The Coinbase Business Account Inside & Out

Are you thinking about expanding your business into crypto? You’re in the right place!

Opening a Coinbase business account is a great way to start, whether you’re looking to accept cryptocurrency payments for goods and services through Coinbase Commerce or manage your company’s investments.

For example, Coinbase Commerce makes integrating crypto payments into your business effortless, allowing you to accept digital currencies. If you’re just curious about what crypto can offer, the business account gives you the tools to explore and grow.

This guide discusses all the must-knows about the business account and includes a step-by-step tutorial to help you set everything up quickly and start on the go.

It’s easier than you think, and we’re here to walk you through it.

What is a Coinbase Business Account?

A Coinbase business account is ideal for businesses using cryptocurrency in their operations. It offers advanced features like institutional investing and trading tools, which go beyond what a private account (personal account) can offer. With this account, your company can securely buy, sell, and store crypto while keeping business and personal funds separate for easier management.

You can also link your business bank accounts to facilitate faster transactions, making buying crypto or withdrawing funds easier.

Furthermore, one business account opens new doors to Coinbase businesses:

- Coinbase Commerce;

- Coinbase Prime;

- Coinbase Exchange;

- Coinbase International Exchange;

Please note that the business account can be created on either the primary Coinbase platform or the Coinbase Pro platform.

The basic Coinbase account is more appropriate for beginners, yet owning a Coinbase Pro account gives access to lower fees, more advanced trading options, and other business-beneficial features.

Coinbase Business Account Pros

Before you open a business account, it is essential to understand the pros and cons of such an account to better prepare your business for it.

1. Tailored Solutions

As seen, Coinbase offers multiple types of business-oriented products, each destined to alleviate your business pitfalls. As a result, Coinbase Commerce is used to process cryptocurrency payments from anyone, while Prime is a brokerage platform.

The Exchange assists the institutional investment of any regulated crypto spot exchange, and the International Exchange opens the door to BTC, ETH, LTC, XRP, SOL, and AVAX perpetual futures contracts.

Not to mention that institutional investing is amongst the most popular uses of the business account type.

2. Security Features

Security is mandatory in the crypto trading industry, so the Coinbase business account offers two-factor authentication, encrypted wallets, and other advanced security features.

3. Lower Fees

If you wish to open a business account, we recommend going with Coinbase Pro, which offers lower costs. For many businesses, getting some of the best price reductions could be the starting point to trade cryptocurrencies.

4. Personal Accounts Vs. Business Accounts

The first and foremost benefit is the segregation between personal and professional accounts. This simplifies expense tracking, making it much easier for businesses to track crypto payments and manage their crypto trading activities.

5. Gain Access to Advanced Trading Options

The business account offers more advanced trading options besides the above. As such, businesses can manage their crypto-related endeavors from the first steps until full-scaling operations.

Coinbase Business Account Cons

Regarding the downfalls of such a business account, the only drawback is the onboarding and verification process, as opening this account could take quite some time. However, this should be understandable, as there are legal and sign-up requirements that the business entity must respect.

Coinbase Business Registration Documents

Further, businesses need to provide proof of their ownership status, a business registration certificate, and some documents proving the existence of their business, in addition to linking either the bank account or the credit/ debit cards to make the necessary purchases.

Required information:

- Legal Entity Name;

- Country and State of Incorporation;

- Place of Operation;

- Business Type;

- Business Description;

- Number of Employees Globally;

- Fund Assets Under Management;

Coinbase Business Account: Minimum Balance Requirement

To further ensure that your business has enough traction within the business account, the Coinbase exchange requires a minimum balance of $1,000. As such, you could prove your company has enough capital to trade cryptocurrencies.

Other Types of Coinbase Accounts

Moreover, there are other types of Coinbase accounts designed to fit various needs, whether you’re an individual just getting started with crypto or a business looking for more advanced tools.

Let’s take a look at the different options available and what they bring to the table.

Individual Accounts:

Coinbase App:

- Fees: Completely free to use.

- Availability: Available on the web, mobile app, and through API.

- Supported Currencies: Major cryptocurrencies like Bitcoin, Ethereum, and Litecoin.

- Best for: Beginners or casual traders who want to do basic things like spot trading or staking.

Coinbase Advanced:

- Fees: Free to use.

- Availability: Accessible on the web, mobile app, and API.

