Best Crypto Bridges for Cross-Chain Transactions in 2025 (UPDATED)

Crypto has changed since its inception. In today’s crypto industry, taking full advantage of decentralized finance often means interacting with multiple blockchains. Having a reliable bridge is indispensable for moving tokens between these platforms.

However, there’s a problem: many users use popular options like the Portal Token Bridge or Synapse Bridge for these transfers. While they are solid choices, plenty of other platforms are out there—many of which might offer even better features for your needs.

In this article, we’ve rounded up the best crypto bridges of 2025. We’ve carefully evaluated them based on factors like supported networks, security, fees, and overall functionality, making finding the perfect platform for cross-chain transfers easier.

What are Crypto Bridges, and Why are they Important for Web3 and DeFi?

Crypto bridges (or blockchain bridges) are software protocols that connect different blockchains, allowing them to communicate and work together, much like a bridge connecting two separate islands.

They work by linking two separate blockchains, making it possible to move assets and data between them seamlessly. These bridges use shared liquidity pools and smart balancing systems to ensure smooth and efficient transfers. The liquidity pools hold native assets for multiple blockchains simultaneously, allowing quick and easy swaps.

With a crypto bridge, you can transfer your assets directly between blockchains in just a few clicks, saving you from the hassle of using a centralized exchange, where you’d have to deposit your assets, trade them, and then withdraw them again.

Using bridges reduces delays and eliminates the need to trust a centralized exchange. Plus, since centralized exchanges often charge hefty fees, decentralized bridges can help you save money on transactions, besides the fact that most decentralized apps don’t require KYC.

Best Crypto Bridges: 2025 Update

Wormhole

Launched in 2021, Wormhole is one of the most recognized cross-chain communication protocols in the blockchain ecosystem. It facilitates seamless interoperability between multiple networks, allowing developers and users to transfer tokens, NFTs, and messages across different chains without friction. Wormhole plays a key role in enabling decentralized applications to operate across ecosystems like Ethereum, Solana, and Avalanche.

What sets Wormhole apart is its focus on generalized messaging, which goes beyond token bridging. Developers can use it to transmit any type of data—such as governance votes, oracle data, or wrapped assets—between blockchains. This makes Wormhole not just a bridge, but a full interoperability layer powering numerous decentralized finance (DeFi) and NFT projects.

Supported Chains

Wormhole currently connects over 30 major blockchains, including Ethereum, Solana, BNB Chain, Polygon, Avalanche, Arbitrum, Optimism, Base, Fantom, Celo, Sui, Aptos, Near, and Cosmos-based networks. This extensive coverage gives it one of the widest multi-chain reaches in the industry.

Security

Wormhole employs multiple layers of security, combining guardian-based verification and continuous audits:

- Guardian Network – Wormhole’s security model relies on a decentralized set of 19 independent “guardians,” run by reputable entities like Jump Crypto, Figment, and Staked. These guardians validate and sign all cross-chain messages before they are executed on destination chains.

- Continuous Audits – The protocol undergoes regular security audits by top firms such as OtterSec, Trail of Bits, and Neodyme.

- Response Layer – After a 2022 exploit, Wormhole introduced additional security layers including real-time monitoring, automated patching, and a rapid response framework to prevent and mitigate vulnerabilities.

Fees

Wormhole doesn’t charge bridge-specific fees itself, but users pay standard gas fees on the blockchains involved. Some front-end interfaces or dApps using Wormhole may include a small service fee for processing cross-chain transactions.

Pros

-

Wide Ecosystem – Supports over 30 major blockchains and counting.

-

Developer-Friendly – Generalized messaging supports tokens, NFTs, and arbitrary data.

-

Strong Partnerships – Backed by Jump Crypto and integrated into leading DeFi protocols.

-

Constantly Audited – Undergoes continuous third-party audits.

-

Active Ecosystem – Used by multiple applications across DeFi, gaming, and NFTs.

Cons

-

Past Exploit – Experienced a major security breach in 2022, though fully patched and reimbursed.

-

Complex Design – Its generalized framework may feel overwhelming for beginners.

