The Q3 2023 Crypto Analysis Report

Undoubtedly, the crypto market is behaving in surprising ways, and the Fear and Greed market sentiment is currently acting like a metronome.

In this article, we are discussing the state of the Q3 crypto market so that you can make informed decisions. We will analyze some of the most influential factors that led to this situation, what significant events happened during the past quarter, and how you can prepare for Q4.

Moreover, we’ve concluded the most vital information from CoinGecko’s report so that you gain additional market insights to help you with your trading strategy.

Top Q3 Crypto Highlights to Set You on the Right Track

- The total crypto market cap dropped 10% in 2023;

- Spot trading volume on DEXs decreased by 31.2% and on CEXs by 20.1%;

- NFT trading volume dropped 55.6%;

- Stablecoins volume also fell by 3.8%;

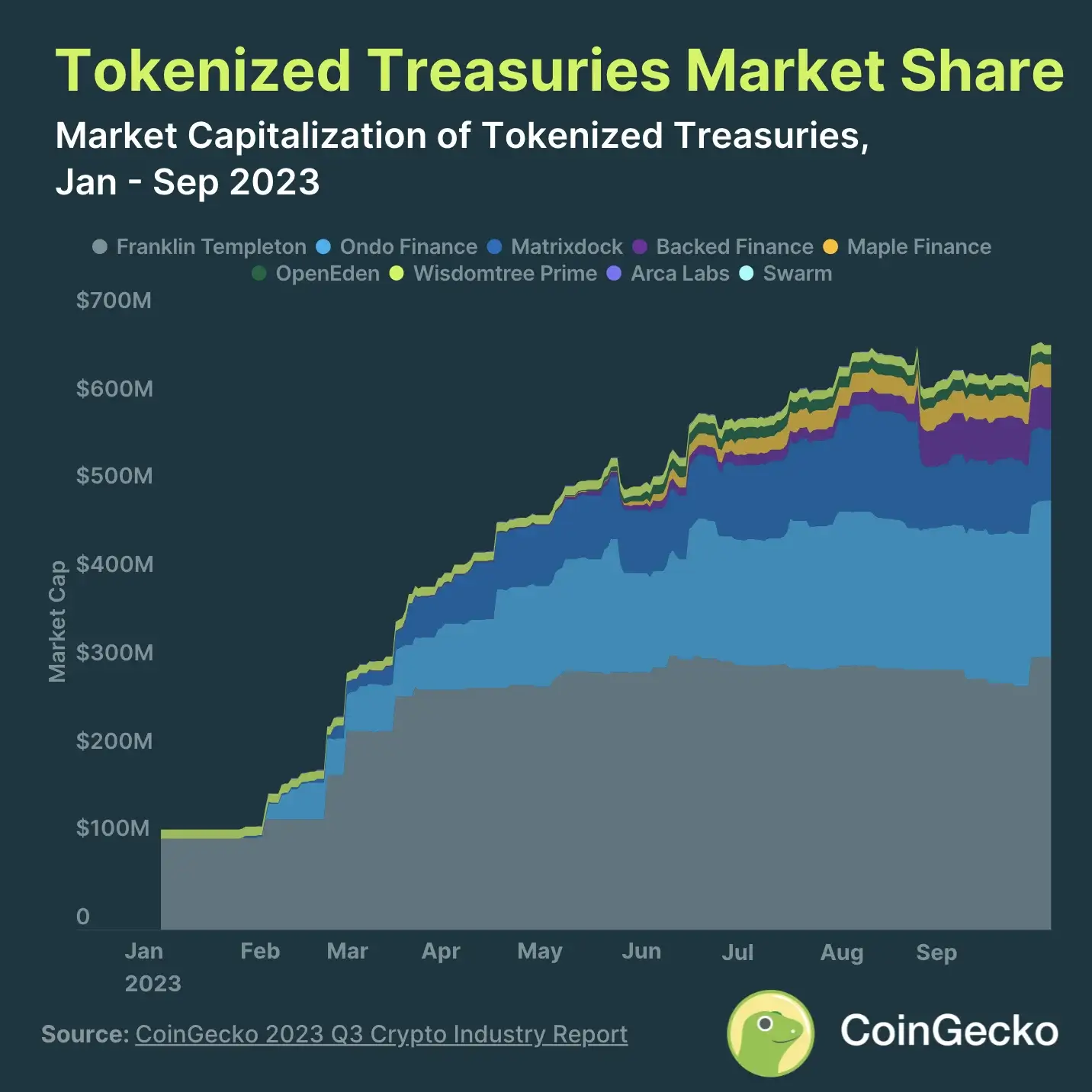

- Tokenized T-bills accounted for $665 million;

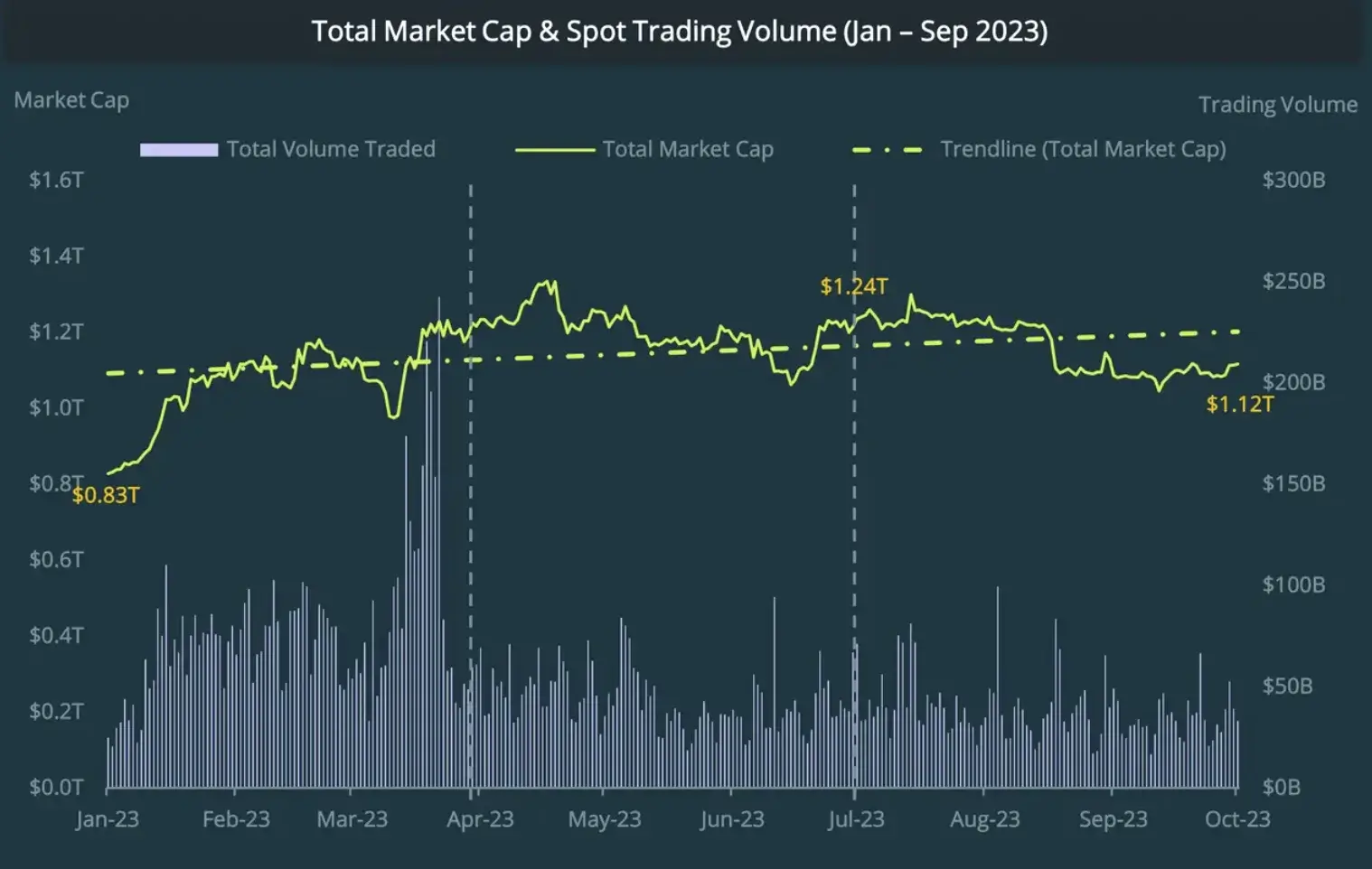

1. The total crypto market cap dropped 10% in 2023

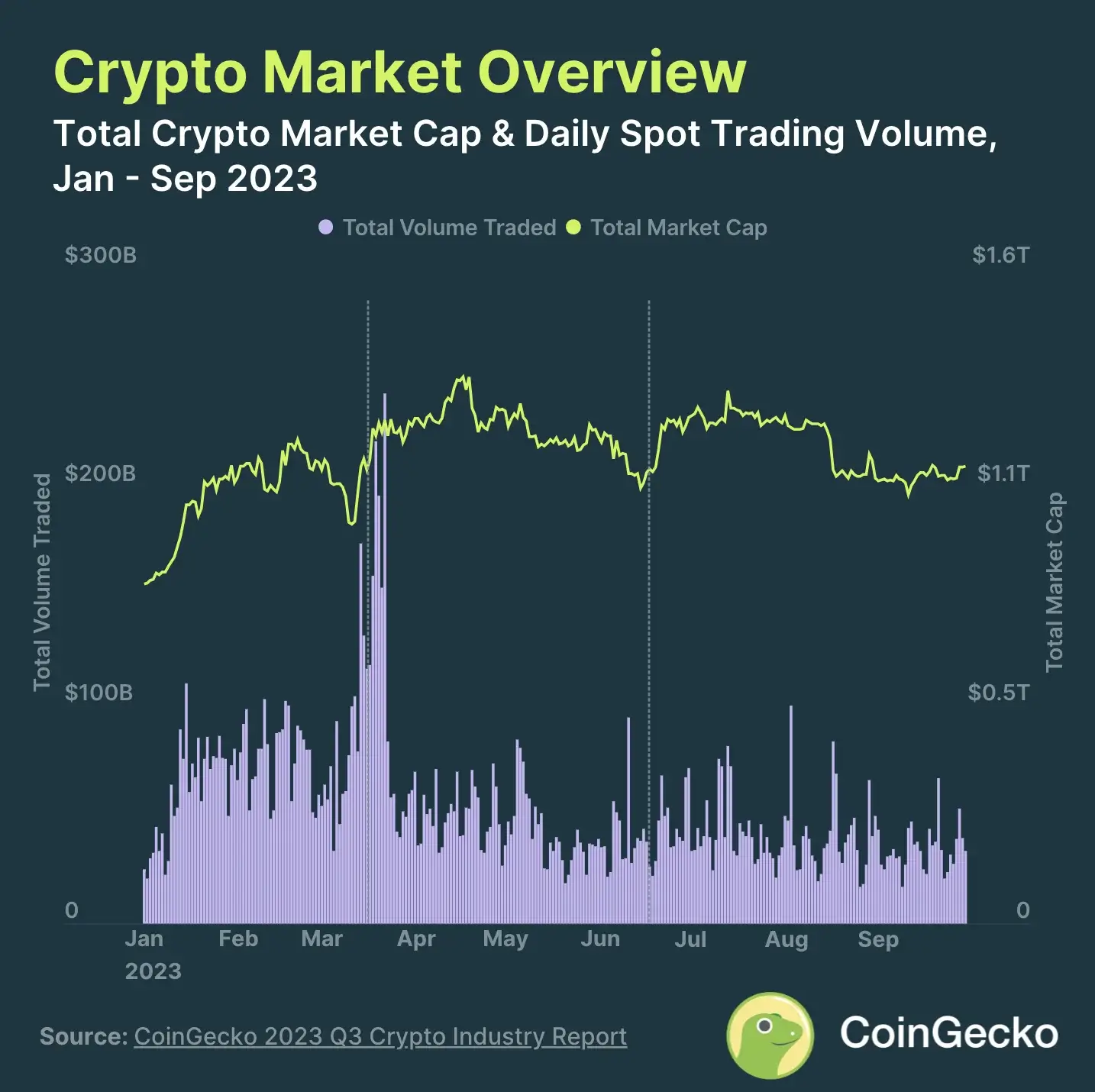

As the total market cap dropped by almost 10% or $119.1 billion, we are now left to wonder whether the market will return and witness another turnaround.

