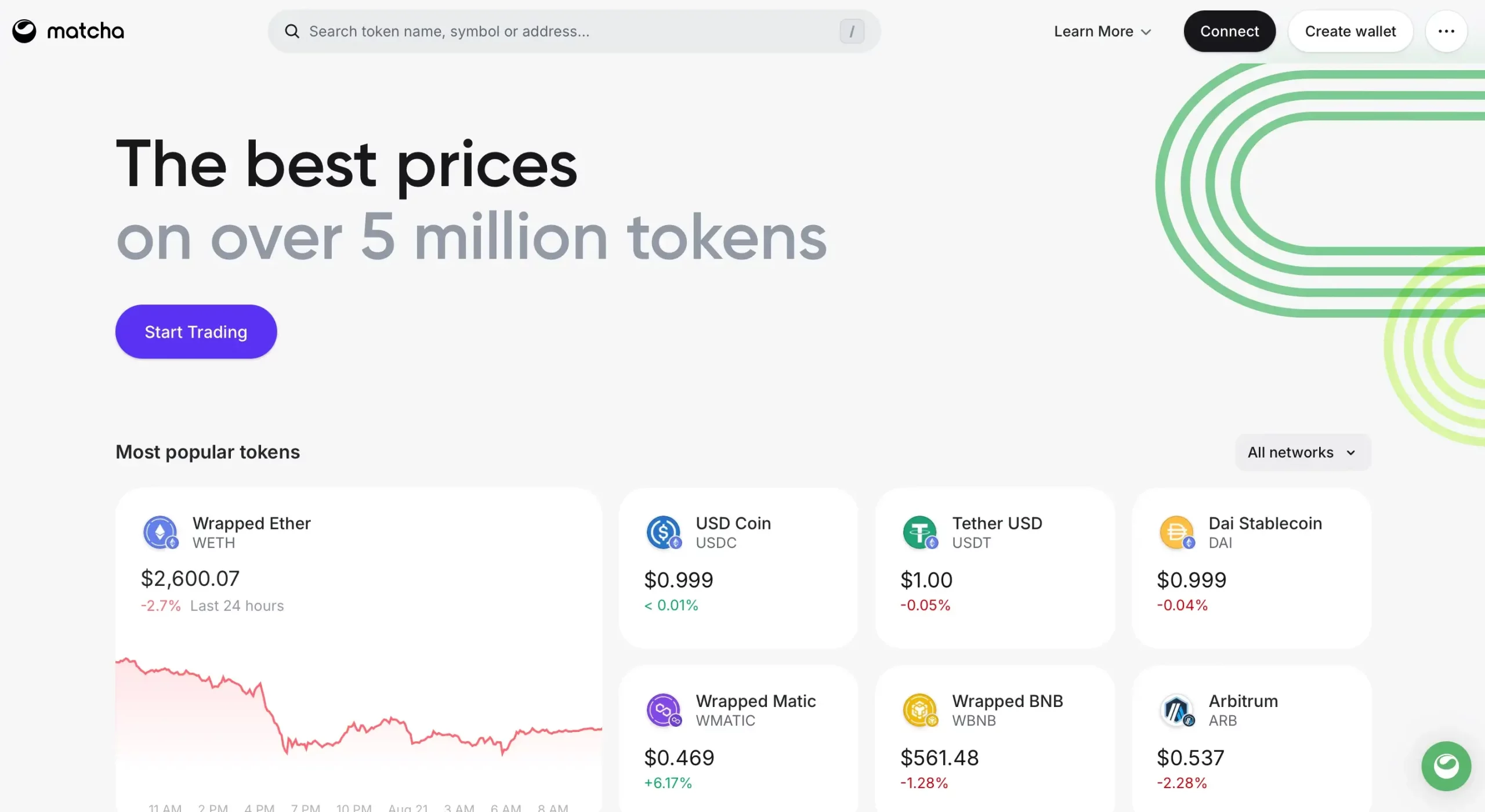

Matcha

Matcha is a top-tier decentralized exchange (DEX) aggregator designed to give traders seamless access to a wide range of cryptocurrencies.

Built by 0x (and also fully compatible with the Optimism network), Matcha harnesses state-of-the-art technology to deliver a smooth and efficient trading experience.

