Bitcoin Briefly Hits $70,000 – Accumulation Builds Beneath the Surface

Bitcoin climbed back above the $70,000 level, marking a psychological milestone after days of choppy price action and visible market fatigue.

- Bitcoin reclaimed $70,000, restoring a key psychological level.

- Whale-sized transactions now dominate exchange inflows, signaling accumulation.

- Short-term holders remain deep in unrealized losses – a setup that has historically preceded local bottoms.

The move comes as on-chain data shows a notable surge in activity from large holders, suggesting that deeper-pocketed investors are absorbing supply while short-term traders remain under pressure.

On the hourly chart, BTC pushed through the $70K mark with improving momentum, supported by a firming MACD and a rising RSI that has moved back toward the upper half of its range. The breakout follows a period of consolidation between roughly $66,000 and $69,000, where repeated dips were met with steady buying interest.

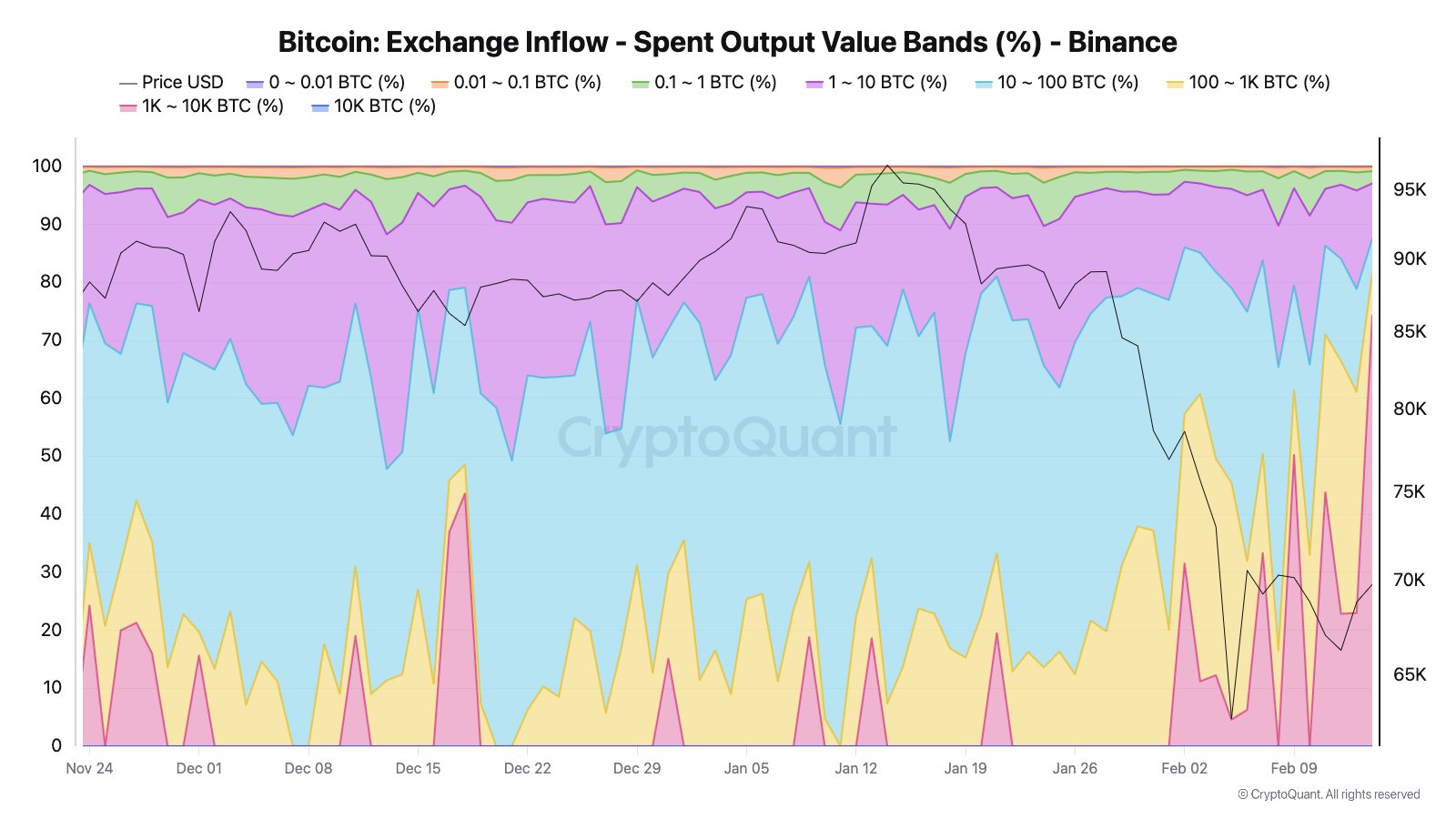

Whale Inflows Dominate Binance Activity

Recent data indicates that transactions between 1,000 and 10,000 BTC now account for approximately 74% of total inflows on Binance. Just days earlier, the 100 to 1,000 BTC cohort had already expanded its share to around 43% of inflows, signaling that mid-sized players were positioning ahead of the latest move.