Yet, the trading volume fell behind, whereby the average daily trading volume in Q3 sat at $39.1 billion, presenting a decline of 11.5% compared to Q2.

2. Spot trading volume decreased on DEXs and CEXs

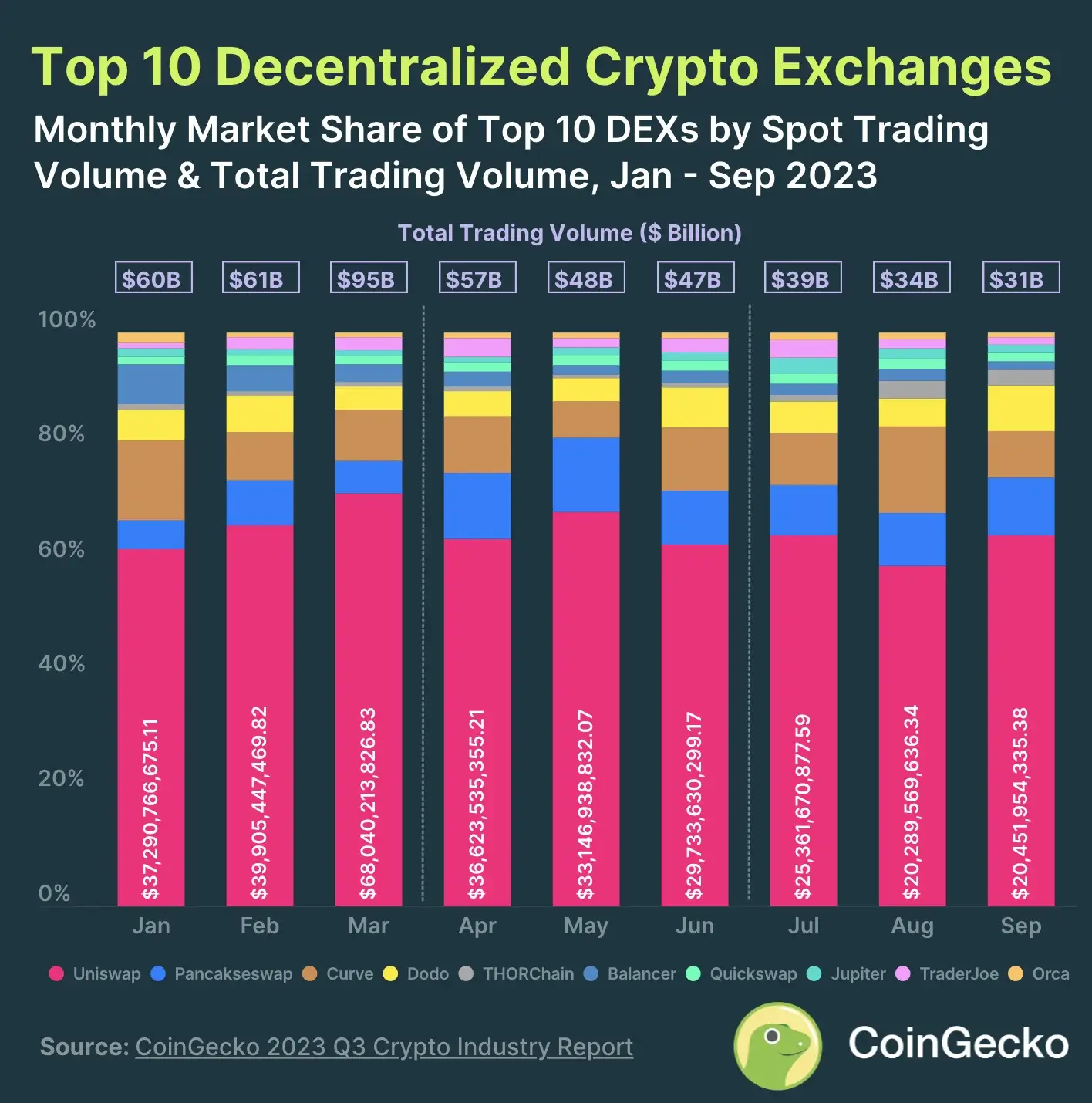

After an extensive review, the overall spot trading volume across DEXs fell by -31,2% since Q2, totaling $105 billion.

However, THORWallet DEX had some of the most significant gains, reaching 113% or $1.27 billion, yet we could not conclude if this is on point or due to illicit activities on the network.

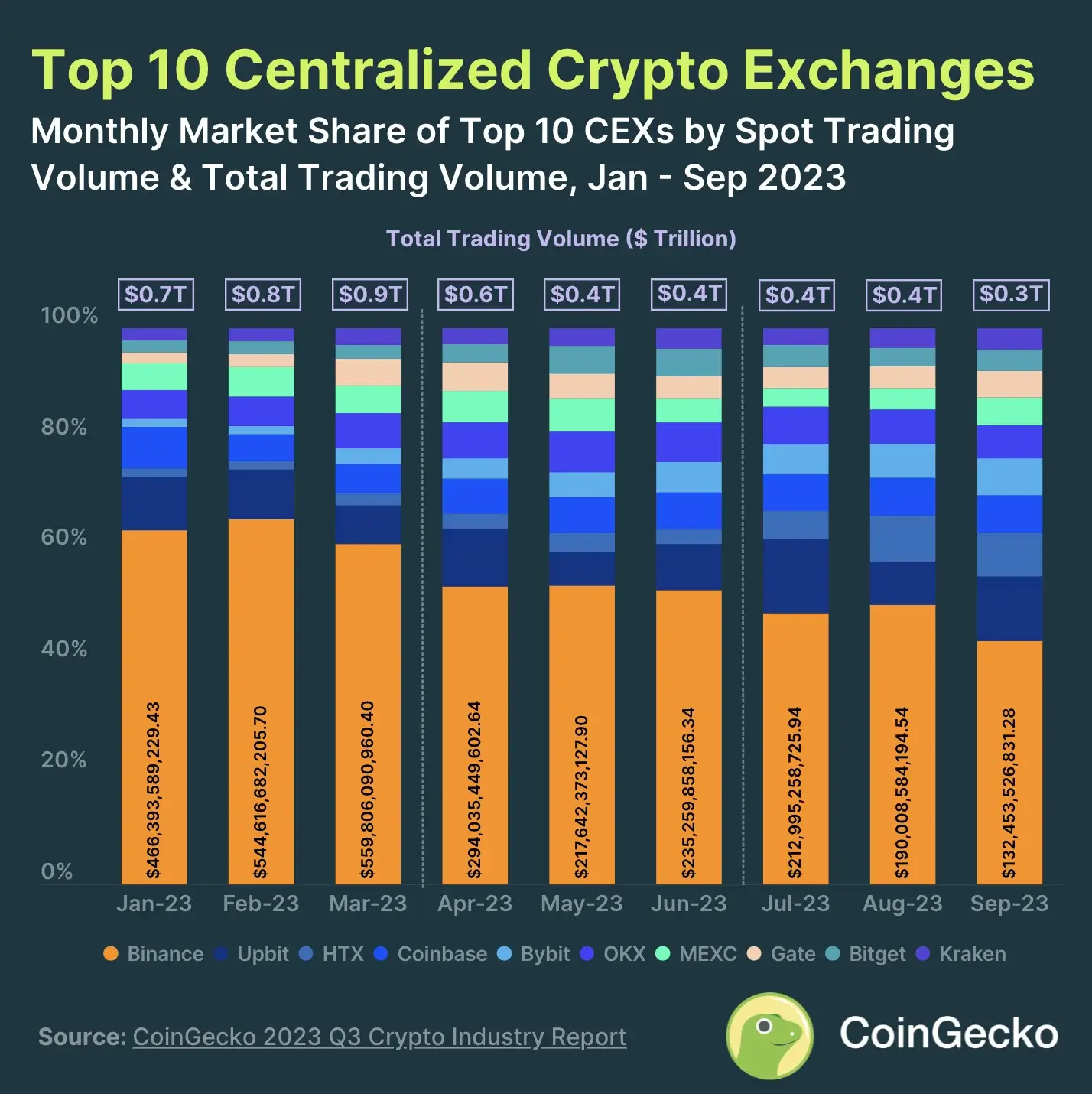

Moreover, this past quarter was turbulent for CEXs, as Binance was pressured by crypto regulators, exiting multiple markets. As a result of such tumultuous progress, we can see a -20.1 % decrease, thus, CEX totaling $1.12 trillion in Q3.

