Copper Shortage Looms as Global Demand Heads Toward a Historic Deficit

The global economy is moving toward a copper shortage that could redefine commodity markets over the next two decades.

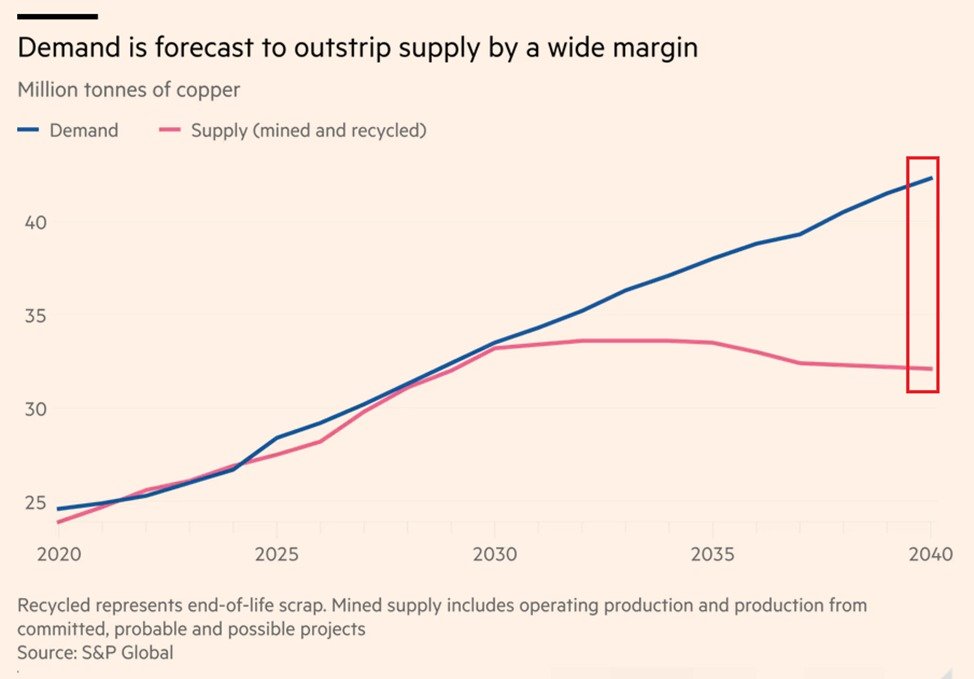

Forecasts point to demand rising much faster than supply, creating a structural imbalance that will be difficult to resolve with current production trends.

- Global copper demand is projected to rise sharply, reaching around 42 million tonnes by 2040

- Supply is expected to peak around 2030 and then decline, creating a potential deficit of about 10 million tonnes

- Asia, electric vehicles, grid upgrades, and AI data centers are the main drivers of demand growth

Demand growth accelerates into 2040

Global copper demand is expected to climb to around 42 million tonnes by 2040, up from roughly 28 million tonnes in 2025. This increase is not driven by a single sector, but by a broad shift toward electrification, digital infrastructure, and industrial modernization.

Asia is projected to account for about 60% of total demand growth over this period. Electric vehicle adoption, power grid expansion, and continued urban development are all major contributors. Each of these trends requires large volumes of copper for wiring, batteries, charging infrastructure, and transmission networks.

AI and data centers add new pressure

Artificial intelligence is emerging as a powerful new source of copper demand. Copper consumption linked to AI-focused data centers is expected to surge by more than 120% by 2040, reaching roughly 2.5 million tonnes per year. High-density servers, cooling systems, and power-hungry computing environments all rely heavily on copper, adding a fast-growing layer of demand on top of existing industrial needs.

Supply peaks, then starts to fall

While demand continues to rise, copper supply is expected to struggle. Global supply is projected to peak at around 34 million tonnes by 2030 before declining to roughly 32 million tonnes by 2040. Even when accounting for recycled copper, total available supply is not expected to keep pace.

Mining faces long-term constraints such as declining ore grades, higher capital costs, lengthy permitting processes, and growing environmental and geopolitical challenges. These factors limit how quickly new supply can be brought online, even in a high-price environment.

A structural deficit takes shape

By 2040, the gap between supply and demand could reach nearly 10 million tonnes – equivalent to about one-third of today’s global copper consumption. This suggests that copper shortages may become a persistent feature of the market rather than a temporary imbalance.

As electrification, AI infrastructure, and energy security become central policy priorities, copper is increasingly viewed as a strategic material rather than just an industrial input.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.