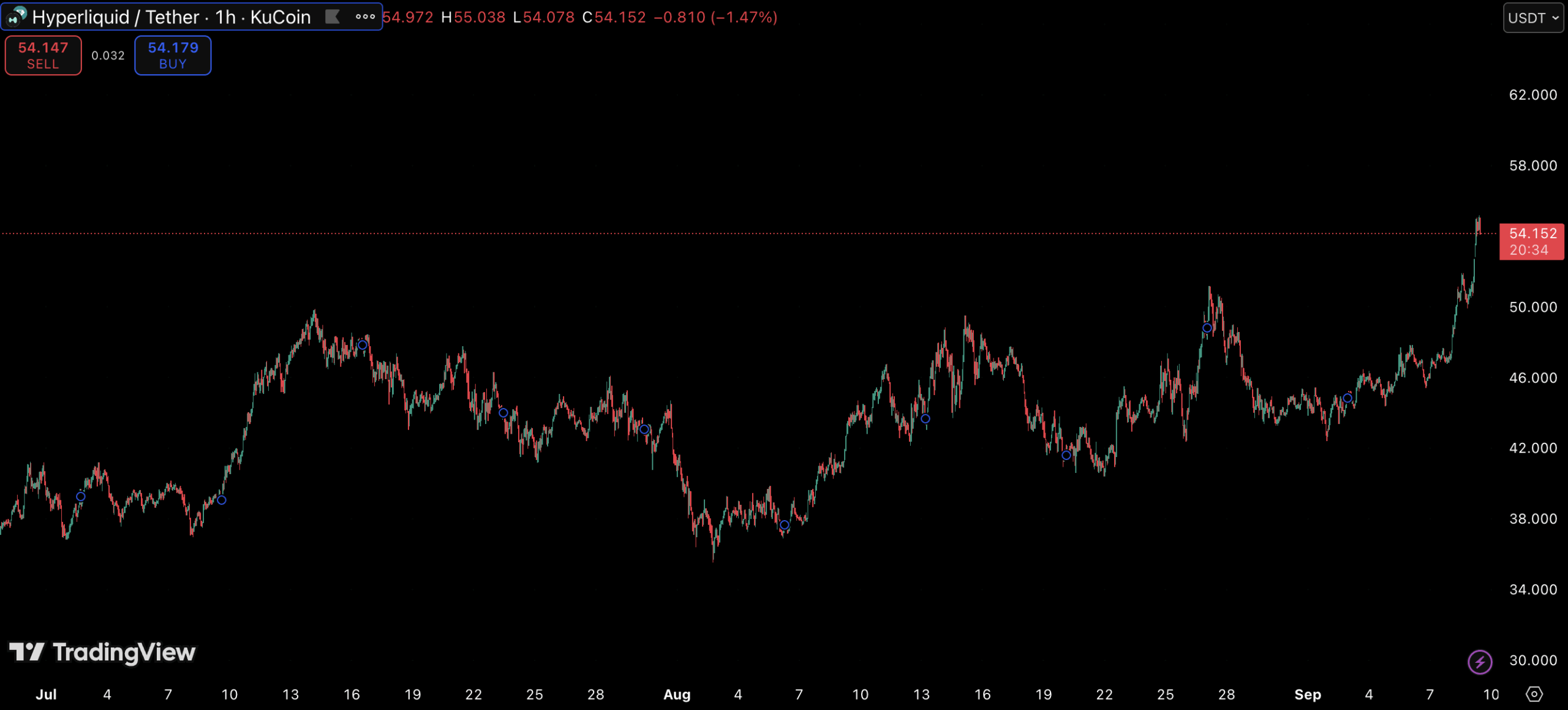

HYPE Token Rockets Past $55 in Breakout Rally

The battle to launch Hyperliquid’s first native stablecoin has set off fireworks across the crypto market - and its token HYPE is riding the wave to new heights.

Validators are preparing to vote on which team will bring the USDH stablecoin to life, with major names like Paxos, Frax, Agora, and the Sky ecosystem in the running. Even Ethena has hinted at joining the contest, underscoring the high stakes. Whoever wins the mandate will shape liquidity on Hyperliquid’s fast-growing perpetual futures exchange, which already manages more than $5 billion in user deposits.

HYPE Rallies on Anticipation

Against this backdrop, HYPE surged to a record near $55, breaking decisively above the $50 barrier and securing a place among the top 15 cryptocurrencies by market cap. Analysts say the momentum reflects expectations that USDH will supercharge Hyperliquid’s role as a liquidity hub, while also showcasing the token’s ability to capture value from the platform’s fee-driven model.

Trading Activity at Fever Pitch

Traders have poured into the market, pushing daily volumes above $755 million — the strongest in months — and driving open interest to a staggering $2.12 billion. That surge has placed Hyperliquid firmly in the spotlight as one of the busiest venues for leveraged bets in crypto.

Whales Double Down

Big money players are showing no hesitation. More than half of HYPE’s largest holders remain long, and some are taking outsized positions. One whale recently deployed $5 million in USDC to open a leveraged long, now sitting on hundreds of thousands in unrealized profit despite steep funding costs.

Beyond Hyperliquid’s Walls

HYPE is no longer confined to its home platform. While around 40% of volumes remain native, listings on Bybit and Bitget have broadened access and visibility. August alone brought $7.48 million in fees to the network, underscoring its growing adoption and sticky user base.

What’s at Stake With USDH

For Hyperliquid, the USDH launch is more than just another token — it’s a chance to deepen its liquidity model and compete directly with the biggest players in decentralized finance. With validator voting just around the corner, scrutiny is high on the candidates’ track records in transparency, compliance, and liquidity management.

The outcome could reshape the platform’s trajectory — and for HYPE, the rally shows just how much is riding on the result.

The information provided in this article is for informational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.