Ethena (ENA) Holds Above $0.55 as Analysts Highlight Key Support Levels

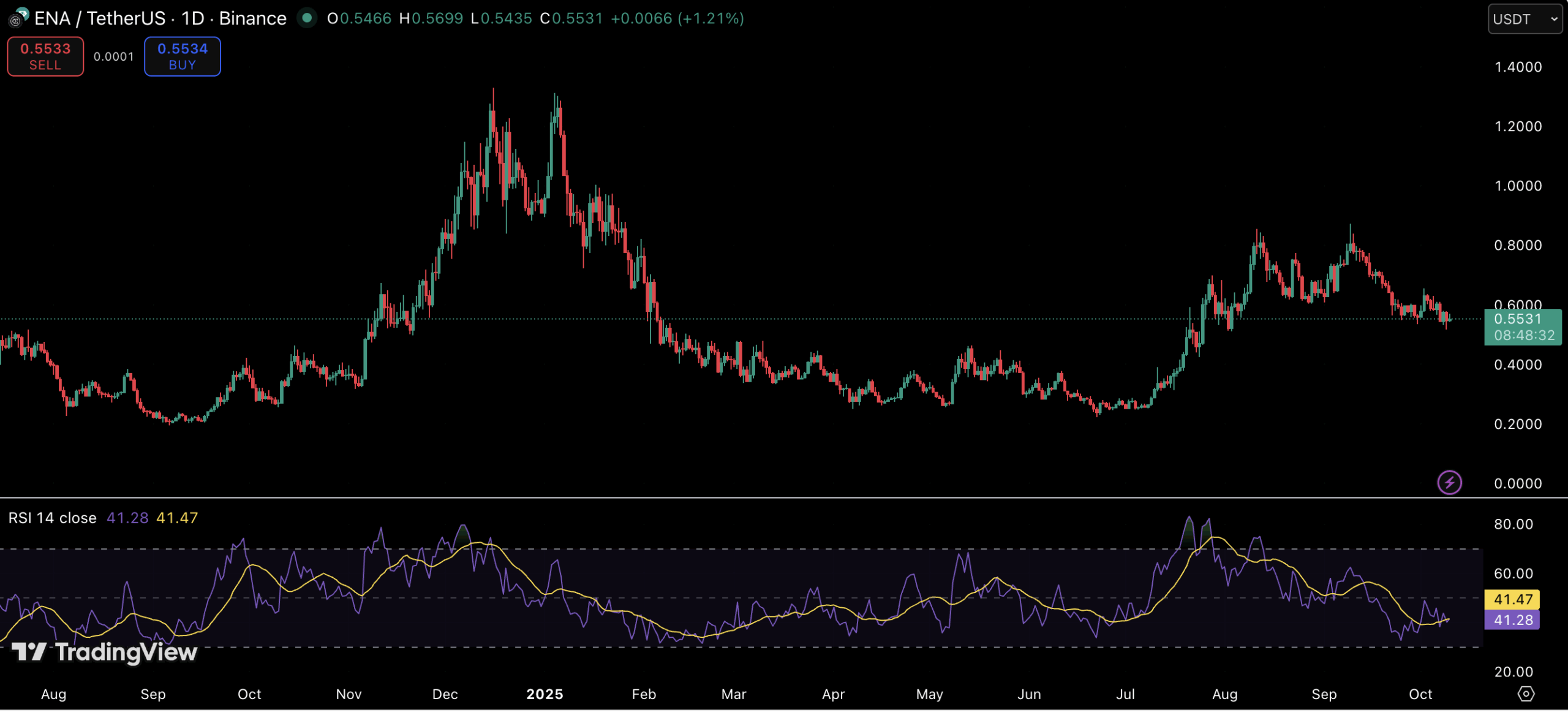

Ethena (ENA) is showing signs of stabilization after recent volatility, with the token trading near $0.55 on Binance.

Despite a modest 1.2% daily uptick, technical signals suggest that the asset is hovering at a crucial juncture between support and resistance zones.

Over the past few months, ENA has struggled to sustain its mid-summer momentum, retreating from highs near $0.80 to its current consolidation range. The daily chart reveals that sellers have maintained pressure below $0.60, while buyers are attempting to defend the $0.50 region – an area that has repeatedly acted as short-term support since late September.