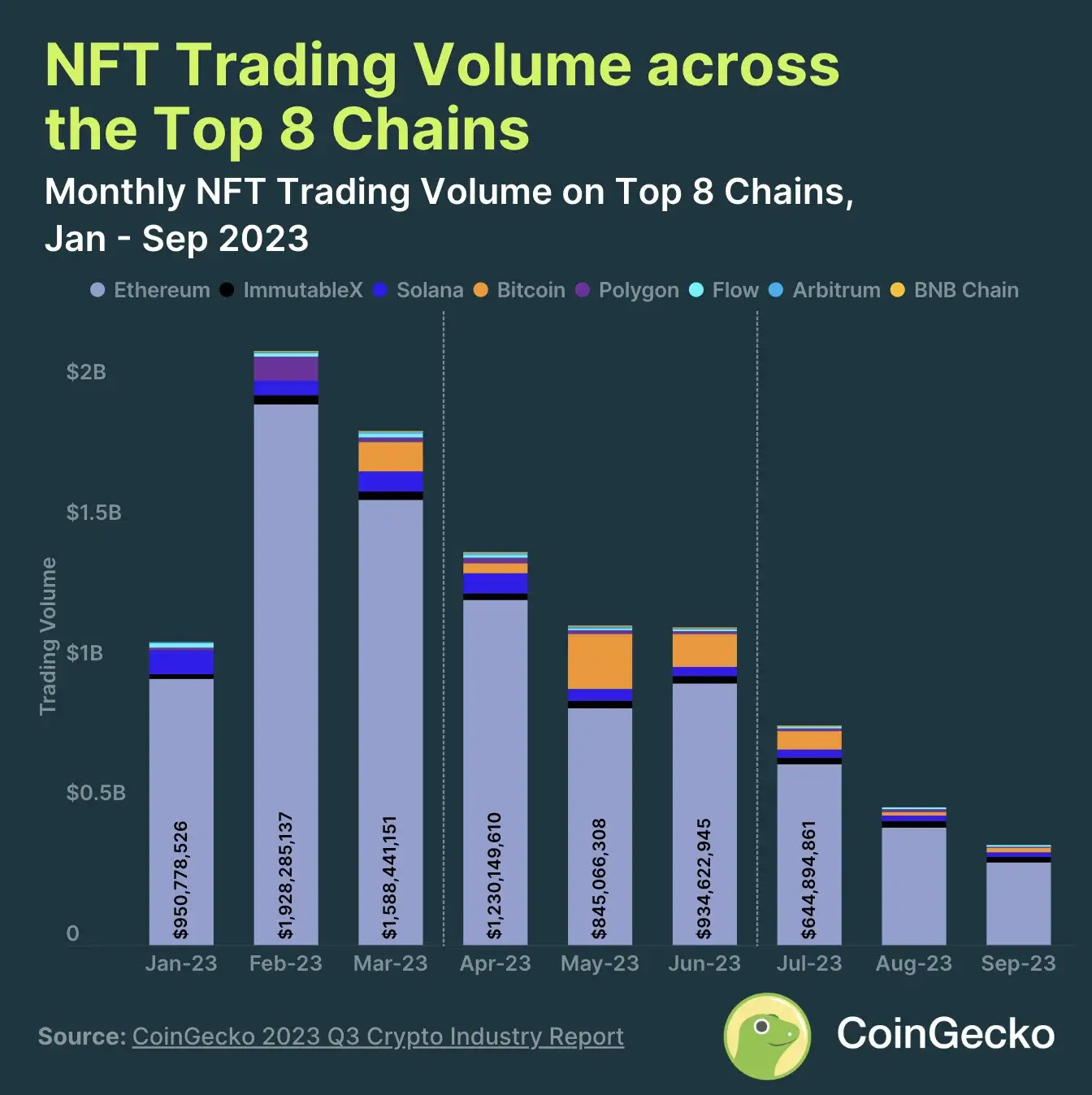

3. NFT trading volume dropped 55.6%

The current state of NFTs (Non-Fungible Tokens) in Q3 totaled $1.63 billion, a massive drop from $3.67 billion in Q2. Yet, Ethereum shows resilience, keeping its 83.2% market dominance, while Bitcoin managed to capture only 5.6% of the market share.

However, the Q3 NFT market was a good quarter for ImmutableX NFTs, which traded past $20 million and increased their market share to 3.9%.

4. Stablecoins volume fell by 3.8%

In the third quarter of 2023, the market capitalization of the top 15 stablecoins decreased by 3.8% or $4.8 billion, bringing the total down to $121.3 billion.

- USDT’s market cap remained stagnant, even though it saw a 2.6% gain in stablecoin market share;

- USDC (USD Coin) felt the most significant loss, with -$2.26 billion (-8.3%);

- Binance USD (BUSD) saw the most significant percentage decline of -45.3%, dropping to -$1.87 billion.

5. Tokenized T-bills accounted for $665 million

It is no wonder that the state of the Real-World Asset (RWA) sector continued to grow in 2023, and as a result, the number of US Treasury bills tripled. As such, the US T-Bills market cap reached a skyrocketing level of $665.0 million. This accounts for a 5.84x gain from a market cap of $114.0 million.

What is striking is the fact that most RWA protocols are Ethereum-based, accounting for 49% share of the market cap, followed by Stellar, with 48% market share.

Q3 2023 Crypto Market at a Glance

To better understand the Q3 crypto market state, it is best to look at it from a yearly point of view. This way, you cannot be drawn into too specific details, yet you’ll have a factual and rational presentation of what significant events influenced the market.

So, undoubtedly, 2023 has been a tumultuous year, filled with lawsuits, crypto regulations, and an overall volatile crypto market that left a significant impact.

In Q1, the cryptocurrency market had a powerful start, reaching new heights. As a result, the total crypto market cap was $1.238. Additionally, this growth accounted for 48.9% or $406 billion on a year-to-year comparison.

After the joyful start, Q2 was marked by the strategy of consolidating gains, even though we witnessed high volatility and other events like Binance’s zero fee removal in late March and Ethereum’s Shapella. As a result, Q2 gains only accounted for 0.14%, ending at $1.240 trillion on June 30, 2023.

Now that we’ve ended Q3, things don’t seem to be going toward an ascending trend, and on top of this, add the current market sentiment, 72 Greed points; this appears to be the market correction we were all scared about.

Moreover, the past quarter also witnessed a significant drop in trading volumes, to be more explicit, 20.2% compared to the second quarter.

Another event that changed the crypto market’s state was the mid-August crash. As a result, Bitcoin’s value dropped from $ 2,000 in a single day. It doesn’t seem to have a substantial weight, yet it caused the total cryptocurrency market cap to drop to $1.1 trillion from $1.2 trillion.

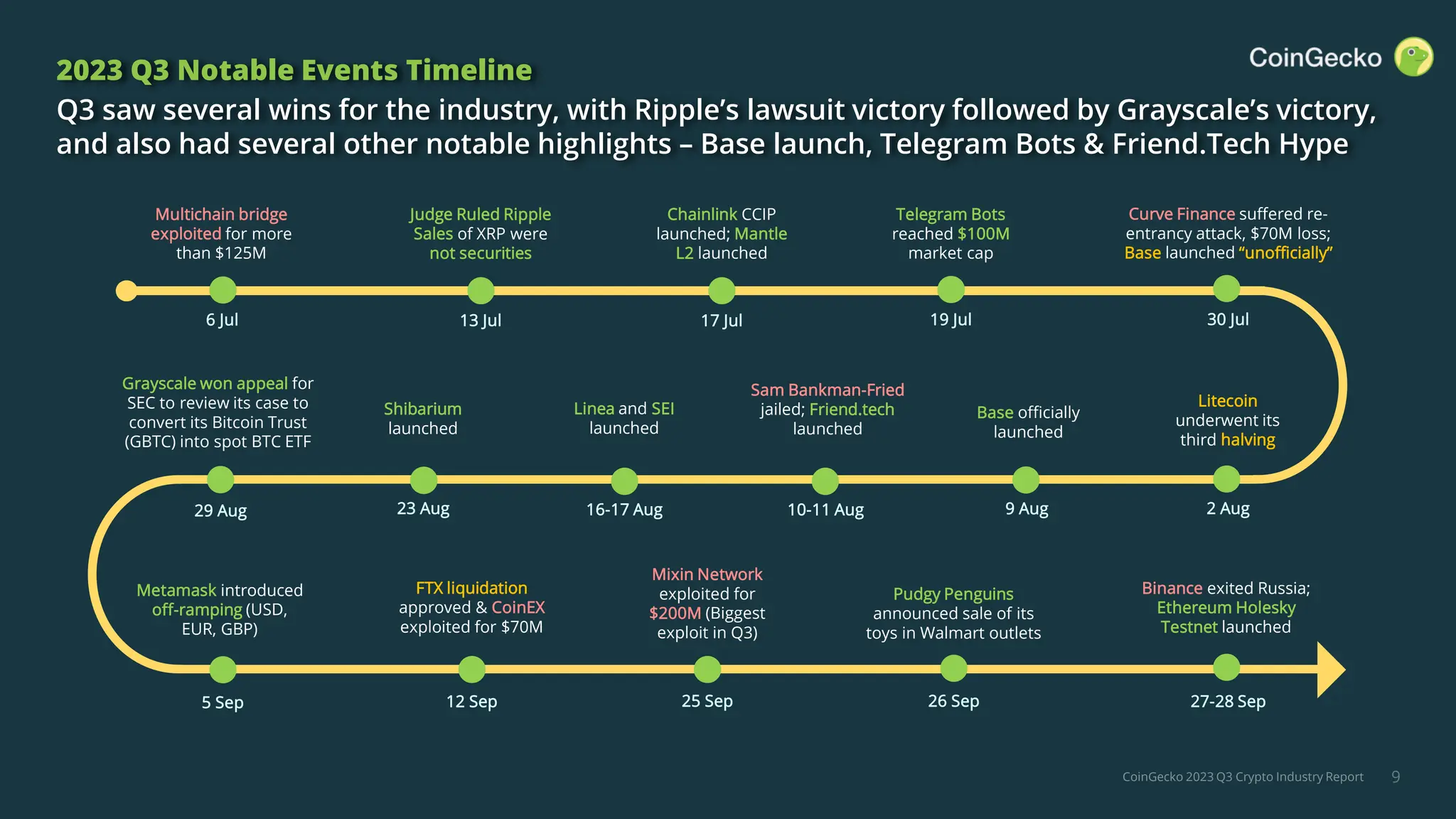

Significant Crypto Events of Q3 2023

There is no doubt that Q3 was marked by a series of impactful events that altered the state of crypto. As such, we invite you to read further and discover some of the most notable events to better grasp the landscape without being in the unknown.

1. The $125 Million Multichain Bridge

The multi-million bridge started with an official Multichain Twitter post announcing that the network experienced multiple unauthorized withdrawals of more than $125 million.

Moreover, the hacker drew $666,000 from the Dogecoin bridge,

leaving an 85% loss of total deposits and another $6.8 million from the Moon River bridge, which included funds in USDC and Tether.

2. Ripple’s XRP Token Skyrockets 96% Following Notable Win in SEC Lawsuit

3. ChainLink launched the Cross-Chain Interoperability Protocol (CCIP), and Mantle Network became the first modular Ethereum L2 solution

4. The Rise of Telegram Bot Tokens – $100M Market Cap

5. Curve Finance Suffers a Massive Financial Setback: $70 Million Loss Recorded

An unfortunate event culminated at the end of July, as more than $70 million in digital assets were retrieved from Curve Finance, a decentralized exchange.

It all started with an exploit of JPEG’d’s pETH-ETH liquidity pool for over $11 million. Experts say that the other four attacks drained Alchemix’s alETH-ETH pool, the CRV/ETH pool twice, Pendle’s pETH-ETH pool, and Metronome’s msETH-ETH pool, for a total of over $70 million.

On the bright side, $52M of stolen assets were recovered by Curve Finance.

