Citi Reports Strong Q3 2025 Earnings as Revenues Rise 9% Across All Divisions

Citigroup posted solid results for the third quarter of 2025, highlighting broad-based growth across its core businesses and continued progress in its multi-year transformation strategy.

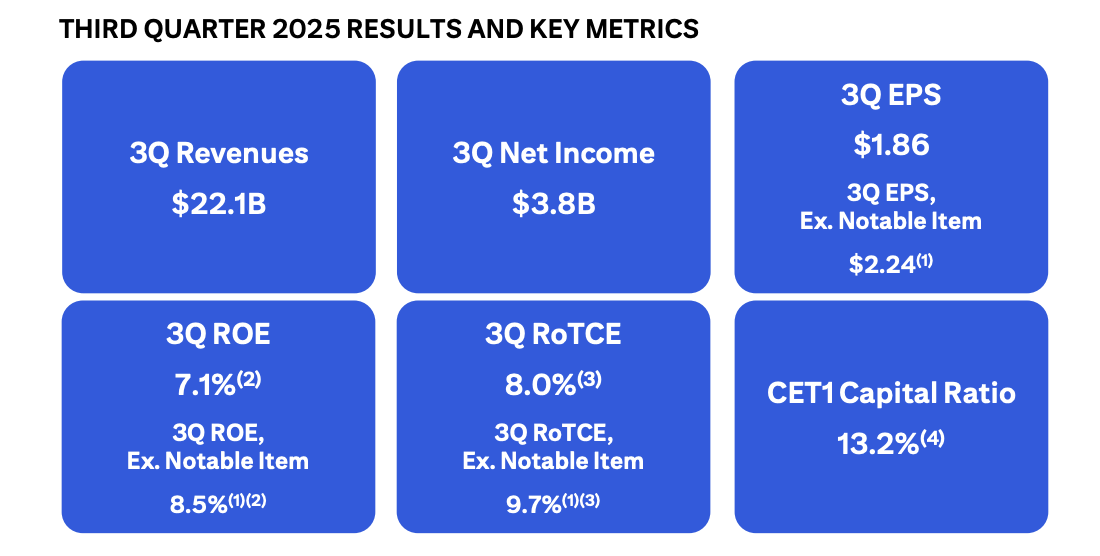

The bank reported net income of $3.8 billion, or $1.86 per share, on revenue of $22.1 billion, up 9% from a year earlier. Excluding a $726 million goodwill impairment linked to the partial sale of its Banamex unit in Mexico, adjusted net income reached $4.5 billion, or $2.24 per share.

CEO Jane Fraser said Citi’s simplified operating structure and technology investments are now delivering results. “Every business had record third-quarter revenue, improved returns, and positive operating leverage,” she noted. “The cumulative effect of our transformation has put Citi in a materially different place in terms of our ability to compete.”

Citi returned $6.1 billion to shareholders in buybacks and dividends during the quarter and maintained a CET1 capital ratio of 13.2%. Book value per share rose to $108.41, while tangible book value per share climbed to $95.72.

Record Performance Across Key Segments

- Services revenue rose 7% to $5.4 billion, marking its best quarter ever thanks to strong Treasury and Trade Solutions performance and growth in Securities Services.

- Markets revenue surged 15% to $5.6 billion, with double-digit gains in both fixed income and equities. Citi cited increased client activity in rates and currencies as well as record prime brokerage balances.

- Banking revenue jumped 34% to $2.1 billion, boosted by robust debt and equity underwriting and a rebound in advisory activity.

- Wealth Management grew 8% to $2.2 billion, while U.S. Personal Banking (USPB) also advanced 7% to $5.3 billion, with particular strength in branded cards and retail banking.

Improving Returns Amid Transformation

Operating expenses rose 9% to $14.3 billion, partly due to the Banamex-related impairment and higher performance-linked pay. Excluding the one-time charge, expenses were up just 3%.

Citi’s return on tangible common equity (RoTCE) improved to 8.0%, or 9.7% excluding notable items, underscoring stronger profitability. Deposits grew 6% year-over-year to $1.4 trillion, while total loans increased 7% to $734 billion.

Outlook

Fraser said the bank’s transformation and focus on digital assets and AI innovation are now delivering tangible benefits. Citi’s sale of a 25% stake in Banamex is seen as a step toward finalizing its long-awaited divestiture, allowing management to streamline operations and focus on high-return areas.

Despite macroeconomic uncertainties and a pending U.S. government shutdown cited in the report’s forward-looking statements, Citi reaffirmed confidence in its long-term strategy.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.