- Supported Currencies: Offers spot trading, perpetual futures, and staking for a wide range of popular cryptocurrencies.

- Best for: Experienced traders who need more advanced tools like perpetual futures and U.S.-regulated futures.

- Fees: $29.99/month subscription.

- Availability: Web and mobile app.

- Supported Currencies: Major cryptocurrencies for trading and staking.

- Best for: Traders who want zero trading fees, increased staking rewards, and priority customer support. It is also great for those who trade frequently and want to save on fees while accessing premium features.

Business Accounts:

Coinbase Prime:

- Fees: $1,000 onboarding cost.

- Availability: Available on the web, mobile app, and API.

- Supported Currencies: Allows spot trading, financing, and staking in major cryptocurrencies.

- Best for: Institutions or high-net-worth businesses that want advanced investment tools and secure custody options.

Coinbase Exchange:

- Fees: $1,000 onboarding cost.

- Availability: Accessible on the web and API.

- Supported Currencies: Primarily for spot trading in major cryptocurrencies.

- Best for: Market makers and liquidity providers who need professional-level trading features.

Coinbase International Exchange:

- Fees: Free to use.

- Availability: API-only.

- Supported Currencies: Supports spot and perpetual futures trading in BTC, ETH, and other major currencies for institutions outside the U.S.

- Best for: International institutions needing access to futures contracts outside U.S. regulations.

Coinbase For Small Businesses

Working with cryptocurrency through Coinbase offers some great benefits and is a real possibility for smaller businesses. Coinbase Commerce allows small businesses to easily accept crypto payments, opening up new payment options and expanding their customer base.

Setting up Coinbase Commerce is straightforward and only requires an email to start. There are no setup fees, and the platform charges a reasonable 1% per transaction. This makes it appealing for small businesses, especially those looking to avoid common issues like chargebacks.

The platform integrates well with popular e-commerce platforms like Shopify and WooCommerce, making it accessible without needing advanced technical skills. Additionally, for businesses needing custom solutions, Coinbase offers an API that allows developers to integrate crypto payments directly into websites or apps.

Coinbase Commerce prioritizes security, and features like two-factor authentication and multi-signature wallets protect transactions and funds.

While some users have pointed out that Coinbase Commerce lacks support for in-person transactions through mobile POS systems, it remains a popular and efficient choice for online businesses looking to accept crypto payments.

How to Create a Coinbase Business Account

Opening a Coinbase Business Account might require more information than setting up a personal account, but following these steps makes the process straightforward.

