Is Stellar About to Explode or Collapse? All Eyes on $0.40 as Major Upgrade Approaches

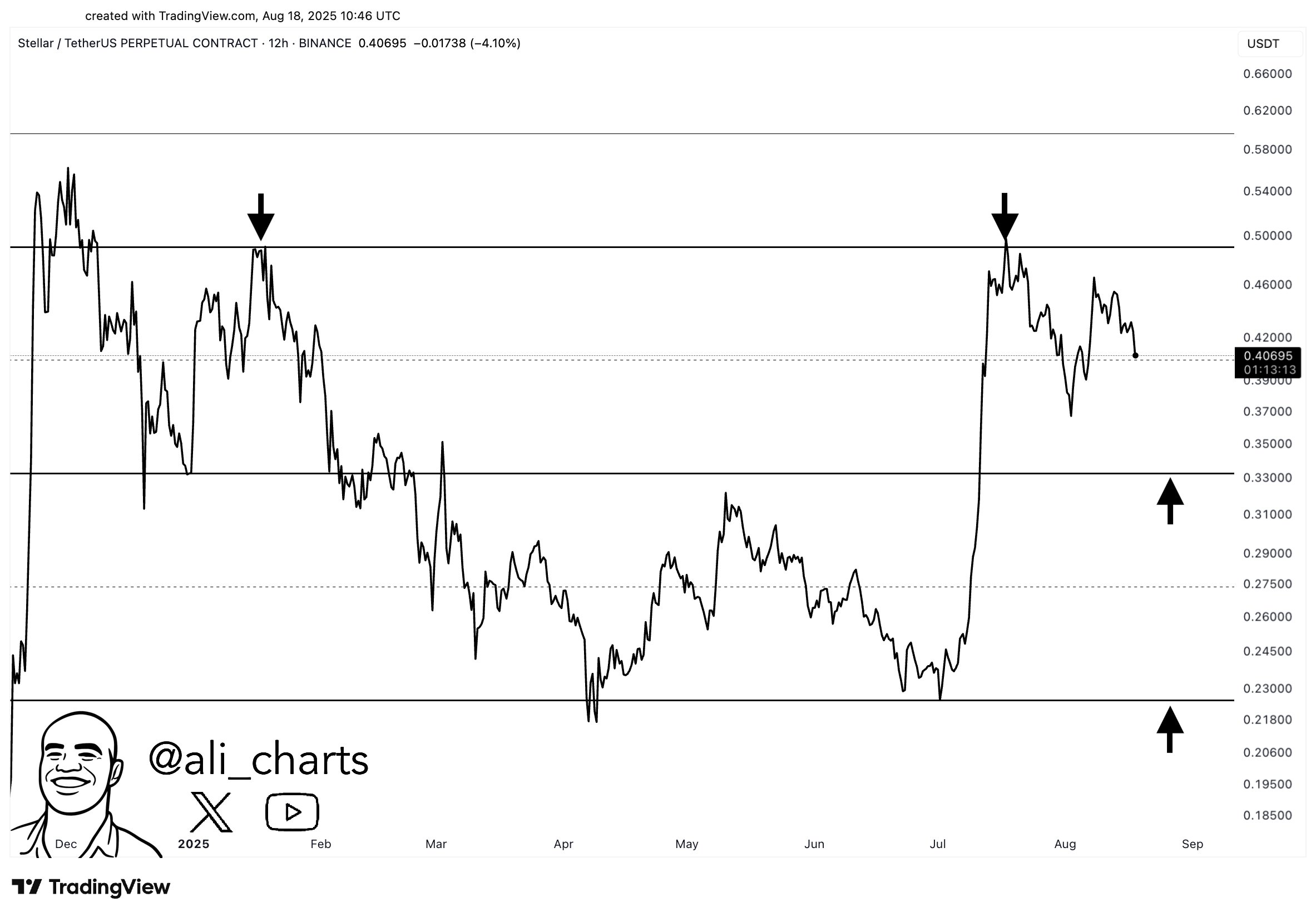

Stellar (XLM) is struggling to hold above the $0.40 level after dropping nearly 8% in the past week, with analysts pointing to strong resistance at $0.42 and downside risk toward $0.33 if bearish momentum continues.

The weakness comes as the Stellar Development Foundation prepares to activate Protocol 23 on mainnet in Q3 2025 – an upgrade that could significantly improve network scalability.

Protocol 23: A Turning Point for Stellar

The highly anticipated Protocol 23 introduces parallel execution for Soroban smart contracts, a feature that early tests show can raise transaction throughput from 1,000 to 5,000 transactions per second. This performance leap is crucial for Stellar’s ambitions in decentralized finance (DeFi), where it competes with faster networks like Ethereum and Solana.

Stellar’s DeFi ecosystem has already grown rapidly, with total value locked (TVL) surging 11x since 2024 to $122 million, according to DeFiLlama. Historically, major upgrades such as 2021’s Protocol 18 have fueled XLM rallies of 30% to 80%, raising hopes that Protocol 23 could drive a similar breakout.

