Gold and Silver Enter Correction Phase Following Parabolic Rallies

Gold and silver both saw sharp reversals after printing fresh all-time highs, with technical indicators flashing clear signs of exhaustion.

Spot gold (XAUUSD) pulled back aggressively after topping near $5,500, sliding to around $5,000 and marking a decline of 10% from the peak. The move followed a near-vertical advance that pushed momentum indicators deep into overbought territory and left prices vulnerable to a rapid correction.

Key takeaways:

- Gold has dropped sharply from its all-time high near $5,500, signaling a momentum reset.

- Silver suffered an even steeper correction after failing to hold above $120.

- Overbought technical conditions preceded the sell-off in both metals.

- Rising volatility and a stronger U.S. dollar added pressure to precious metals.

On the daily chart, gold’s Relative Strength Index had previously surged above ninety, a level typically associated with extreme overheating. As price rolled over, the RSI retreated toward the neutral zone, reflecting a swift unwinding of bullish momentum.

The Moving Average Convergence Divergence remains in positive territory, but the histogram has started to flatten after a prolonged expansion, pointing to slowing upside strength. Trading volume expanded notably during the decline, a sign that the move was driven by active selling rather than a routine pullback.

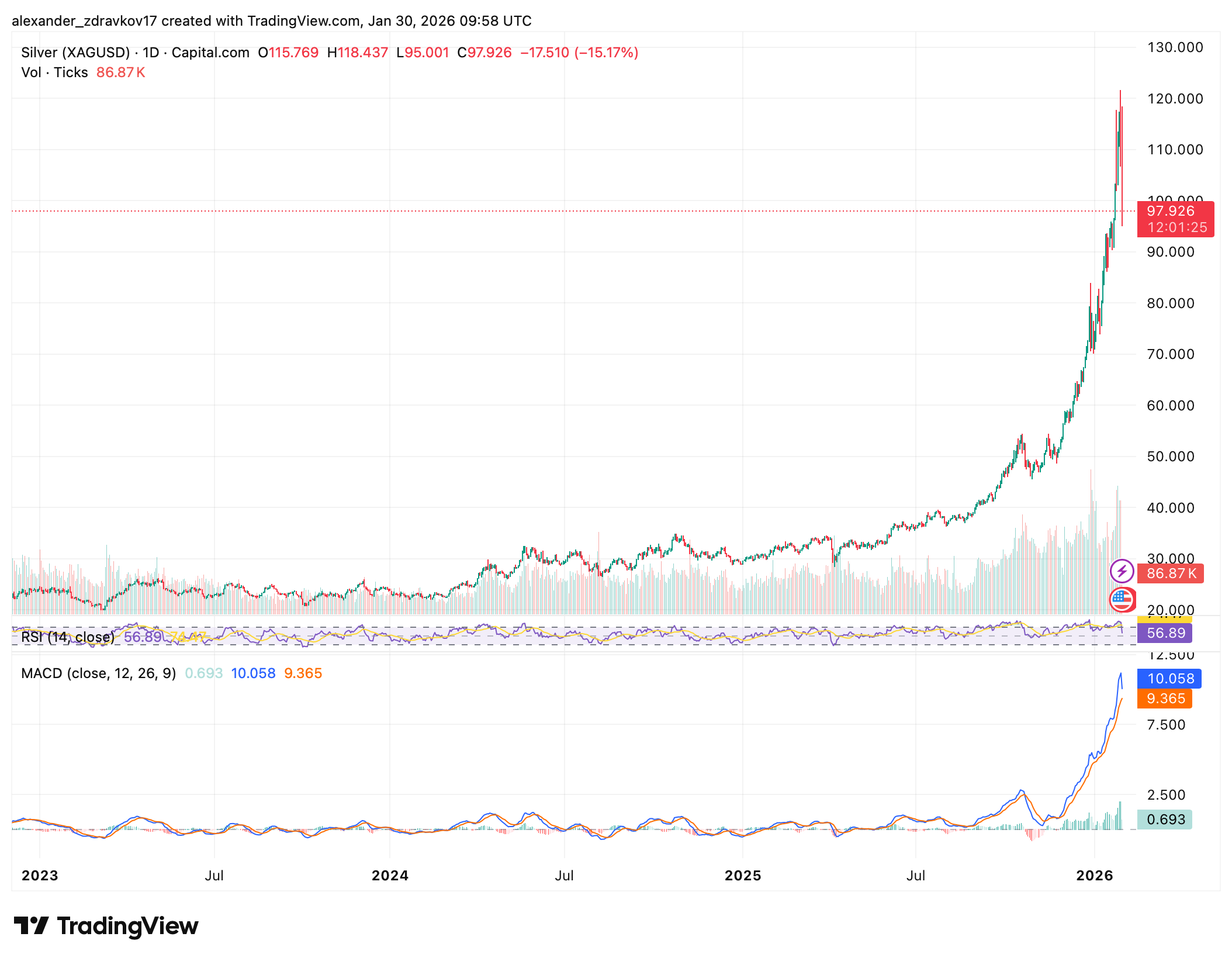

Silver’s Breakdown Signals Elevated Volatility

Silver mirrored gold’s reversal but with significantly higher volatility. After reaching an all-time high near $120, the metal collapsed to approximately $97, registering a drop of more than 15% in a single session. The daily RSI fell from overbought levels into the mid-fifties, while the MACD remains elevated but shows characteristics often seen ahead of deeper corrective phases. A sharp increase in volume accompanied the sell-off, reinforcing the view that the move reflected forced liquidation rather than profit-taking alone.

Broader market dynamics also aligned with the weakness in precious metals. The volatility index climbed above eighteen, indicating rising market stress, while the U.S. dollar index strengthened toward ninety-seven. The combination of higher volatility and a firmer dollar created additional headwinds for gold and silver, accelerating the retreat from record highs of $5,500 for gold and $120 for silver.

What Investors Should Watch Next

Investors will be closely monitoring whether gold can stabilize above the $4,900–$5,000 zone and whether silver can defend the psychological $100 level. Sustained weakness in momentum indicators or continued strength in the U.S. dollar could open the door to deeper corrections. Conversely, a slowdown in selling pressure accompanied by declining volume may signal that both metals are transitioning from a corrective phase into consolidation rather than a full trend reversal.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.