Whether you are a new starter or a more seasoned investor, earning free Litecoin can still be a joyful moment for each of you, and the best part is that you can start anytime you want, with no strings attached.

As such, researching the best Litecoin faucet could be daunting, especially with many websites available. Luckily for you, you’ve come to the right place!

In today’s comprehensive guide, we will present to you anything you need to know about the best LTC faucets to get you started right away:

- Litecoin (LTC): A Brief History.

- What is a Litecoin faucet, and how does it work?

- How to choose the best LTC faucet?

- How much does an LTC faucet pay?

- What are the 7 best LTC faucets for 2023 and beyond?

- Tips and tricks for earning big LTCs.

So, let’s jump right in, and you start earning some free Litecoin today!

1. Litecoin (LTC): A Brief History

Developed in 2011 by a former Google engineer, Charlie Lee, Litecoin aimed to be a complementary addition to the creation of Bitcoin, born in 2009. To this day, Litecoin is considered the “silver to Bitcoin’s gold,” occupying #15 place within the crypto market cap rank.

At its core, LTC addresses some of Bitcoin’s limitations, such as transaction speed and high fees, and emerged from modifying the core code of Bitcoin, as it is a BTC forking.

As of September 2023, Litecoin (LTC) is valued at approximately $63.53, presenting itself as an opportunistic investment, as many crypto investors are pushing LTC prices to $80.

With such potential, it’s wise to seize the opportunity to earn Litecoin tokens through these exceptional faucets.

2. What is a Litecoin faucet, and how does a Litecoin faucet work?

In short, a Litecoin faucet is an online medium that pays in a particular cryptocurrency, in our case, in LTC, in exchange for different actions, such as playing a game, liking a post, completing a survey, and many more.

The concept of faucets originated from the pioneering work of Gavin Andresen, a former Bitcoin core developer, who created the first faucet website. This website rewarded users with bitcoins, allowing them to acquire and utilize the cryptocurrency.

But why would the best Litecoin Faucet reward its users with free cryptos, you may wonder?

Well, a Litecoin faucet has many faces, meaning that besides serving as a starting point for those who wish to enter this exciting crypto landscape or those who want to diversify their digital asset portfolio, an LTC faucet has a more significant impact on the cryptocurrency businesses.

It helps promote the currency within the digital world, extending the crypto community and reaching a better brand awareness, ultimately leading to greater adoption of Litecoin.

As a result, we may say that this is the beauty of utilizing the finest Litecoin faucet options available, bringing you closer to effortlessly earning free cryptocurrency tokens.

However, before getting excited and earning free Litecoins, it’s wise to start by choosing an LTC-compatible wallet that will protect your assets and ensure maximum security.

3. How to choose the best LTC faucet?

Before jumping, there are some aspects that you need to be aware of that will make a big difference in earning your Litoshi. Nothing complicated, only some fundamental aspects, such as:

- Checking the legitimacy of the said LTC faucet through peer reviews to ensure the community’s trust in the faucet.

- What are the payout rates and the frequency at which you can get your free Litecoins? Some faucets offer higher payouts, while others may pay out more frequently.

- Security measures are also critical, as some faucets may integrate the well-known two-factor authentication (2FA) or email verification to protect your account. At this step, ensuring your wallet address’s protection is also wise.

These are just a few points for choosing the best faucet, yet the most critical ones, but, like said, there is no need to sweat about it, as we’ve got you covered.

4. How much does an LTC faucet pay?

Estimating the exact amount that an LTC faucet pays is more complex, as it varies from one medium to another. However, at this point, it is essential to know that you’ll not hit the jackpot overnight, and being realistic about it will make the journey more satisfying.

Instead, it’s a constant effort as Litecoin faucets typically pay out from small to slightly larger amounts depending on a couple of factors, such as the current market conditions and the generosity of the faucet owner.

Additionally, there is a “golden ratio” between the paid amount, the frequency, and the withdrawal thresholds. On top of this, some faucet owners may establish loyalty bonuses and referral programs to help you earn additional free Litecoin.

Best Litecoin Faucets You Should Check Out in 2023

As promised, we arrived at the most awaited moment, so we have prepared the best Litecoin faucets list you can choose from in 2023 and beyond.

Read further, take notes, and start earning today!

1. Cointiply

It’s no wonder we chose Cointiply to be on top of our list; for sure, it’s at the top of many others, but let’s find out why.