6. Litecoin Undergoes Third Halving: Block Rewards Decreased to 6.25

7. Coinbase’s Base network officially launched

8. FTX Founder Sent to Jail

9. Binance Lists Sei (SEI) and Linea ERC20 Token Launch

10. Shibarium Network Launched | SHIB Plunges 9% due to Bridge Issues

11. Grayscale’s Triumphant Outcome in the Spot Bitcoin ETF Case

12. MetaMask Launched Fiat-off-Ramp Feature

13. FTX Liquidate its Crypto Holdings & CoinEx $70M Theft

14. Mixin Network Suffered a $200 Million Loss

15. NFT Pudgy Penguins Toys Entered Walmart Chain

16. Binance’s Exit Strategy from the Russian Market

Now that we have concluded with the most important events of the Q3 crypto market, it’s time to move further and dive deeper into some of the most well-known currencies and the DeFi (Decentralized Finance) market’s state to grasp better what lies ahead.

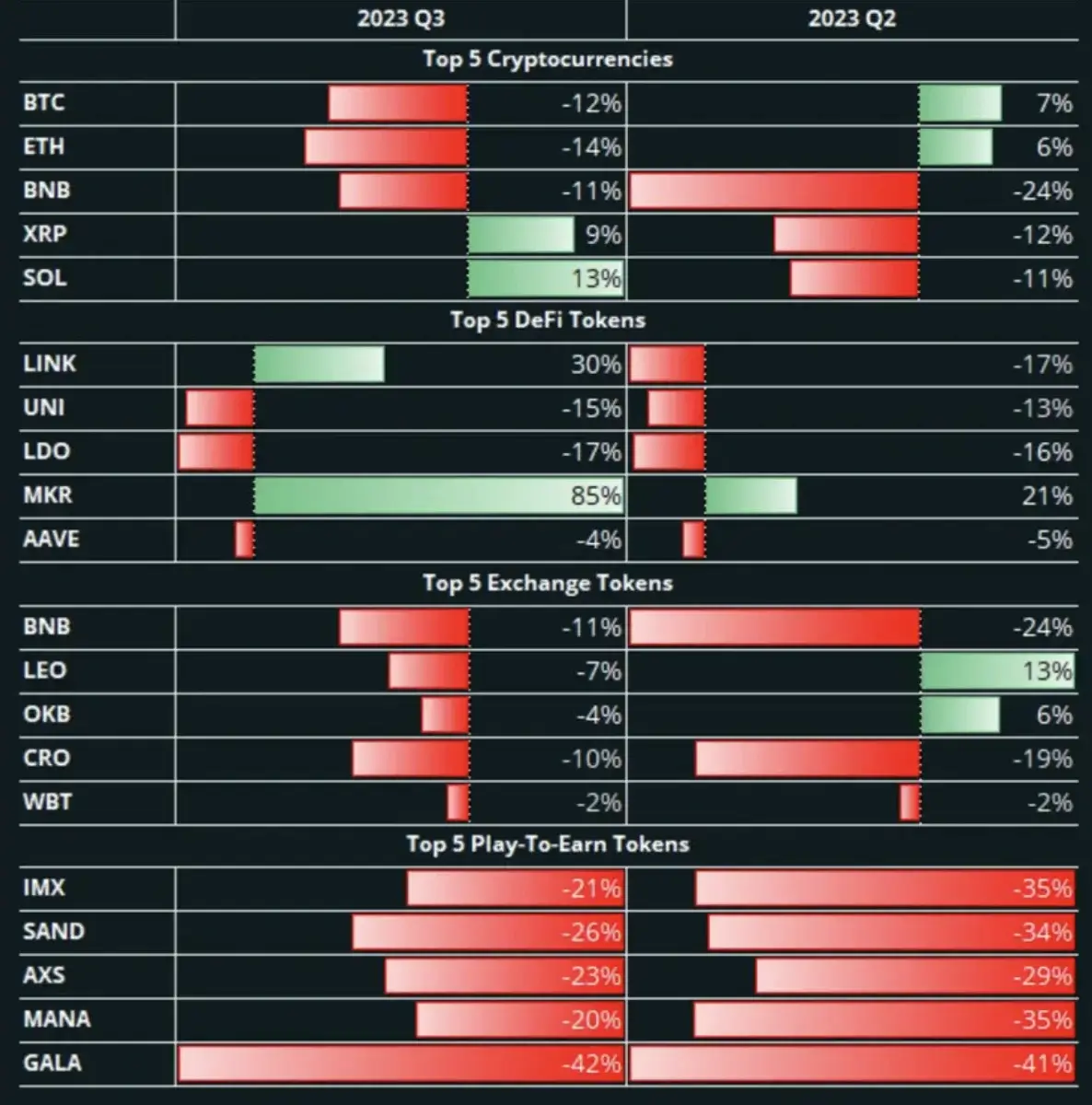

Q3 Crypto Price Performance Insights

As stated, Q3 has been a challenging quarter, and some significant events impacted crypto prices. As such, only a handful of cryptos, such as XRP, SOL, LINK, and MRK, reached the finish line on a positive note. On the other hand, the most well-known cryptocurrencies, BTC, ETH, and BNB declined as shown in the graph below.

Moreover, MRK entered the Top 5 DeFI Tokens, marking a +85% gain, whereas LINK had a +30% increase. The rest of the top 5 tokens had lost ground.

As for the exchange tokens that fell behind alongside the market decline, we have:

- BNB: -11%;

- CRO: -10%;

- LEO: -7%;

- OKB: -4%;

- WTB: -2%;

On the Play-to-Earn side of the fence, the token prices kept dropping, GALA having the biggest downfall, with -44%, despite other tokens revolving around -20%.

Bitcoin Analysis in the Q3 2023

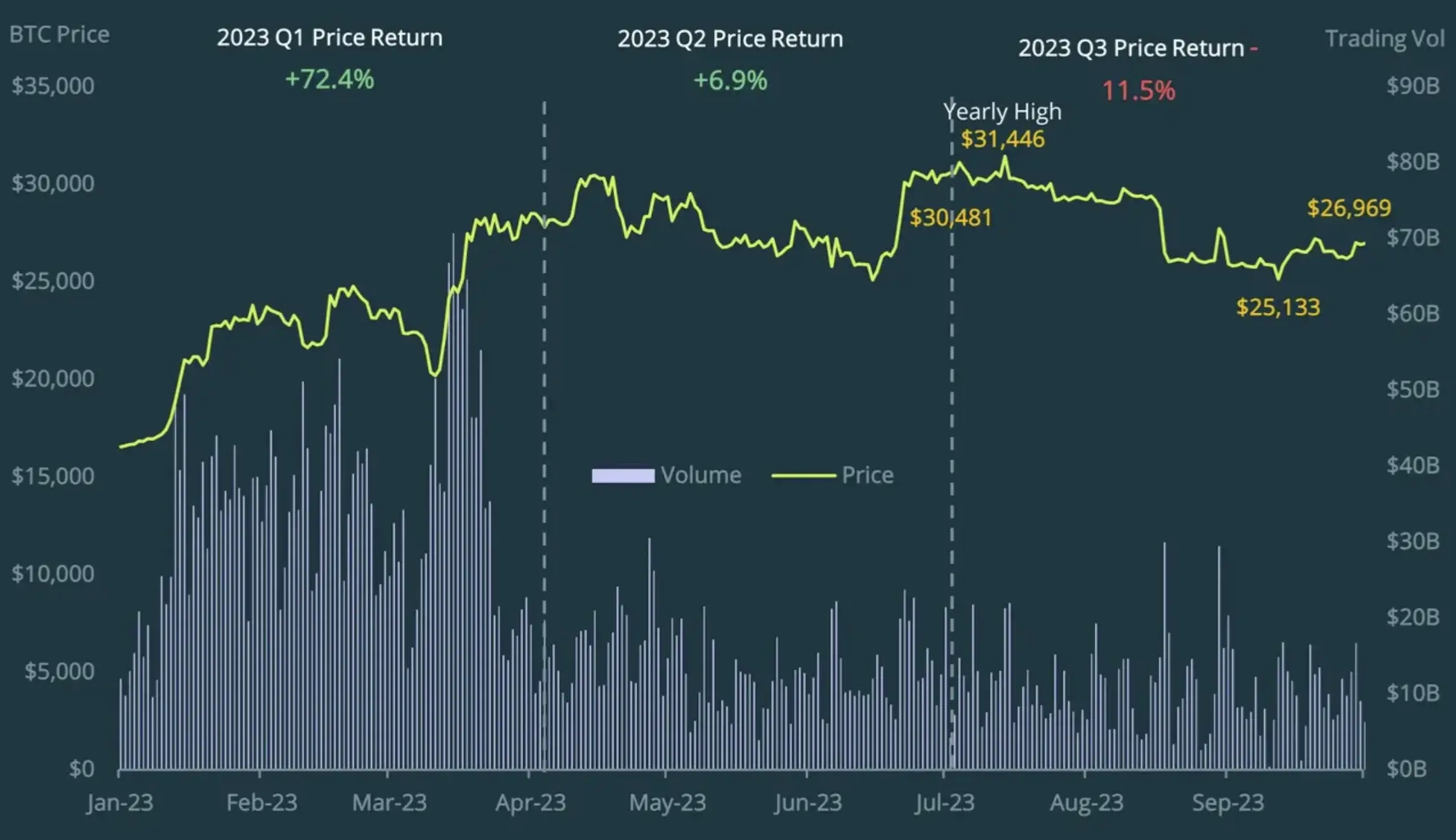

Bitcoin witnessed a rocky road in Q3, 2023, as it enjoyed the growth marked by the Blackrock spot ETF filling. As a result, on July 14, BTC reached an all-time high of $31,446, celebrating an 89.3% year-to-date gain.

However, the euphoric state didn’t last long, as Bitcoin ended Q3 with an -11% decrease, dropping to $26,969. Also, the average trading volume is down by 20.6% compared to Q2 2023, only gaining $11 billion.

