Bitcoin’s Next Major Move May Be Close as Key Levels Come Into Focus

Bitcoin is approaching a decisive moment, with technical, on-chain, and market structure indicators all pointing toward a potential trend shift.

Analysts are increasingly highlighting similarities with past cycle transitions, while key resistance levels are now coming into focus.

Key Takeaways

- Bitcoin dominance failing at the 21-week moving average echoes patterns seen before the 2019 bull market.

- The 6–12 month holder cost basis near 100,000 is emerging as a crucial structural level.

- A Bollinger Band squeeze suggests volatility expansion is imminent, with upside targets already defined.

Michaël van de Poppe notes that Bitcoin dominance recently failed to break above its 21-week moving average, a level that has historically acted as a turning point. This rejection mirrors the structure seen in 2019, when dominance peaked before capital began rotating into risk assets.

According to van de Poppe, the broader setup resembles that earlier period when Bitcoin briefly dipped below its 50-day moving average, only to reclaim it and transition into a sustained bull phase. The implication is that the market may once again be in a late-stage consolidation rather than the start of a deeper downturn.

So far, so good.

The #Bitcoin dominance couldn't break through the 21-Week MA.

That's a good sign, as that copypastes the pattern which we've seen in 2019.

I view current market conditions as the period we've witnessed in 2019, where we also briefly broke beneath the 50-MA on… pic.twitter.com/xCGbvrquDm

— Michaël van de Poppe (@CryptoMichNL) January 6, 2026

He also emphasizes that the current macro backdrop shares similarities with that cycle, suggesting that structural conditions remain supportive rather than restrictive.

Long-Term Holder Cost Basis Emerges as Key Threshold

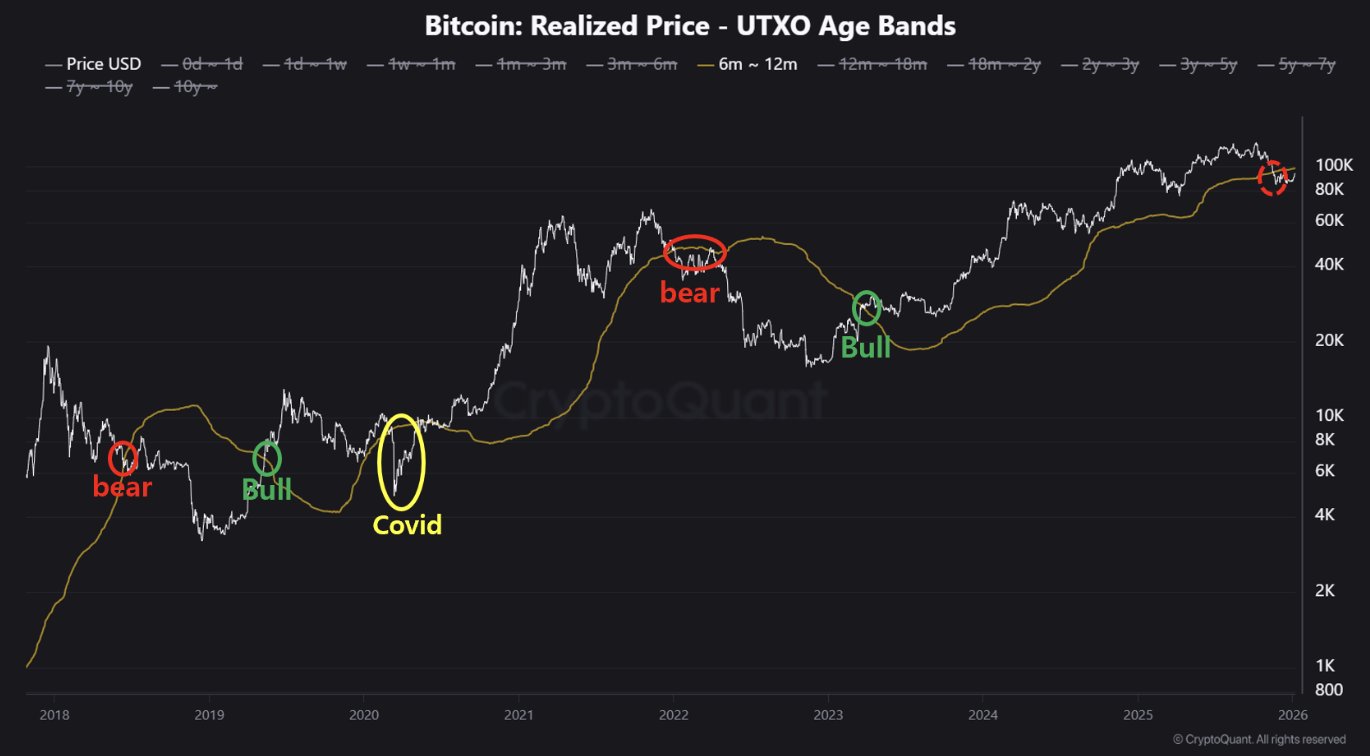

On-chain data adds another layer to the narrative. Analysis shared by CryptoQuant highlights the importance of Bitcoin reclaiming the 6–12 month holder realized price, currently hovering near the 100,000 level.

This metric represents the average cost basis of mid-term holders and has historically acted as a dividing line between bearish and bullish market regimes. A sustained move above it has often marked the start of broader upside expansion, while repeated rejections tend to keep price action range-bound.

CryptoQuant contributor DanCoinInvestor describes this level as a structural pivot, where reclaiming it would signal a clear shift in market control back toward buyers.

Bollinger Band Squeeze Signals Imminent Expansion

From a pure technical perspective, veteran analyst John Bollinger points to a near textbook Bollinger Band squeeze forming on the Bitcoin chart. Such compressions typically precede periods of heightened volatility.

Bollinger suggests that Bitcoin is building a strong base, with an initial upside objective around 100,000, followed by a secondary zone near 107,000 if momentum accelerates. However, he also cautions that failure to hold current levels could invalidate the setup and push price back into a defensive phase.

A little classic technical analysis: Near perfect base for $BTCUSD with a Bollinger Band Squeeze and breakout. First upside target 100,000, second ~107,000, third ???https://t.co/7A43k87lZn

If we fail here it is back into the trenches.— John Bollinger (@bbands) January 5, 2026

Market at a Crossroads

Taken together, these signals suggest Bitcoin is nearing a crossroads rather than confirming a directional breakout. The rejection in dominance, improving on-chain structure, and tightening volatility all point toward a market preparing for expansion, but confirmation remains dependent on reclaiming key technical and on-chain thresholds.

For now, Bitcoin appears to be balancing between continuation and hesitation, with the next decisive move likely to define sentiment for the weeks ahead.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.