Solana Holds $127 as ETFs Attract Inflows, But Zero Knowledge Proof’s Daily Price Discovery System Dominates Market Attention!

See how Solana holds near $127 as ETF inflows defy a broader market crash, while ZKP’s daily price dynamics and participation system make it the best crypto to buy now.

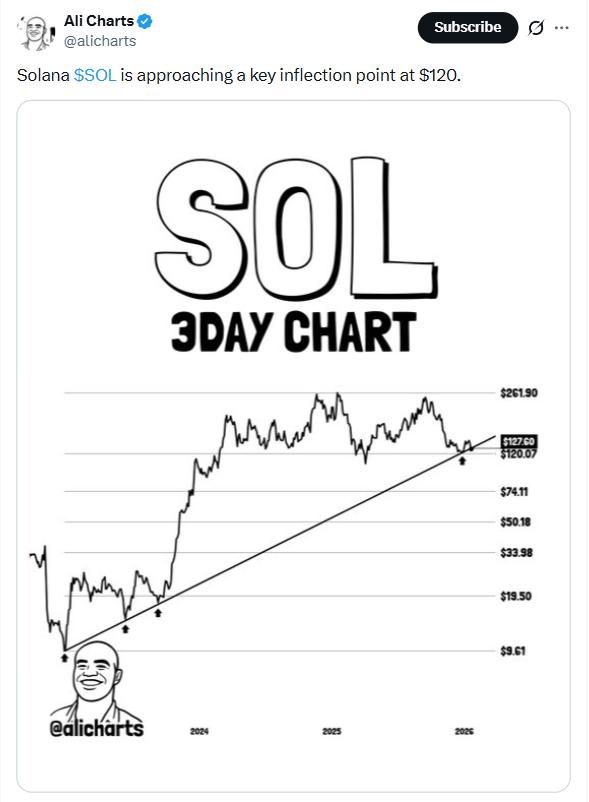

At the time of writing Solana (SOL) is trading around $127, down nearly 11% on the week, after a sharp sell-off across global risk assets erased more than $120 billion from the total crypto market. The move effectively ended SOL’s near-term attempt to reclaim the $150 level, but investor behaviour suggests conviction has not collapsed despite the drawdown.

At the same time, attention is shifting toward Zero Knowledge Proof (ZKP) for structural reasons. ZKP is being evaluated through how its daily participation framework directly determines price formation and allocation, replacing speculative discovery with a system where outcomes emerge from real on-chain activity.

SOL ETFs Buck the Trend as Capital Rotates Out of Bitcoin

One of the most notable developments during the sell-off was Solana’s relative strength in exchange-traded products. Solana spot ETFs recorded $3.08 million in net inflows during a period when most digital assets saw aggressive outflows.

This stands in sharp contrast to Bitcoin, which experienced $483 million in net ETF outflows as investors de-risked amid macro uncertainty. Ethereum and most large-cap assets followed a similar pattern, reinforcing the significance of SOL’s divergence.

From a market structure perspective, this matters because ETF flows tend to reflect institutional positioning rather than retail sentiment.

Why Solana’s On-Chain Activity Remains Resilient

The current on-chain metrics support the ETF narrative. Despite the sell-off, Solana’s network activity has remained remarkably stable.

According to the data:

- Solana added 8.6 million new addresses

- Followed by 8.4 million, a decline of just 2.38%

This level of consistency during a broad market drawdown is significant. New address creation typically reflects real usage and incoming demand, not short-term speculation. The fact that address growth barely moved suggests that user engagement has not meaningfully rolled over.

Key technical levels to watch:

- $125: Primary support, now structurally important

- $132: First resistance, reclaim needed for trend stabilisation

- $136: Breakout zone for a partial retrace

- $119: Downside target if $125 fails

A sustained move back above $132 would strengthen the bullish recovery case.

What is Zero Knowledge Proof?

ZKP is an infrastructure-focused blockchain designed to enable verifiable computation at scale. Its architecture allows complex workloads to be executed and validated on-chain with cryptographic correctness, making it suitable for applications where results must be provably accurate without relying on centralised trust.

Presale Auction Participation Decides ZKP’s Price Each Day

Zero Knowledge Proof operates on a fundamentally different pricing mechanism. ZKP does not rely on order books, liquidity pools, or speculative bidding to determine early price levels. Instead, price formation is driven directly by daily participation dynamics.

Each day, ZKP opens a new on-chain presale auction window. A fixed supply is distributed for that day, and each participant’s allocation is calculated proportionally based on their contribution relative to the total activity for that window.

This creates a pricing system where:

- There is no fixed entry price

- Outcomes depend on real participation, not timing

- Daily resets prevent carryover advantages

- Allocation is transparent and verifiable on-chain

In simple terms, ZKP’s price each day is not discovered through trading, but emerges organically from collective participation behaviour.

What This Means for Early Buyers

Zero Knowledge Proof’s dynamic pricing model has important implications for early participants. ZKP rewards relative engagement within each daily cycle.

For buyers, this introduces a different form of market logic:

- Early phases operate under lower participation density

- Allocation is driven by activity, not speculation

- There is no structural advantage for whales or private rounds

- Daily resets ensure equal conditions across time

As participation increases over time, competition naturally rises, and later entrants face tighter allocation conditions. This makes early involvement a function of network discovery rather than marketing hype.

The Bottom Line

Solana’s current setup reflects a market where institutional interest and real usage are diverging from short-term price weakness. ETF inflows during a broad market crash, combined with stable on-chain growth, suggest that SOL retains structural support even as macro conditions remain fragile.

ZKP represents a different type of opportunity altogether. Its daily presale coin price dynamics remove traditional speculative mechanics and replace them with a participation-driven allocation system. Instead of trading volatility, early buyers are positioning around structural scarcity and transparent distribution logic.

Explore Zero Knowledge Proof:

Website: https://zkp.com/

Auction: http://buy.zkp.com/

Telegram: https://t.me/ZKPofficial

FAQs

- Why is Solana holding up despite the market sell-off?

ETF inflows and stable on-chain activity suggest continued institutional interest and real network usage, even as prices correct.

- How does ZKP’s pricing model work?

ZKP’s price is determined daily through on-chain participation, with allocations calculated proportionally based on total activity each day.

- Why does early participation matter for ZKP buyers?

Early phases operate under lower participation density, meaning allocation conditions become more competitive as network awareness grows.

This publication is sponsored and written by a third party. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page. Readers are encouraged to conduct their own research before engaging in any cryptocurrency-related actions. Coindoo will not be liable, directly or indirectly, for any damages or losses resulting from the use of or reliance on any content, goods, or services mentioned.