Dollar Drops 15% From Its Peak, Flashing a Major Liquidity Warning

The U.S. dollar is sliding to levels not seen in years, and markets across the globe are starting to react.

The U.S. Dollar Index (DXY) has fallen to around 96.8, marking a drop of roughly 15.6% from its 2022 peak. This is the steepest sustained decline since 2017, a period that preceded a major surge in global liquidity and one of the most explosive risk-asset rallies on record.

- The U.S. dollar has dropped more than 15% from its 2022 high, reaching levels last seen in 2017.

- Similar dollar weakness in the past preceded major liquidity-driven rallies in crypto and other risk assets.

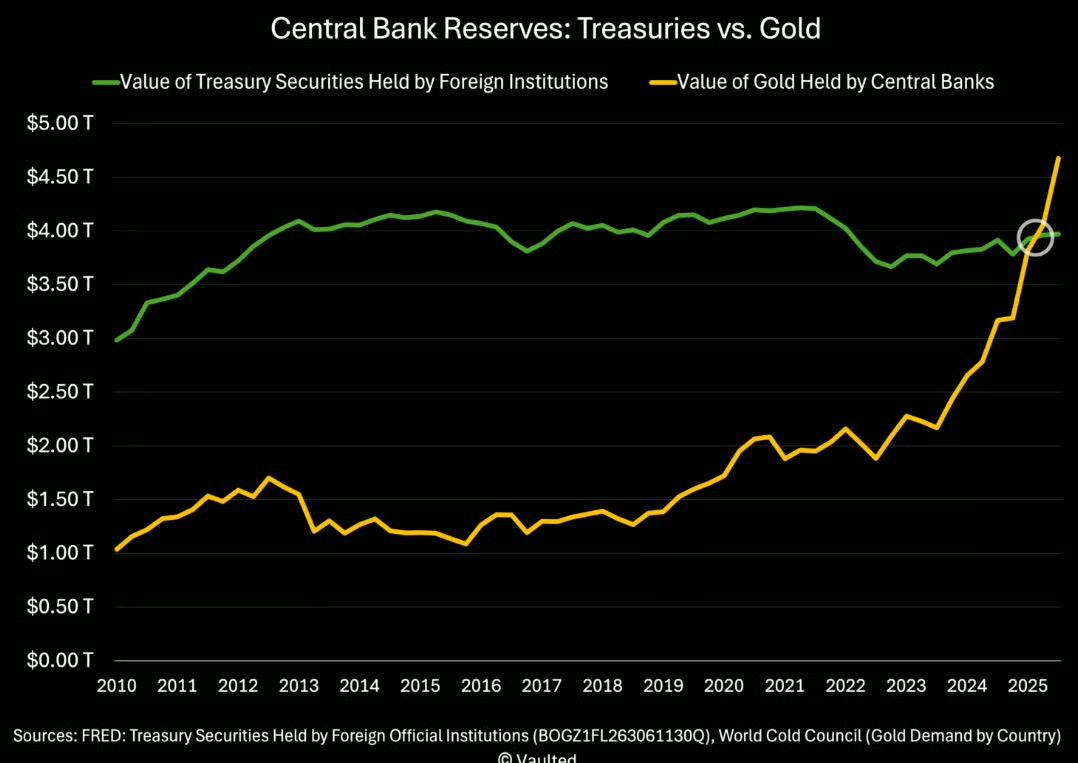

- Central banks now hold more gold by value than U.S. Treasuries for the first time in nearly three decades.

Back then, a weakening dollar coincided with a sharp shift in capital flows. Liquidity moved out of defensive positions and into higher-risk assets, helping ignite a historic bull run in crypto markets. Bitcoin, for example, climbed from under $200 to nearly $20,000 within a relatively short time frame.

Today’s setup is drawing clear comparisons.

Dollar weakness and the liquidity signal

A falling dollar is more than just a currency story. It often reflects easier financial conditions globally, as dollar-denominated debt becomes cheaper to service and capital looks for higher returns outside cash and bonds.

The current move in the DXY suggests that liquidity is once again searching for risk. While equities have held firm and precious metals continue to attract strong inflows, crypto markets are increasingly being viewed through the same macro lens that fueled previous cycles.

Historically, prolonged dollar weakness has tended to align with periods of strong performance for assets that benefit from monetary expansion and declining real yields.

Central banks send a powerful message

At the same time, a structural shift is unfolding in global reserve management.

For the first time since 1996, the total value of gold held by central banks – estimated at roughly $4.6 trillion – has surpassed the value of the U.S. Treasuries they hold, which stands near $3.9 trillion. This reversal highlights a growing preference for hard assets over sovereign debt among monetary authorities.

This trend reflects deeper concerns about currency debasement, rising debt levels, and long-term purchasing power. Gold’s role as a neutral reserve asset appears to be strengthening just as confidence in traditional debt instruments shows signs of erosion.

Hard assets regain center stage

The combination of a weakening dollar and shifting central bank reserves is reinforcing the case for a broader hard-asset cycle. Gold and silver have already moved aggressively higher, while Bitcoin is increasingly being discussed alongside them as part of the same macro narrative.

Rather than isolated rallies, these moves point toward a longer-term reallocation of capital – away from paper assets and toward stores of value that are perceived as scarce and resistant to monetary dilution.

As global liquidity dynamics continue to evolve, markets are increasingly treating gold, silver, and Bitcoin as part of the same structural shift – one driven by declining confidence in fiat currencies and growing demand for hard assets.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.