-

Guardian Model – Relies on a limited number of guardian nodes, which introduces some degree of semi-centralization.

Top 9 Best Bridges in Crypto

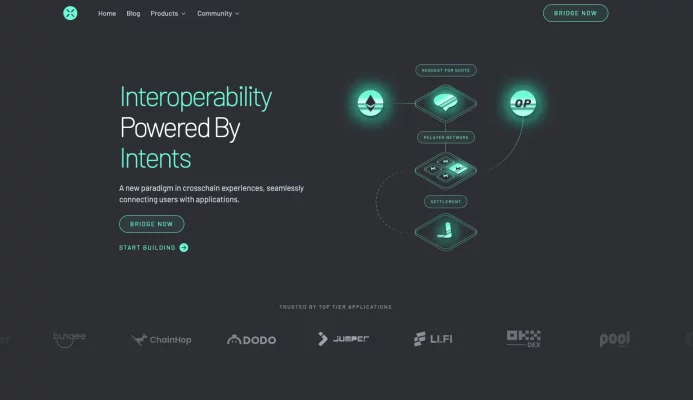

Across.to

Launched in 2021, Across Protocol is a popular cross-chain solution using intents, and we consider it the best platform for bridging at the time of writing. And that’s especially because intents-based frameworks are gaining traction in the bridging space, and Across often offers the fastest and cheapest bridge options.

What sets Across apart is that it only transfers real, canonical assets, not wrapped or synthetic tokens. It operates on chains with official bridges to ensure genuine token transfers.

Supported Chains

There are over 17 supported chains available: Aleph Zero, Blast, zkSync, Optimism, Base, Arbitrum, Soneium, Ethereum, Polygon, Ink, Mode, Redstone, Scroll, World Chain, Zora, Lisk, and Linea.

Security

Across Protocol prioritizes user security with several key features:

- UMA’s Optimistic Oracle – The protocol relies on UMA’s optimistic oracle, which uses a one-step dispute mechanism. Anyone can propose answers to specific questions, and if undisputed within a short time frame, the answer is verified.

- Dataworker Proposals – The Dataworker submits proposals to the optimistic oracle for valid refunds and optimal reallocations of liquidity provider (LP) capital, improving capital efficiency while maintaining security.

- Canonical Token Transfers – Across exclusively handles genuine (canonical) assets, avoiding the risks associated with synthetic or wrapped tokens.

Fees

Across Protocol charges liquidity provider fees based on whether the relayer takes repayment from the origin or destination chain. If repayment happens on the origin chain, no fees are charged; otherwise, a fee based on liquidity utilization is applied.

Additionally, relayer fees are set by users to incentivize relayers, covering costs like gas, opportunity costs, and capital risk. These fees are reflected in the difference between the transaction’s input and output amounts.

Pros

- Fast Transactions – The relayer network ensures quick cross-chain transfers.

- Low Fees – Competition among relayers keeps costs low. Gas-optimized for near-zero bridge fees.

- High Security – Backed by UMA’s optimistic oracle with strong dispute mechanisms.

- User-Friendly – Easy-to-use interface, great for beginners.

- Genuine Assets – Only transfers real assets, avoiding synthetic token risks.

Cons

- Limited Blockchain Support – Works with a small number of blockchains.

- Relayer Reliance – Performance depends on the quality of relayers.

Stargate

Stargate, built on LayerZero, is a fully composable cross-chain bridge protocol enabling seamless native asset transfers between blockchains.

Unlike traditional bridges that rely on inefficient wrapped or intermediate tokens, Stargate eliminates this need, allowing users to transfer native tokens directly.

Powered by unified liquidity pools shared across chains, it ensures instant guaranteed finality and delivers a streamlined, one-step cross-chain bridging experience.

Supported Chains

Currently, we have identified over 18 supported chains on the Stargate platform: Arbitrum, Avalanche, Base, BNB Chain, Ethereum, Fantom, Kava, Linea, Mantle, Metis, Optimism, Polygon, Hemi, and others.

