Ethereum Takes 65% of the Tokenization Market as Institutions Pile In

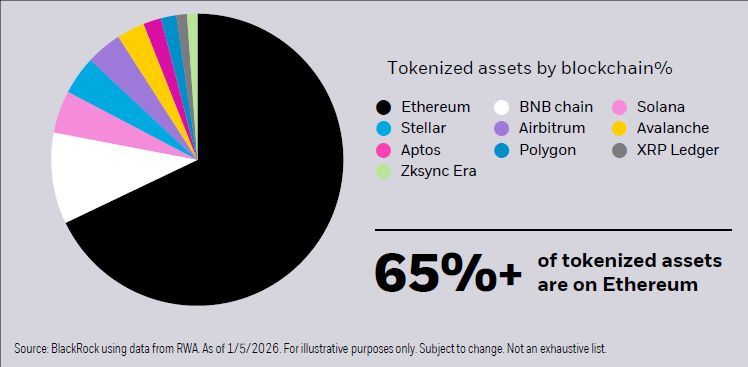

Ethereum’s role as the backbone of onchain finance is becoming harder to ignore. A newly released chart from BlackRock shows that more than 65% of all tokenized assets currently reside on the Ethereum mainnet, underlining the network’s dominance just as ETH prices attempt to stabilize after a volatile correction.

According to the data, Ethereum holds a commanding lead over all competing blockchains in the tokenization race, with alternatives such as Stellar, Solana, Polygon, Avalanche, and the XRP Ledger sharing a much smaller portion of the market. The chart, based on real-world asset (RWA) data as of early January 2026, highlights where institutions are actually choosing to settle tokenized value – and the answer remains overwhelmingly Ethereum.

Key Takeaways

- Ethereum now secures over 65% of all tokenized assets onchain, far ahead of competing networks

- Institutional tokenization activity continues to favor Ethereum despite recent market volatility

- ETH price is consolidating near $2,900, with momentum stabilizing but not yet bullish

This matters because tokenized assets are no longer a niche experiment. They include tokenized funds, bonds, treasuries, and other financial instruments increasingly used by large asset managers and financial institutions. The concentration of these assets on Ethereum suggests that, despite higher fees and ongoing scaling debates, trust, liquidity, and infrastructure depth continue to outweigh cost considerations for serious capital.

Ethereum price action reflects consolidation, not collapse

While Ethereum’s onchain fundamentals strengthen, price action tells a more cautious short-term story. On the 4-hour chart, ETH is trading around the $2,900 level after failing to hold above the $3,300–$3,400 zone earlier this month. The pullback erased a significant portion of January’s gains, but selling pressure has started to slow.

Momentum indicators paint a mixed picture. The RSI remains below the neutral 50 level, suggesting buyers are still tentative, while the MACD shows early signs of flattening after a deep negative phase. Volume has picked up during recent rebounds, hinting that dip buyers are active, though conviction remains limited.

Importantly, Ethereum has so far defended the psychological $2,800–$2,900 region, an area that previously acted as support during earlier consolidation phases. A sustained hold above this zone could open the door for a renewed attempt toward $3,100, while a clean breakdown would shift focus toward the mid-$2,600s.

Why tokenization leadership matters for ETH’s long-term outlook

The contrast between Ethereum’s short-term price weakness and its growing dominance in tokenized assets is striking. While speculative flows across crypto markets have cooled, institutional infrastructure continues to build quietly in the background. Tokenization is not driven by hype cycles but by settlement reliability, security, compliance tooling, and deep liquidity – areas where Ethereum has a multi-year head start.

For long-term investors, this creates a divergence worth watching. Price may remain range-bound in the near term, especially if broader crypto sentiment stays cautious. However, the steady migration of real-world value onto Ethereum strengthens the argument that ETH’s role in global finance is expanding, not shrinking.

If risk appetite returns to digital assets, Ethereum’s position at the center of tokenized finance could become a powerful narrative driver once again.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.