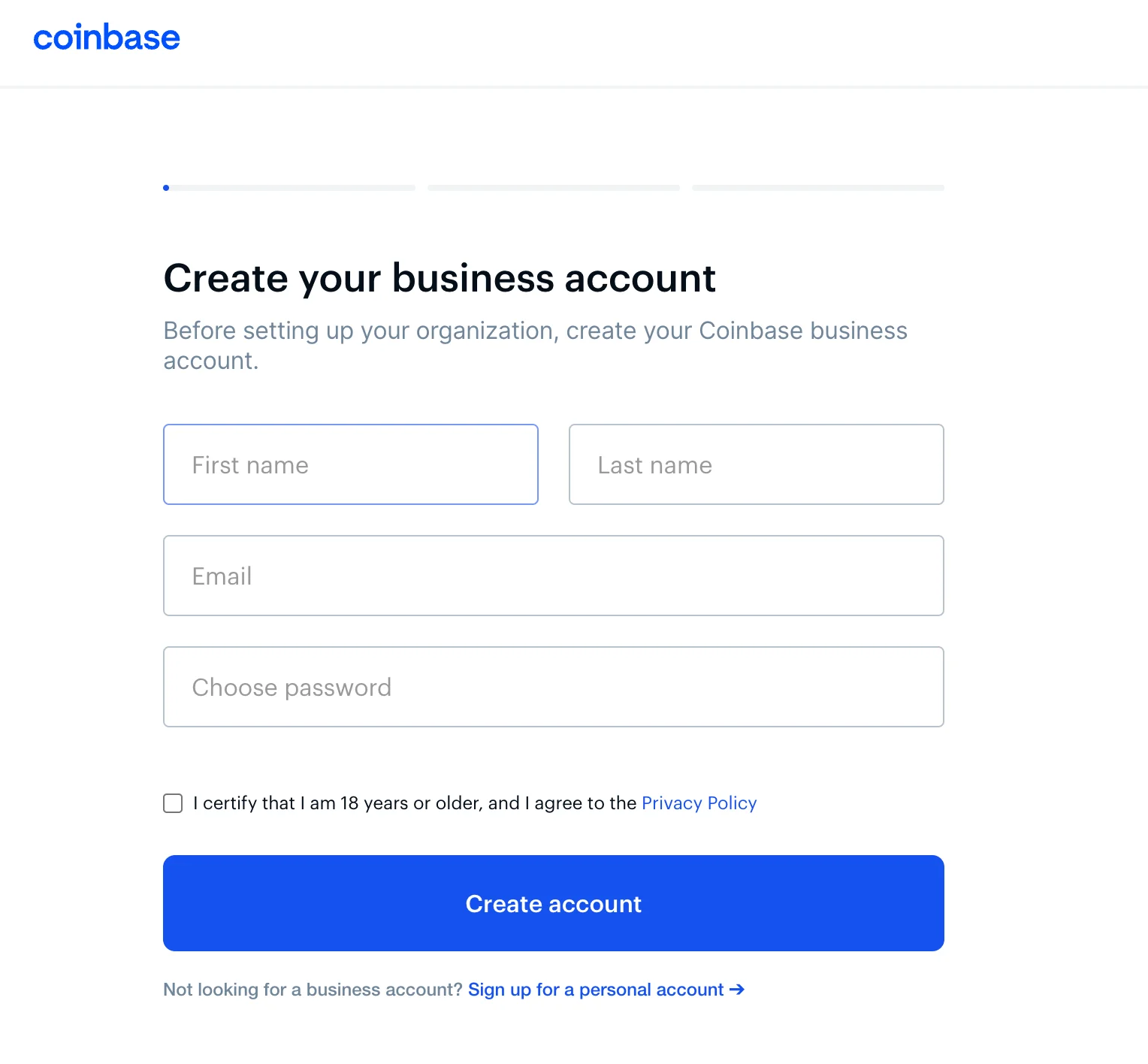

Step 1: Create Your Business Account

Visit coinbase.com and click on the sign-up button. Choose the Business Account option and fill in your basic details, such as first and last name, email address, and chosen password. After completing this step, check your inbox and follow the instructions to verify your email address.

Step 2: Set up Two-Factor Authentication (2FA)

At this stage, you must secure your account with two-factor authentication. Enter your business phone number to receive a verification code via SMS, which will be required to complete the process. Once you receive the code, input it to proceed. This adds an extra layer of security to your account.

Step 3: Create Your Organization

In this step, you must enter the legal entity name, which is simply your official company name.

