How Wall Street’s Dollar Optimism Vanished in One Year

A dramatic unwind is unfolding in currency markets - and this time it is institutional money leading the move.

Key Takeaways:

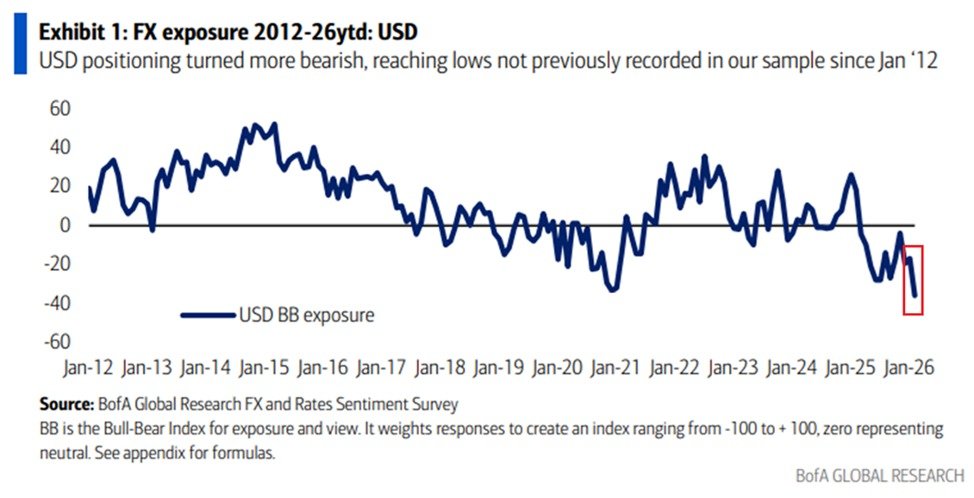

- Institutional dollar positioning has fallen to its weakest level in at least 14 years.

- Most fund managers expect central banks to continue trimming dollar reserves.

- Gold is the most crowded global trade, reflecting reserve diversification.

- Capital is rotating toward Europe, emerging markets, and Japan as U.S. allocations shrink.

February data from Bank of America’s Global Fund Manager Survey shows professional investors are positioned against the U.S. Dollar more aggressively than at any point in at least fourteen years. Net exposure has collapsed to -35, a reading that not only erases last year’s optimism but sinks below the panic levels seen during the April 2025 tariff shock.

At the start of 2025, the mood could not have been more different. Dollar positioning was deeply positive at +30, reflecting confidence in U.S. growth, higher yields, and global demand for American assets. Twelve months later, that conviction has flipped into one of the most negative currency stances in modern survey history.

From Yield King to Policy Risk

Several forces are converging behind the reversal.

Markets are increasingly pricing in additional Federal Reserve easing in 2026, with at least two quarter-point cuts expected. That shift erodes one of the dollar’s key advantages – superior yield relative to other developed markets.

At the same time, investors are citing mounting policy unpredictability. Aggressive trade moves in 2025 and continued political pressure on institutions such as the Federal Reserve have injected a risk premium into U.S. assets. The result is a subtle but meaningful reassessment of the dollar’s traditional safe-haven status.

The irony is striking. During the April 2025 “Liberation Day” tariff announcement, U.S. stocks, bonds, and the dollar briefly sold off together in a rare episode of capital flight. Equities eventually recovered, with the S&P 500 surging sharply into early 2026. The dollar, however, never regained sustained momentum – and sentiment has only deteriorated since.

Central Banks Rethink Reserve Strategy

The shift extends beyond hedge funds and asset managers. According to the same survey, 87 percent of respondents expect global central banks to continue reducing dollar allocations in their foreign-exchange reserves.

Gold is absorbing a large share. The metal surged into the $4,000–$5,000 range earlier this year, reinforcing its appeal as a politically neutral store of value. “Long gold” is now the single most crowded trade globally, cited by half of surveyed managers.

“Short dollar” has climbed into the top three crowded positions – a remarkable development given the currency’s historical dominance in global finance.

The Big Rotation: Beyond America

Currency pessimism is only one piece of a broader asset reallocation. Portfolio managers are executing what some describe as a “Beyond the U.S.” strategy.

Allocations to U.S. equities have dropped sharply to a 22 percent net underweight – down dramatically from near-neutral positioning just one month earlier. Instead, global capital is dispersing across three regions.

Europe has emerged as the primary beneficiary. Managers are holding Eurozone equities at a 35 percent net overweight, the highest in years, supported by fiscal expansion and valuation discounts relative to U.S. markets. Germany’s large-scale infrastructure push has helped anchor the bullish narrative.

Emerging markets remain heavily favored as well. A softer dollar eases financial stress for economies carrying dollar-denominated debt, while AI-driven supply chains in Taiwan and South Korea continue attracting inflows. Vietnam’s reclassification to emerging-market status has also drawn passive investment flows.

Japan, meanwhile, is regaining attention. Corporate reforms, record buybacks, and dividend growth are reshaping the equity story. A strengthening yen adds further appeal for international investors seeking unhedged returns.

How Low Could the Dollar Go?

Strategists at major institutions now see scope for the U.S. Dollar Index to drift toward the low-90s by year-end. Such a move would mark a decisive extension of the currency’s downtrend and confirm that the shift is more structural than cyclical.

What makes the moment unusual is not simply the scale of bearish positioning – but its breadth. From reserve managers to hedge funds to long-only asset allocators, the consensus is forming around diversification away from U.S. concentration risk.

For a currency that has dominated global finance for decades, that is a meaningful inflection point.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.