Cointiply is a widespread Litecoin faucet that allows you to earn Litecoin and various other cryptocurrencies through straightforward tasks like visiting websites, solving captchas, watching videos, completing surveys, and playing games.

With its clean and user-friendly interface, Cointiply is a good starting point for beginners, ensuring a seamless experience in earning their initial Litecoin rewards.

A standout feature of Cointiply is its unique “multiplier” functionality, allowing users to boost their earnings by playing their amazing sci-fi-themed multiplier game.

Adding to the excitement, Cointiply offers an array of entertaining games through which users can earn more Litecoin. Attractive options such as “Coin Flapper,” “Coin Rain,” and “Wheel of Coins” provide an enjoyable way to earn additional cryptocurrency rewards on the platform.

Cointiply features:

- Enjoy the loyalty program to boost your loyalty bonus to 100%.

- Earn 5% interest on your Litecoin balance when you reach 35,000 Coins. Additionally, you can send Litecoins directly to your Cointiply account to earn even more interest.

- Upon completing the tasks, you’ll be rewarded with points that can be cashed in for real prizes while boosting your level.

- Play the Sci-Fi game, multiply your gains, and join over 3 million Cointiply users.

- Enjoy the fast payment option and withdraw your gains at any time to your LTC wallet.

- Additionally, customer support is available 24/7 to help you with any issues.

- Now that you’ve earned your free Litecoins, it’s time to tell your friends about it and enjoy the 25% referral program.

2. Coinpayu

Coinpayu is another Litecoin faucet making headlines in 2023 due to its high and easy-paying capacity, whereby to earn free Litecoins, you just need to register and begin earning through watching ads.

Coinpayu is a well-designed platform with an intuitive interface that offers three different adverts to its users:

- The first type of ad is the Surf Ad, in which you must wait a few seconds after clicking to get paid, and after several ads, you need to confirm your human nature by solving a captcha.

- The second type is the Windows Ad, which you must click on before earning. In this case, you will need a second screen to keep your tab in order.

- The final ad type is the Video Ad, which allows you to watch a video to earn your free LTCs. This payment type is decent despite not being compared to the initial two.

Moreover, Coinpayu has integrated offerwalls, and you can also earn Litecoin through their campaigns in which you can choose between a referral program, affiliate, and others.

3. Free-Litecoin

Free-Litecoin.com is a reliable Litecoin faucet that lets you earn free Litecoin quickly and easily, claiming more than $200 in Litecoin and ensuring a steady accumulation of cryptocurrency rewards.

This LTC faucet focuses on simplicity and convenience, making it effortless to earn Litecoin. Additionally, the platform provides a user-friendly interface, allowing you to navigate smoothly and maximize your earnings.

You won’t find distracting games or complex features there, as they prioritize a straightforward process of claiming and accumulating free Litecoin.

Free-Litecoin.com features:

- Start today, and you can earn over $200 in Litecoin hourly. Besides this, play the multiply game and enjoy the benefits.

- Once you’ve started to gain free Litecoins, be sure to invite your friends over and benefit from a bonus of 25% of the Litecoin they earn.

- As we discussed the security measures, this faucet advises themselves that they adhere to strict rules to secure your Litecoins, offering transparency to the entire procedure.

- Be sure to benefit from the interest offer, where you get a 10% yearly reward for having your gained LTC into your account.

- And lastly, withdraw and deposit your Litecoins without any limit.

Simple and straightforward, right?

4. Fire Faucet

Fire Faucet is a versatile multi-cryptocurrency faucet that allows you to earn various cryptocurrencies, including Litecoin, through simple tasks like website visits, captcha solving, and game participation.

Like the predecessor faucets already presented, Fire Faucet boasts an intuitive interface that ensures seamless navigation for beginners while enabling them to accumulate Litecoin effortlessly.

You can gain rewards by watching videos, completing surveys, and seizing various offer opportunities. Also, it acknowledges and rewards your loyalty, providing a loyalty bonus.

To earn Litecoin on this site, you must ensure you have achieved ACP, and then the claiming process begins. Users can choose the amount per minute, which ranges from 1-4 ACP. For example, if you choose three ACPs per minute, you will be rewarded three times the cryptocurrency you select, in this instance, Litecoin.

If you are looking for even more tremendous earning potential, Fire Faucet offers a premium membership option. Upgrading to a premium membership grants you access to enhanced earning opportunities and increased payouts, opening doors to maximize your Litecoin earnings.

Fire Faucet features:

- The platform advertises itself as offering the highest rates, and by staying more and more active on the platform, your rates will keep growing. Moreover, they award the top 20 users every day with huge bonuses!

