Prediction Markets Drive DEX Activity to Record High

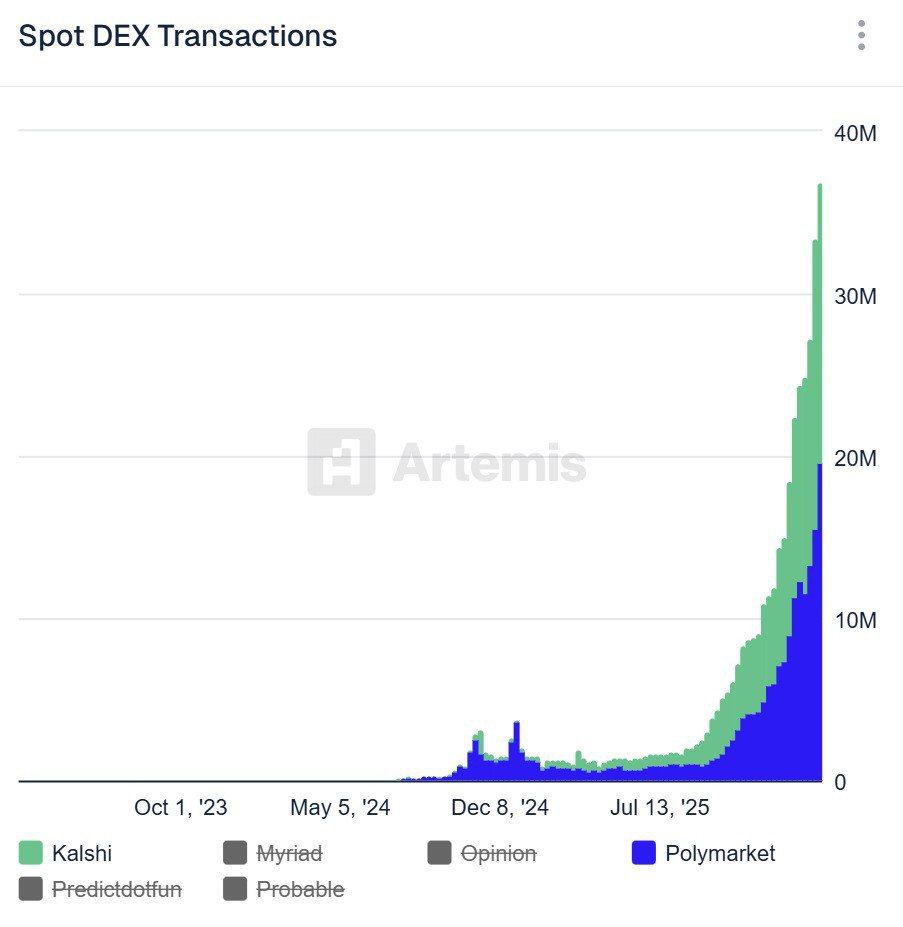

Weekly activity across spot decentralized exchanges has reached a historic peak, with 38.1 million transactions recorded over the past seven days.

Key Takeaways

- Weekly DEX transactions hit a record 38.1 million, driven largely by prediction markets.

- Polymarket led activity, slightly ahead of Kalshi.

- Volumes have surged more than 130x since 2024.

- POLY token and major airdrop officially confirmed.

- A dedicated blockchain launch is increasingly expected.

More than half of that traffic came from prediction markets, underscoring how event-based trading has become one of the fastest-growing corners of crypto.

At the center of the surge is Polymarket, which logged 19.6 million weekly transactions by mid-February 2026, edging ahead of rival Kalshi at 17.4 million. The milestone highlights an intensifying battle between the two largest names in the prediction economy.

Record-Breaking Week for Prediction Markets

Transaction growth has accelerated sharply. Combined activity across leading platforms helped push weekly DEX transactions to an all-time high of 38.1 million, signaling that event-driven speculation is now a dominant on-chain force rather than a niche segment.

Since early 2024, trading volumes across major prediction markets have expanded more than 130-fold, surpassing $13 billion as markets broadened from political elections into sports, macroeconomic policy decisions, and major global events. In November 2025 alone, the sector recorded nearly $10 billion in monthly turnover – at the time its strongest performance on record.

Institutional Capital Fuels the Battle

Capital inflows have mirrored user growth. Polymarket secured backing from the Intercontinental Exchange at a $9 billion valuation in late 2025, while Kalshi closed a $1 billion Series E round that lifted its valuation to $11 billion. The scale of these investments signals rising institutional confidence in event-based financial markets.

Polymarket re-entered the U.S. market in November 2025 after acquiring QCEX, a CFTC-regulated derivatives exchange, giving it the federal framework needed to operate domestically. Kalshi, already established in the U.S., expanded retail access through integration with Robinhood, tapping into more than 27 million funded accounts.

At the same time, Polymarket strengthened its visibility through a strategic partnership with X, becoming the platform’s official prediction market partner.

Different Trading Styles, Different Users

Market structure data shows clear behavioral contrasts. Kalshi tends to see higher turnover and more frequent trades, reflecting short-term positioning. Polymarket users, by comparison, often hold longer-dated contracts, resulting in relatively stronger open interest dynamics.

Polymarket has officially confirmed plans to launch a native token, tentatively tickered POLY, alongside a large-scale community airdrop aimed at decentralizing the platform. Early projections suggest between 5% and 10% of total token supply could be distributed to users, with some analyst estimates valuing the allocation pool at up to $750 million.

Eligibility is expected to reward active trading volume, consistent participation, and engagement across multiple categories, though the official snapshot date remains undisclosed.

Could a Dedicated Blockchain Be Next?

Trademark filings and developer signals suggest the platform may eventually launch its own dedicated blockchain network – either a Layer 2 or full Layer 1 – designed to optimize settlement speed, reduce fees, and handle surging transaction volumes. Early 2026 trading alone has already surpassed $4.9 billion.

Despite federal progress, regulatory friction remains in certain states, including Nevada and Massachusetts, where prediction markets face scrutiny under gambling frameworks. However, broader federal approval and political support have strengthened the industry’s overall footing.

With record-breaking transactions, billion-dollar valuations, a token launch on the horizon, and potential blockchain expansion, prediction markets are rapidly evolving into one of crypto’s most competitive and strategically important sectors.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.