China Trading Surge Triggers Sell Signal in Metals

The global metals market is flashing warning signals after a powerful surge pushed parts of the sector into territory reminiscent of the 2020 commodity peak.

Key Takeaways

- Metals are trading at stretched levels, echoing conditions seen near the 2020 peak.

- Silver’s move above 100 dollars signaled extreme divergence from other commodities.

- China’s futures volumes surged sharply, driven by heavy retail speculation.

- Exchanges are tightening rules, raising the risk of a pullback.

Recent data show the Bloomberg All Metals Total Return Subindex reaching a new extended high relative to the broader Bloomberg Commodity Index – a divergence that has historically preceded cooling phases.

Silver’s explosive jump above 100 dollars per ounce in January amplified those concerns. The move marked one of the most extreme stretches ever recorded versus copper and crude oil. Because industrial commodities typically move together over longer cycles, sharp dislocations often reflect speculative pressure rather than stable, demand-driven growth.

Silver’s Breakout and the “Sell” Signal Debate

Market strategists note that when metals outperform the broader commodity complex by a wide margin, it can act as an early warning sign for both commodities and equities. Similar patterns emerged during the mid-2020 peak, when overheated positioning eventually gave way to broader market consolidation.

The recent spike in volatility and relative strength in metals has revived that discussion. While momentum remains strong, historical precedent suggests such conditions rarely persist without a reset.

China’s Futures Market Explodes Higher

At the same time, trading activity in China has surged to extraordinary levels, reinforcing concerns that speculation is accelerating the move.

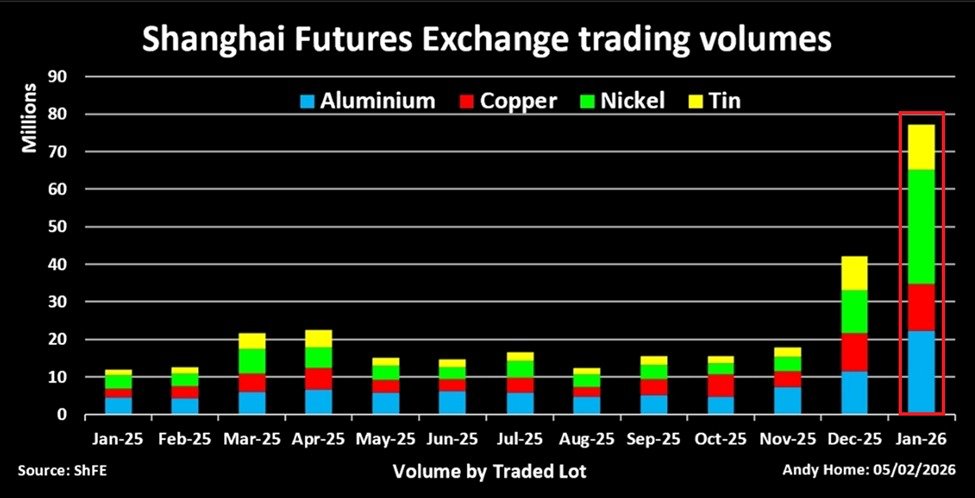

Combined futures volume in aluminum, copper, nickel and tin on the Shanghai Futures Exchange jumped 86 percent month over month in January to 78 million lots – the highest level in at least a year. That total is roughly five times the average monthly volume recorded during the first eleven months of 2025.

Nickel contracts led the surge, with 30 million lots traded in January – a 300 percent increase from December. Tin trading also reached remarkable levels, with single-day volumes surpassing 1 million metric tons, more than double the world’s annual physical consumption of the metal.

Retail Speculation Takes Center Stage

A wave of retail participation appears to be fueling much of the momentum. Metals have become one of the most discussed trades across Chinese social media platforms and investor chatrooms, echoing past episodes of crowd-driven buying in other asset classes.

Such rapid inflows into futures markets can amplify volatility, particularly when leverage is involved. The widening gap between paper trading volumes and underlying physical demand has drawn increased scrutiny from analysts.

Regulators Step In

Authorities have responded by tightening trading rules and raising margin requirements repeatedly over the past two months. Both the Shanghai and Guangzhou futures exchanges have adjusted conditions dozens of times in an effort to curb excessive speculation and stabilize markets.

Whether these measures will cool the rally remains uncertain. For now, the metals complex continues to benefit from strong momentum, but the combination of stretched valuations, surging speculative volumes and regulatory intervention suggests the trade may be entering a more vulnerable phase.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.