Supporting over 9 million tokens (including, of course, OP token), Matcha provides extensive flexibility, whether you’re trading well-known assets or diving into niche tokens.

With its smart order routing system, Matcha ensures optimal pricing by aggregating liquidity from more than 130 sources. It identifies the most efficient and cost-effective trading routes, making it a powerful tool for maximizing value.

Pros of Matcha DEX Aggregator

- Extensive asset coverage;

- Includes limit orders and Matcha Auto for seamless trading;

- Leverages smart order routing for the best rates.

Cons of Matcha DEX Aggregator

- May require a steeper learning curve for new users;

- Platform performance relies on the underlying liquidity sources.

What is Optimism (OP)?

Optimism (OP) is a Layer-2 scaling solution for Ethereum that enhances transaction speed and reduces costs by processing transactions off-chain while still benefiting from Ethereum’s security.

It uses optimistic rollups to bundle and compress transactions, which are then submitted to the Ethereum mainnet for finalization. This approach reduces the load on Ethereum, enabling faster and cheaper transactions for users of decentralized applications (dApps).

Optimism is also known for its commitment to retroactive public goods funding, where a portion of its protocol revenues is allocated to projects that benefit the Ethereum ecosystem and broader public goods initiatives. This makes Optimism not only a powerful tool for scaling Ethereum but also a platform that supports and sustains the growth of decentralized applications and blockchain technology.

What is an Optimism DEX?

An Optimism DEX is a decentralized exchange that operates on the Optimism network, a Layer-2 scaling solution for Ethereum.

Optimism is designed to provide faster and cheaper transactions by reducing the load on the Ethereum mainnet. DEXs on Optimism allow users to trade cryptocurrencies directly from their wallets without relying on a centralized platform.

These DEXs benefit from Optimism’s scalability and low transaction fees, making them an efficient choice for traders looking to avoid the higher costs typically associated with Ethereum Layer-1 transactions.

But an Optimism DEX Aggregator?

Optimism DEX Aggregators, instead of sourcing liquidity from a single DEX on Optimism, search multiple decentralized exchanges on the network to find and offer the best prices for traders.

This means users can get optimal trading outcomes by accessing the most competitive prices across various platforms, all within the Optimism ecosystem.

These aggregators simplify the process by automating the search for the best deals, saving traders time and reducing costs.

FAQs

What is the Best DEX to Use?

The best-decentralized exchange (DEX) depends on your trading needs and preferences. Uniswap is a popular choice for its user-friendly interface, high liquidity, and wide token availability. 1inch stands out for its price optimization by aggregating liquidity from multiple sources, ensuring you get the best rates. SushiSwap offers additional DeFi features like yield farming, while Curve is known for its efficiency in stablecoin trading.

When selecting a DEX, also consider its integration with wallets like Coinbase Wallet or MetaMask. The best DEX for you will align with your trading goals, preferred network, and the specific features you need.

What is the Best Optimism Exchange?

When it comes to Optimism DEXs, our research suggests that Uniswap currently stands out as the top decentralized exchange on the Optimism network. However, the best exchange for you may vary depending on your specific needs. We recommend reading our full article and doing additional research to find the right fit for your trading goals.

What is the Best DEX Now?

Currently, Uniswap is often considered the leading decentralized exchange (DEX) due to its significant trading volume, user-friendly interface, and extensive liquidity pools. However, the best DEX can vary based on individual needs, trading preferences, and the network you’re using. Platforms like SushiSwap, Curve, and 1inch are also popular alternatives, each offering unique features and benefits. It’s important to choose a DEX that aligns with your specific requirements.

What is the Best Multi-Chain DEX?

The best multi-chain DEX depends on your specific trading needs. Popular options include Uniswap, PancakeSwap, and SushiSwap. DEX aggregators such as 1inch, ParaSwap, and KyberSwap can also offer competitive rates. Consider factors like fees, supported chains, token selection, and security when choosing.

Conclusion

As the Optimism network and blockchain technology continue to grow in popularity, the ecosystem around it is expanding rapidly. The surge in interest has led to a diverse range of DEXs and DEX aggregators emerging on the network, each bringing its own set of features and benefits to the table.

With Optimism’s emphasis on speed and low transaction costs, these platforms are designed to meet the evolving needs of traders seeking efficiency and effectiveness.

And as new options become available, you’ll find even more tools to enhance your trading experience.