The Latest Crypto News You Might Have Missed – 19-26 August

After several weeks of quiet in the crypto industry, with little news appearing in the press, the week of August 19 to August 26 brought a whirlwind of activity. Last week was packed with unexpected developments, from the arrest of Telegram’s CEO to McDonald’s getting rugged.

Besides, new twists in the U.S. elections and fresh legal charges have also grabbed attention, adding to the buzz. We’ve done a thorough analysis of these events, offering you the most accurate explainers.

In this article, we break down everything you need to know from last week within the crypto industry around the globe.

[nativeAds]

Top Crypto Industry News

1. Telegram CEO Arrested, Toncoin Plunges by 14%

Summary: Toncoin dropped by over 14% after French media reported the arrest of Telegram CEO Pavel Durov, linked to a criminal investigation in France.

Details: On August 25, 2024, French media revealed that Pavel Durov, the CEO of Telegram, was arrested at Le Bourget Airport.

The arrest follows a warrant issued by OFIM, a French police office that fights violence against minors. Authorities accused Durov of not properly moderating illegal content on Telegram, including drug trafficking and child exploitation material.

As news spread, Toncoin (TON), the cryptocurrency linked to Telegram, saw its value drop by over 14%.

Despite this, the broader digital asset market remained stable. Some prominent figures, including Elon Musk, supported Durov’s release on social media.

French authorities extended Durov’s detention. His arrest could last up to 96 hours as investigators investigate allegations of fraud, organized crime, and failure to moderate harmful content on Telegram.

Telegram has since stated that the platform follows EU laws and continues to improve its moderation efforts.

Source: CoinDesk

2. McDonald’s Instagram Hacked, Scammers Steal $700K Promoting Fake Grimace Memecoin

Summary: Hackers took over McDonald’s official Instagram account to promote a fake memecoin based on the chain’s mascot, Grimace, making off with $700,000.

Details: On August 21, 2024, scammers hacked McDonald’s official Instagram page and used it to promote a fraudulent cryptocurrency called “Grimace.”

The posts, which targeted McDonald’s 5.1 million Instagram followers, claimed the memecoin was a new experiment on the Solana blockchain.

The hackers used this opportunity to control 75% of the Grimace token’s supply and distributed it across multiple wallets. The token’s value quickly surged to a $25 million market cap but crashed shortly after when the hackers dumped their tokens. Ultimately, they made off with $700,000 in Solana from this scheme.

McDonald’s has since regained control of the account and removed the misleading posts. The company apologized for the incident, calling it an “isolated issue.”

Source: Cointelegraph

3. RFK Jr. Suspends Presidential Bid, Endorses Trump Amid Bitcoin Support

Summary: Robert F. Kennedy Jr. has announced he is suspending his independent presidential campaign and endorsing fellow Bitcoin supporter Donald Trump.

Details: On August 23, 2024, Robert F. Kennedy Jr., an independent candidate and Bitcoin (BTC) advocate, declared he was suspending his presidential campaign.

Speaking in Phoenix, Arizona, Kennedy explained that he would only withdraw from ballots in swing states, aiming to prevent his candidacy from helping Democratic candidate Kamala Harris.

Kennedy emphasized that he was not ending his campaign entirely but shifting his focus to support Donald Trump, another pro-Bitcoin figure. He expressed concerns that staying on the ballot in swing states could inadvertently benefit Harris, with whom he disagrees on key issues.

Kennedy’s move came after Donald Trump showed interest in Bitcoin, and the two candidates had overlapping views on crypto. The announcement followed Kennedy’s earlier statements about the potential of a U.S. Bitcoin reserve and blockchain-based government transparency.

Robert F. Kennedy Jr.’s decision to suspend his campaign has triggered a flurry of activity on Polymarket, with betting odds now shifting in favor of former President Donald Trump.

Source: Decrypt

4. Crypto Advocate Michelle Bond Charged of Illegally Accepting FTX Cash

Summary: Former crypto advocate Michelle Bond has been indicted for illegally accepting campaign donations from her former boyfriend, Ryan Salame, an ex-FTX executive, during her 2022 congressional campaign.

