Top Crypto Presales to Watch in 2026: AI and Infrastructure Tokens Leading the Race

Explore top crypto presales to watch in 2026, including AI and infrastructure tokens like IPO Genie, DeepSnitch AI, and Nexchain, with a focus on utility, compliance, and real-world adoption.

19th February 2026: The new presale crypto market looks very different in 2026. Two years ago, many projects launched with hype but no product or real world use. Most of them are gone. What survived are teams building real tools that solve real problems.

In February 2026, regulation became a bigger focus. Treasury Secretary Scott Bessent supported the CLARITY Bill, and suddenly investors started asking better questions.

What does this token actually do?

Who runs the project?

Is the smart contract audited?

The best crypto presale in 2026 is not built on memes. It is built on utility, compliance, and execution. That is why AI and infrastructure tokens are getting attention.

If you are looking to buy a crypto during the presale now, start with projects solving what matters to you. The presales discussed here let everyday investors access private deals, using AI and blockchain to make investing fairer.

Why AI and Infrastructure Projects Matter Now

Let’s keep it simple.

Most people discover crypto projects through social media. That can be risky. AI tools now scan thousands of tokens, detect red flags, and help filter better opportunities. It is like having a research assistant working all day.

At the same time, infrastructure projects fix slow and expensive networks. Ethereum can still get costly during high demand. Faster and cheaper systems help crypto grow beyond early adopters.

Many new presale crypto launches in 2026 focus on either AI tools or blockchain infrastructure. That is not hype. That is demand.

What Separates Real Projects from Hype

Most crypto presales fail because teams cannot deliver.

Before joining any crypto presale to buy, ask:

- Does it solve a real problem?

- Is the team public and verifiable?

- Are tokenomics clear?

- Is there working code?

- Are there early users?

If the answer is not clear, then please walk away.

Simple checks save money.

IPO Genie: Opening Private Markets to Everyone

Earlier, startup investing was mostly for the wealthy. You often needed $250,000 and strong Silicon Valley connections just to participate.

IPO Genie $IPO changes that model.

It uses AI to find pre-IPO deals and allows qualified investors to join with lower minimums, starting around $2,500.

This makes it interesting for presale crypto for retail investors who want structured access instead of speculation.

Media Coverage and Analyst Commentary

IPO Genie has caught attention in crypto media. Coindoo highlighted it as a potential hidden gem presale for 2026, and analysts like Michael Wrubel and Heavy Crypto discussed its approach to private market access and community participation. While media coverage increases visibility, it is not a financial endorsement. Always do your own research before investing.

What the analyst says about IPO Genie – Michael Wrubel & Heavy Crypto

Media coverage increases visibility but is not financial endorsement. Always do your own research.

The Tier System And Tokenomics Makes Sense

IPO Genie offers four access levels. Higher tiers may receive larger allocations and added benefits.

IPO Genie structures access in four levels: screenshot of tier system and tokenomics

Here is how it works:

AI agents scan for companies raising Series A or B rounds. When a deal appears, eligible users receive research and structured details.

Half of the token supply goes to presale participants. Team tokens are locked for two years and then vest gradually.

That reduces early dumping risk.

For investors looking at new presale crypto, vesting structure matters more than hype.

DeepSnitch AI: Market Intelligence That Actually Works

DeepSnitch AI focuses on scam detection and risk monitoring.

Instead of chasing moonshots, it helps users avoid bad tokens. Tools like SnitchFeed and SnitchScan track wallets, analyze contracts, and flag unusual activity.

Think of it as a crypto risk dashboard.

The project reports early fundraising of over $1.6 million. It later reached $0.03985, around 160% above its starting price. Instead of rushing to exchanges, the team gives presale users early platform access.

As regulation increases, verification tools may become more valuable.

For your reference: Financial Innovation and Technology for the 21st Century Act

Nexchain: Building Better Blockchain Plumbing

Infrastructure projects are not flashy. But they matter.

Nexchain aims to increase transaction speed while lowering costs. Many networks still process only 15 to 30 transactions per second. That is far below traditional systems.

If infrastructure scales, applications follow. Games, payments, and business tools all depend on fast networks.

For presale crypto for retail investors, infrastructure plays are higher risk. Adoption takes time. Developer support decides success.

