Nvidia Stock: AI Supercycle Faces Its Biggest Test This Week

Nvidia is entering one of the most ambitious growth phases in its history — and the stock market can’t decide whether to celebrate or panic.

Key Takeaways:

- Nvidia has already booked around $500B in chip orders for 2025–2026

- Stock is trading lower despite strong fundamentals

- Major investors recently exited NVDA positions

- New NVLink partnership aims to boost AI and supercomputing performance

- January earnings guidance now seen as a critical market trigger

The chipmaker revealed in October that it already has $500 billion worth of booked orders for 2025–2026, covering its current Blackwell GPUs and next year’s Rubin architecture, along with networking components essential for large-scale AI infrastructure. That massive pipeline has analysts expecting another year of explosive sales, despite concerns that AI demand might be peaking.

The company’s CEO has made it clear that Nvidia isn’t slowing down. After nearly 600% revenue growth in just four years, the booked-sales figure signals that the next cycle of AI computing still has “room to run,” and analysts now interpret the commentary as pointing toward meaningfully stronger revenue in 2026 than Wall Street previously projected.

All Eyes on Wednesday’s Earnings – A Market-Defining Moment

The tension now shifts to Nvidia’s Q3 earnings report this Wednesday, which is widely viewed as the most important earnings announcement of the quarter — and possibly of the year. Analysts surveyed by LSEG expect $1.25 earnings per share on $54.9 billion in revenue, representing a 56% jump from last year. Forward guidance is expected to come in around $61.44 billion for the January quarter, and whether the company confirms or beats that figure could set the tone for the next phase of the AI trade.

This isn’t just another tech earnings event — it has become a sentiment benchmark for the entire market. Nvidia sits at the heart of the AI boom, and its results will heavily influence how investors position themselves in 2025: either doubling down on AI-linked equities or shifting away from the most crowded trade in the S&P 500. A strong beat paired with bullish guidance could reignite risk appetite across markets, while even a small miss — or softer tone — could trigger broader risk-off positioning, given how tightly Nvidia’s valuation is intertwined with U.S. stock performance.

Investors Rotate Out Despite Fundamental Strength

Despite the exceptional outlook, Nvidia shares have struggled in recent sessions, slipping nearly 2% to $186.60 and showing more weakness in pre-market trading near $184.66. The pullback comes as several well-known investors and institutions — including SoftBank and Peter Thiel — have recently exited their positions. Separately, Nvidia now represents roughly 8% of the entire S&P 500 index, amplifying market-wide sensitivity to any movements in the stock.

Technical indicators are also adding pressure. On the daily chart, RSI has fallen to 46, signaling cooling momentum, while MACD has crossed bearish, hinting at a continuation of short-term selling.

A New Partnership Signals the Next Phase of AI Compute

At the Supercomputing Conference in Denver, Nvidia unveiled NVQLink — the first universal interconnect for hybrid quantum-classical systems. The rollout includes a new NVLink Fusion partnership with Arm, enabling bandwidth of up to 1.8 TB/s between Arm CPUs and Nvidia GPUs — a major leap for supercomputing in fields like drug discovery, materials science, and climate research.

Our partnership with @NVIDIA keeps growing. 🤝

By extending Arm Neoverse with NVIDIA NVLink Fusion, we’re enabling partners to achieve Grace Blackwell-class performance, bandwidth, and efficiency — delivering greater intelligence per watt for the AI era.https://t.co/LD3w2kzCQy pic.twitter.com/FRxvXXP9or

— Arm (@Arm) November 17, 2025

More than a dozen global research centers are already adopting the upgraded architecture, reinforcing the sense that Nvidia’s AI dominance is expanding beyond corporate data centers and into scientific supercomputing.

A Scale Never Seen Before in Tech — Raising Big Questions

Even with the company breaking technical and commercial records, some fund managers warn that Nvidia’s valuation has entered unprecedented territory.