- Enjoy a clean design with no pop-ups; we all know they can be frustrating.

- Complete each task and grow your EXP, as leveling up comes with bonuses on top of the level gift.

- And as you probably know, a good crypto faucet has a referral program to spread the good news with your friends.

5. Allcoins.pw

Allcoins.pw emerges as a highly rewarding Litecoin faucet, offering an extensive range of supported cryptocurrencies, such as Dogecoin, Bitcoin, Ethereum, and Litecoin.

You can claim LTC every 6 minutes with a simple click, ensuring a steady gain of cryptocurrency rewards, and the opportunities for earning free LTC keep on going. Additionally, you can maximize your LTC earnings between claim sessions by engaging in games, offerwalls, or utilizing the auto-faucet feature.

Despite having the least user-friendly design, this Litecoin faucet goes above and beyond to provide various avenues to increase your cryptocurrency holdings. Still, once you get the hang of it, it becomes a good platform that does its job – it allows you to accumulate Litecoin.

In complement to the impressive earning potential, Allcoins.pw offers an enticing referral program with a significant 25% commission on your referral’s earnings. You can also share your referral links with friends and invite them to join, ensuring you and your friends are rewarded for participating.

Furthermore, if you’re eager to earn even more Litecoin, this faucet allows you to mine the cryptocurrency. By downloading the Command Miner and running it in the background on your computer, you can effortlessly mine Litecoin on autopilot while attending to other tasks.

Allcoins.pw is undoubtedly a faucet worth exploring if you’re seeking a reliable source of free Litecoin, all while injecting an element of fun into the process.