The dominance of these large transaction bands suggests strategic accumulation rather than retail-driven momentum. In previous cycles, similar shifts in exchange inflow composition have often coincided with transitional phases in price structure, particularly near local bottoms or major inflection points.

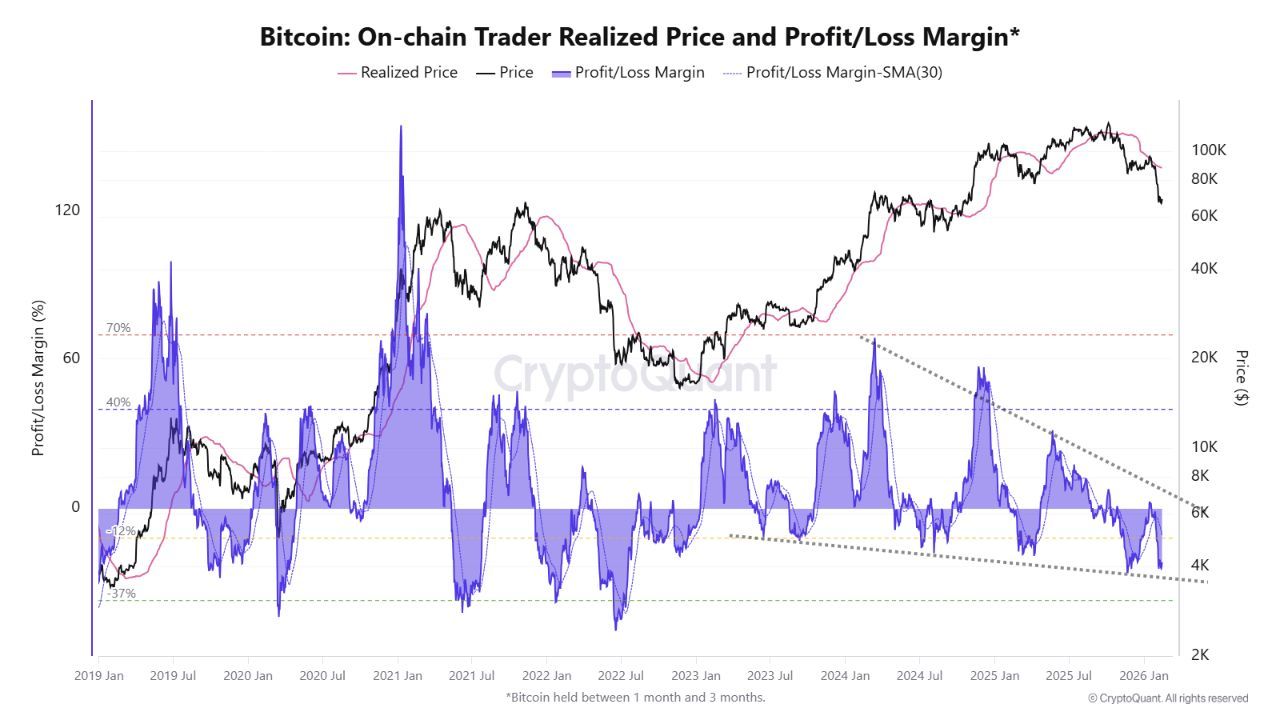

Short-Term Holders in Deep Stress Territory

At the same time, short-term holders – those who have held Bitcoin for one to three months – are sitting on roughly 20% unrealized losses. Historically, this level of underwater positioning has aligned more closely with local bottoms than cycle tops.

When recent buyers experience this degree of stress, the market typically sees weak hands exit, profit and loss margins compress, and supply gradually dry up. Such stress clusters have frequently appeared before upside resolution, especially when paired with rising accumulation from larger entities.

A key on-chain level to watch is the short-term holder realized price, currently near $88,000. While Bitcoin remains below that threshold, many recent buyers are still underwater, which can create overhead resistance on rallies. However, sustained strength above $70,000 may begin to shift sentiment if momentum continues to build.

Technical Picture Strengthens Above 70K

From a technical standpoint, reclaiming $70,000 restores a key round-number support-turned-resistance zone. The recent push has been accompanied by a strengthening MACD histogram and an RSI recovery toward bullish territory, hinting at improving short-term momentum.

If bulls can defend the breakout and convert $70K into support, the next challenge lies in clearing recent local highs near the $71,000-$72,000 region. Failure to hold above this level, however, could invite renewed volatility as stressed short-term holders react to price swings.

For now, the combination of whale-dominated inflows, elevated short-term stress, and a clean move back above a major psychological level places Bitcoin at a critical juncture.

Historically, markets tend to turn when pressure peaks – and current on-chain data suggests that pressure is clearly building.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.