Security

Stargate incorporates robust security measures to establish trust and reliability in its cross-chain bridge operations:

- Unified Liquidity Pools – Stargate’s use of shared liquidity pools prevents fractured liquidity issues, ensuring smooth transactions without the risk of failure or reversion due to insufficient liquidity on the destination chain.

- Instant Guaranteed Finality – By eliminating the need for wrapped tokens, Stargate ensures that all transactions are final and cannot be reverted, even in scenarios with high transaction volumes.

- ∆ Algorithm – Stargate’s proprietary Delta (∆) algorithm optimizes liquidity pool rebalancing to prevent exhaustion during concurrent transactions.

- LayerZero Security Foundation – LayerZero provides a strong security backbone by enabling decentralized and verifiable message delivery between blockchains.

- Audited Smart Contracts – Stargate’s codebase undergoes regular audits to identify and mitigate vulnerabilities.

Fees

Stargate charges a flat 6 bps transaction fee, with 5 bps allocated to the protocol treasury and 1 bp to veSTG holders. Gas fees, paid in the native gas token, cover LayerZero’s execution fee and costs for verifying messages via the Decentralized Validation Network (DVN).

In V2, Stargate introduced dynamic fees managed by the AI Planning Module (AIPM), which ensures optimal liquidity distribution across pools and adjusts costs based on demand. When liquidity in a specific pool is low, rebates are offered to incentivize rebalancing and maintain smooth operations.

Pros

- Native Asset Transfers – Seamlessly transfers native assets without wrapped tokens.

- Blockchain Support – Works with multiple EVM-compatible Layer 1 and Layer 2 chains.

- User-Friendly – Easy-to-use interface for smooth bridging.

- Cost Transparency – Estimates slippage and gas costs before transfers.

- Liquidity Rewards – Earn STG tokens by providing liquidity.

- High TVL – Trusted platform with significant total value locked.

Cons

- Dynamic Fees – V2’s dynamic fees may confuse some users.

- Liquidity Risk – High demand could still lead to liquidity pool exhaustion.

- Gas Fees – Extra gas fees for LayerZero execution and verification.

Rhino Fi

Rhino.fi is an easy-to-use multi-chain platform that lets you access top DeFi opportunities all in one place. Built on StarkEx Validium Layer 2 technology, your tokens are securely linked to Ethereum’s blockchain, the second largest in the world, giving you full control over your assets.

Rhino.fi is self-custodial, meaning only you can access deposit tokens. The Rhino.fi team can never touch your funds. If Rhino.fi ever goes offline, you can still withdraw your tokens to the Ethereum mainnet through the Data Availability Committee.

Supported Chains

With Rhino Fi, you can bridge to over 27 major chains, such as Ethereum, Arbitrum, Avalanche, Avalanche Nova, Optimism, zkSync, Base, Linea, BNB Chain, TON, Tron, Polygon, and many others.

Security

The most relevant security aspects of Rhino.fi are:

- Self-Custody – Users can fully control their tokens and withdraw funds through the Data Availability Committee, even if the platform shuts down.

- StarkEx Validium Layer 2 – This technology leverages Ethereum’s security, meaning tampering with funds would require breaching Ethereum’s blockchain.

Fees

Rhino.fi offers low trading fees, ranging from 0% to 0.3%. If you provide liquidity (maker), fees start at 0.15%; if you take liquidity (taker), fees start at 0.20%. These fees drop as your 30-day trading volume increases, with the best fees (0% for makers and 0.14% for takers) at over $30 million in volume. Swap fees are a flat 0.30%; transfer fees depend on the token and are updated regularly.

Pros

- Self-Custody – You have full control of your tokens.

- High Security – Built on StarkEx Validium Layer 2 with Ethereum’s blockchain security.

- Wide Chain Support – Access DeFi on over 27 chains.

- Emergency Withdrawals – Withdraw funds even if the platform goes offline.

Cons

- Variable Transfer Fees – Fees depend on the token and can change.

- Volume-Dependent Fees – Best fees are only available with high trading volumes.

- Challenging for Newbies: New users may initially find it a bit complex.

