US Dollar Hits 50% of Global Payments as Euro Falls to One-Year Low

The global financial order is undergoing a quiet but powerful transformation. Over the past two years, two parallel trends have reshaped the hierarchy of money: the US dollar has strengthened its dominance in global transactions, while gold has surged back to prominence as a core reserve asset.

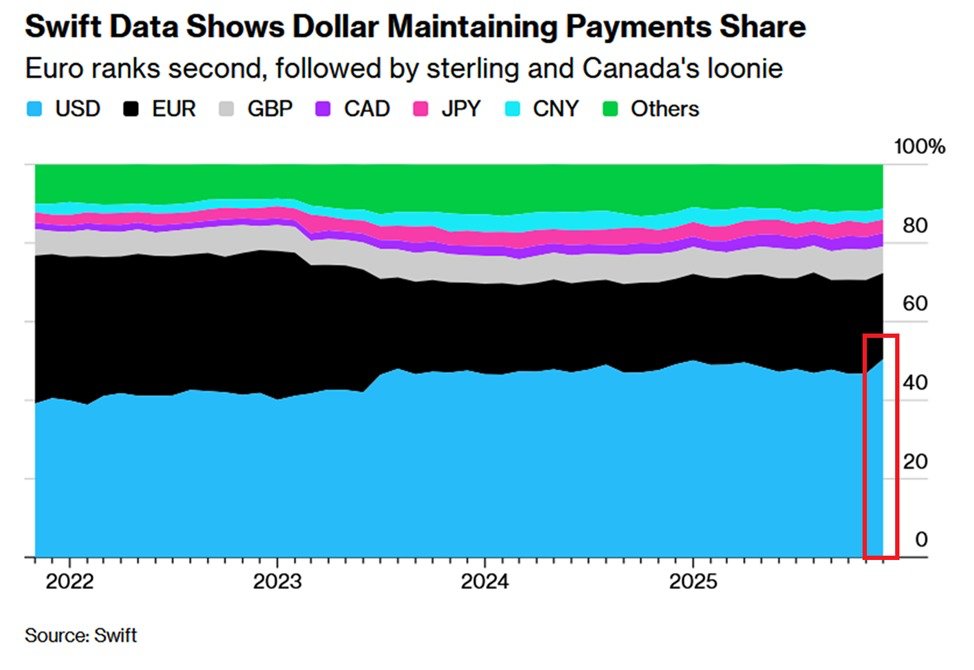

- The US dollar now accounts for 50.5% of global SWIFT transactions, widening the gap with all other currencies.

- The euro’s share has weakened to 21.9%, losing ground as trade shifts and structural challenges weigh on its global role.

- Gold has surpassed the euro as the second-largest reserve asset, as central banks accelerate purchases to hedge against geopolitical risk.

At the same time, the euro’s position has steadily weakened across multiple fronts.

Fresh data from SWIFT shows that the US dollar accounted for 50.5% of all international payment messages in December 2025 – the highest level since 2023. That figure represents an increase of 11.6 percentage points over the past four years, underscoring the dollar’s expanding influence despite geopolitical fragmentation and ongoing debates about de-dollarization.

The gap between the dollar and its closest competitors is now significant. The euro holds just 21.9% of global transaction share, slipping to a one-year low. The British pound stands at 6.7%, while both the Canadian dollar and Japanese yen account for 3.4% each. The Chinese yuan ranks sixth globally at 2.7%, a figure that has remained largely unchanged despite Beijing’s efforts to promote its currency in trade finance.

Transaction activity overall continues to expand. SWIFT processed 13.4 billion trade instructions in 2024, up from 11.9 billion in 2023 – a 12.6% annual increase. Beyond payment messaging, the dollar is involved in roughly 89% of all global foreign exchange transactions, reinforcing its central role in global liquidity.

Euro Faces Structural Headwinds

Although the euro remains the second-most used currency globally, its influence is gradually eroding in several regions.

Russia’s pivot away from Western currencies following the 2022 invasion of Ukraine marked a turning point. Energy trade that was once denominated largely in euros has shifted toward the ruble, Chinese yuan, and Indian rupee. At the same time, many emerging economies in the so-called Global South are increasingly settling trade in local currencies through bilateral arrangements, reducing reliance on both euro and dollar clearing systems.

Within Europe itself, growth challenges are limiting the currency’s external expansion. The European Central Bank has acknowledged stagnation in productivity and weakening industrial competitiveness, particularly in sectors such as automotive manufacturing. While intra-European SEPA payments remain active, the euro’s global share has plateaued.

Digital payments also pose a sovereignty challenge. Nearly two-thirds of card-based transactions in the euro area are processed by non-European companies. This has intensified the ECB’s push toward launching a Digital Euro in an effort to strengthen regional control over payment infrastructure.

Gold Reclaims Reserve Status

While the dollar strengthens its transactional dominance, central banks are reshaping their reserve portfolios in a different direction.

For the first time since 1996, gold holdings by value now exceed central bank holdings of US Treasuries. In 2024 and 2025, gold overtook the euro to become the second-largest reserve asset globally, accounting for roughly 20% of total reserves compared to the euro’s 16%.

Poland has emerged as one of the most aggressive buyers, adding 102 tonnes in 2025 alone and bringing its total reserves to approximately 550 tonnes – even surpassing the European Central Bank’s own gold holdings. China, although slowing purchases in late 2025, accumulated more than 350 tonnes between 2020 and 2025 as part of a broader diversification strategy. Other steady buyers include India, Turkey, Uzbekistan, and Brazil.

According to survey data from the World Gold Council, 95% of central banks expect global gold reserves to continue rising through 2026. The driving force behind this accumulation is clear: gold carries no counterparty risk and cannot be frozen or sanctioned. In a world where financial systems are increasingly used as geopolitical tools, many monetary authorities view gold as a neutral asset.

A Fragmented but Dollar-Centric System

The global monetary system is not collapsing into de-dollarization. Instead, it is fragmenting in layers. The dollar remains deeply embedded in trade finance, foreign exchange markets, and payment systems. Meanwhile, gold is rising as a strategic hedge within reserve portfolios. The euro, once viewed as a potential challenger to dollar supremacy, is facing structural and geopolitical pressures that are gradually reducing its global footprint.

Looking ahead, some analysts suggest that narrowing interest rate differentials in 2026 could soften the dollar’s relative strength. However, for now, transaction data tells a clear story: the US dollar continues to dominate the arteries of global finance, even as central banks quietly diversify their vaults with gold.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.