Bitcoin Hash Rate in Q3 2023

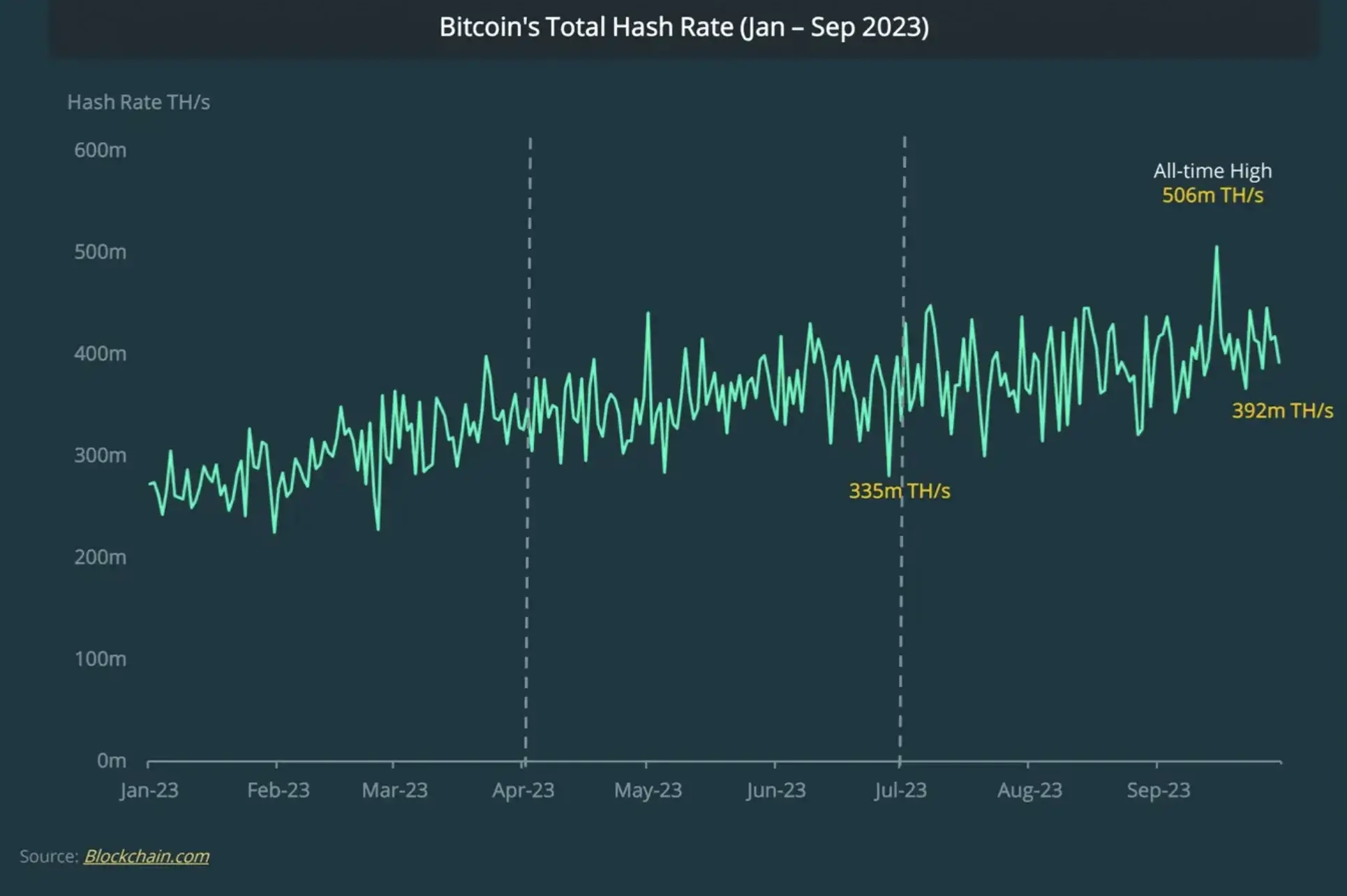

It’s no wonder the Bitcoin hash rate continues to grow, reaching an all-time high of 506m TH/s. This achievement represents a 17% QoQ increase, marking a milestone since Q2 was bumpy.

The State of Ethereum in Q3 2023

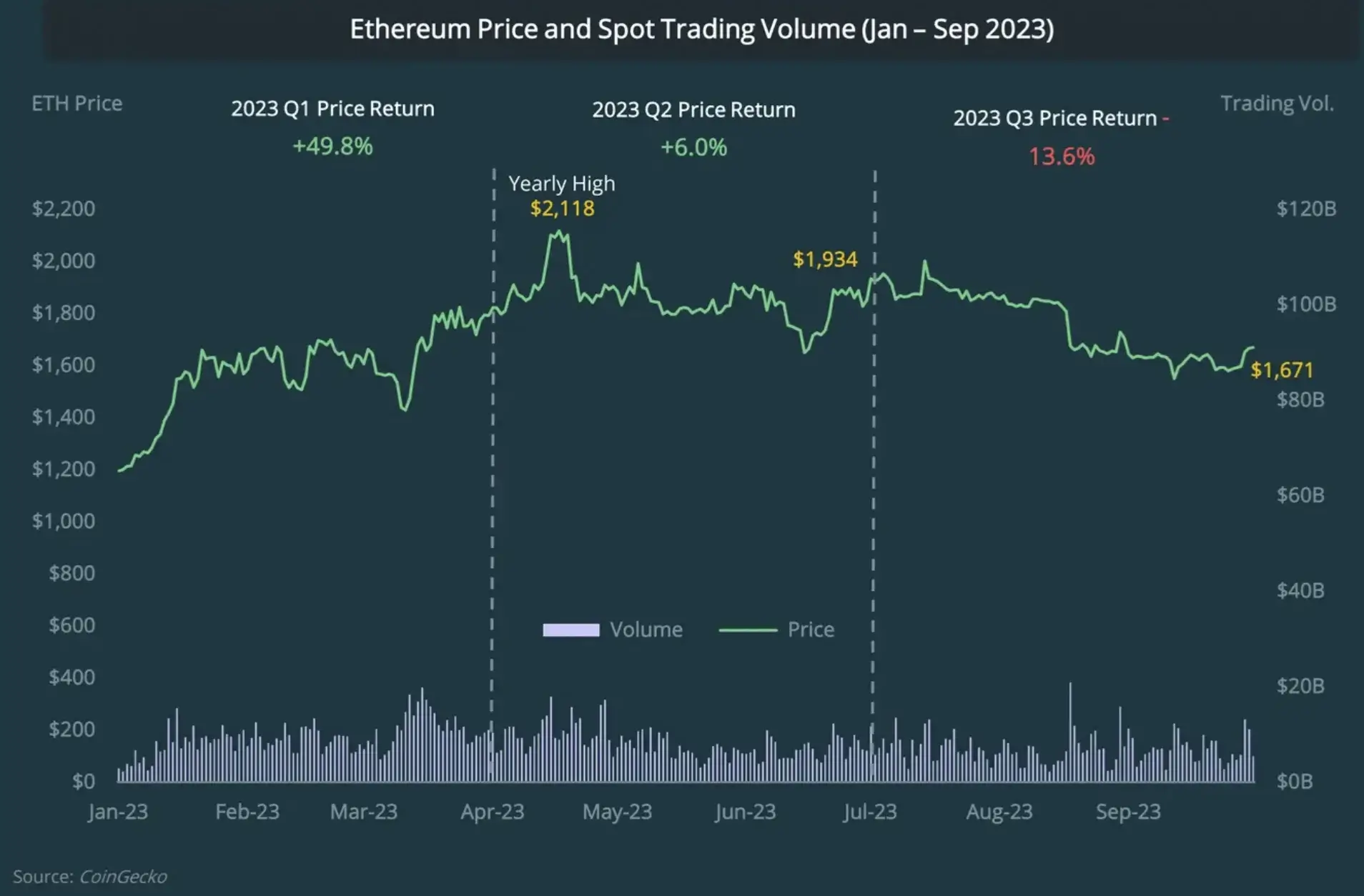

Things are not going too well with Ethereum, as it ended this quarter with a staggering drop of -13.6%. As a result, it’s possible to even close the year in the red. Moreover, the daily trading volume also decreased by -5.4%, reaching an average of $211 billion at the end of Q3.

Ethereum Consensus Layer Staking in Q3 2023

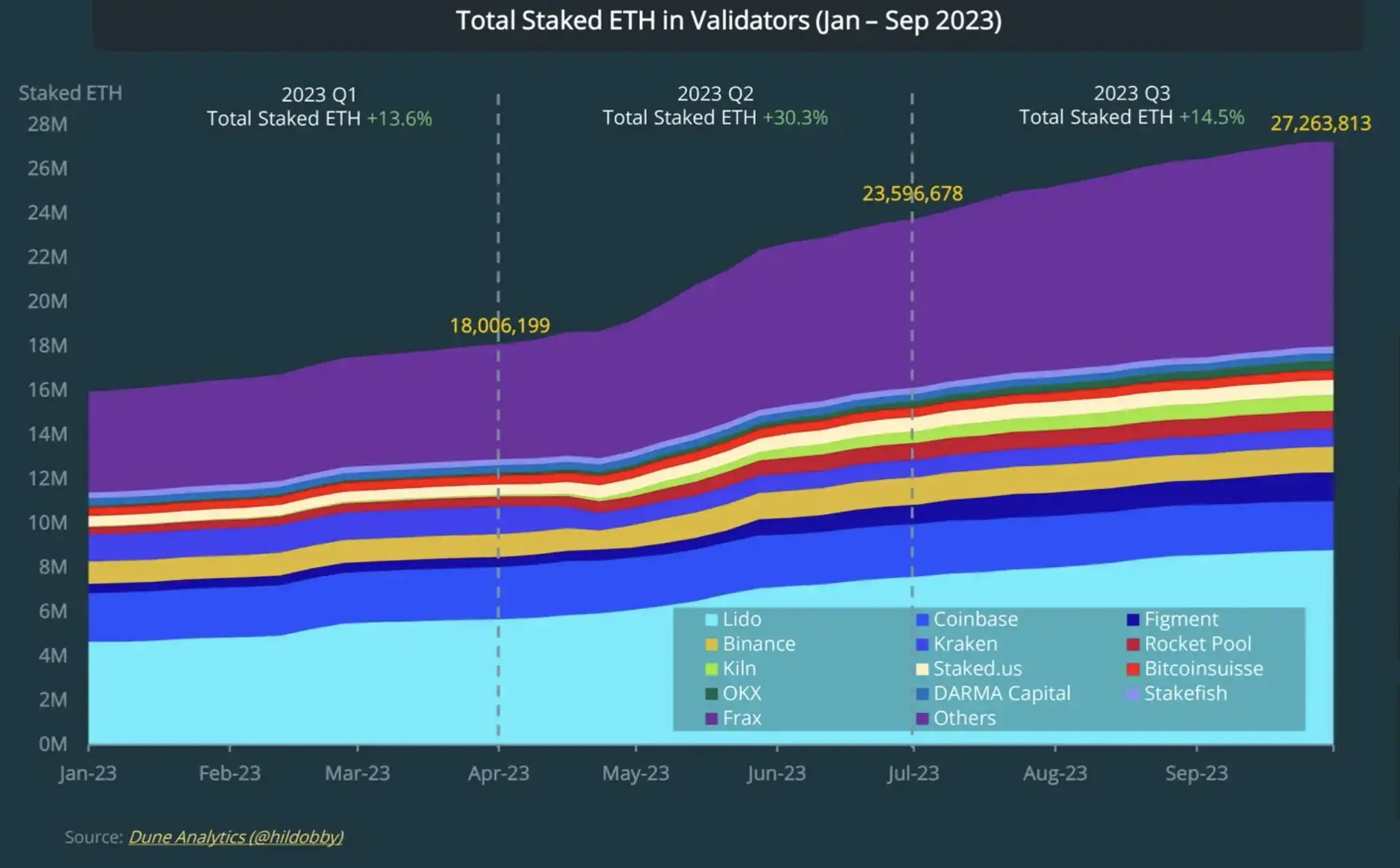

Ethereum ended Q3 with a gain of 3.5 million QoQ, marking a slow but positive growth of +14.5%.

