Bitcoin Whales Are Buying Again – While Everyone Else Is Losing

Bitcoin’s on-chain signals are sending mixed but highly revealing messages. While price action remains choppy near the $90,000 zone, large holders are quietly stepping in, even as broader investors begin to lock in losses for the first time in more than a year.

Together, these trends paint a picture of a market caught between short-term stress and long-term positioning.

Key takeaways

- Large Bitcoin holders are accumulating at one of the fastest paces seen in recent months.

- Realized losses have returned, echoing patterns seen ahead of past bear markets.

- The market is showing a clear split between short-term stress and long-term positioning.

Whales quietly add while prices stall

Data from Santiment shows that wallets holding at least 1,000 Bitcoin have accelerated their accumulation. Over the recent period, these large holders added more than 104,000 BTC, increasing their collective balances by around 1.5%. This marks one of the strongest accumulation phases since late 2025.

At the same time, on-chain activity is heating up at the high end. Daily transfers worth over $1 million have climbed to a two-month high, signaling renewed movement among large players. Historically, this combination of whale accumulation and rising high-value transfers tends to appear during periods of market consolidation, rather than at euphoric tops.

In other words, while price momentum looks tired, deep-pocketed investors appear to be treating current levels as an opportunity rather than a warning sign.

🐳 Large Bitcoin whales are accumulating at an encouraging pace, wallets with at least 1K $BTC have collectively accumulated 104,340 more coins (a +1.5% rise). Additionally, the amount of $1M+ daily transfers is back up to 2-month high levels.

