BitMine Adds $103 Million in Ethereum to Its Corporate Treasury

While short sellers question its future, BitMine Immersion Technologies is quietly building one of the most powerful corporate Ethereum treasuries in history.

Blockchain data shows the company has been on a buying spree this month, adding more than $190 million worth of Ether in under a week – even as critics call its strategy outdated.

Betting on the Network

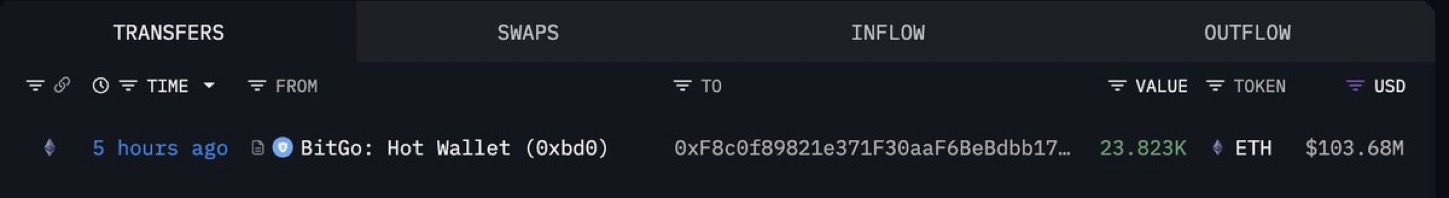

The latest transaction, identified by Lookonchain, revealed a transfer of 23,823 ETH from a BitGo wallet to BitMine’s treasury, worth about $103.7 million at current prices. It follows a similar $89.7 million purchase earlier in the month.

That makes BitMine the single largest public Ethereum holder, now controlling around 2.83 million ETH, valued at roughly $12.4 billion – second only to Michael Saylor’s Strategy in total crypto reserves.

For Tom Lee, BitMine’s founder and Fundstrat co-creator, this is part of a deliberate plan to capture 5% of Ethereum’s total supply and position the firm as a long-term institutional backbone for the network.

Confidence vs. Criticism

Not everyone is convinced. Earlier this week, short-seller Kerrisdale Capital announced a bearish position against BitMine, calling its business model “a relic.” Shares dropped 1.5% on the day, though Ether only slipped 1%, trading around $4,330.

But market sentiment is shifting. Fundstrat’s own Mark Newton believes Ethereum is nearing a short-term bottom, expecting a reversal toward $5,500 once the current correction stabilizes near $4,200. If that scenario plays out, BitMine’s accumulation could look remarkably prescient.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.