Bitcoin’s Mining Difficulty Hits New High, More Pressure on Miners

The steady rise in Bitcoin’s mining difficulty continues to reinforce the network’s decentralization, even as it places growing pressure on miners operating in an increasingly competitive environment.

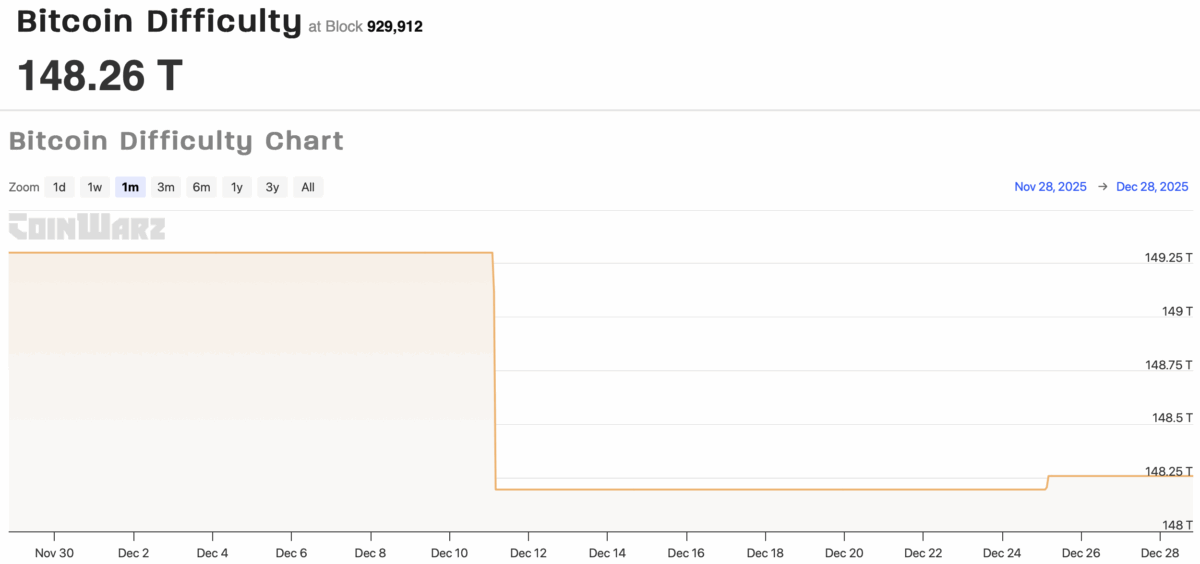

The most recent difficulty adjustment, the final one of 2025, pushed the metric to roughly 148.2 trillion, reflecting a modest increase in the computational effort required to mine new blocks. Based on current network conditions, the next scheduled adjustment in early January 2026 is expected to raise difficulty further, approaching 149 trillion.

Key takeaways:

- Bitcoin mining difficulty ended 2025 at a new all-time high

- Another difficulty increase is expected in early January 2026

- Faster-than-target block times are driving the adjustment higher

- Rising difficulty strengthens network security but pressures miners

At present, average block times are slightly faster than Bitcoin’s long-term target of ten minutes. When blocks are found too quickly, the protocol automatically responds by increasing difficulty, ensuring that block production slows back to its intended pace.

Why Bitcoin’s Difficulty Keeps Climbing

Bitcoin relies on an automated difficulty adjustment mechanism to maintain consistency across its ledger. Every 2,016 blocks—roughly once every two weeks—the network recalibrates how hard it is to mine based on how quickly the previous set of blocks was completed.

If miners collectively add more computing power and blocks are mined faster than expected, difficulty increases. If mining power drops and block times slow, difficulty falls. This feedback loop is one of Bitcoin’s most important design features, keeping issuance predictable regardless of how much hardware joins the network.

Throughout 2025, mining difficulty repeatedly reached new all-time highs. Two particularly sharp increases occurred during Bitcoin’s strong price rally in September, before a sharp market correction later in the year disrupted broader crypto markets. Even so, total network hashrate has continued to trend upward, signaling that miners are still committing capital and energy to secure the network.

Rising Costs, Stronger Security

Higher difficulty has direct consequences for miners. As competition intensifies, operators must deploy more advanced hardware and consume more energy just to maintain the same share of block rewards. For smaller or less efficient miners, this can compress margins or force shutdowns, further consolidating the industry among well-capitalized players.

At the same time, rising difficulty plays a critical role in protecting Bitcoin itself. By making it progressively harder to mine blocks, the network prevents any single miner—or coordinated group—from rapidly gaining control by suddenly adding large amounts of computing power.

This protection is central to Bitcoin’s resistance to majority attacks, where an entity controlling most of the network’s computing power could attempt to manipulate transactions or double-spend coins. Even without such an attack, a dominant miner could flood the market with newly mined Bitcoin, creating sustained selling pressure and undermining price stability.

By continuously adjusting difficulty in line with total computing power, Bitcoin maintains a steady issuance schedule and preserves its decentralized structure. While the mechanism increases operational strain on miners, it also strengthens the network’s long-term resilience—ensuring that no single participant can overpower the system or distort its economic foundations.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.