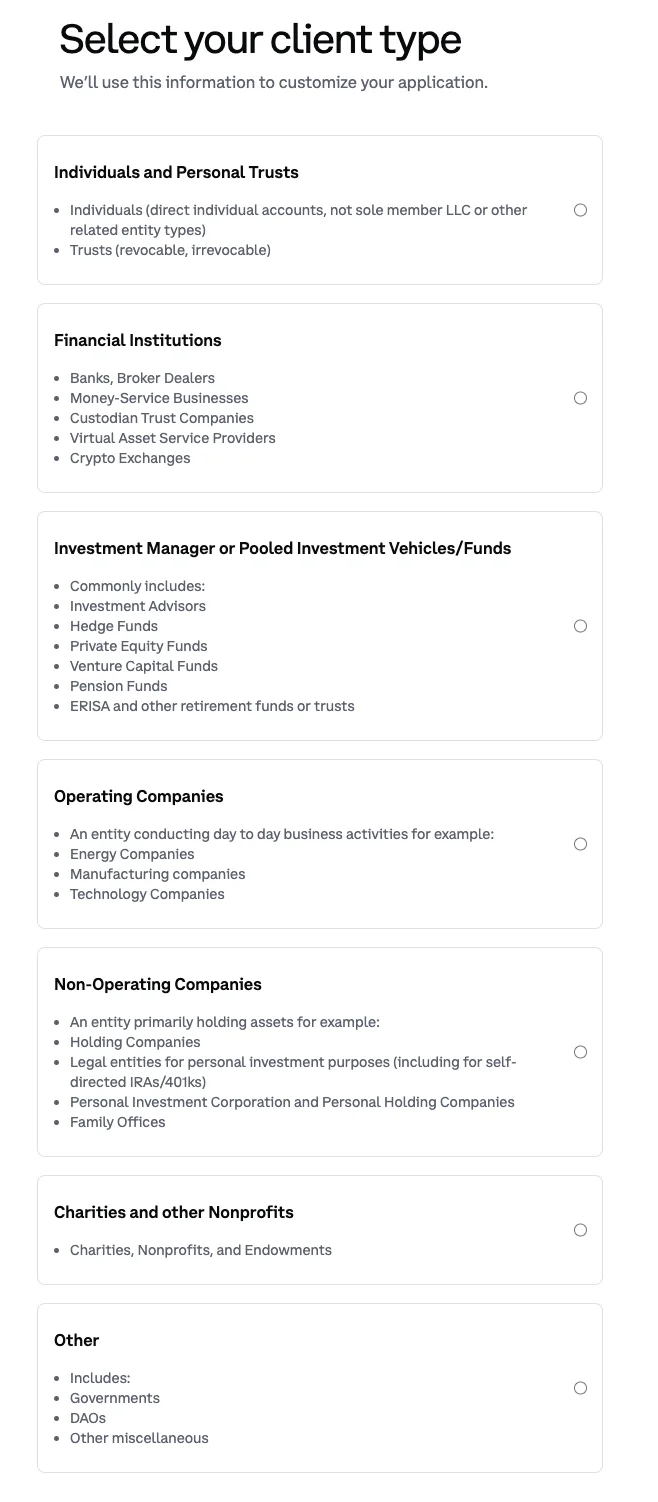

Step 4: Select Your Client Type

Now, select the type of business you operate. You’ll be given options such as non-profit, cooperative, corporation, etc. Choose the one that best fits your business, as seen in the picture below.

Step 5: Additional Legal Entity Details

Here, you will need to provide more information about your business. Coinbase will use this data to customize your account according to your business needs, along with the necessary products, like the Coinbase Commerce platform we discussed earlier. This includes:

- Entity type: Choose the category your business falls under, such as non-profit or corporation.

- Anticipated monthly activity: Select an estimate of your monthly crypto activity.

- Top 5 country selection: Choose up to 5 countries where your business will primarily operate.

- Funding sources: Select all sources that will be used to fund your Coinbase business account. Based on this information and regulatory policies, Coinbase will determine if your account can be opened, and if you are eligible, you’ll provide additional contact details to complete your business profile.

Step 6: Business Verification

This step requires you to provide specific business documents and authorized personnel details. You’ll need to submit:

- Operational details such as the nature of your business;

- Tax and billing information;

- Authorized applicant contact details: This includes the authorized person’s name, job title, email address, date of birth, ID type, and LinkedIn URL.

Additionally, upload the necessary business documents:

- Business registration certificate;

- Proof of business address.

Below are just a couple of the required documents, but it all depends on your type of business. For more details, check out the official Coinbase page.

- Articles/Memorandum of Association;

- Authorized Representative List;

- Constitution;

- Proof of Entities Operating Address;

- Shareholders/Members Register;

- Source of Funds.

Step 7: Application Review

Once you’ve submitted all necessary documents, your application will enter the review process. You can check the status by logging into your account and viewing the Application Tab. The statuses may show as submitted, in review, in progress, or approved.

FAQ

What is the difference between Coinbase Business and Personal?

The Coinbase business account allows your business entity to buy, sell, and store cryptocurrency, compared to the individual account, enabling you to do the same, but with your cryptos.

What Are the Advantages of Coinbase Business Account

Here are five benefits of the Coinbase business account:

- Tailored Solutions and products;

- Security Features;

- Lower Fees;

- Segregation between the personal accounts and the professional ones;

- Gain Access to Advanced Trading Options;

What Coinbase Business Account Offers?

Coinbase business accounts offer a way for companies to interact with the cryptocurrency industry through different Coinbase solutions for various business aspects. As such, a business can choose between Coinbase Commerce, Prime, Exchange, and International Exchange.

In Conclusion

As we’ve reached the end of this step-by-step guide, we hope it helped overcome some of the hurdles you’ve possibly encountered.

Also, opening a Coinbase business account unlocks a new world of financial possibilities for your company, regardless of your business motives. Whether your business goals are accepting cryptocurrency payments, streamlining investments, or exploring the crypto trading niche, Coinbase offers a robust suite of business-oriented solutions.ons.