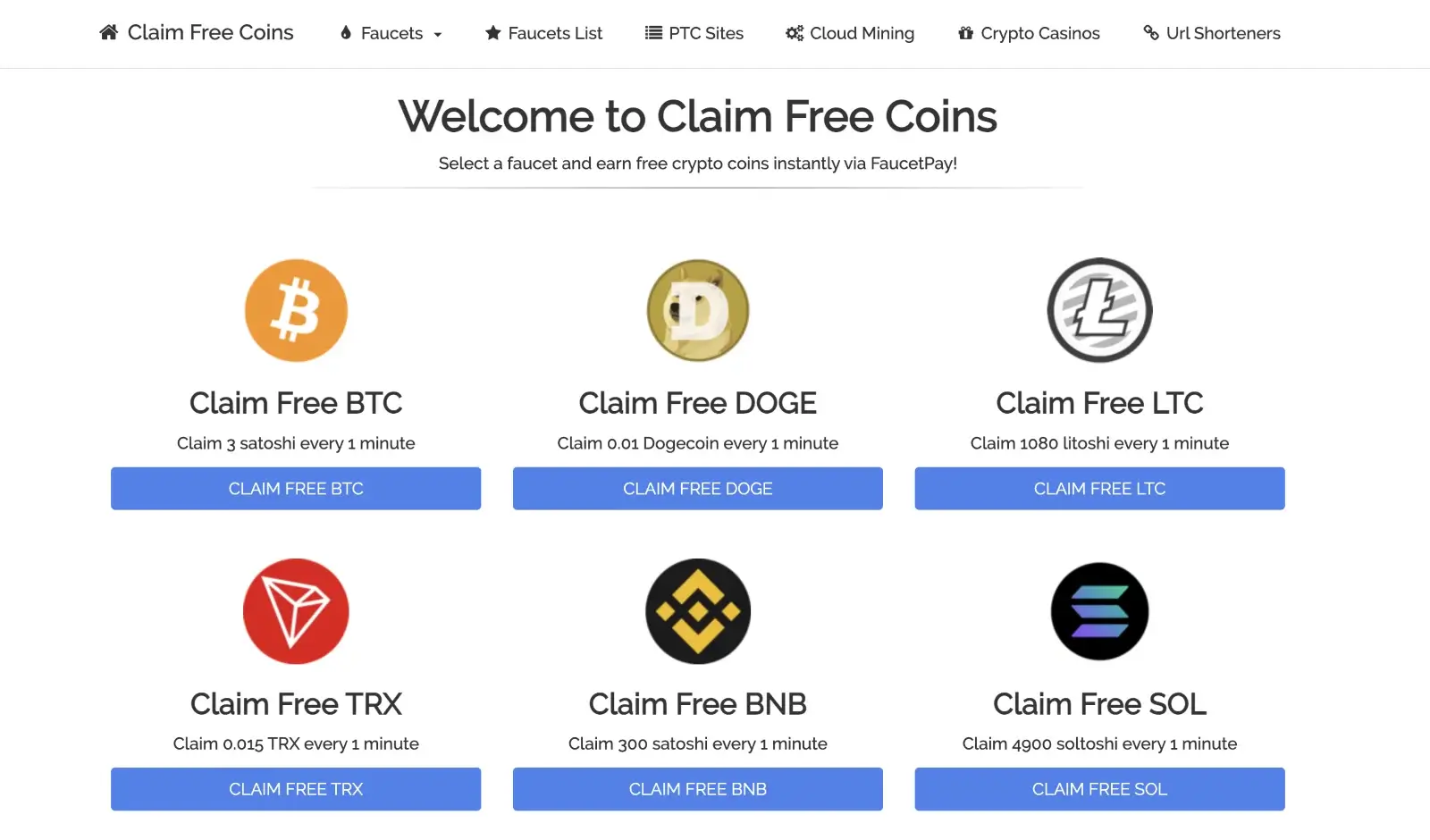

6. Claim Free Coins

As consumer input plays a crucial role in brand advertising, brands collaborate with trusted platforms like Claim Free Coins to gather feedback at every stage of brand development. By watching ads on this faucet, you contribute your opinions and earn free LTC as a reward.

Getting started and earning free Litecoins on Claim Free Coins is effortless, and the sign-up process is simple, accessible, and user-friendly. Moreover, thousands of dollars worth of Litecoin is distributed daily on this platform, whereby you can accumulate 1080 Litoshi every 1 minute through regular claims.

Furthermore, inviting your friends to join can supercharge your earning potential, as every action you take brings you closer to accumulating more crypto.

Start participating on Claim Free Coins today and unlock the benefits of sharing your feedback while earning free LTC.

7. LitecoinFaucet.com

This faucet advertises itself as winning free Litoshis every 60 seconds instant through FaucetPay and in a matter of minutes, as the process is done through three easy steps:

- Entering your wallet address,

- Solving captchas,

- Completing the short link by visiting the sponsor’s website.

For those who don’t know what FaucetPay is, this 3rd-party micro-payment processor is used by many crypto faucets to process transactions to its users, including you. What’s nice about this is that you can accumulate your Litecoins and withdraw them directly to your wallet.

Additionally, this faucet has a referral program that offers a 25% commission to your FaucetPay for life for every user referred to this Litecoin faucet.

Be sure to check the platform and start enjoying your LTC gains.

FAQ

How to Get Litecoin for Free?

There are several ways to get Litecoin for free, including faucets, airdrops, mining, or participating in various giveaways with such prizes.

One of the most profitable is participating in an LTC faucet, more precisely, websites or apps that reward users with small amounts of Litecoin for completing tasks like solving captchas, playing games, etc.

Which is the Highest-paying LTC Faucet?

It’s hard to say which is the highest-paying Litecoin faucet because every LTC faucet reward can vary over time as faucets change their reward structures or new faucets emerge.

You should also know from the start that faucets will not make you a fortune. If it is to choose the faucets with the highest rewards, the sites presented in this guide offer the highest payouts of those on the market, which are also well known.

Which are the Best LTC Faucet Sites?

Analyzing dozens of sites, we can say that the best Litecoin faucet sites when updating the article are Cointiply, Coinpayu, Free-Litecoin, Fire Faucet, Alltcoins.pw, and Claim Free Coins.

Best Litecoin Faucet | Final Thoughts

Now that we’ve reached the end of this comprehensive guide for the best Litecoin faucet for 2023 and beyond, we hope you’ll choose the right platform that suits your needs and gives you the required benefits.

Whether a new starter or an experienced investor, the presented faucets can offer a convenient way of earning free cryptos without any strings attached.

Additionally, by learning a bit more about the history of Litecoin, you’ll be able to further create a strategy of investments for your free digital assets and where to position yourself compared to the most well-known currencies, such as Bitcoin, Ethereum, and others.

Usually, choosing the right LTC faucet must consider some external factors, such as the frequency, security, and payout rate. Yet, keep in mind that the goal is to earn free LTC, not to hit the jackpot, as many overly crypto enthusiasts are thinking about.

As it is a gradual process, approaching the best LTC faucets with a realistic eye will separate you from the speculator type of investor. So, take your time to explore the faucets and enjoy the journey through the realm of Litecoin!