Rubic Exchange

Rubic Exchange is a multichain DeFi platform designed to be a one-stop solution for decentralized trading. It enables users to perform cross-chain swaps seamlessly, offering instant swaps and access to the best rates through its DEX aggregator.

With support for major swap protocols and global accessibility, Rubic empowers users to trade effortlessly across different networks. Completely decentralized, Rubic operates without requiring KYC, ensuring user privacy and convenience for traders worldwide.

Supported Chains

Currently, Rubic Exchange supports over 27 chains. Some popular options on Rubic are TON, Tron, Linea, Base, Arbitrum, and others.

Security

Some great security features are:

- Decentralized Architecture – Rubic operates without external servers, relying solely on blockchain and frontend interactions, significantly reducing attack vectors like DDoS.

- One-Click DeFi – Solves DeFi complexity by combining multiple steps (wallet connections, token swaps, and bridging) into a single “one-click” process for users.

- Secure and Audited – Fully audited contracts ensure reliability and safety for users.

- SDK and White-Label Tools – Provides integration solutions for dApps and wallets with fee-sharing incentives.

Fees

Currently, Rubic charges $2 for cross-chain swaps and $1 for on-chain swaps, plus standard gas fees.

Pros

- Easy to Use – One-click swaps simplify complex DeFi processes.

- It supports 27+ Blockchains and works with many popular chains like TON, Tron, and Arbitrum.

- Secure – Fully audited contracts and decentralized architecture ensure safety and privacy.

- High Transaction Volume – Over $1.24 billion in transactions, showing reliability.

Cons

- Fees – $2 for cross-chain swaps and $1 for on-chain swaps, plus gas fees.

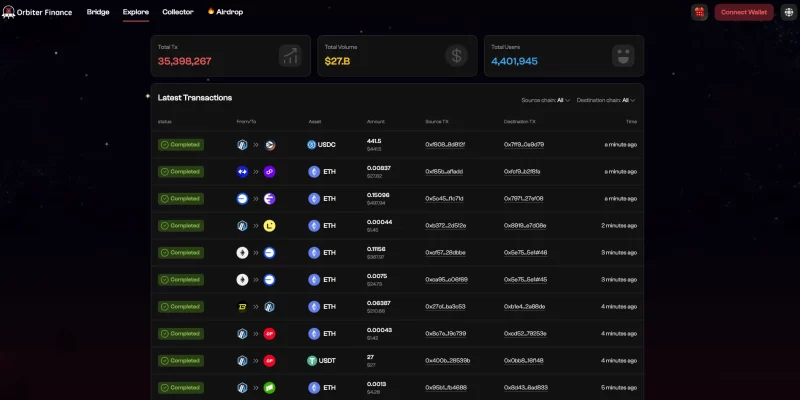

Orbiter Finance

Orbiter Finance is one of the top cross-chain bridges in the crypto space right now, designed to make transferring assets between Ethereum’s layer 2 networks smooth and cost-effective.

By leveraging cutting-edge ZK-rollup technology, Orbiter Finance enables fast, low-gas transfers while ensuring privacy and efficiency. The platform takes advantage of the robust security of Ethereum layer 1, ensuring that transactions remain safe while benefiting from lower costs and greater scalability.

Notable investors, including Tiger Global and OKX Ventures, are backing the platform’s growing success and showing strong support for its potential to improve the broader Ethereum ecosystem.

Supported Chains

Orbiter supports over 70 chains, including Ethereum, Arbitrum, Polygon bridges, Optimism, Immutable X, Base, Linea, BNB Chain, TON, Tron, Ink, etc.

Security

The most relevant security aspects related to Orbiter Finance are:

- Zero-Knowledge Proofs (ZKPs) – Orbiter uses ZKPs to verify transactions without revealing sensitive data, ensuring privacy and secure cross-rollup transfers.

- Cross-Rollup Transactions – Transfers between Layer-2 solutions are protected by the security measures inherent to the networks, including ZK rollups and optimistic rollups.

- Decentralized Architecture – Orbiter’s decentralized design reduces reliance on single points of failure, boosting overall platform security.