Details: Michelle Bond, once a leading figure in Washington’s crypto policy scene, was indicted in federal court for allegedly taking illegal contributions during her failed congressional run in 2022. Court documents reveal that the funds originated from her then-boyfriend, Ryan Salame, a former senior executive at FTX. Bond, who previously worked as a lawyer for the U.S. Securities and Exchange Commission (SEC), was accused of filing false financial documents related to the campaign.

Salame, who was not named in the accusation but whose description matches, received a 7.5-year sentence after pleading guilty to campaign finance violations and other charges. Bond’s indictment argues that she used Salame’s funds for her campaign while claiming they were self-funded.

Despite raising over $1.5 million, most of which allegedly came from Salame, Bond was unsuccessful in the Republican primary.

Sources: CoinDesk

Latest Cryptocurrency News – Regulations

5. Australian Court Backs Regulator in Lawsuit Against Kraken’s Local Operator

Summary: The Australian Securities and Investments Commission (ASIC) won a legal case against Bit Trade Pty Ltd., Kraken’s operator in Australia, for offering a financial product without following required regulations.

Details: On August 23, 2024, the Federal Court of Australia ruled that Bit Trade Pty Ltd. violated Section 994B of the Corporations Act by offering a margin extension product to retail clients without making a “target market determination.”This determination is legally required before financial products can be offered to consumers. ASIC filed a case against Bit Trade to enforce compliance with these rules.

Since October 2021, Kraken’s margin extension product has been available on its platform without meeting this regulatory requirement. While the Court acknowledged some complexities in applying current regulations to innovative crypto technologies, it ultimately ruled in favor of ASIC.

Kraken expressed disappointment with the ruling but confirmed they would comply with the Court’s decision. They also pointed out that the judgment highlighted Australia’s unclear regulatory framework for crypto products. ASIC has indicated that it will seek financial penalties against Bit Trade.

