Why Central Banks Are Turning Away From the Dollar and Back to Gold

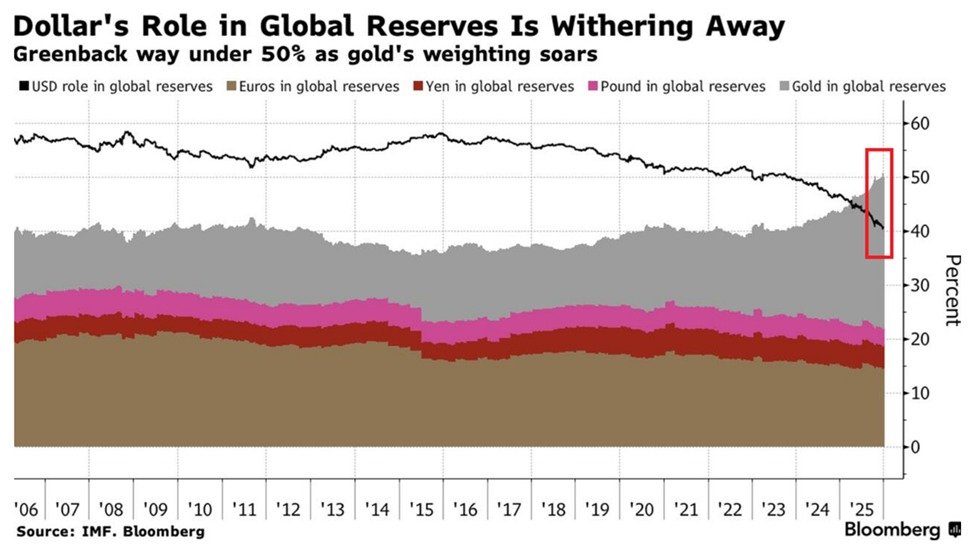

The structure of global reserves is undergoing a noticeable transformation, with fresh data pointing to a steady decline in the dominance of the US dollar and a renewed rise in gold’s strategic importance.

The global reserve system is entering a new phase, as fresh data reveal a steady erosion in the dominance of the US dollar and a renewed embrace of gold by central banks. What was once viewed as a gradual diversification trend is now becoming a defining feature of the post-pandemic financial order, with meaningful implications for currencies, commodities, and global markets.

- The US dollar’s share of global reserves has fallen to around 40 percent, the lowest level in decades.

- Gold now represents roughly 28 percent of global reserves, surpassing the combined share of major currencies.

- Central banks are favoring gold to reduce political and currency-related risks.

- The shift is reshaping market dynamics, supporting gold prices and challenging the dollar’s long-term dominance.

The Dollar’s Grip on Global Reserves Is Weakening

The US dollar now accounts for roughly 40 percent of global currency reserves, its lowest level in at least two decades. Over the past ten years, that share has fallen by around 18 percentage points, highlighting a structural shift rather than a short-lived adjustment. While the dollar remains the world’s primary reserve currency, its unrivaled position is slowly being diluted.

Importantly, this is not simply a rotation into rival currencies such as the euro or the yen. Their combined share has remained relatively subdued, suggesting that central banks are becoming more cautious about concentrating reserves in any single fiat system. Rising government debt levels, persistent fiscal deficits, and the increasing use of financial sanctions have all contributed to concerns about long-term currency risk and political exposure.

Gold Reclaims a Strategic Role for Central Banks

As confidence in fiat concentration wanes, gold has re-emerged as a cornerstone of reserve management. Its share of global reserves has climbed to about 28 percent, the highest since the early 1990s, after rising roughly 12 percentage points over the past decade. Gold now accounts for more global reserves than the euro, Japanese yen, and British pound combined, a striking reversal from the era when paper currencies dominated central bank portfolios.

This renewed demand reflects gold’s unique position in the financial system. Unlike sovereign currencies, gold carries no counterparty risk and sits outside the reach of political decisions. Many central banks are not only buying more gold but also repatriating it, choosing to store physical bullion within domestic vaults as a form of monetary insurance.

What This Shift Means for Markets and the Global Economy

The change in reserve composition is already leaving its mark on markets. Gold prices surged by around 65 percent in 2025, marking their strongest annual performance since the late 1970s. Over the same period, the US Dollar Index fell roughly 9.4 percent, its weakest annual showing in eight years. This divergence highlights how official-sector flows and investor sentiment are increasingly aligned.

Over the longer term, a smaller dollar footprint in global reserves could reduce structural demand for US assets, particularly Treasuries, potentially pushing borrowing costs higher. For emerging markets, greater reliance on gold may offer insulation from currency volatility and external shocks, but it also signals a world in which monetary fragmentation is becoming more pronounced.

While the dollar is unlikely to lose its reserve status anytime soon, the trajectory is clear. The global financial system is becoming more multipolar, with gold reclaiming its role as a neutral anchor in an increasingly uncertain economic and geopolitical landscape.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.