Long-Term Bitcoin Holders May Be Done Selling – Here’s What the Data Shows

Bitcoin’s long-term holder behavior appears to be changing direction after months of steady distribution, challenging the dominant narrative that seasoned investors are still aggressively selling.

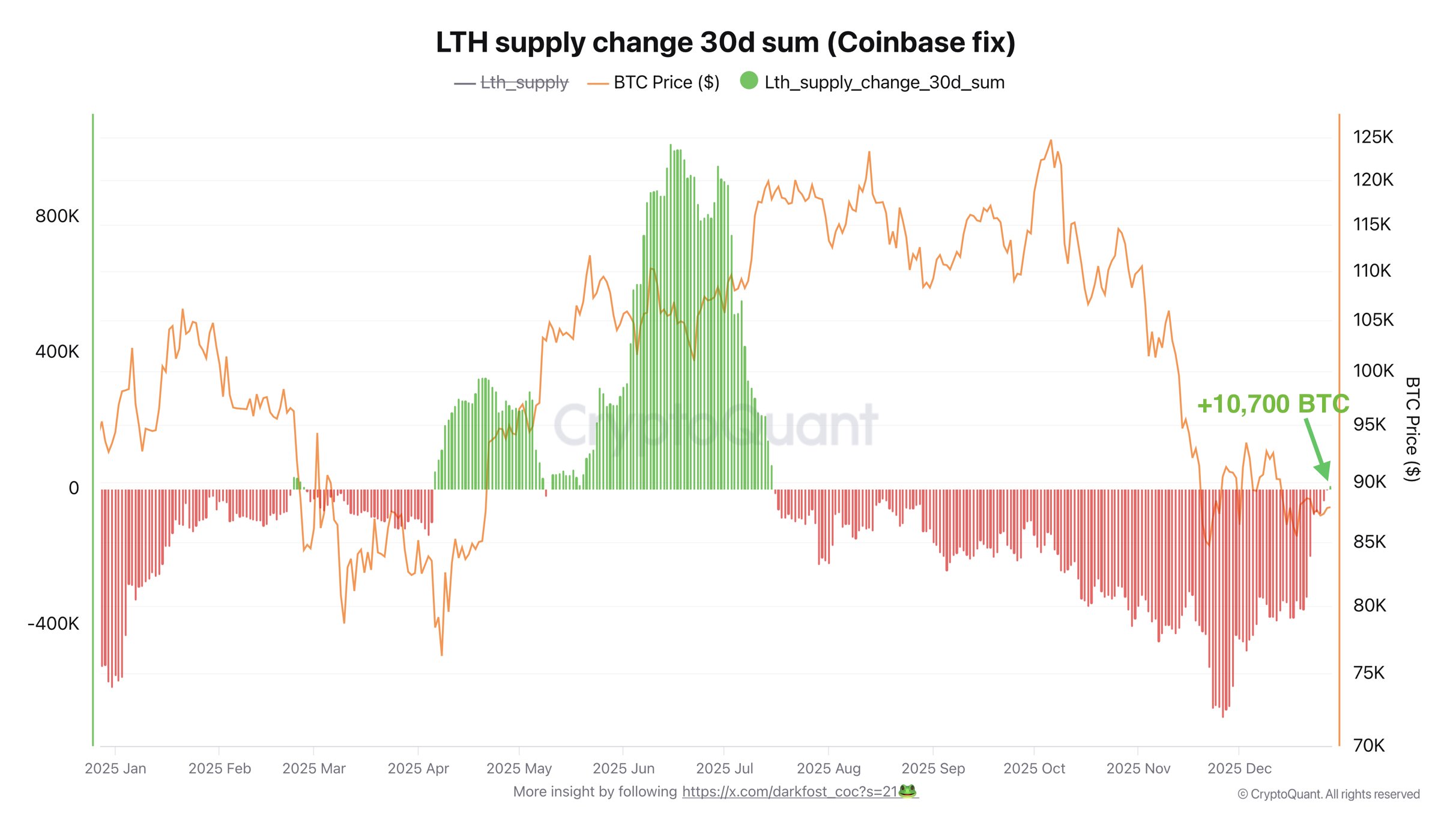

Fresh on-chain analysis suggests that the supply held by long-term holders (LTHs) has begun to grow again, marking a potential inflection point in Bitcoin’s current market phase.

- Long-term Bitcoin holders appear to have reduced selling pressure.

- Adjusted data shows LTH supply turning positive for the first time in months.

- Around 10,700 BTC has shifted back into long-term holding status.

- Historically, similar shifts have preceded consolidation or recovery phases.

According to an analysis shared by Darkfost, earlier conclusions about heavy LTH selling were partially skewed by a large movement of roughly 800,000 BTC linked to Coinbase. Once that distortion was filtered out, a clearer picture of underlying supply dynamics emerged.

Long-term holders, defined as wallets holding BTC for more than six months, had been consistently reducing their share of total supply since mid-July. That trend reflected a prolonged distribution phase, often associated with late-cycle conditions or market uncertainty.

First Positive LTH Supply Shift Since July

That pattern has now shifted. The 30-day net change in long-term holder supply has flipped back into positive territory, with approximately 10,700 BTC transitioning from short-term to long-term status.

While the size of the move remains relatively small, it represents a meaningful change in behavior. Rather than continuing to offload coins into the market, long-term holders appear to be easing off selling pressure and beginning to rebuild positions.

At the same time, short-term holders have largely held onto their Bitcoin, allowing supply to migrate back toward longer holding cohorts.

Why This Matters for Bitcoin’s Market Structure

Historically, periods when long-term holder supply stabilizes or starts rising again have often coincided with the formation of consolidation ranges. In some cases, these transitions have also preceded broader bullish recoveries, depending on macro conditions and follow-through demand.

This does not guarantee an immediate price breakout. However, it does suggest that forced selling from long-term participants may be fading – a structural shift that can quietly improve Bitcoin’s downside resilience.

A Subtle Signal, Not a Market Call

The current increase in LTH supply is still modest and should not be viewed as a definitive trend reversal on its own. But it does signal a potential cooling in distribution behavior at a time when sentiment remains fragile and price action subdued.

If accumulation continues and expands over the coming weeks, it could strengthen the case that Bitcoin is transitioning out of a distribution-heavy phase and into a more balanced market structure.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.