China’s Overseas Investment Surge Changes the Global Flow of Capital

China’s role in global markets is quietly changing, and fresh capital flow data shows why investors are paying closer attention.

- China’s private sector has replaced the central bank as the main channel exporting liquidity to global markets.

- Overseas assets and foreign investments surged at a pace far above historical norms in 2025.

- Global markets are becoming more reliant on capital flows coming directly from China.

Rather than funneling export earnings mainly into official reserves, China is now exporting liquidity through its private sector, reshaping how global markets are financed.

Overseas assets hit record levels

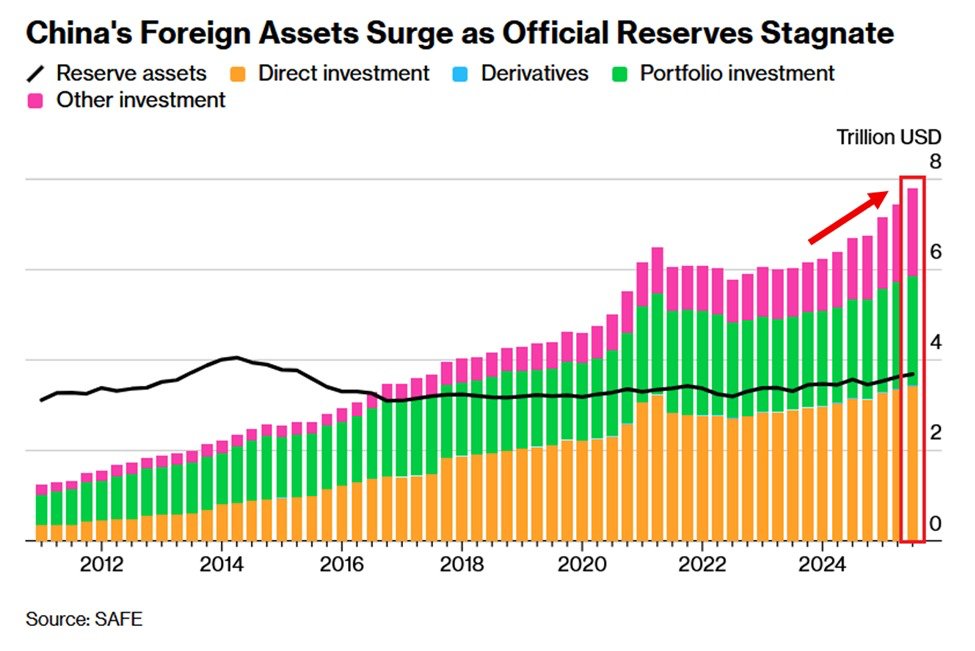

In the third quarter of 2025, China’s non-official sector holdings of overseas assets jumped by about $260 billion, pushing the total to a record $1.95 trillion. Over the first three quarters of the year, these holdings expanded by roughly $1 trillion, more than double the average annual increase seen over the past decade. The pace and scale of this growth suggest a structural shift rather than a temporary surge.

A significant share of this capital flowed directly into Western financial markets. Chinese private investors purchased around $535 billion in U.S. and European stocks and bonds during the period, already surpassing any full-year increase recorded over the past 20 years.

This wave of investment has effectively turned China’s private sector into a key source of global liquidity at a time when other funding channels remain tight.

Trade surplus bypasses central bank reserves

The surge was underpinned by a record $1.2 trillion trade surplus. Unlike previous cycles, nearly two-thirds of the resulting foreign assets ended up with companies, individuals, and state lenders instead of the central bank. As a result, China’s official reserve assets rose by only about $230 billion in the first three quarters of 2025, a modest increase relative to the size of the surplus.

Historically, China parked most of its export earnings in central bank reserves. That model is now changing. Capital is increasingly recycled through the private and quasi-private sector into global equities, bonds, direct investment, and other instruments, altering how Chinese liquidity reaches international markets.

Why this matters for global liquidity

Data from State Administration of Foreign Exchange highlights strong growth in portfolio and direct investment alongside stagnating official reserves. The takeaway is clear: global markets are becoming more reliant on liquidity sourced from China’s private sector rather than central bank reserve accumulation. As this trend deepens, shifts in Chinese investor behavior and policy signals are likely to have a much larger impact on global asset prices than in the past.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.