Source: CoinDesk

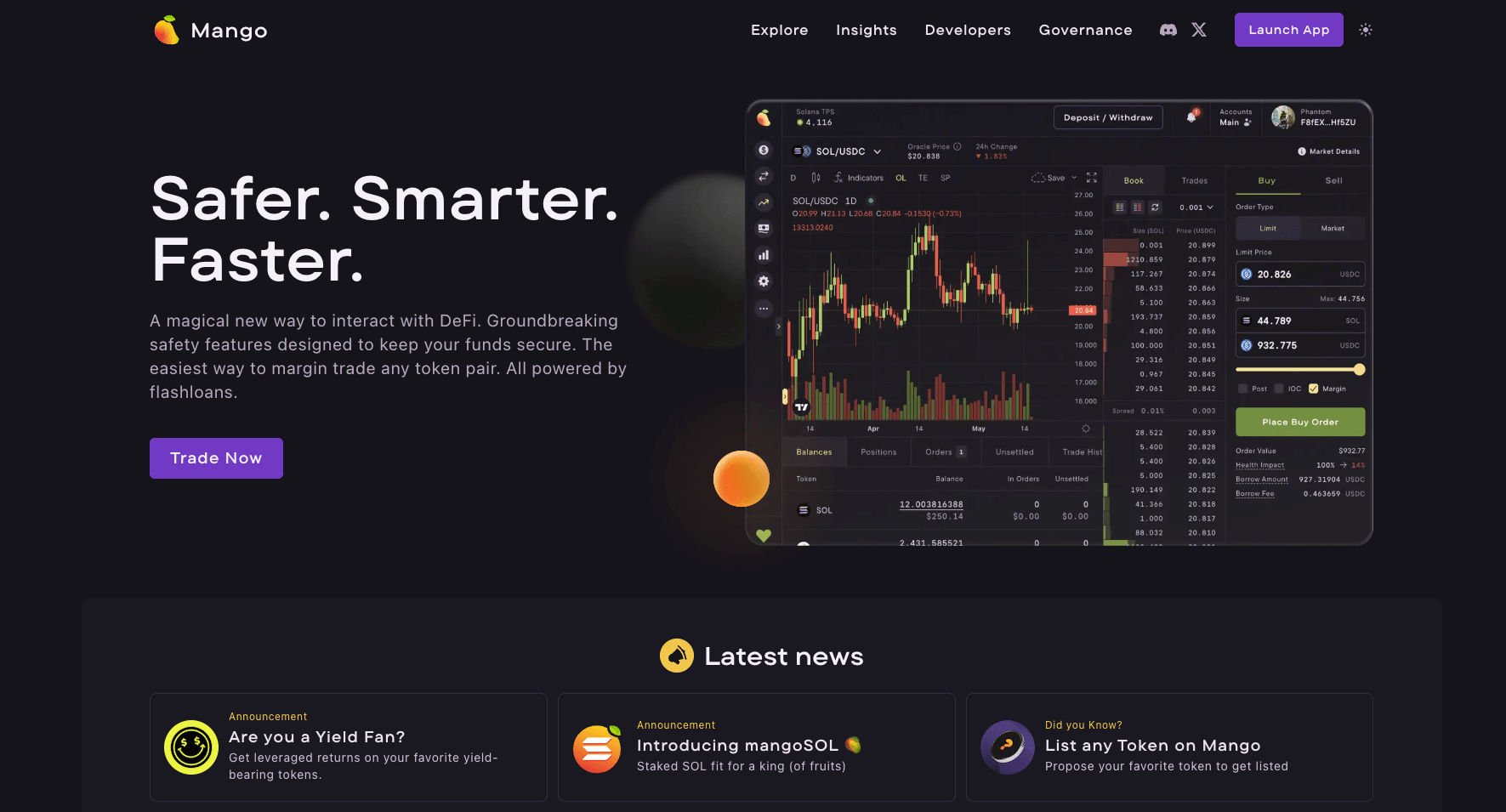

6. SEC Alleges Securities Fraud Against Solana’s Top Decentralized Exchange

Summary: Mango Markets, once a leading decentralized exchange on Solana, faces serious allegations from the U.S. Securities and Exchange Commission (SEC) for breaking securities laws.

Details: Mango Markets, previously a top decentralized exchange on Solana, is preparing to settle with the SEC over multiple securities law violations.

The proposal, introduced by Mango DAO (the group managing Mango Markets), suggests paying fines and removing MNGO tokens. This settlement could make Mango Markets’ future uncertain, as the MNGO tokens are crucial for its daily operations.

The SEC claims that Mango DAO sold unregistered securities, and Mango Labs acted as an unlicensed broker.

The proposal also mentions that the Department of Justice and the Commodity Futures Trading Commission are investigating Mango Markets.

Source: CoinDesk

Top of the Latest Cryptocurrency News – Markets

7. Bitcoin Price Rises After a Quiet Week

Summary: Bitcoin’s price increased significantly on Friday after a slow week, driven by optimism about the Federal Reserve’s potential interest rate cut and other market news.

Details: The crypto market had been relatively quiet until Friday when Bitcoin’s price surged. The increase came after Federal Reserve Chair Jerome Powell hinted at a possible interest rate cut in September, sparking optimism among investors. Bitcoin’s price climbed above $64,600, marking a 7% rise over the week before settling around $63,500 as the weekend approached. This is the highest Bitcoin has been since early August.

Ethereum also saw gains, rising 6% to $2,750 by the end of the week despite ongoing withdrawals from its newly approved exchange-traded funds (ETFs).

Additionally, Solana saw a notable price increase, with its coin rising nearly 10% to $153. Meme tokens on Solana’s blockchain, such as Dogwifhat and Floki, also experienced significant gains of up to 30%.

Source: Decrypt

8. Stablecoin Market Cap Hits a New All-Time High

Summary: After 11 months of steady growth, the total value of stablecoins, excluding algorithmic ones, has reached a new all-time high of $168 billion.