However, Lido is taking the lead as being the dominant provider, with 32.2% of all staked Ethereum. As such, it represents a 31.9% increase compared to Q2 2023. Yet, while Lido is leading the way, Binance and Coinbase are losing market share in front of competitors.

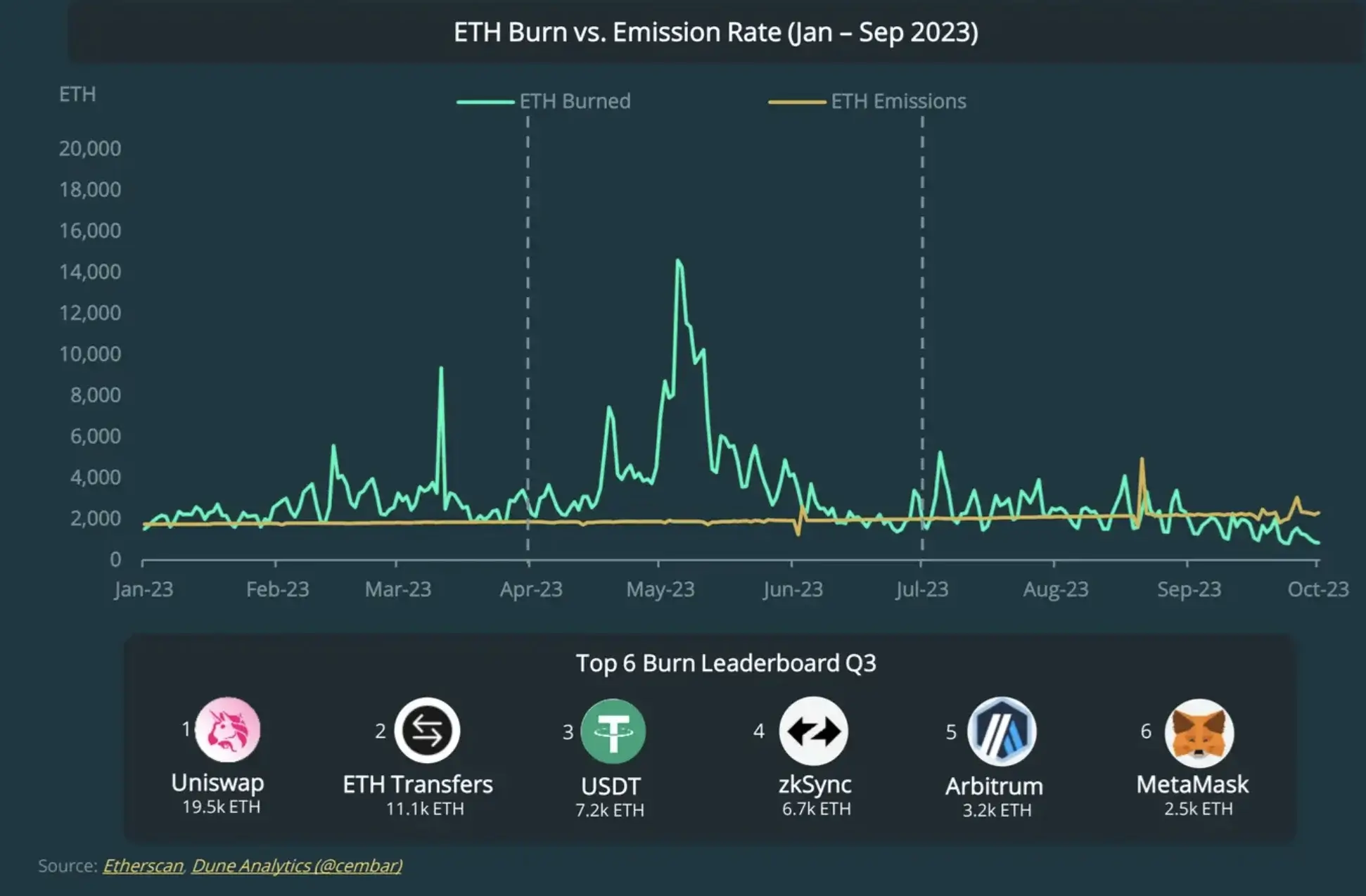

Ethereum Burn Rate in Q3

This year has been a bumpy ride for Ethereum, as it reached its first inflationary quarter of 2023, whereby the network got supplemented with another 850 ETH. As a result, in Q3 2023, 199K ETH burned.

As you can see in the above graph, the most burned ETH was in July, especially on July 5, marking the most significant, 5.2K, one-day burn’ Yet it could not overturn May 5 when 14.6K were burnt in a single day.

Furthermore, Uniswap remained the largest burner, with 19.5K ETH, yet this is a massive drop from Q2, -88.4%, whereas it burned 97.5K ETH.

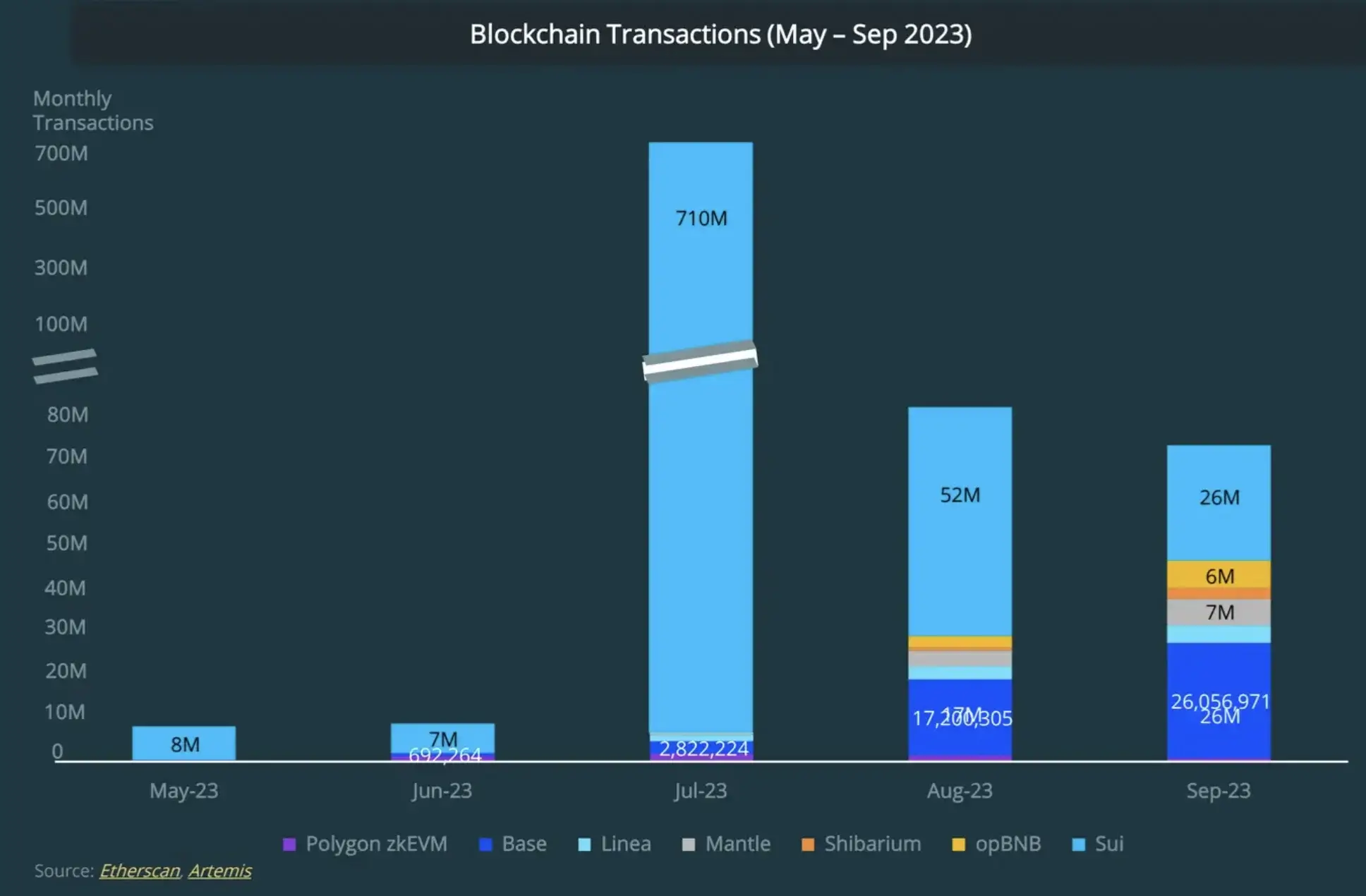

2023 New Blockchains

Sui, the decentralized blockchain, dominated, accounting for 91% of all transactions from May to September 2023, with 802 million transactions.