Key Levels from On-Chain Data

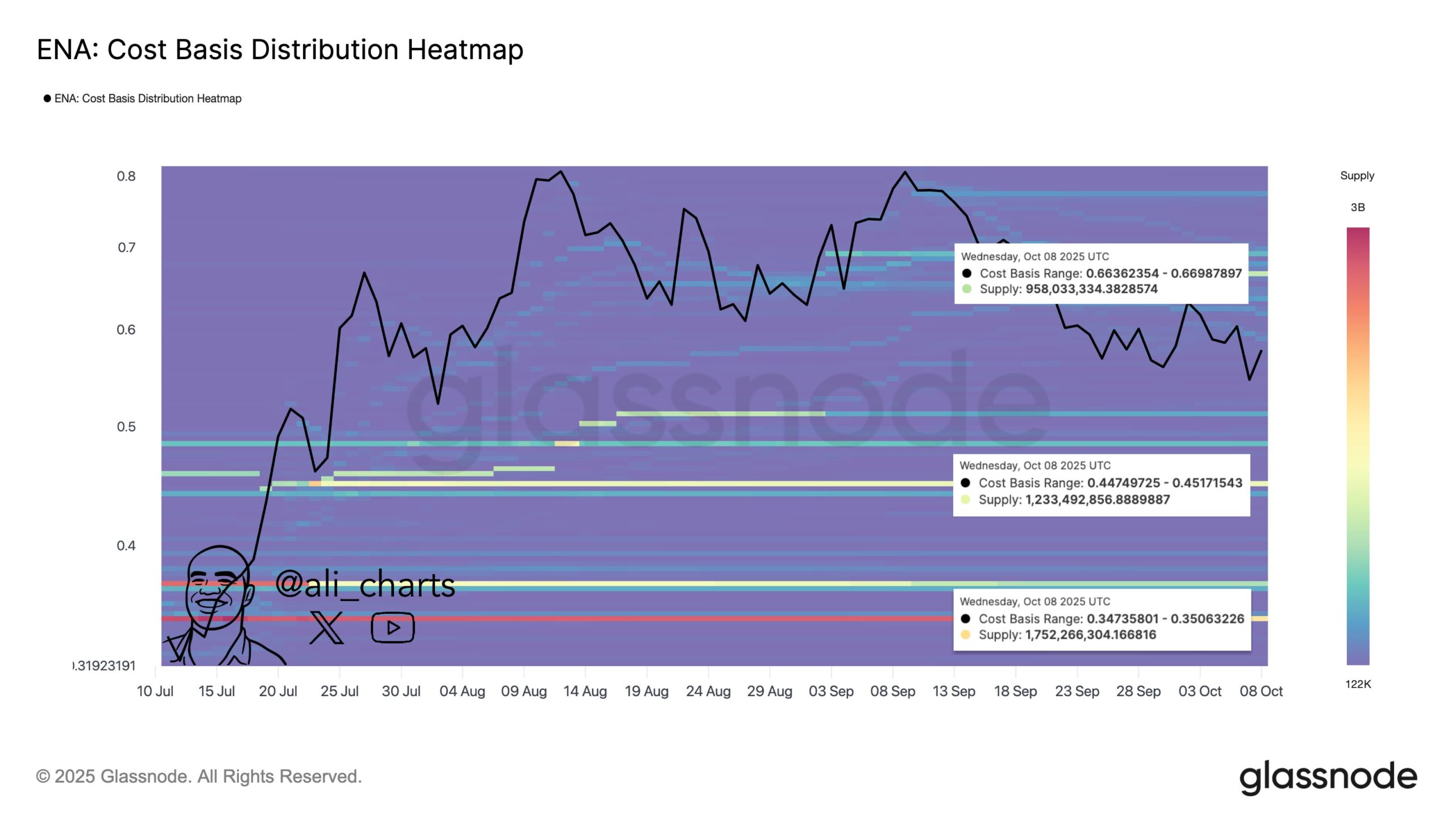

According to on-chain analyst Ali Martinez, Ethena faces significant resistance at $0.67, with strong support zones emerging at $0.45 and $0.35.

Data from Glassnode’s cost basis heatmap indicates that a large concentration of addresses accumulated ENA between these lower bands, suggesting potential buying interest if prices revisit those levels.

The current resistance cluster at $0.67 aligns closely with the upper bound of recent trading ranges, making it a pivotal barrier to watch. A successful breakout above this level could trigger renewed bullish momentum, while a failure could see ENA retesting the mid-$0.40s zone.

Momentum and RSI Outlook

The Relative Strength Index (RSI) currently sits around 41, reflecting subdued momentum after weeks of decline. Historically, similar RSI levels have coincided with accumulation phases before notable price rebounds. However, until ENA breaks above its short-term moving average resistance, sideways trading remains the most likely scenario.

Broader Market Context

The broader crypto market’s volatility and investor sentiment will likely continue to influence ENA’s trajectory. While Bitcoin’s dominance remains high, altcoins like Ethena could benefit from renewed liquidity inflows if risk appetite strengthens in the coming weeks.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.