🔗 Chart: https://t.co/CJOfiOBbWU pic.twitter.com/4loxDFtUdb

— Santiment (@santimentfeed) January 25, 2026

Investors slip into losses again

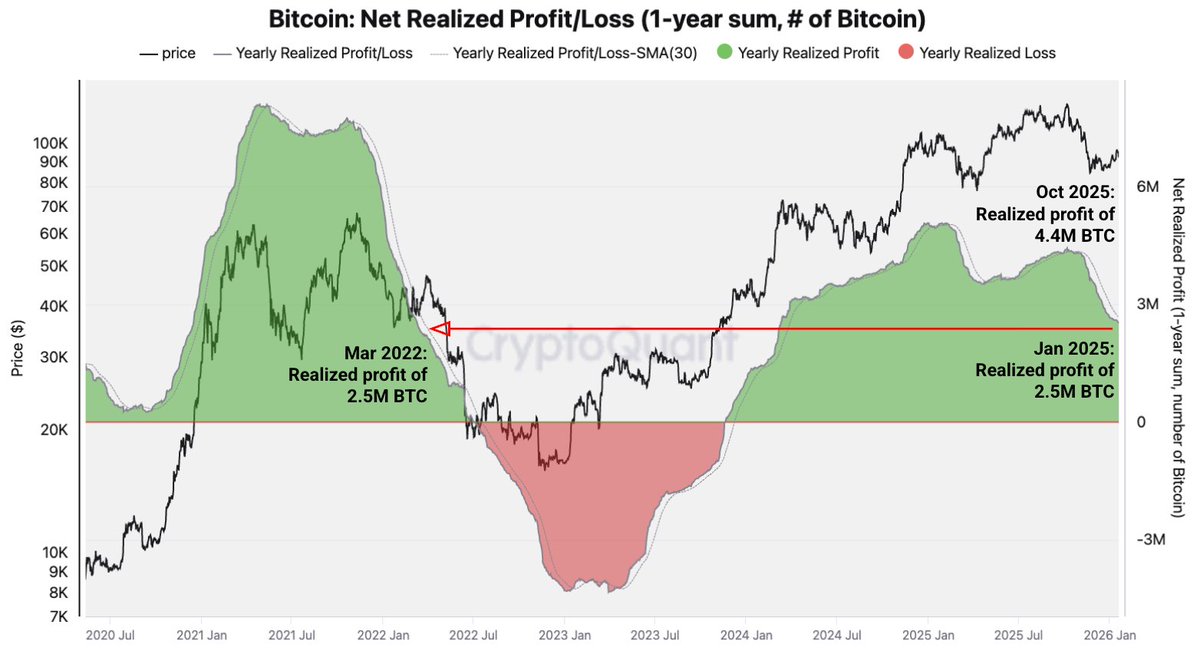

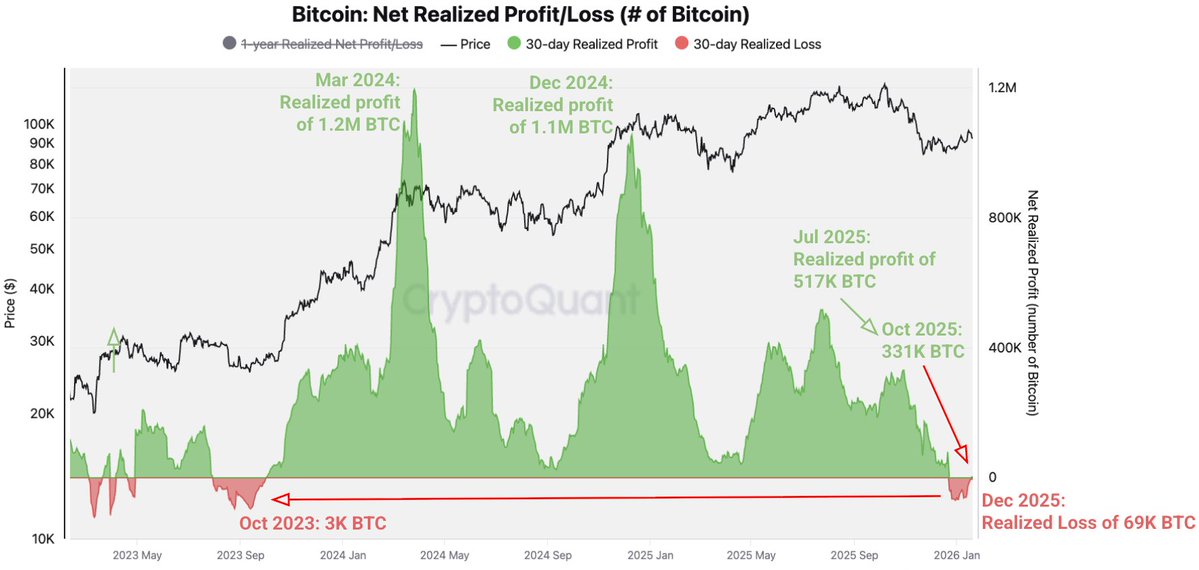

In sharp contrast to whale behavior, data from CryptoQuant shows that many Bitcoin investors have started losing money again on a realized basis. Since December, holders have realized roughly 69,000 BTC in losses, equivalent to about $6.1 billion, marking the first sustained loss period since October 2023.

Realized profits peaked in early 2024 and then steadily weakened through late 2025. That downtrend has now flipped negative, a structure that closely mirrors the transition phase seen between the 2021 bull market and the 2022 bear market.

Net realized profits have dropped to around 2.5 million BTC, a level last seen in March 2024 and strikingly similar to March 2022, when the previous bear market was already unfolding.

This does not automatically signal a full market downturn, but it does confirm that selling pressure is no longer dominated by profits. Instead, stress-driven exits are starting to reappear.

A familiar tension in the cycle

The contrast between whale accumulation and retail-level losses highlights a recurring pattern in Bitcoin’s market cycles. Larger holders often accumulate during periods when sentiment is fragile and price action feels directionless, while smaller participants tend to capitulate or de-risk after extended volatility.

For now, Bitcoin remains stuck in a tug-of-war. On one side, realized losses and fading profit momentum suggest caution. On the other, aggressive accumulation by large wallets hints that long-term confidence has not disappeared.

Whether this phase resolves into a deeper correction or sets the stage for the next leg higher will likely depend on how long this divergence can persist.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.