Fees

Orbiter Finance charges a protocol fee of 0.00023 ETH for bridging assets between blockchains. A trading fee of 0.2% to 0.3% is applied depending on the trade.

Pros

- Innovative and Efficient – Orbiter Finance leverages ZK roll-up technology for fast, low-cost, and secure transfers between Ethereum’s Layer 2 networks.

- Strong Security – It Utilizes Zero-Knowledge Proofs (ZKPs) and cross-rollup transactions to ensure secure, private asset transfers with robust protection.

- Wide Support – Orbiter supports over 70 chains.

- Strong Backing – Investors like Tiger Global and OKX Ventures lend credibility and confidence in its potential within the Ethereum ecosystem.

- High Performance – Transfers are up to six times faster and more cost-effective than traditional cross-chain bridges.

Cons

- Security Concerns – The lack of post-launch security audits raises concerns about platform safety.

- Lack of Team Transparency – Limited information on the team behind the project.

deBridge

deBridge is a well-known cross-chain protocol enabling seamless transfer of tokens and arbitrary data between blockchains. Built on a decentralized validator network, it ensures trustless validation and strong security.

By utilizing off-chain transaction validation and Arweave-based data availability, deBridge delivers a highly efficient and scalable solution for cross-chain interoperability.

Supported Chains

deBridge supports over 18 chains, including Arbitrum, Avalanche bridge, Polygon, BNB Chain, Ethereum, Gnosis, Base, Optimism, Solana, Fantom, etc.

Fees

deBridge charges a flat fee for every cross-chain message transfer, paid in the native gas token of the source blockchain (e.g., ETH on Ethereum). Half of these fees reward deBridge validators, ensuring decentralization and protocol reliability. Fees for each message are visible in the deBridge Explorer or via the DebridgeGate smart contract.

Security

Some important security features that we can find at deBridge are:

- Decentralized Validator Network – Validators verify all cross-chain transactions independently, ensuring trustless validation and protocol security.

- Arweave Data Availability – Validator signatures are securely stored on Arweave, ensuring data persistence and availability.

- Delegated Staking and Slashing – Validators and delegators are incentivized to maintain high standards with staking rewards and the risk of slashing for misbehavior or downtime.

- Transaction Finality – Validators wait for sufficient block confirmations to ensure transaction finality, minimizing risks from probabilistic blockchain models.

Pros

- Fast and Efficient – Near-instant settlement with faster finality than traditional systems.

- Advanced Trading Features – Gasless limit orders, zero slippage, and unlimited market depth for seamless cross-chain trades.

- Strong Security – Decentralized validator network, Arweave-based data availability, and slashing mechanisms ensure reliability and safety.

- Wide Chain Support – Supports 18+ major chains, including Ethereum, Solana, and BNB Chain.

- No Locked Liquidity Risk – Eliminates the need for liquidity pools, reducing risk exposure.

Cons

- Flat Fee Structure – This may be costly for small transactions.

- Complexity for Beginners – Advanced features like staking and gasless orders can confuse new users.

- Validator Dependency – System reliability heavily depends on validator performance.

Hop Protocol

Hop Protocol is designed to facilitate fast, seamless token transfers between various Ethereum layer 2 networks. It enables near-instantaneous asset movement, making it one of the best cross-chain bridges for Ethereum Layer 2 scaling solutions.

Operating on a non-custodial model, Hop ensures that funds are never controlled by a single entity, safeguarding liquidity providers and users. The protocol has undergone Solidified and Monoceros Alpha audits, further reinforcing its security and reliability.

Supported Chains

Currently, the Hop Protocol supports various Ethereum scaling solutions, including Polygon, Gnosis, Optimism, Arbitrum One, Arbitrum Nova, Base, Linea, and Polygon zkEVM.

Security

Hop Protocol ensures secure asset transfers across blockchains with the following features:

- On-chain Security – Hop uses the security of the blockchains it connects to, ensuring all important actions, like transferring assets and verifying data, happen transparently and cannot be changed.

- Minimal Trust – Hop reduces the need for trusted middlemen by using a decentralized network of nodes to manage communication between blockchains, keeping things more secure and less reliant on one single party.