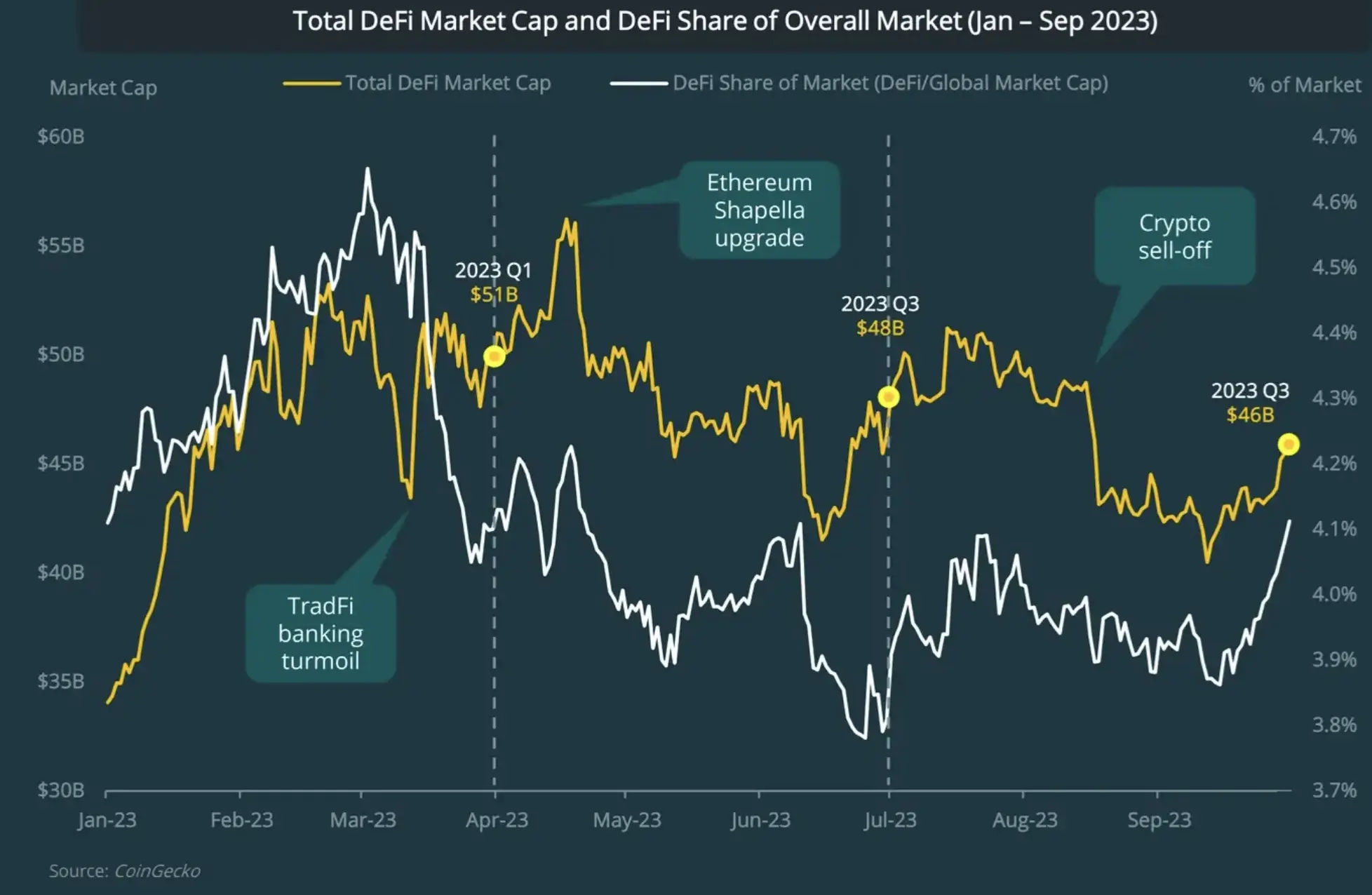

DeFi Analysis in Q3 2023

As already seen with other cryptos, the market cap of DeFi saw a little progress in July, showcasing a great deal of resilience after the August plunge. Yet, it returned to its feet towards the end of September, but still, it wasn’t enough to cover the -4.9 decrease of the quarter.

What is striking is the fact that the DeFi market outperformed the overall crypto market in Q3 by 9.6%. Yet, the August sell-off resulted in a 6.3% market cap decrease, reaching $43 billion.

Afterward, the market cap of DeFi dropped to $41 B and recovered towards the end of September to $46 billion.

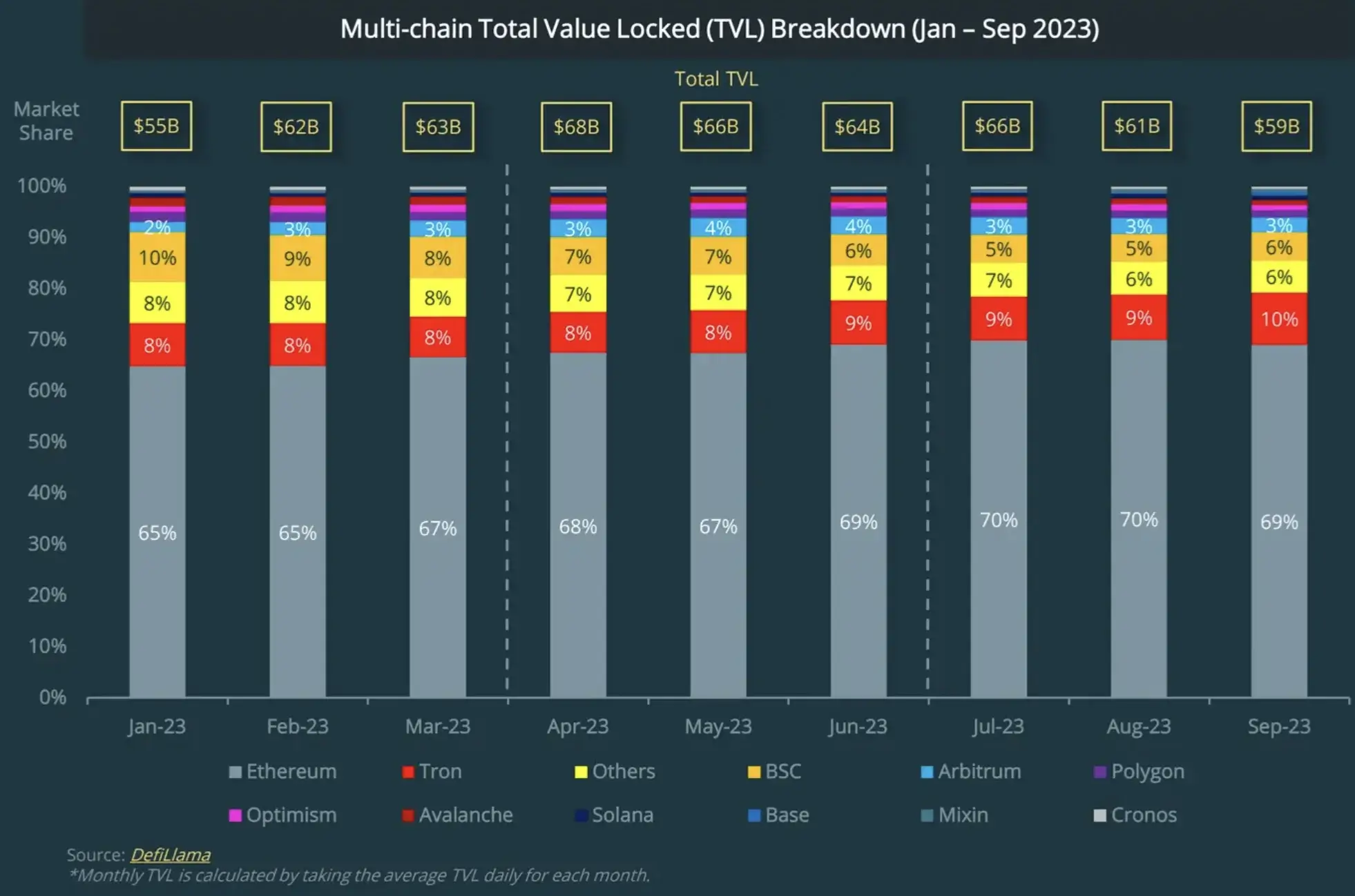

DeFi Multichain Market Share in Q3 2023

The overall TVL of the multichain market share dropped from $64 billion to $59 billion due to weak markets and stablecoins leaving the ecosystem. Moreover, Ethereum retained a 70% share of TVL in Q3 2023.

BNB Smart Chain, Polygon, and Avalanche collectively lost $984 billion. On the bright side, Solana and Tron saw positive outcomes, whereas Tron pushed its TVL by 18.7%, reaching $520 million.

The State of NFTs in Q3 2023

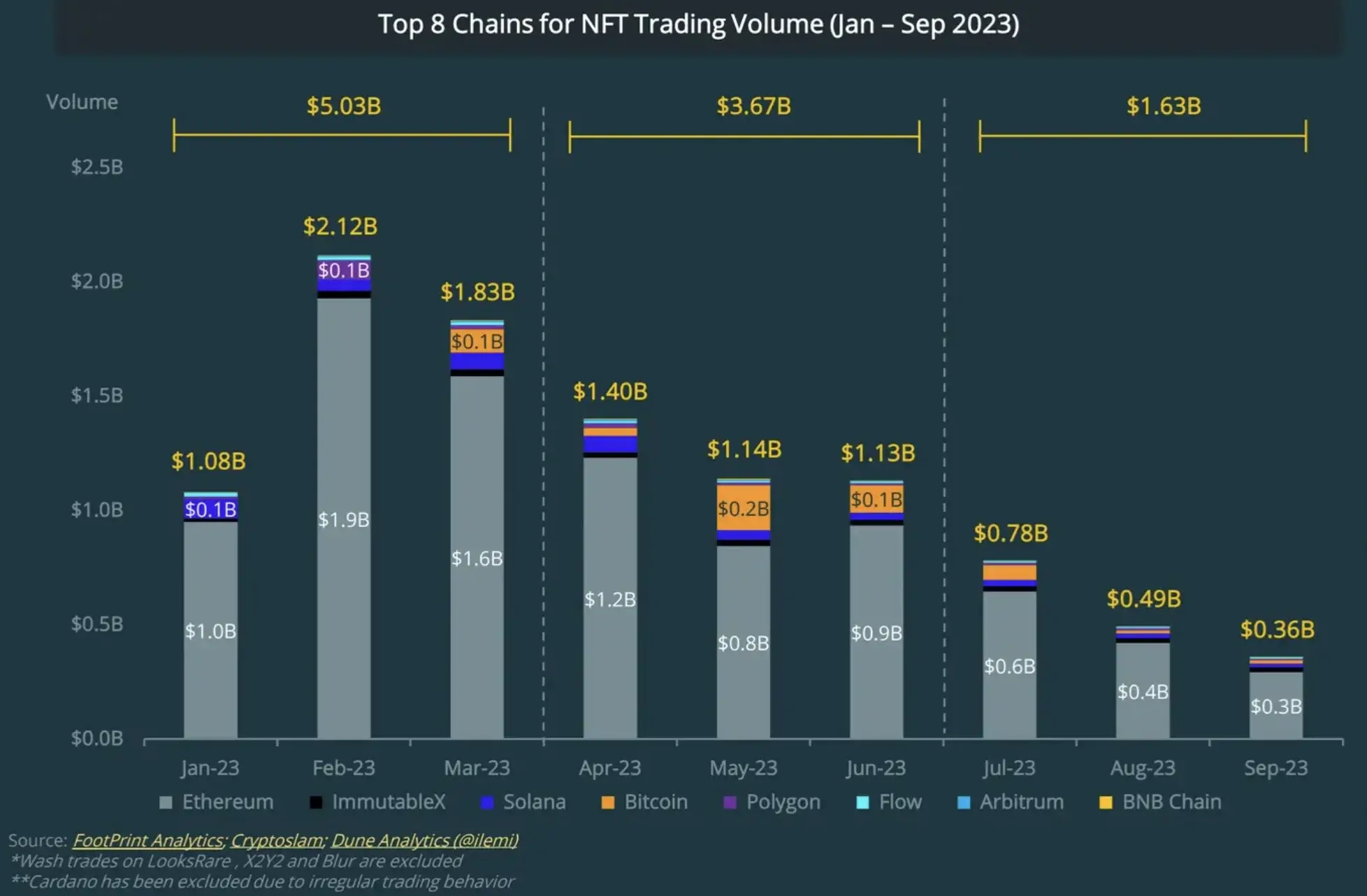

Non-Fungible Token Trading Volume Across 8 Chains in Q3 2023

The NFT trading volume diminished considerably, by 55.6% in Q3, compared to Q2. As a result, from $3.67 billion in Q2, it dropped substantially to $1.63 billion in Q3.

