US Corporate Bond Downgrades Hit Highest Level Since 2020

The balance of power in the US corporate bond market is shifting rapidly, with downgrades now overwhelming upgrades at a pace not seen since the depths of the pandemic-era credit shock.

New data highlights a sharp deterioration in credit quality, raising concerns about corporate balance sheets as financing conditions remain tight.

Key Takeaways

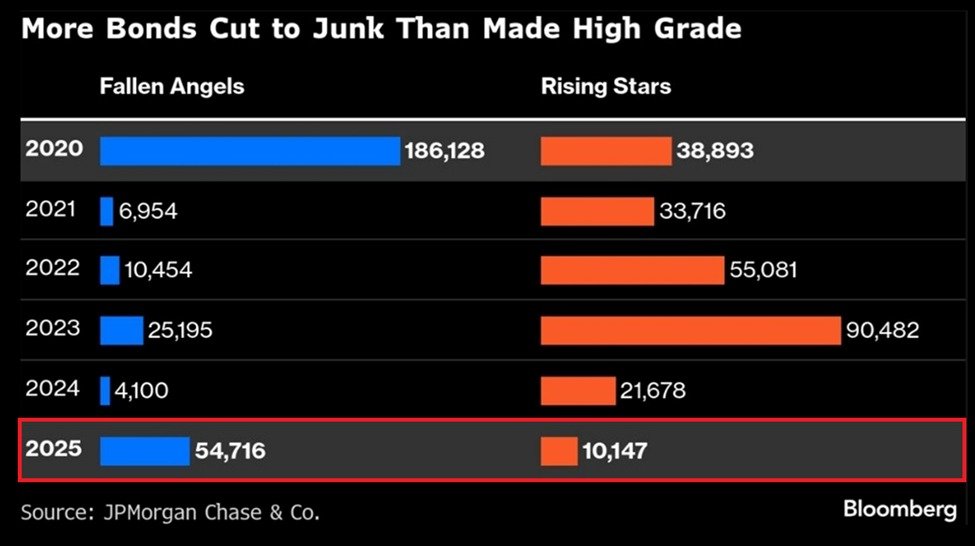

- About $55 billion of US corporate bonds were downgraded to junk in 2025, the highest since 2020.

- Upgrades fell to roughly $10 billion, leaving downgrades more than five times higher.

- Over $60 billion of bonds now sit on the edge of junk status, signaling rising credit stress.

In 2025, roughly $55 billion worth of US corporate bonds were downgraded from investment-grade to junk status, marking the highest annual total since 2020. At the same time, upgrades back into investment-grade territory fell to just $10 billion, the weakest showing in at least six years. The imbalance underscores a market increasingly tilted toward credit stress rather than recovery.

Downgrades Outpace Upgrades by a Wide Margin

The scale of the divergence is striking. For every dollar of bonds upgraded in 2025, more than five dollars were downgraded, pushing the downgrade-to-upgrade ratio to approximately 5.5 times. That ratio now exceeds even 2020 levels, when pandemic-driven disruption triggered widespread rating cuts across corporate America.

The contrast with last year is equally stark. In 2024, upgrades meaningfully outpaced downgrades, with only about $4 billion in bonds falling to junk status compared with roughly $22 billion regaining investment-grade ratings. The reversal in 2025 suggests that credit fundamentals have weakened considerably in a relatively short period.

Rising Risk of “Fallen Angels”

Adding to the concern is the growing pipeline of bonds hovering just above junk territory. Around $63 billion in US corporate debt is currently rated at the lowest rung of investment grade, up sharply from about $37 billion at the end of 2024. These so-called “fallen angels in waiting” face heightened risk of forced selling if further downgrades occur, particularly from funds restricted to holding investment-grade debt.

According to analysis shared by The Kobeissi Letter, the accelerating pace of downgrades reflects mounting pressure from elevated interest rates, refinancing challenges, and slowing earnings growth across several sectors. Higher borrowing costs are making it harder for leveraged companies to defend their credit ratings, especially as large portions of corporate debt approach maturity.

Broader Market Implications

A sustained wave of downgrades could ripple through credit markets, widening spreads, increasing volatility, and tightening financial conditions further. For investors, the shift signals rising default risk and a narrowing margin for error, particularly in lower-quality credit segments.

As the year progresses, markets will be watching closely to see whether credit stress stabilizes or deepens. For now, the data points to a clear trend: US corporate bond credit quality is weakening, and the balance between risk and reward is becoming increasingly fragile.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.