- Proof-of-Transfer – Hop uses a unique method to confirm that assets are transferred correctly across blockchains, ensuring that transactions are valid.

- Bonding and Penalties – Hop requires nodes to form bonds to encourage honesty. If they act dishonestly, they lose their bonds.

Fees

Hop Protocol fees depend on several factors. There are no AMM fees, but each transfer involves a 0.01% to 0.04% swap fee for converting tokens into hTokens and back. Layer 2 to Layer 2 transfers incur 0.02% to 0.08%, while Layer 2 to Layer 1 costs 0.01% to 0.04%.

Slippage can occur due to liquidity changes, but it’s less of an issue as liquidity grows. Bonder fees range from 0.05% to 0.30%, compensating bonders for liquidity and risk. Gas fees for destination chain transactions are included in the fee estimate.

A minimum fee of $0.25 applies to prevent spam.

Pros

- Optimized for Ethereum Layer 2 – Best for cross-chain transfers within Ethereum’s Layer 2 ecosystem.

- Instant Transfers – Token transfers are almost instantaneous.

- Supports Leading Solutions – Works with popular Ethereum Layer 2s like Polygon, Gnosis, and Arbitrum.

- Non-Custodial – Users retain full control over their assets.

Cons

- Limited to Layer 2 – Supports Ethereum Layer 2, not many Layer 1 or other blockchains.

- Depends on Liquidity – Transfer costs and slippage can vary based on available liquidity.

- Still Growing – Newer protocol with less adoption compared to other solutions.

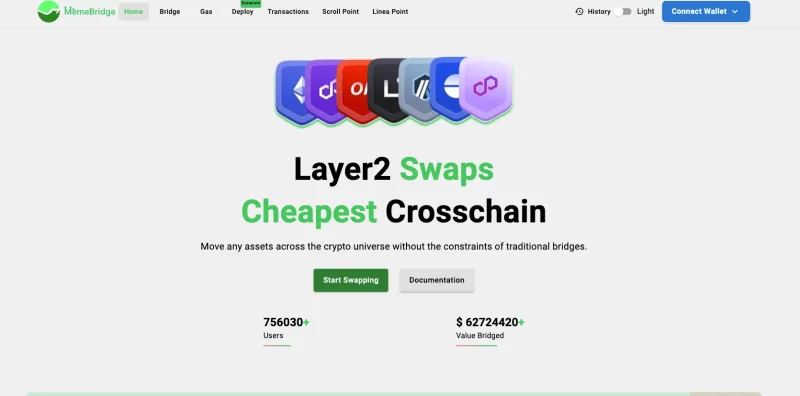

MemeBridge

MemeBridge is a popular cross-chain bridge solution that enables the effortless transfer of digital assets across different blockchain networks. Its mission is to help great memes overcome barriers and reach broader audiences.

Positioned as the “cheapest Layer 2 bridge,” MemeBridge allows users to transfer assets while earning points quickly. The platform strives to improve the accessibility and efficiency of digital asset transactions, making them easier for the community to engage with.

Supported Chains

MemeBridge supports approximately 40 chains, including Arbitrum Bridge, Base, Ethereum, Optimism Bridge, and other major blockchain networks.

Security

- Smart Contract Audits – Regular audits by reputable firms help identify and fix vulnerabilities.

- Decentralized Oracles – Using decentralized oracles reduces reliance on single points of failure, enhancing security.

Fees

MemeBridge doesn’t specify a fixed fee percentage; each transfer’s fees will be shown. They depend on network costs and will be displayed when you initiate the transaction.

Pros

- Wide Chain Support – MemeBridge supports around 40 blockchains, including major networks like Arbitrum, Base, and Ethereum.

- Ease of Use – The platform focuses on improving community accessibility and efficiency.

Cons

- New Platform – As a relatively new solution, it may face growing pains or evolving features.

- Unclear Fee Structure – The platform does not specify a fixed fee percentage while fees are shown during transactions.