Details: The market cap for stablecoins has surged to $168 billion, marking its highest level ever. This growth has been consistent over the past 11 months, surpassing the peak of $167 billion in March 2022.

Crypto analyst Patrick Scott noted that this increase might be due to new investments entering the market. He suggested that the high stablecoin market cap indicates fresh money flowing into cryptocurrencies.

The new record does not include algorithmic stablecoins, which are maintained by algorithms rather than being backed by assets like cash or gold.

Tether (USDT) has led the stablecoin market, with its value reaching over $117 billion in August 2024, up from $91.69 billion at the start of the year. Circle’s USD Coin (USDC) has also grown, reaching a market cap of over $34 billion in 2024, though still below its peak of $55.8 billion in June 2022.

Despite the rise in market cap, trading volumes for stablecoins fell by 8.35% in July, dropping to $795 billion. This decline is attributed to lower trading activity on centralized exchanges and concerns about future regulations affecting stablecoins in Europe.

Source: Cointelegraph

Top of the Latest Cryptocurrency News – Altcoins

9. Sony Launches Soneium Blockchain Network

Summary: Sony, the company famous for the Walkman, has announced its own blockchain network called Soneium, built on Ethereum.

Details: On August 25, 2024, Sony Block Solutions Labs, a collaboration between Sony Group and Singapore’s Startale Labs, introduced its blockchain project, Soneium.

The network will operate as a layer-2 solution on the Ethereum blockchain, utilizing Optimism’s OP Stack technology. Soneium aims to provide users with faster and cheaper transactions.

Soneium will launch in test mode soon and will focus on attracting Web3 enthusiasts in its first year. In the next two years, Sony plans to eventually integrate the blockchain with its various businesses, including Sony Music and Sony Pictures.

The project also intends to onboard other companies and decentralized applications (dApps) within three years, extending beyond just Sony products.

The move reflects a broader trend of mainstream companies exploring blockchain technology. Sony’s decision to launch its own network signals growing interest in the potential of decentralized platforms to reshape the future of digital services.

Source: CoinDesk

10. Grayscale Launches New Avalanche Trust for AVAX Token Investment

Summary: Grayscale Investments has launched a new investment product, the Grayscale Avalanche Trust, providing investors with exposure to the AVAX token, which supports the Avalanche blockchain.

Details: On August 22, 2024, Grayscale Investments announced its latest addition to its range of crypto investment products: the Grayscale Avalanche Trust.

This new trust allows investors to invest in the AVAX token, which is used for transaction fees and secures the Avalanche blockchain. The Avalanche blockchain is known for its speed and scalability compared to Ethereum.

Grayscale, a major player in the crypto asset management space, now offers over 20 different investment products. The firm has been expanding its offerings recently, focusing on decentralized artificial intelligence (AI) with new funds such as the Grayscale Bittensor Trust and the Grayscale Sui Trust, which invest in the TAO and SUI tokens.

Grayscale’s new CEO, Peter Mintzberg, formerly of Goldman Sachs, has been leading these expansions. The Avalanche Trust is part of Grayscale’s strategy to provide investors with a range of options in the evolving crypto market.

As of the time of writing, the AVAX token is trading around at $27, according to CoinMarketCap data.

Source: CoinDesk

11. Brazil Approves Second Solana ETF

Summary: Brazil’s Securities and Exchange Commission (CVM) has approved a second Solana exchange-traded fund (ETF), which will be launched by Hashdex in collaboration with BTG Pactual.

Details: The Brazilian Securities and Exchange Commission (CVM) has approved another Solana (SOL) ETF.

The new product will be managed by Hashdex, a Brazil-based asset management company with over $962 million in assets, in partnership with BTG Pactual, a prominent local investment bank.

Hashdex is known for its experience in the ETF market, having previously introduced several crypto-based ETFs on Brazil’s B3 stock exchange, including those tied to Bitcoin, Ethereum, and the Nasdaq Crypto Index.

This approval follows the CVM’s earlier decision on August 8, 2024, to approve the country’s first Solana ETF, which was introduced by QR Asset, another local asset manager.

Source: CoinDesk