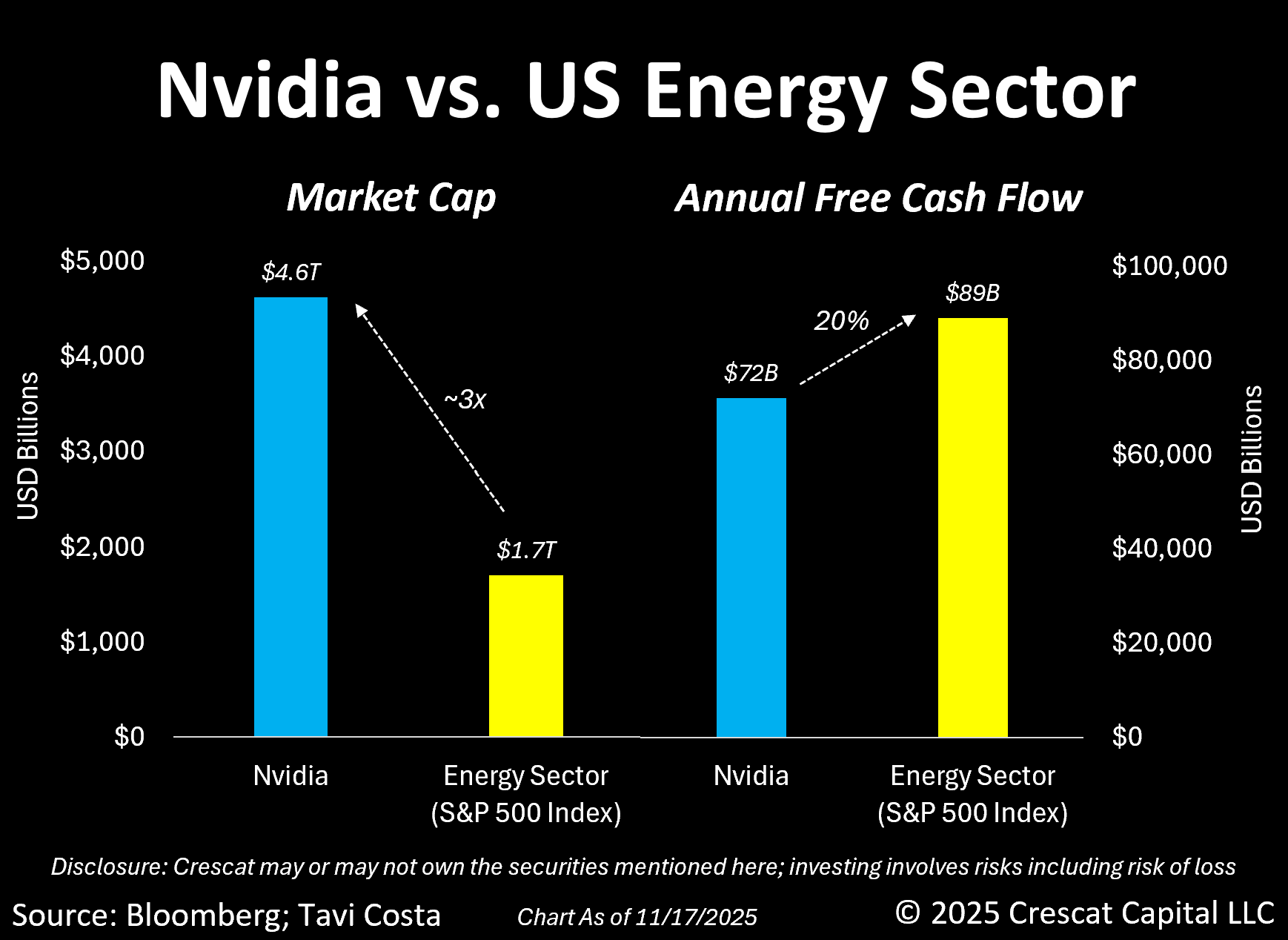

The entire U.S. energy sector — composed of dozens of public companies — is now valued at barely one-third of Nvidia’s market cap, and its annual free cash flow still exceeds Nvidia’s by around 20%.

Critics argue that while AI innovation is transformative, energy is the foundation powering that innovation — a reminder of how concentrated capital has become in a single tech winner.

The Road Ahead

With half-a-trillion dollars in advance orders, next-generation GPUs lined up for production, and scientific institutions rapidly integrating its interconnect technology, Nvidia appears primed for years of elevated demand.

But the stock’s latest retreat — despite flawless fundamentals — shows that expectations are so high that even “great” might not be enough to keep investors comfortable. Earnings guidance in January could decide whether Nvidia’s momentum narrative regains control or whether profit-taking becomes the dominant force.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.