Connext

Connext is a modular protocol designed to enable secure fund and data transfers across different blockchains and rollups. It allows developers to create cross-chain applications (xApps) that seamlessly interact with multiple blockchain ecosystems simultaneously.

The core philosophy of Connext is to simplify blockchain interaction for end users, ensuring they don’t need to be aware of the underlying chains in use. The platform leverages a decentralized network of routers that facilitate cross-chain activity and secure the network, allowing participants to earn rewards as they help support the bridge’s operations.

Connext strives to enhance composability and interconnectivity within the blockchain industry, making multi-chain interactions smoother and more efficient.

Supported Chains

Connext supports 10 chains, including Ethereum, BSC, Arbitrum, Polygon, Gnosis, Optimism, Linea, Metis, Base, and Mode. It is expected to integrate with six more chains, such as zkSync, Mantle, and Avalanche.

Security

Connext includes several key security features that made us include the project in this article:

- Router Address Management – Separate Recipient and Owner addresses are used for security. Store them in hardware wallets.

- Admin Token Protection – Admin tokens must be long and stored securely to prevent unauthorized access to APIs.

- Private Key Handling – Use encrypted key management systems like Web3Signer, not plaintext storage.

- SSH Security – Enable key-based authentication and two-factor or physical tokens for SSH access.

- Router Isolation – Run routers in private subnets with controlled access, using NAT for internet access.

Fees

Connext charges a 0.05% router fee on the transferred asset when liquidity is available for immediate swaps. This fee is applied during the “fast path” process.

Relayer fees are paid for executing transactions on the destination chain. These fees, depending on the chain and service provider, are paid in either the native or transacting asset and can be estimated through the Connext SDK and standard gas costs.

Pros

- Security Focused – Strong security measures like private key encryption and secure API access.

- Modular Design – Flexible for developers to create various cross-chain applications.

- Decentralized – Routers are decentralized, providing reliability and rewards for participants.

- Growing Ecosystem – Supports multiple chains and is expanding to more in the future.

Cons

- Fees – Charges a fee on transfers and additional costs for relayers.

- Limited Chain Support – Not all blockchains are supported yet.

- Complex Setup – Integration can be complex for developers.

Comparing Best Crypto Bridges to Use

| Platform | Best For | Supported Chains | Security Features | Fees | Pros | Cons |

| Across Protocol | Best for fast, low-fee cross-chain transfers | 17+ chains (Arbitrum, Ethereum, Polygon) | UMA’s Optimistic Oracle, canonical token transfers | Liquidity provider fees, gas fees | Fast, low fees, high security, genuine asset transfers | Limited chain support, relayer dependency |

| Stargate | Best for seamless native asset transfers | 18+ chains (Arbitrum, Avalanche, Ethereum) | Unified liquidity pools, LayerZero security, audited code | 6 bps flat fee, dynamic fees in V2 | Native asset transfers, high liquidity, user-friendly | Dynamic fees, liquidity risk, gas fees |

| Rhino.fi | Best for self-custodial, high-security transfers | 27+ chains (Ethereum, Arbitrum, Avalanche) | Self-custody, StarkEx Validium Layer 2 | 0%–0.3% trading fees, volume-dependent | Full control over assets, wide chain support, high security | Variable fees, complex for beginners, volume-dependent fees |

| Rubic Exchange | Best for easy cross-chain DeFi trading | 27+ chains (TON, Tron, Arbitrum, Base) | Decentralized, fully audited, one-click DeFi | $2 cross-chain swaps, $1 on-chain swaps | Easy to use, supports 27+ blockchains, secure, high volume | Fees for cross-chain swaps |

| Orbiter Finance | Best for efficient Ethereum Layer 2 transfers | 70+ chains (Ethereum, Arbitrum, BNB Chain) | Zero-knowledge proofs, cross-rollup transactions | 0.00023 ETH fee, 0.2–0.3% trading fee | Innovative, fast, secure transfers, strong backing | No post-launch audits, lack of team transparency |

| deBridge | Best for cross-chain tokens and data transfers | 18+ chains (Ethereum, Solana, BNB Chain) | Decentralized validators, Arweave data availability | Flat fee paid in native gas tokens | Fast, secure, no liquidity risk, wide chain support | Flat fee may be costly for small transfers, complex for new users |