Nexchain tokenomics snapshot

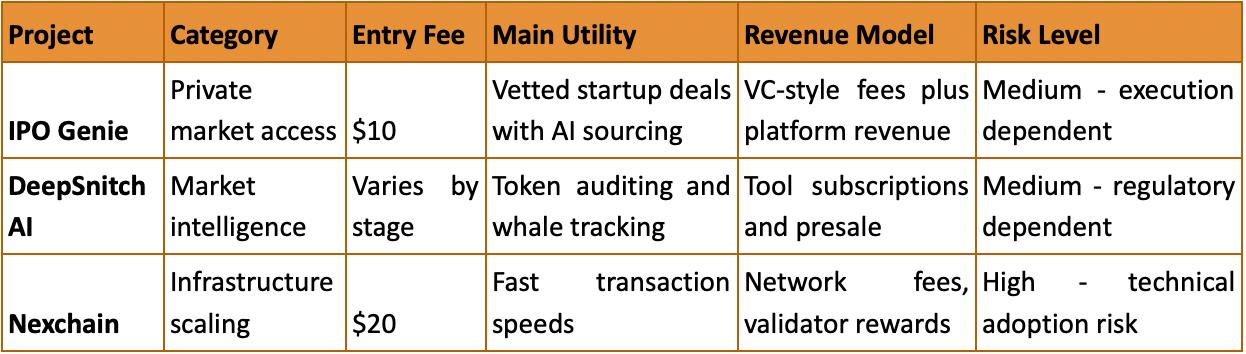

Comparing Projects Side by Side

Each project tackles a different problem for different users. IPO Genie serves investors wanting deal access. DeepSnitch AI helps traders avoid scams. Nexchain builds for developers needing better infrastructure.

When evaluating a crypto presale to buy now, match the project to your thesis.

Token Economics That Prevent Disasters

Here’s why most decisions to buy crypto during presales fail: teams design tokenomics that encourage dumping.

Early investors buy cheap. No vesting schedules lock their tokens. The day it hits exchanges, they sell everything. Price crashes. Retail gets wrecked.

What Smarter Projects Do

- Lock team tokens

- Use vesting schedules

- Add revenue sharing

- Focus on real utility

- Reduce supply over time

Strong tokenomics do not guarantee success. But weak tokenomics most definitely guarantees problems.

New Presale Crypto Comes With Risks

Presale crypto can be exciting but risky. Here’s what to watch out for:

- Market swings: Prices can drop fast.

- Team issues: Deadlines and promises may fail.

- Hard to sell: Tokens may be locked or have low liquidity.

- Rules can change: Laws are still evolving.

- Pick wisely: Real products and users are safer than hype.

Due Diligence Checklist Before Investing

Don’t skip these steps:

Before joining a presale or smart contract fundraising, do your homework. Check the team’s social media, blogs, articles etc., to make sure they really have the experience they claim.

Read the audit report to see if smart contracts were reviewed and fixed.

Join community channels, real projects have users asking questions, not just hype.

Verify any partnerships on the partner’s channels.

Understand token allocation: how much goes to the team, when it unlocks, and how much stays with presale versus later rounds.

Taking the time now helps avoid big losses later.

Final Take on 2026 Presales

The market grew. Projects raising millions of vibes alone are done. What survived are teams building real solutions to actual problems.

- IPO Genie democratizes venture capital access that was locked behind wealth barriers.

- DeepSnitch AI provides intelligence tools for navigating scam-filled markets.

- Nexchain tackles infrastructure bottlenecks limiting mainstream adoption.

Surely they are attacking genuine problems with structured approaches and transparent operations.

But..

None of them guarantees returns. All face execution challenges, market volatility, and regulatory hurdles. For presale crypto for retail investors, the key question in 2026 is simple

Which teams can execute while regulations evolve and markets fluctuate?

Answer that honestly, invest amounts you can afford to lose, and you’ll navigate presales with clarity instead of regret.

Frequently Asked Question

What Is the CLARITY Bill?

The CLARITY Act is a proposed U.S. crypto regulation framework. It aims to define which agency regulates which type of digital asset.

The CFTC would oversee most crypto markets.

The SEC would regulate digital assets that function like securities.

Clear rules reduce confusion for projects and investors.

How will the CLARITY Bill affect crypto projects?

Clearer rules may attract institutional capital. Projects that follow compliance standards, such as KYC and licensing, may face fewer regulatory risks.

Projects without structure could face shutdowns or legal pressure.

In 2026, compliance may separate serious projects from short-term speculation.

For investors seeking top presales in 2026, IPO Genie illustrates how AI-driven, structured access could uncover early-stage opportunities with strong growth potential.

Official Channels:

IPO Genie Presale Link | Telegram | X – Community

This publication is sponsored and written by a third party. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page. Readers are encouraged to conduct their own research before engaging in any cryptocurrency-related actions. Coindoo will not be liable, directly or indirectly, for any damages or losses resulting from the use of or reliance on any content, goods, or services mentioned.