Gold and Silver Go Parabolic as Confidence in the Dollar Starts to Crack

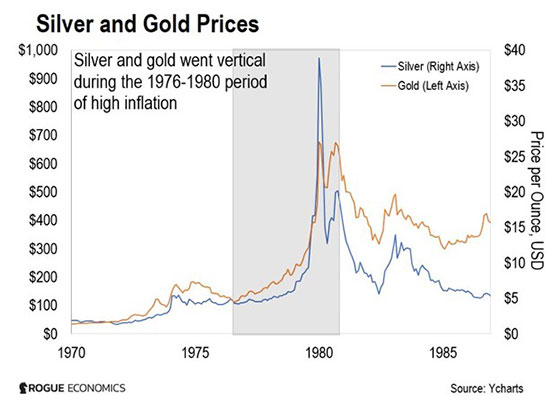

Gold and silver are no longer acting like calm defensive assets. Their recent price behavior looks erratic, aggressive, and emotional, echoing the late 1970s rather than a typical risk-off move.

The comparison to the 1976–1980 period is gaining traction as both metals surge simultaneously, something that historically happens when confidence in fiat money begins to crack.

- Gold and silver are moving together in a way that historically signals stress, not stability.

- Silver’s sharp surge points to fear-driven demand rather than speculative enthusiasm.

- Extreme premiums for physical metal suggest growing distrust in paper markets.

- Any near-term pullback in metals is likely to be driven by forced selling, not a change in the broader trend.

Back then, inflation was the dominant driver. Today, the catalyst appears broader. Markets are not simply hedging inflation or recession risk – they are reacting to a growing distrust in the US dollar and the financial system surrounding it.

Silver’s sudden surge raises red flags

Silver’s nearly 7% single-day jump stands out even in an already volatile environment. This kind of move suggests urgency rather than speculative positioning. Silver is aggressively catching up to gold after lagging behind, a pattern often seen when investors scramble for liquidity alternatives rather than rotating portfolios strategically.

Historically, when silver moves this violently alongside gold, it tends to reflect fear-driven behavior rather than optimism. Investors are not buying because metals are fashionable, but because they are perceived as safer than financial assets tied to debt and leverage.

Paper prices versus physical reality

One of the most alarming developments is the widening gap between paper prices and physical markets. Futures contracts and ETFs continue to define global benchmarks, yet reports from Asia point to extreme premiums for physical silver.

In markets such as China and Japan, physical silver is reportedly trading far above international spot prices. These levels are highly unusual and suggest that trust in paper claims is eroding. When buyers are willing to pay steep premiums just to secure physical metal, it often signals concern about delivery, counterparty risk, or systemic stability.

Forced selling could come before the next leg higher

Despite the bullish long-term implications, short-term turbulence cannot be ruled out. As equity markets – particularly tech and AI-heavy segments – come under pressure, large funds may be forced to raise cash quickly.

In such scenarios, gold and silver are often sold not because investors want to exit, but because they are among the few liquid assets that can be sold immediately. These forced liquidations can create sharp pullbacks, even in strong bull trends, before prices resume their climb once the pressure eases.

The Federal Reserve is boxed in

The policy dilemma is becoming increasingly visible. The Federal Reserve faces two unappealing options. Cutting rates to stabilize equities risks fueling inflation fears and accelerating capital flight into hard assets. Holding rates steady to defend the dollar tightens financial conditions further, increasing stress across housing, equities, and credit markets.

Markets are beginning to price in this no-win scenario, which helps explain the urgency behind the move into gold and silver.

Confidence, not recession, is driving the move

What makes this moment different is that markets are not reacting to a standard recession narrative. Instead, they are responding to a loss of confidence. When the two oldest forms of money on Earth rise violently together, history suggests investors are questioning the reliability of the system itself.

Whether the next phase brings a temporary shakeout or a continuation of the surge, the message from metals is clear: something is under strain beneath the surface of global markets.

At the time of writing, silver is trading above the $110 price level.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.