| Hop Protocol | Best for fast Ethereum Layer 2 transfers | Ethereum Layer 2s (Polygon, Arbitrum) | On-chain security, minimal trust, bonding penalties | 0.01%–0.04% swap fee, 0.05%–0.30% bonder fee | Optimized for Layer 2, non-custodial, instant transfers | Limited to Layer 2, liquidity-dependent, still growing |

| MemeBridge | Best for low-cost Layer 2 bridging | 40 chains (Arbitrum, Base, Ethereum) | Smart contract audits, decentralized oracles | Variable, displayed at transfer initiation | Wide chain support, ease of use, low-cost Layer 2 bridge | New platform, unclear fee structure |

| Connext | Best for developer-friendly cross-chain apps | 10 chains (Ethereum, Polygon, Arbitrum) | Router address management, private key handling | 0.05% router fee, relayer fees | Security-focused, decentralized, modular design | Limited chain support, complex setup, extra costs for relayers |

Disclaimer. This table provides a quick overview. For more details on each platform, please check the full information above.

Choosing the right cross-chain bridge depends entirely on what you’re looking to achieve. What works best for one person might not be ideal for you, so it’s important to consider your needs carefully. The best advice is to read through the details of each bridge and think about what matters most to you before making a decision.

For example, if you want to move assets between specific blockchains, make sure the bridge you choose supports those chains. Not all bridges work with every blockchain, so checking compatibility is key. Another important factor is fees—some bridges can be expensive, especially if you move assets frequently. If you’re cost-conscious, look for options with lower fees to save money in the long run.

Safety should also be a top priority. Ensure the bridge you’re considering has solid security measures, such as third-party audits or decentralized technology, to protect your assets.

Another aspect to consider is ease of use. If you’re new to cross-chain transfers or want a simple process, choose a bridge with an intuitive and beginner-friendly interface.

Finally, consider any extra features that may be important to you, like rewards, staking options, or more control over your assets.

Take your time to review each option and choose the one that works best for your specific goals.

Future of Crypto Bridges and Trends to Watch in 2025

The future of bridges looks exciting and full of potential as technology continues to improve and adapt. In 2025, we will likely see major changes in how bridges work, making it easier and safer for users to move assets between blockchains.

These developments will improve existing systems and introduce new possibilities for people using these platforms or those who want to bridge tokens with greater efficiency and security.

One key area to watch is the progress in seamless cross-chain transfers. Moving tokens and data smoothly across different blockchains has always been a big goal, and 2025 could be the year this becomes a reality.

New technologies are being developed to allow multiple blockchains to work together rather than connect two chains simultaneously. This could make processes faster, simpler, and more user-friendly, putting the top crypto bridges ahead of the curve in innovation.

Another big focus will be improving security. Hackers have often targeted crypto bridges, so developers are working hard to make them safer. Stronger encryption methods and more decentralized designs will help protect users and reduce risks. New tools like zero-knowledge proofs are also being explored, making it possible to verify transactions without giving up private information.

At the same time, regulations are becoming a larger part of the crypto industry. Governments are paying closer attention to how these bridges operate, which could lead to stricter rules. While this might create some challenges, it could also bring more legitimacy to the industry.

Regulated platforms could attract more investors, while unregulated ones might see less use. The future of bridge tokens and cross-chain technology will likely depend on finding the right balance between innovation and following the rules.

One thing is certain: bridges, including the top crypto bridges in use today, will remain essential to the blockchain ecosystem. As new trends arise, the focus will remain on building faster, safer, and more user-friendly systems that meet the needs of both casual users and big investors.

Conclusion

If you’re searching for some of the best crypto bridges to use, you’ve got plenty of great options. In this article, we’ve highlighted 9 top-quality bridges to help you get started.

However, remember that the key is to pick one that supports all the blockchains you need for cross-chain transfers. The best bridge for you depends on your specific needs and the tokens you’re working with, so take your time to choose the right fit!