Mystery Hong Kong Firm Reveals $436M Bet on BlackRock’s Bitcoin ETF

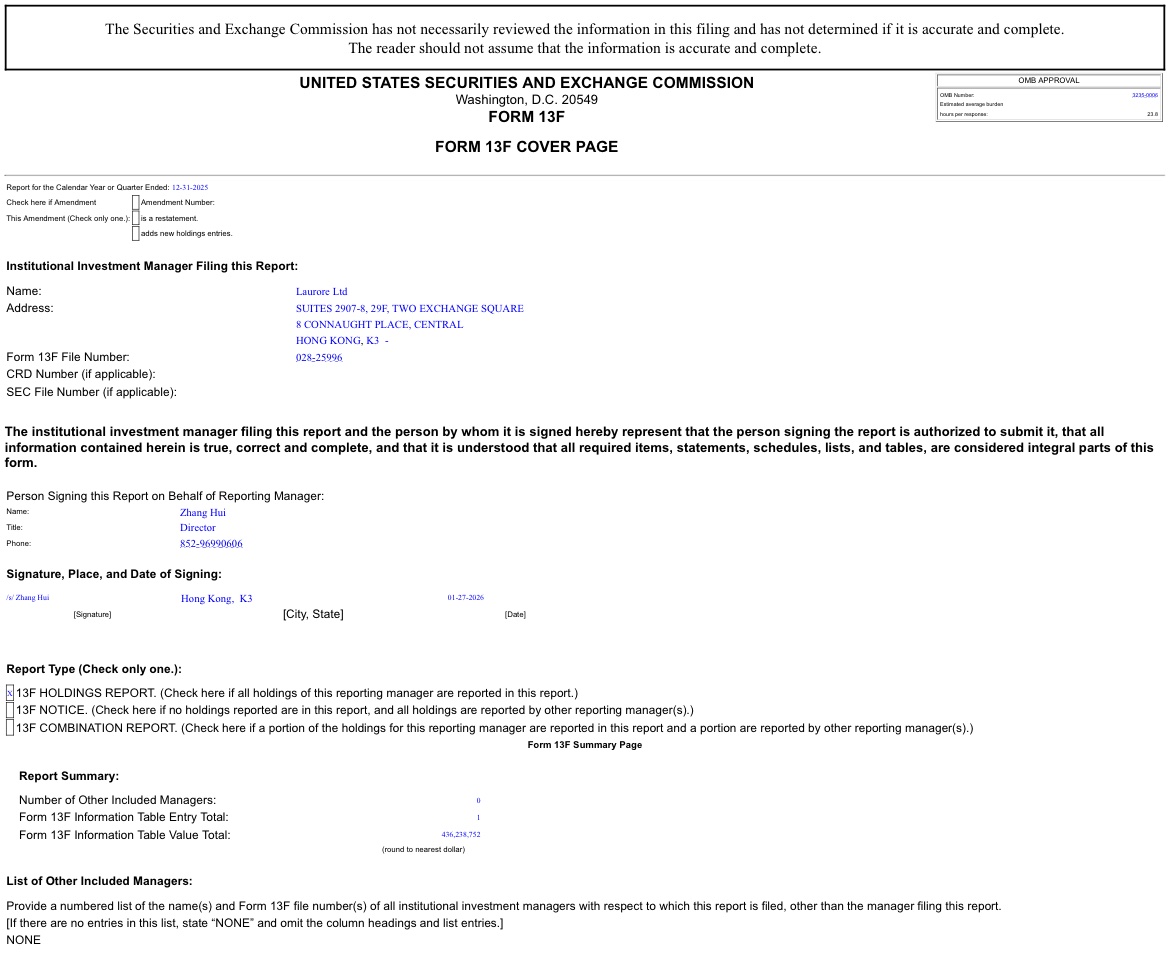

A previously unknown Hong Kong-based firm has surfaced as the largest new institutional investor in BlackRock’s iShares Bitcoin Trust (IBIT), according to a newly filed SEC Form 13F for the quarter ending December 31, 2025.

Key Takeaways

- Laurore Ltd. revealed a $436M stake in BlackRock’s IBIT, becoming the largest new shareholder in Q4 2025.

- The firm listed IBIT as its only holding, pointing to a dedicated Bitcoin exposure vehicle.

- Major institutions added shares despite a 23% BTC drop, showing strong conviction.

- Sovereign wealth funds and large players are consolidating ownership of the ETF.

Laurore Ltd. disclosed ownership of 8,786,279 shares of IBIT, valued at approximately $436.2 million at the end of Q4. Notably, the filing shows IBIT as the firm’s only reported holding, suggesting the entity may function as a dedicated vehicle for Bitcoin exposure rather than a diversified investment company.

The filing was signed by Zhang Hui and lists the company’s address at Two Exchange Square in Central, Hong Kong. Beyond that, little is publicly known about the firm.

A “Ghost” Investor Sparks Speculation

The scale of the position and the lack of public footprint have raised eyebrows across the market. Laurore Ltd. has no visible website, no media presence, and no prior investment disclosures.

Some market observers believe the structure points to an offshore setup, potentially using Cayman Islands or British Virgin Islands entities to access U.S.-listed ETFs. Others speculate the vehicle could represent capital from mainland China seeking regulated Bitcoin exposure through U.S. markets despite domestic restrictions.

While early chatter linked the position to Bitcoin’s sharp October 2025 price drop, further analysis suggests the shares were likely accumulated after that correction, during the fourth quarter recovery phase.

Institutional Conviction Remains Strong Despite Price Drop

Laurore’s entry comes during a turbulent quarter. Bitcoin fell roughly 23% in Q4 2025, yet large institutions largely held their ground or added exposure.

Millennium Management increased its IBIT stake by more than 67%, maintaining its position as the largest overall holder. Jane Street boosted its holdings by over 50%, bringing its total to more than 20 million shares. Analysts suggest that position likely reflects market-making and volatility management strategies rather than outright directional bets.

Sovereign wealth capital also deepened its footprint. Abu Dhabi-linked Mubadala expanded its position by more than 45%, contributing to combined holdings exceeding $1 billion by year-end – a strong signal that some state-backed investors view Bitcoin as a long-term strategic asset.

Rotation, Not Retreat

Not every major institution added exposure. Harvard Management reduced its IBIT stake by about 21% but simultaneously initiated a new $87 million position in BlackRock’s Ethereum ETF, signaling portfolio diversification rather than a full exit from digital assets.

Meanwhile, Goldman Sachs and JPMorgan trimmed their direct ETF holdings during the quarter, scaling back exposure amid heightened volatility.

Still, ownership appears to be concentrating. While several smaller firms exited positions entirely, 17 of the top 25 IBIT holders increased their stakes, reinforcing a trend toward consolidation among high-conviction institutional players.

The arrival of Laurore Ltd. adds a new layer of intrigue to that trend. Whether it represents discreet sovereign capital, offshore private wealth, or strategic Chinese money seeking exposure abroad, its nearly half-billion-dollar allocation underscores a broader theme: despite volatility, institutional appetite for regulated Bitcoin exposure remains firmly intact.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.