Gold and Silver Steady After Sharp Drop as Momentum Indicators Signal Consolidation

Gold and silver stabilized in early trading after a sharp selloff, with technical indicators pointing to a pause in downside momentum as traders reassess near-term direction.

Key Takeaways:

Spot gold was trading around $4,907.68, after falling from highs near the $4,960–$4,970 range. The metal briefly dipped toward the $4,880 area before recovering, suggesting buyers stepped in near short-term support. Meanwhile, silver hovered near $74.49, little changed on the session, after rebounding from a decline toward the $73.00-$73.50 zone.

Gold: Support Holds as Momentum Flattens

Gold’s intraday chart shows a decisive breakdown from the $4,950 area, followed by a steep move lower before stabilizing near $4,880. Price has since recovered modestly, forming a consolidation band just below $4,910.

The MACD (12, 26, 9) remains slightly positive but is flattening, with the histogram narrowing – typically a sign that bearish pressure is easing but bullish momentum has yet to reassert itself. Meanwhile, the RSI (14) is near 47–51, close to the neutral 50 level, indicating neither overbought nor oversold conditions.

A sustained move back above $4,920 would suggest renewed upside momentum, while failure to hold the $4,880–$4,890 support band could invite further downside.

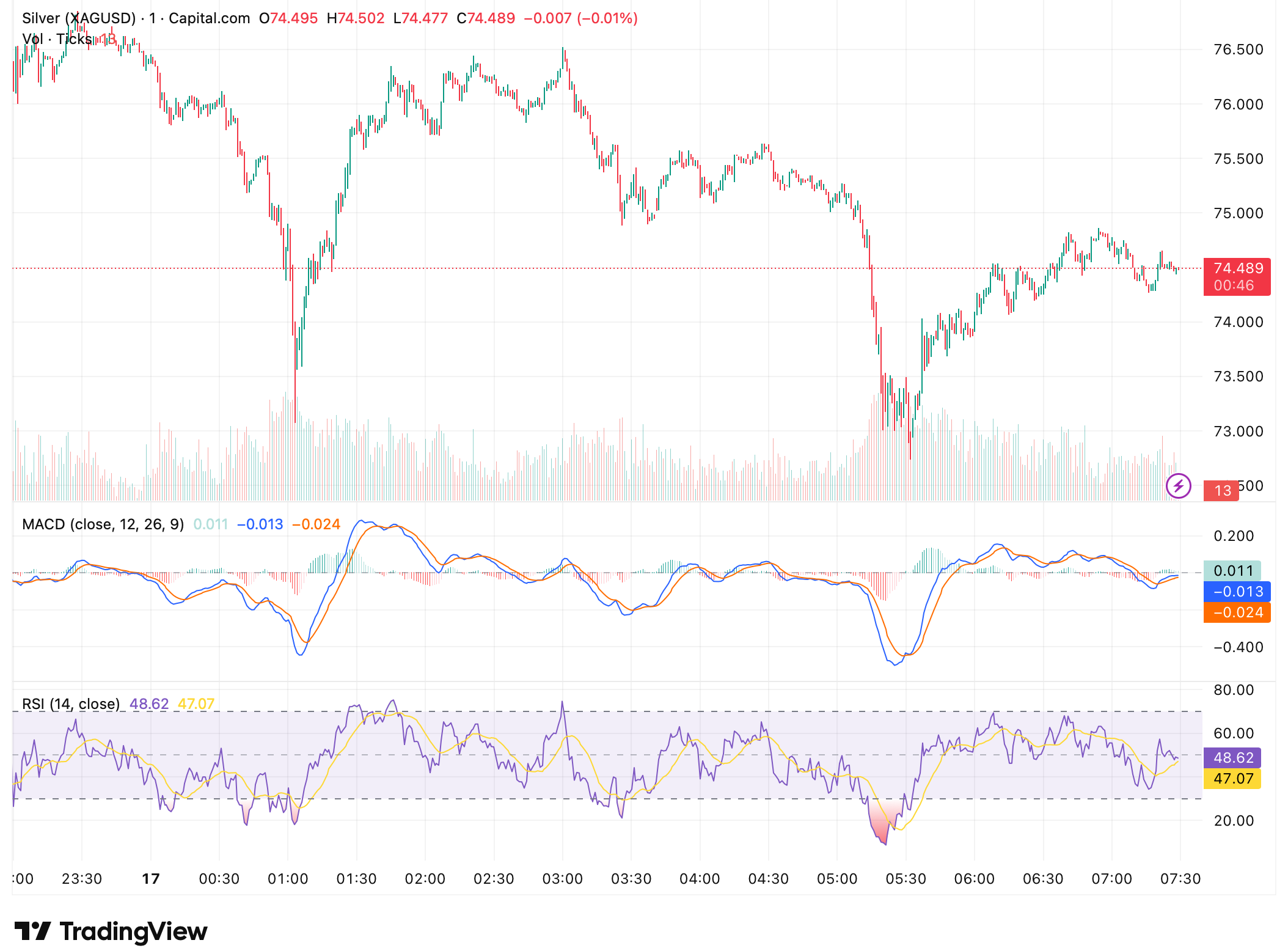

Silver: Range-Bound After Volatility Spike

Silver mirrored gold’s price action, sliding sharply before finding buyers near $73.00. The rebound toward $74.50 places the metal back into a short-term consolidation range.

Technically, silver’s MACD has turned marginally positive, though the signal lines remain tightly compressed, suggesting consolidation rather than a new trend. RSI readings near 47–49 also reinforce a neutral stance, with momentum neither stretched nor exhausted.

For now, both metals appear to be digesting recent volatility. Traders are likely watching whether support levels hold as macro drivers – including dollar strength and interest rate expectations – continue to shape short-term flows in precious metals markets.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.