Real-World Asset Tokenization: Promise and Pressure

Another driver for Stellar is its role in the expanding real-world asset (RWA) sector, now valued at $26 billion. Partnerships with Archax and Aberdeen have brought tokenization of a $7.3 billion money market fund onto Stellar, while Franklin Templeton has already launched a $445 million tokenized treasury.

READ MORE:

Millions Are Mining Pi Network on Their Phones: Price Crash Becomes a Warning to Investors

Still, Ethereum dominates the space with 58% of non-stablecoin RWA activity, making it difficult for Stellar to capture meaningful market share. Sector-wide, RWA tokens have underperformed compared to AI and DeFi plays, dragging on momentum.

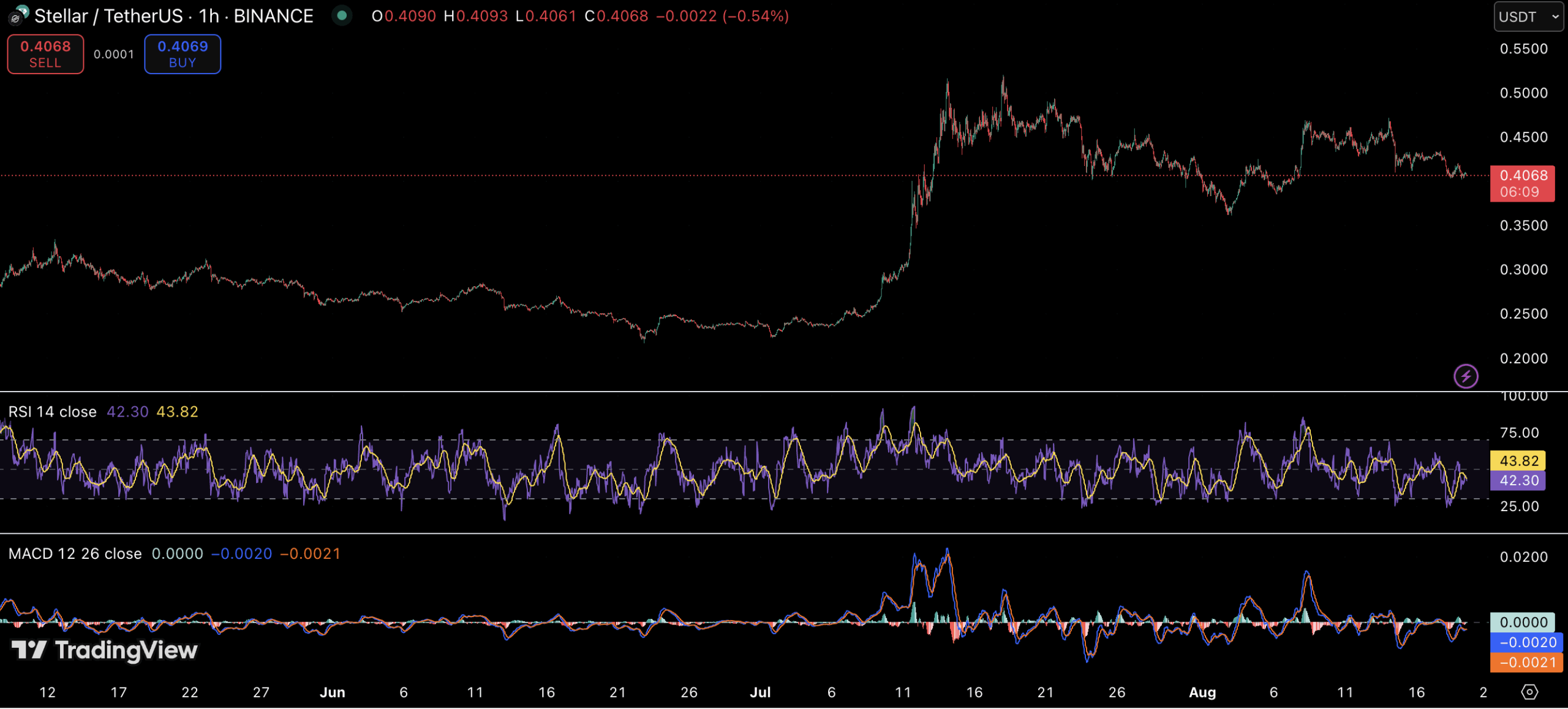

Technical Weakness Raises Caution

On the technical front, Stellar’s chart reflects short-term bearish signals. RSI levels hover near 40, suggesting oversold conditions, while derivatives data shows negative funding rates (-0.009%) and $700K in long liquidations recorded on August 18.

The presence of a death cross between the 9-day and 21-day SMAs adds further downside risk. If XLM fails to hold $0.378, a Fibonacci retracement level, traders warn of potential panic selling similar to May’s 12% plunge below $0.30.

Outlook: Scalability vs. Market Headwinds

XLM’s near-term direction depends on whether buyers can reclaim the $0.42 resistance. Success in Q3 may hinge on institutional inflows into tokenized assets offsetting retail selling pressure.

If Protocol 23 delivers on its scalability promises and institutional adoption grows, Stellar could regain momentum. But if bearish technicals prevail, the path toward $0.33 or even $0.22 support levels, highlighted by analysts, remains a real risk.

The information provided in this article is for informational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.