Bitcoin Enters Critical Support Zone as Long-Term Holders Start Selling

Bitcoin is now trading in a historically important price zone - one that has often acted as either a launchpad for recovery or the start of deeper capitulation.

Key Takeaways

- Bitcoin is trading near a historically important support zone.

- Long-term holders have started selling at a loss, with SOPR falling to 0.88.

- This behavior was last seen near the end of the 2023 bear market.

- The broader trend still shows most long-term holders in profit.

According to on-chain analytics platform Alphractal, Bitcoin is hovering around a key support level based on the average price paid by short-term holders. In past cycles, when price falls into this area, one of two things usually happens: either a local bottom forms, or the market enters a stronger selloff before long-term accumulation begins.

Bitcoin is currently trapped between support and resistance defined by the Short-Term Holder Realized Price.

In recent weeks, price has been closely respecting the -1σ and -1.5σ deviation bands, showing how critical this zone has become.

Historically, whenever Bitcoin breaks… pic.twitter.com/V0w1JcRLGO

— Alphractal (@Alphractal) February 16, 2026

At the same time, another important signal is flashing.

Long-Term Holders Are Starting to Feel Pressure

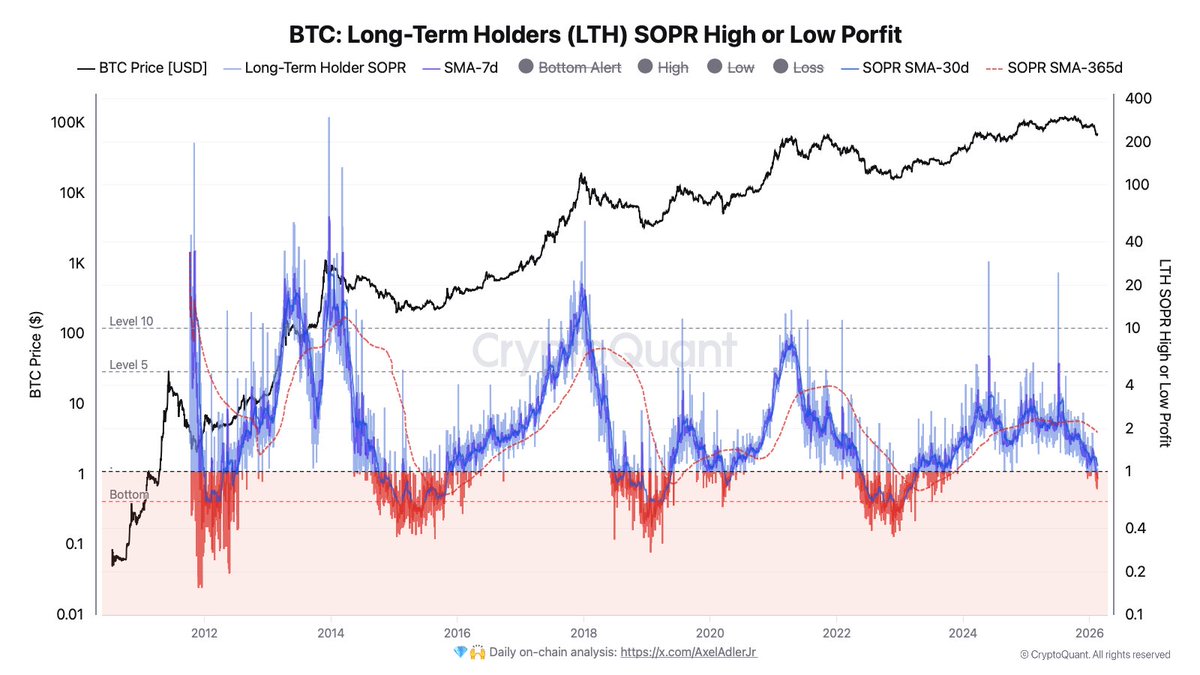

The Long-Term Holder SOPR – a metric that shows whether long-term investors are selling in profit or at a loss – has just dropped below 1, currently sitting at 0.88.

When this indicator falls below 1, it means long-term holders are, on average, selling Bitcoin at a loss.

This has not happened since the final phase of the 2023 bear market.

Historically, when long-term holders begin realizing losses, it signals rising stress in the market. These are typically the most patient investors, so when they start selling under pressure, sentiment is clearly weakening. However, the situation is not extreme yet.

On a broader timeframe, the monthly average of the indicator still remains above 1, meaning most long-term holders are still in profit overall.

Not Capitulation – But Early Warning Signs

True bear market endings have typically been marked by much deeper loss realization, where selling becomes widespread and emotionally driven.

We are not there yet.

Instead, the current data suggests early-stage pressure rather than full capitulation. If Bitcoin stabilizes here, this zone could become a reset point before recovery. If selling intensifies, the market could move into a deeper correction phase.

For now, the message from on-chain data is clear: pressure is building – but surrender has not arrived.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.