However, Ethereum maintained its dominance of 83.2% of the NFT market, and Bitcoin came in second place with a 5.6% market share.

Yet, ImmutableX NFT kept its grounds with $20 million monthly, capturing 3.9% of the overall NFT market.

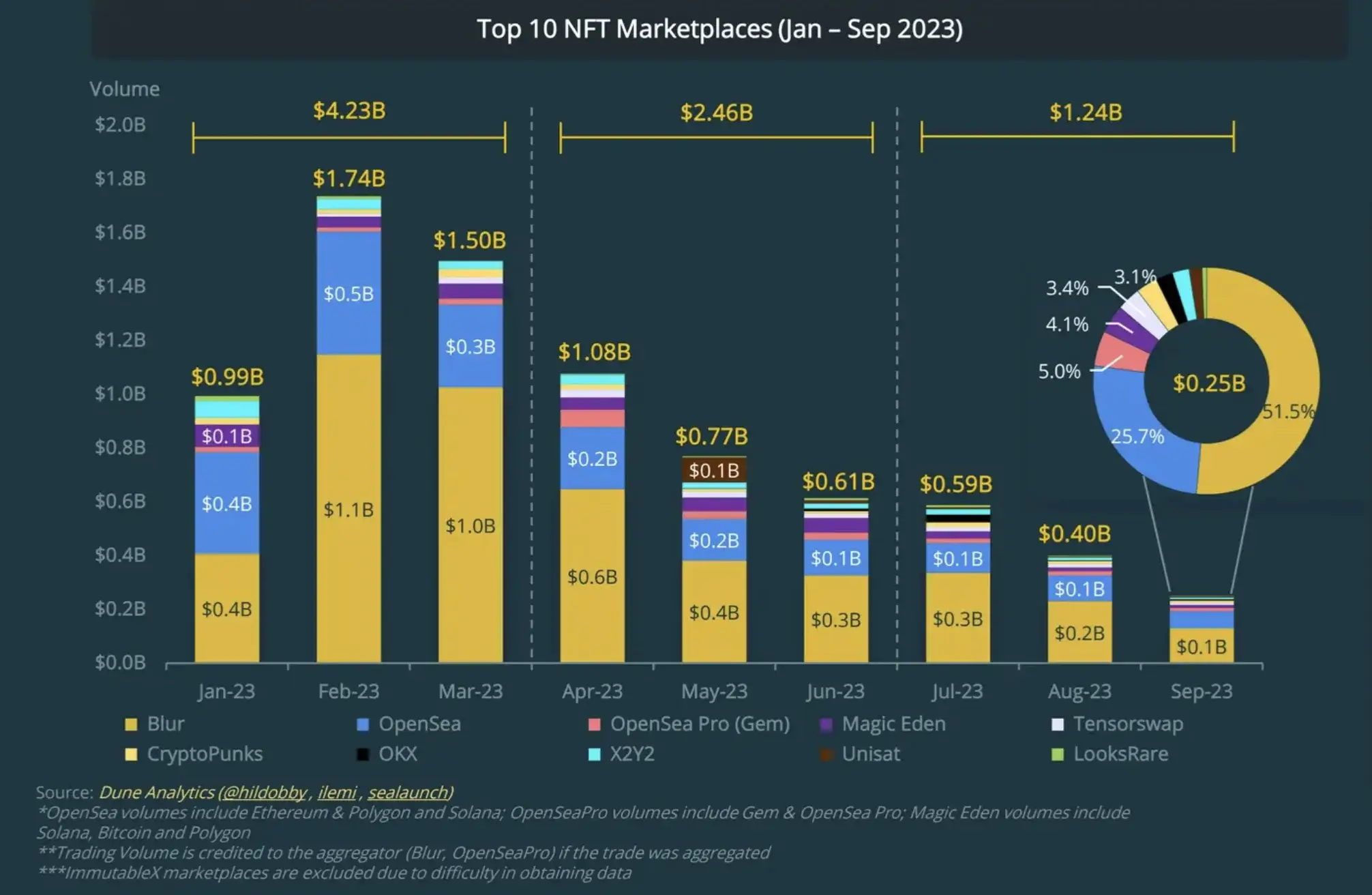

NFT Trading Volume by Platform in Q3

The truth is harsh, as the marketplace trading volume diminished by -49.7% in Q3. Besides this, a couple of platforms showed a positive aspect whereby Blur managed to keep its position and increase its trading volume, acquiring 56.1%. Also, thinking of its users, Blur announced its season 2 airdrop campaign, scheduled for November 20, 2023.

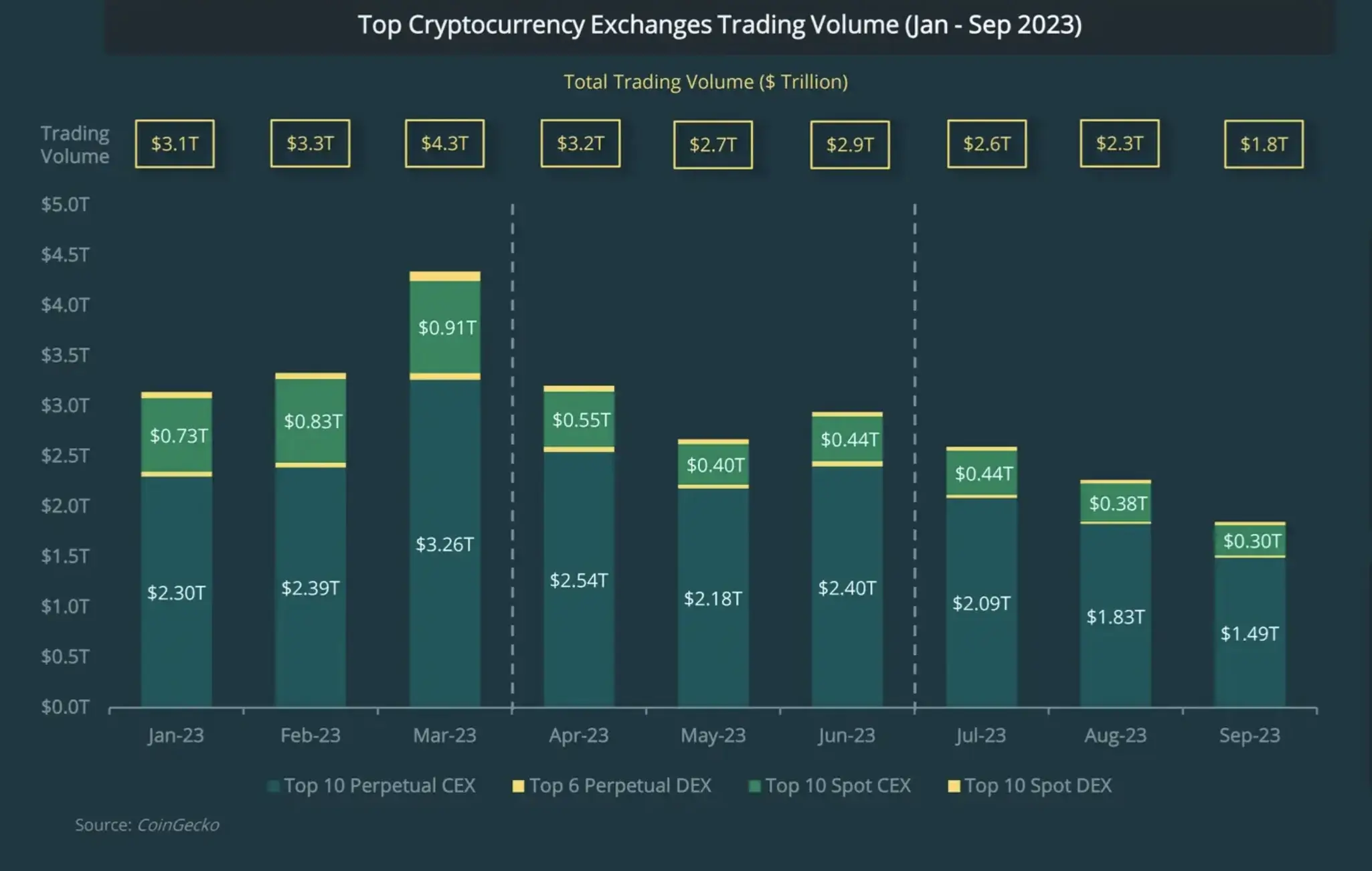

Q3 Top Crypto Exchanges Trading Volumes

The crypto market exchange trading volume showed a – 23.9% decrease compared to Q2 2023. As such, the total trading volume stands at $6.7 trillion.

As for platforms, the situation is as follows:

- CEXes: -20.1%;

- DEXes: -31.2%;

- Spot markets: -21.2%;

- Perpetual markets: -24.5;

Challenges of the Q3 2023 Crypto Market

There’s no doubt that the crypto market is broken and scarred after the collapse of the crypt exchange FTX. Moreover, as the trial of Sam Bankman-Fried, the former CEO of FTX, is charged with multiple fraud counts, he pleaded not guilty.

Moreover, the crypto market witnessed increased volatility, leading to price fluctuations across various currencies. Moreover, the resulting volatility makes it challenging for investors to make informed decisions and predict future movements.

On top of this, consistent regulatory pressure, as seen in the Binance scrutiny, creates further uncertainties. And as we all know, big investors don’t like uncertainties, especially within the crypto sector.

Also, security breaches played a significant role in developing the Q3 market states, and protecting digital assets takes more space, time, and effort than investing itself. Yet, we are left to wonder what could be done for the crypto market to get back on its feet and follow an ascending pathway.

How to Overcome These Challenges

A few aspects can be seamlessly improved, yet it requires education, collaboration, and enhanced security measures, thus encouraging stability and innovation.

But let’s break it down even further:

1. Educating Investors

Every rising crypto project should cover this aspect and offer its investors the opportunity to further enhance their knowledge within the crypto landscape.

2. Collaboration with Regulators

Even though it sounds too far-fetched, a collaboration between these two could create more precise, fair, and transparent regulations. As such, these efforts could pave the way for others in the crypto space, leading to a more balanced crypto economy.

3. Enhanced Security

If most crypto projects would spend more on implementing some of the best features, security measures, protocols, advanced encryptions, and regular security audits, the crypto landscape could thrive more. Even DEXs and CEXs could invest more in cutting-edge security to safeguard their users’ assets.

4. Innovation in NFT Space

Whether due to security reasons or the mainstream adoption of such technologies, the NFT sector needs more innovation. Whether through active collaborations with multiple artists from various domains or developing user-friendly platforms and exploring uncharted use cases to attract more participants and revive the NFT market.

By addressing these challenges collaboratively, the crypto industry can create a more stable, secure, and trustworthy environment for investors, fostering long-term sustainability and growth.

Final Thoughts

As we’ve concluded in this Q3 crypto report, stakeholders must work together to foster and develop an environment of trust, transparency, and innovation.

By addressing and solving such aspects, the crypto industry can reach a higher level of maturity, strengthening its foundation and ensuring a more robust and sustainable future.